While the economy shifts to a lower gear, strong optimism surrounds Q1 earnings

Our recent article, “Soft landing, hard landing, or ‘no landing’ for economy?” outlined the growing belief among global fund managers in a “no landing” scenario.

According to data analyst firm Statista, that scenario basically “describes an outcome where robust economic growth coincides with a failure to bring down inflation despite the Fed’s or any other central bank’s efforts to cool it.”

What a difference two weeks and some new data points can make.

In addition to last week’s Federal Reserve meeting, rate decision, and press conference, there have been several significant reports related to the housing market, manufacturing and service sector data, GDP growth and inflation, and employment.

Recent weak economic data and persistent inflation above the Federal Reserve’s target have clouded predictions on what kind of landing is in store for the economy.

Federal Reserve announcement: Inflation remains a significant problem

The Fed held rates steady and did not commit to future rate hikes or specify rate cuts in its latest announcement and Chair Powell’s comments.

CBS News reported on the May 1 announcement,

“Federal Reserve officials said they are leaving their benchmark rate untouched, noting that progress in taming U.S. inflation has stalled. …

“Fed Chairman Jerome Powell has repeatedly said the central bank prefers to keep rates high until inflation retreats to about 2% on an annual basis, rather than risking cutting too early and fueling another round of price spikes. Despite the Fed’s flurry of interest rate hikes, inflation remains stubbornly high, with March prices rising 3.5% from a year earlier, fueled by higher housing and gasoline prices.

“In a press conference to discuss the central bank’s decision, Powell stressed that he’s confident inflation will recede to the Fed’s target of 2%, although the economy is taking longer to reach that point than policy makers previously expected. Powell also sought to tamp down any concerns the Fed could reverse course in response to persistent inflation, saying it is ‘unlikely the next policy rate move will be a hike.’ …

“Powell demurred when asked if the Fed continues to cut rates three times in 2024, as it had indicated earlier this year. Instead, he responded that Fed officials need to feel more confident before they move to ease borrowing costs.”

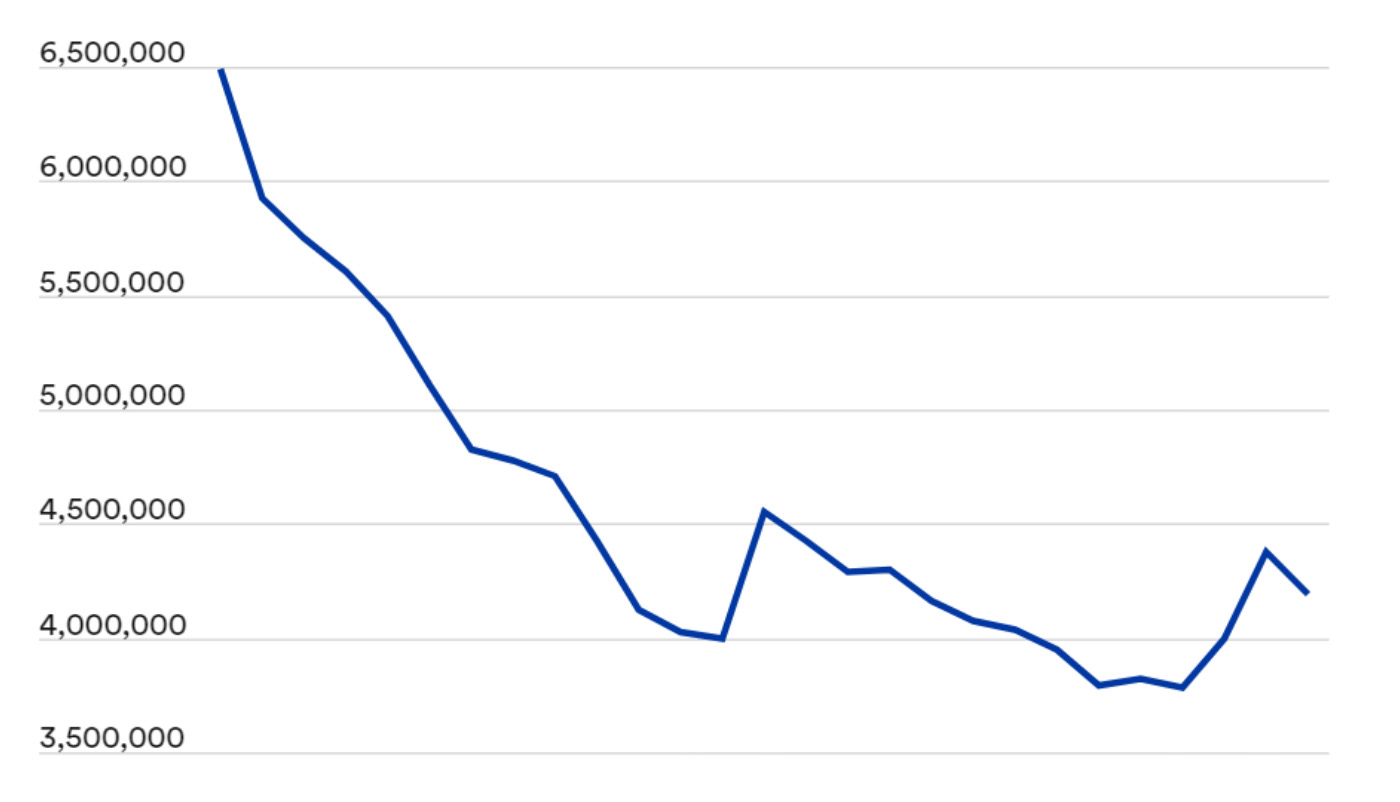

Existing home sales decline in March

Bankrate reported on the most recent data, saying, “Existing-home sales in March 2024 fell 4.3 percent from February and are off 3.7 percent from a year ago, according to the National Association of Realtors. … ‘Home sales are essentially stuck,’ NAR Chief Economist Lawrence Yun told reporters. He blamed the combination of still-high mortgage rates and not enough inventory.”

FIGURE 1: U.S. EXISTING HOME SALES (APRIL 2022–MARCH 2024)

Sources: National Association of Realtors, Bankrate

ISM manufacturing and nonmanufacturing indexes move lower in April

First Trust provided overviews of both Institute for Supply Management (ISM) reports, noting,

“After a brief one-month stint above 50, the ISM Manufacturing index missed consensus expectations and fell to 49.2 in April. …

“The ISM Services index missed consensus expectations and fell into contraction territory for the first time in sixteen months. Although the service sector has not matched the same weakness as the manufacturing sector (which has posted readings below 50 in seventeen of the last eighteen months), activity has been softening lately.”

Figure 2: ISM SERVICES PMI COMPOSITE INDEX

Sources: Institute for Supply Management, Haver Analytics, First Trust

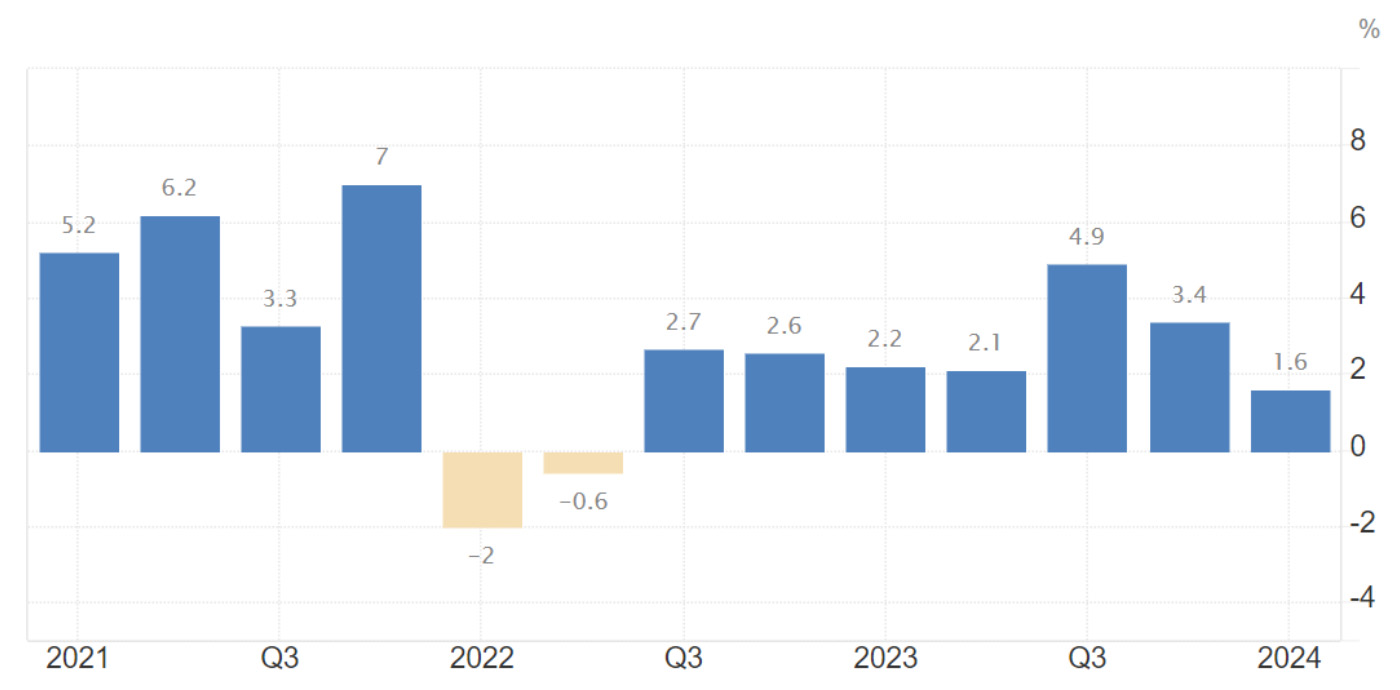

Q1 2024 GDP estimate disappoints

CNBC provided the following summary points for the advance estimate for Q1 2024 GDP that was released by the Bureau of Economic Analysis on April 25:

- “Gross domestic product, a broad measure of goods and services produced in the January-through-March period, increased at a 1.6% annualized pace, below the 2.4% estimate.

- “The personal consumption expenditures price index, a key inflation variable for the Federal Reserve, rose at a 3.4% annualized pace for the quarter, its biggest gain in a year.

- “Consumer spending increased 2.5% in the period, down from a 3.3% gain in the fourth quarter and below the 3% Wall Street estimate.

Figure 3: U.S. GDP GROWTH RATE—3-YEAR TREND

Sources: U.S. Bureau of Economics, Trading Economics

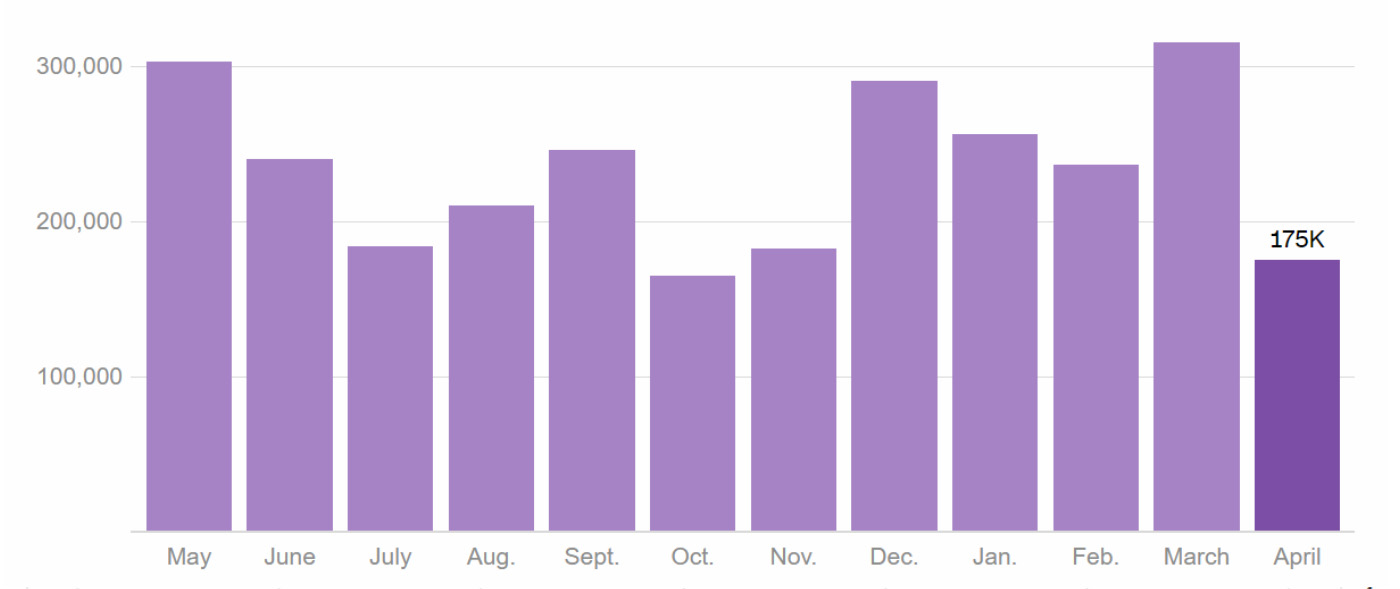

Job growth slows to its lowest rate in 2024

CNN Business provided commentary on the employment report from May 3:

“US job growth slowed considerably last month, with just 175,000 positions added in April, according to Bureau of Labor Statistics data released Friday.

“The slower-than-expected gains—April’s tally is the lowest since October of last year—come as the Federal Reserve has sought to cool demand to tame high inflation.

“Economists have anticipated the labor market would see a gradual slowdown due to the pressure of high interest rates.”

FIGURE 4: TOTAL NONFARM PAYROLL EMPLOYMENT GROWTH—1-YEAR TREND

Note: Employment numbers reflect the monthly change in nonfarm jobs and are seasonally adjusted. Figures from the two most recent months are preliminary.

Sources: U.S. Bureau of Labor Statistics, CNN

A major bright spot: Corporate earnings

While the economy may be showing signs of weakening, the current earnings season and the outlook for earnings moving forward represent a point of optimism, at least for equity markets.

FactSet reported the following on May 3:

“At this stage of the Q1 earnings season, S&P 500 companies continue to perform well compared to expectations. Both the percentage of S&P 500 companies reporting positive earnings surprises and the magnitude of earnings surprises are above their 10-year averages. … On a year-over-year basis, the S&P 500 is reporting its highest earnings growth rate since Q2 2022. …

“… The blended (combines actual results for companies that have reported and estimated results for companies that have yet to report) earnings growth rate for the first quarter is 5.0% today.”

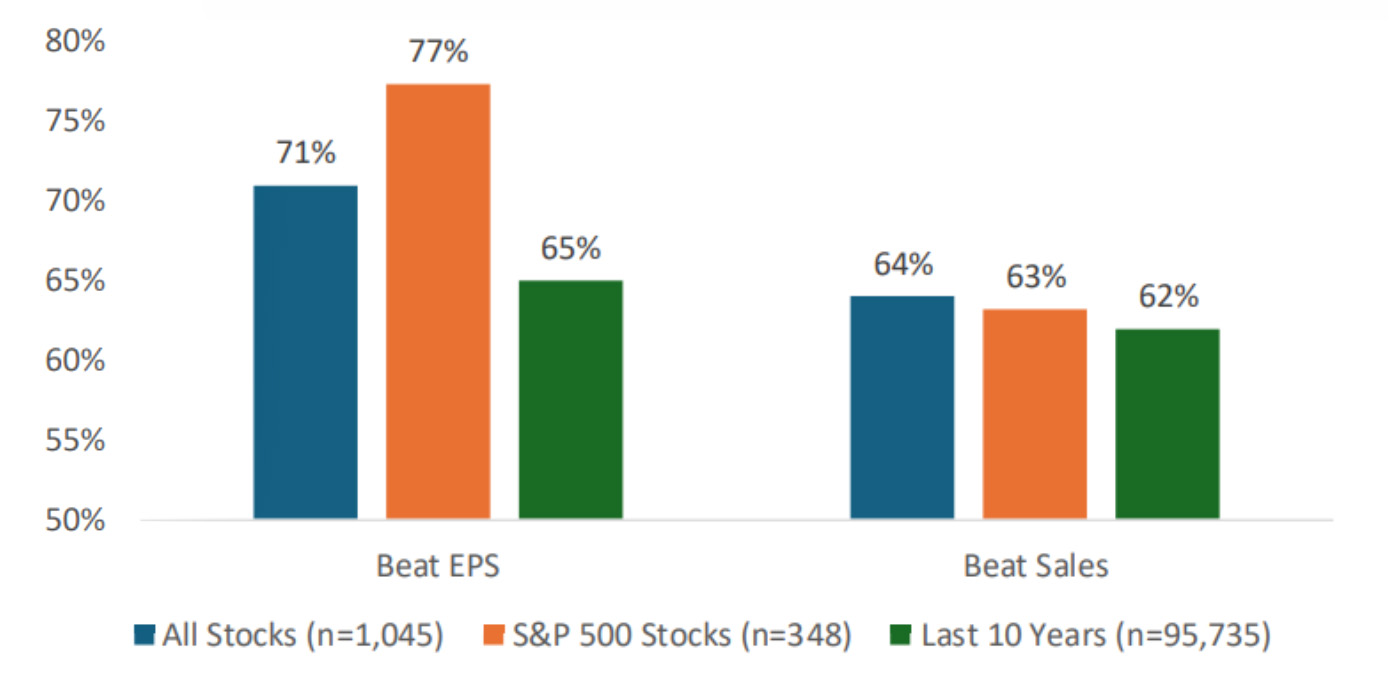

Bespoke Investment Group also added its perspective the same day:

“Looking at earnings season more broadly, we’ve now gotten 1,045 overall Q1 earnings reports, with 348 of those being S&P 500 names. As shown [below], 71% of all stocks have beaten EPS estimates, while the beat rate is 6 points higher at 77% for S&P 500 stocks. Both readings for this quarter are much higher than the 65% EPS beat rate we’ve seen across the 95,000+ reports we’ve gotten over the last ten years. Sales beat rates this quarter are much closer to the long-term number of 62%, however.”

FIGURE 5: EPS AND SALES BEAT RATES THIS SEASON VS. LAST 10 YEARS

Source: Bespoke Investment Group

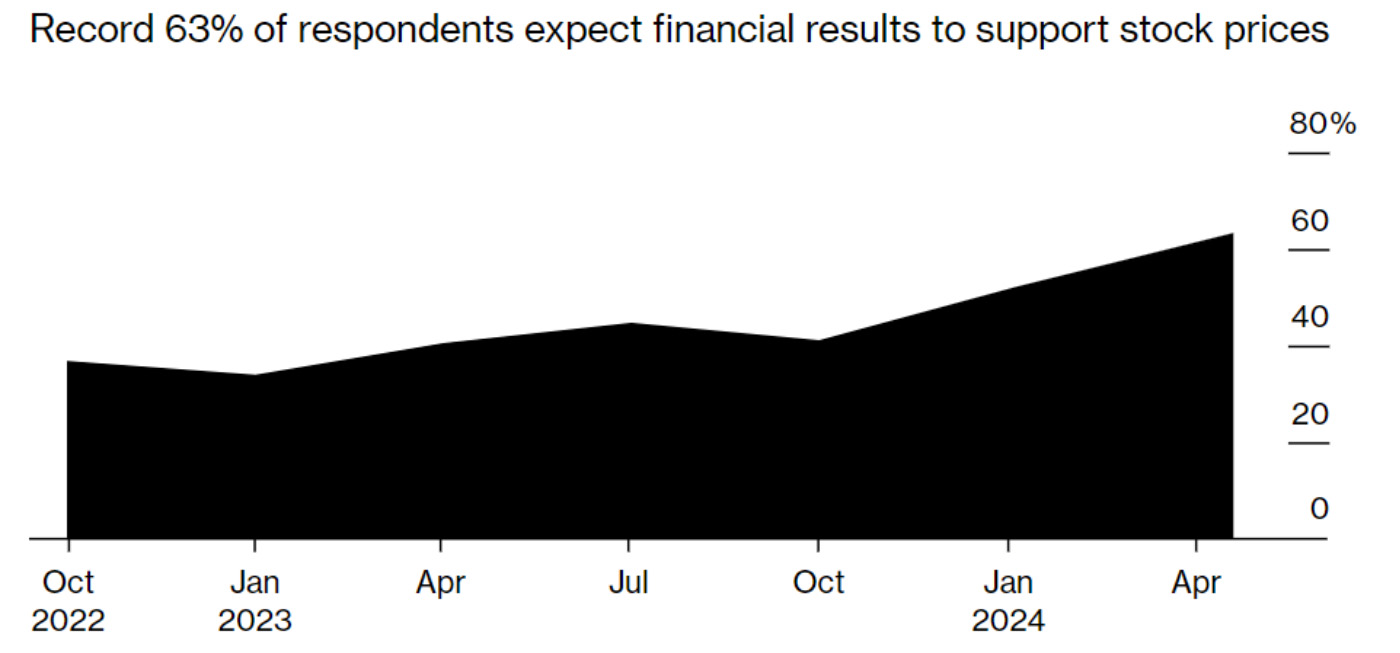

And Bloomberg finds that market analysts and strategists have given the “highest vote of confidence for corporate profits since the poll [Markets Live Pulse Survey] began asking the question in October 2022.”

FIGURE 6: THIS EARNINGS SEASON WILL REINVIGORATE S&P 500

Source: Bloomberg MLIV Pulse surveys, April 2024

RECENT POSTS

SUGGESTED ARTICLES