U.S. equity markets put in their biggest rally last week since the pandemic in 2020, with the Dow, S&P 500, and NASDAQ registering gains of 4.15%, 5.9%, and 8.1%, respectively.

The better-than-expected CPI data released last week was likely the primary driver, though many analysts believe that the midterm election results (and resulting gridlock) had more than a little to do with it.

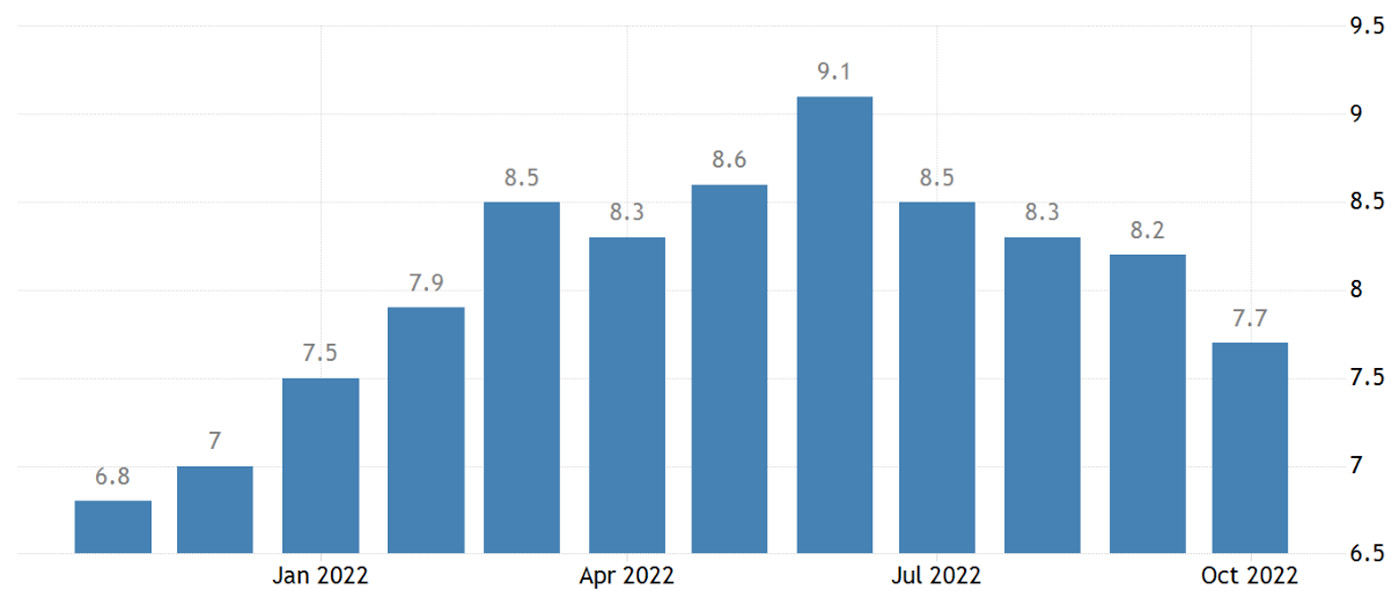

The October inflation headline reading came in at 7.7%, below the 8.2% reported for September. Markets reacted as though this was a strong signal that inflation has peaked, offering some cover for the Federal Reserve to either slow or reduce future interest-rate increases.

Trading Economics noted that the annual inflation rate “slowed for a 4th month to … the lowest since January, and below forecasts of 8%,” adding,

“Energy cost increased 17.6%, below 19.8% in September, due to gasoline (17.5% vs 18.2%) and electricity (14.1% vs 15.5%). A slowdown was also seen in food (10.9% vs 11.2%) and used cars and trucks (2% vs 7.2%). On the other hand, prices for shelter (6.9% vs 6.6%) and fuel oil (68.5% vs 58.1%) increased faster. Compared to the previous month, the CPI rose 0.4%, below expectations of 0.6%. Shelter contributed over half of the increase (0.8%) and gasoline rose 4%, after falling in the previous 3 months. At the same time, cost of medical care services (-0.6%) and commodities (0%) pushed the CPI down. Still, figures continue to point to strong inflationary pressures and a broad price increase across the economy, mainly in the services sector while prices of goods have benefited from some improvements in supply chains.”

FIGURE 1: U.S. INFLATION (CPI) RATE—ONE-YEAR TREND

Sources: Trading Economics, U.S. Bureau of Labor Statistics

There was further encouraging news on the inflation front this week. MarketWatch reported on Tuesday, “U.S. wholesale prices rose just 0.2% in October, a fourth straight soft reading that suggests inflation is on the wane after hitting a 40-year high earlier in the year. Economists polled by The Wall Street Journal had forecast a 0.4% gain.”

First Trust, while cautiously optimistic about last week’s inflation report, suggested some restraint in analyzing the results when it comes to future Fed actions:

“While it’s too early to tell for sure, there were several positive pieces of evidence in today’s report. … Is inflation slowing down? On a year-over-year basis, that looks to be the case, as overall consumer prices rose 0.4% in October, falling short of the consensus expected +0.6%, and pushing the year-ago comparison down for the fourth month in a row to 7.7%. But let’s not break out the champagne bottles yet; inflation is still a major problem for the economy, and a 7.7% annual inflation rate is still far above the Federal Reserve’s long-term target of 2.0%. … While today’s report may be a welcome sign to the markets—make no mistake—the Fed still has a very long way to go before it can say the inflation scare is over.”

Over this past weekend, Barron’s amplified the call for caution when it comes to inflation expectations:

“And if inflation runs a bit cooler than economists’ forecasts, but still at a multiple of what the Federal Reserve deems acceptable, markets go into a bullish frenzy. Bonds and stocks rally massively, as investors conclude that the Fed could be close to ending its aggressive interest-rate increases because inflation is subsiding quickly from its recent four-decade high. …

“The Fed and the markets alike anticipate inflation pressures abating significantly in 2023. However, history is not on their side, according to a paper from Rob Arnott, Research Affiliates founder and chairman, and Omid Shakernia, a partner at the firm who heads its multi-asset strategies.

“They find that when year-over-year inflation rises above 8%, as has happened with the CPI this year, it doesn’t recede quickly but tends to accelerate 70% of the time, based on data from 14 advanced economies dating back to January 1970. That doesn’t mean inflation necessarily will hit new highs in coming months. But, given the previous consensus that price pressures would be transitory, they write, ‘we dismiss that possibility at our peril.’ …

“Arnott writes in an email: ‘While it is entirely possible that inflation will dissipate in 2023, the other end of the possible spectrum—that inflation persists for a decade—is no less likely. That’s the basic problem.’”

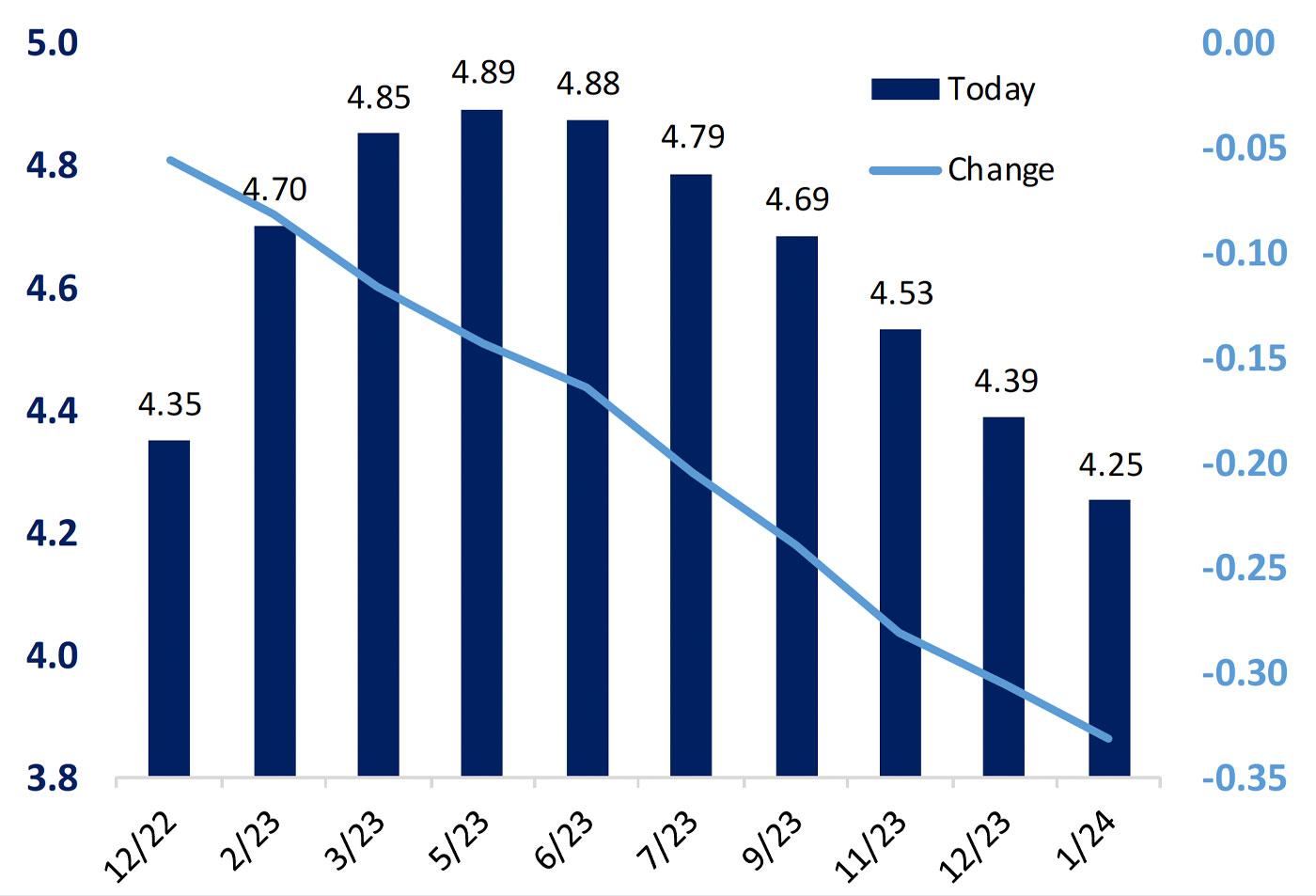

Bespoke Investment Group conducted a deep dive into future expectations for the Federal funds rate, noting,

“While there was little change in tone from FOMC officials on the tape Thursday, the market significantly ratcheted down expectations for the pace of hikes going forward. After Powell talked down the likelihood of a 75 bps hike back in May and then proceeded to hike 75 bps four times in a row, it now appears as though the market is finally taking a 75 bps hike off the table for the December meeting.

“In addition, the terminal rate has been priced back down below 5%, and the market is pricing in a slightly lower rate in January 2024 than it is for this December. We’re still a long way from inflation levels getting anywhere near the Fed target of 2%, but most would agree that we’ve reached the peak and are moving down the other side of the mountain.”

FIGURE 2: FED FUNDS RATE PRICING BY FED MEETING DATE

Source: Bespoke Investment Group

New this week: