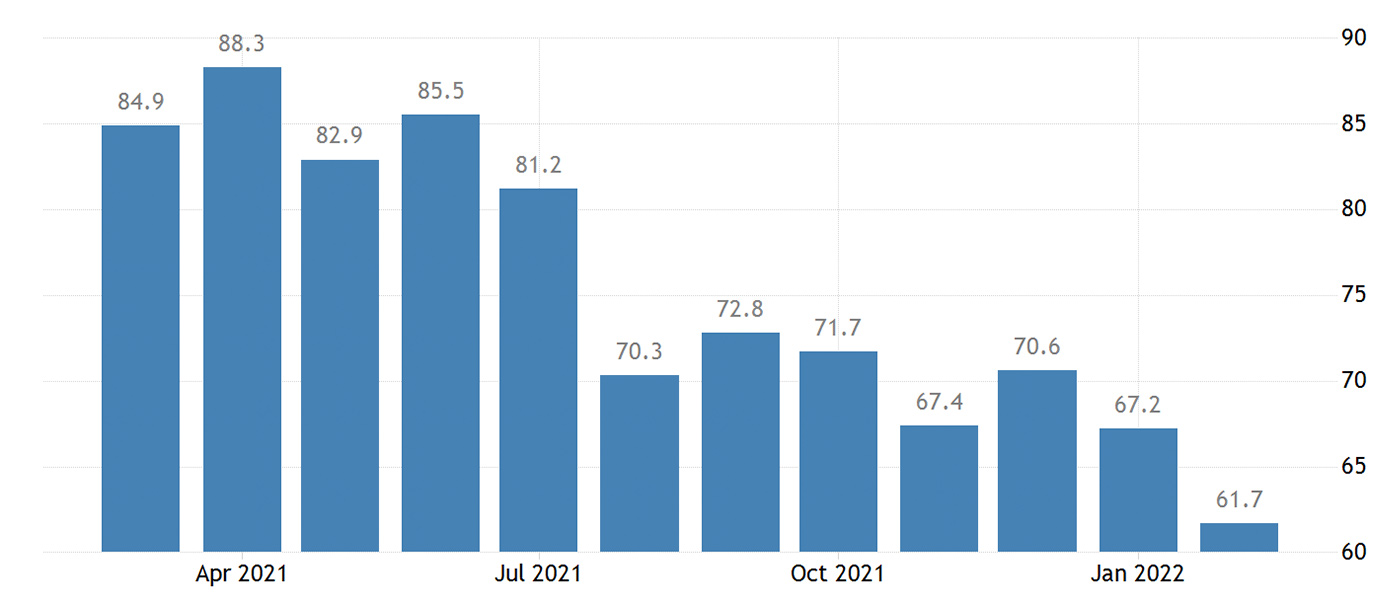

The University of Michigan’s preliminary consumer sentiment index for February fell to the lowest level since October 2011. The index was reported at 61.7, down from 67.2 in January. Reuters reported that “economists had forecast the index edging up to 67.5.”

FIGURE 1: UNIVERSITY OF MICHIGAN U.S. CONSUMER SENTIMENT

Sources: Trading Economics, University of Michigan

Personal finances, inflation, and economic outlook fuel sentiment decline

Surveys of Consumers chief economist, Richard Curtin, reported last week,

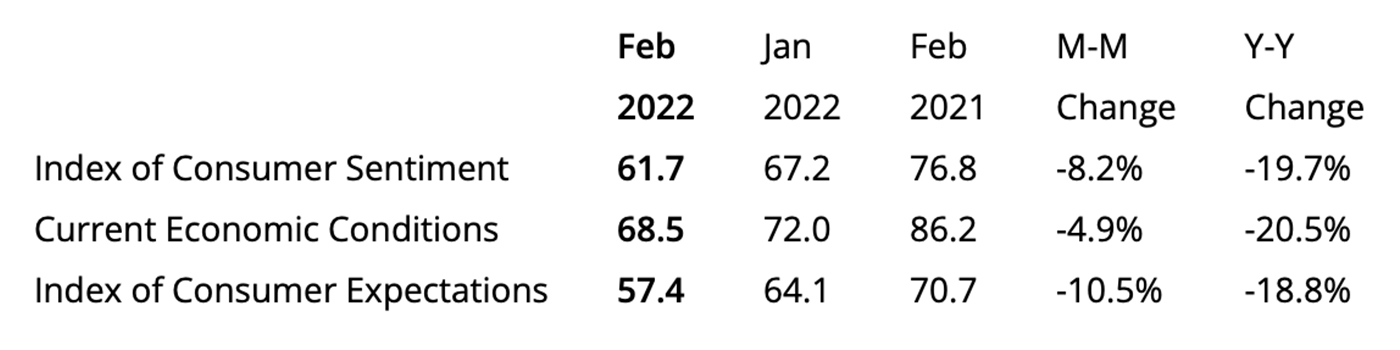

“Sentiment continued its downward descent, reaching its worst level in a decade, falling a stunning 8.2% from last month and 19.7% from last February. The recent declines have been driven by weakening personal financial prospects, largely due to rising inflation, less confidence in the government’s economic policies, and the least favorable long term economic outlook in a decade. Importantly, the entire February decline was among households with incomes of $100,000 or more; their Sentiment Index fell by 16.1% from last month, and 27.5% from last year. The impact of higher inflation on personal finances was spontaneously cited by one-third of all consumers, with nearly half of all consumers expecting declines in their inflation adjusted incomes during the year ahead. In addition, fewer households cited rising net household wealth since the pandemic low in May 2020, largely due to the falling likelihood of stock price increases in 2022.”

TABLE 1: CONSUMER SENTIMENT PRELIMINARY FEBRUARY RESULTS

Source: University of Michigan

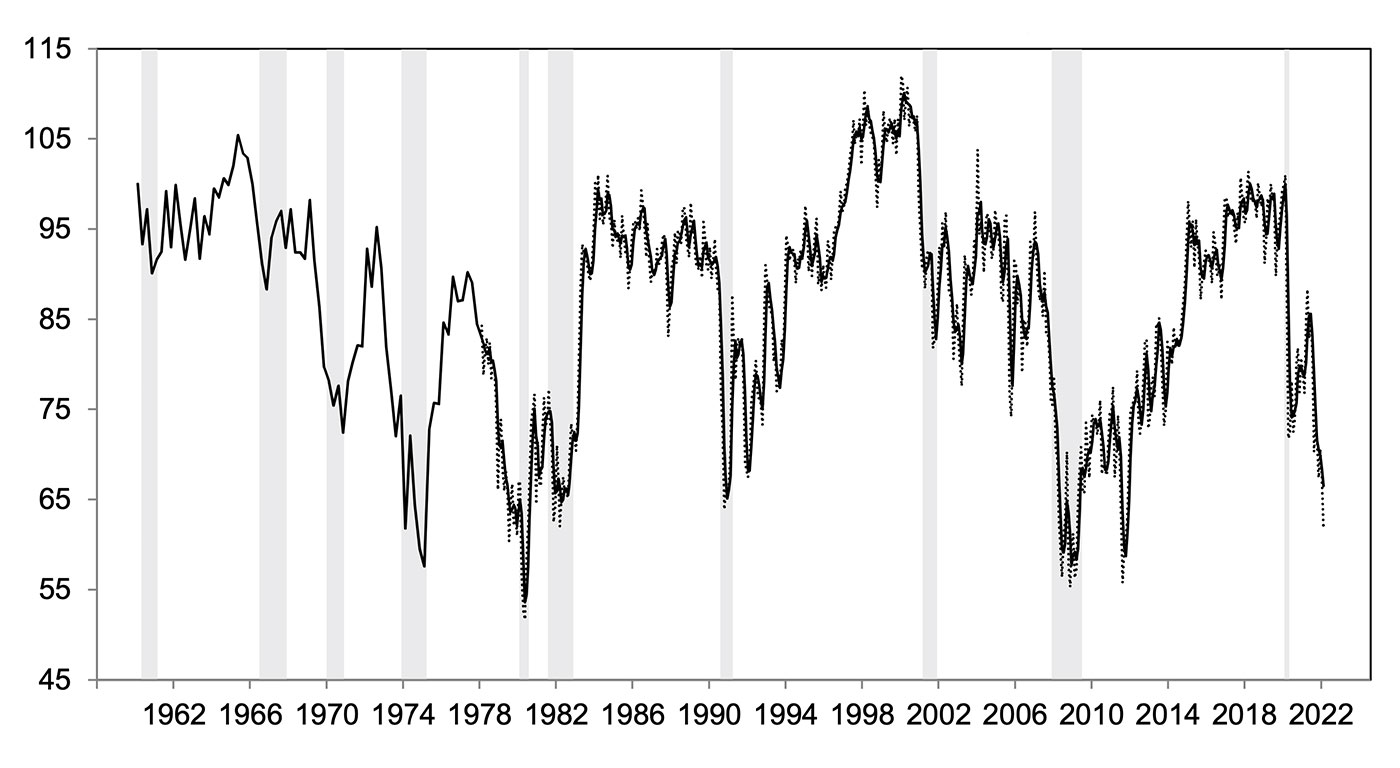

FIGURE 2: HISTORICAL TREND FOR CONSUMER SENTIMENT—MONTHLY AND THREE-MONTH MOVING AVERAGE

Source: University of Michigan

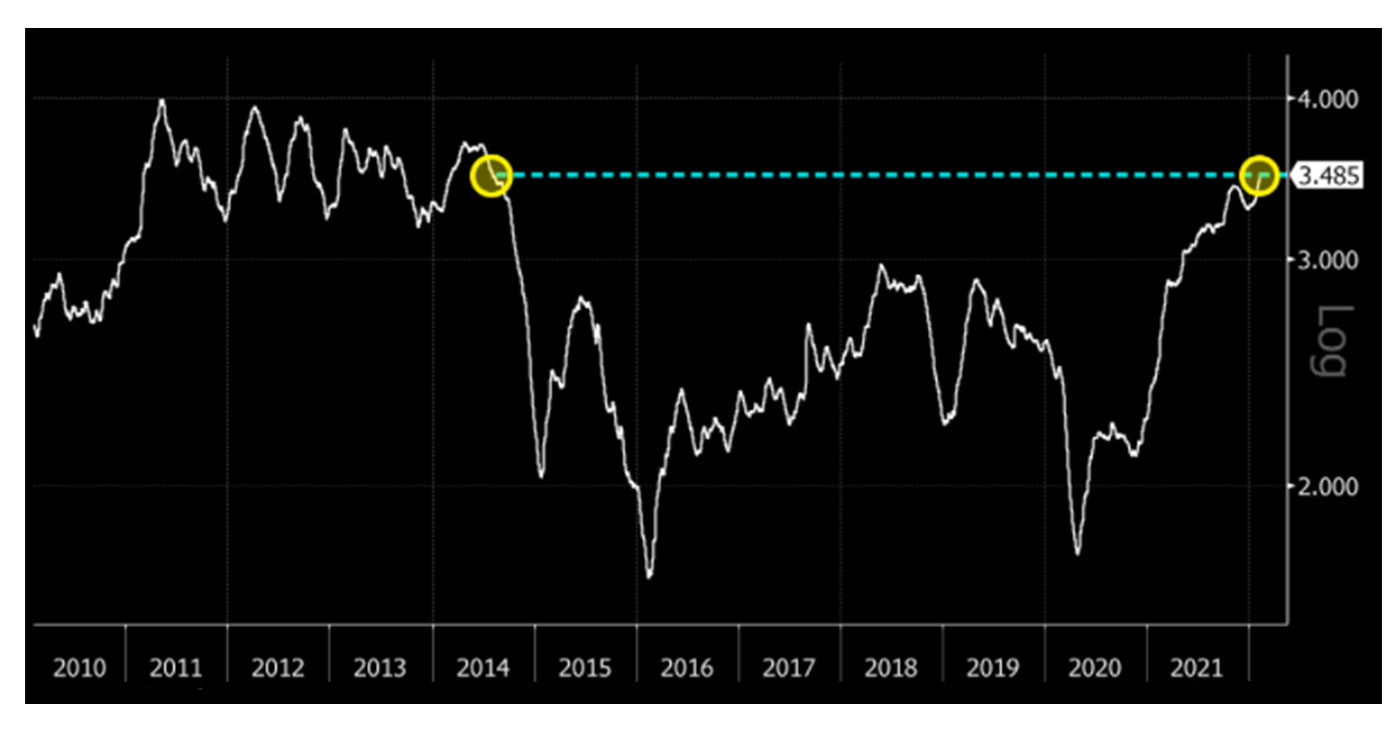

Gasoline prices continue upward trend

A major contributor to consumers’ inflation concerns is the trajectory of retail gasoline prices.

Bloomberg reports,

“National gasoline prices have ticked higher, once again, according to the American Automobile Association, reaching the highest since August 2014. … Prices in California are as high as $4.702 per gallon. … With Brent crude rising steeply over the past year, … [oil] is posing a threat to spending. … For consumers, higher gasoline prices can mean fewer trips to the grocery store, choosing not to commute to work, and only filling half the tank to stay on budget. Gig economy workers who rely on their car are particularly affected. It’s a similar story when it comes to food prices or even the record high cost of aluminum.”

FIGURE 3: GAS PRICES CONTINUE TO RISE—NATIONAL AVERAGE PRICE PER GALLON (REGULAR)

Source: Bloomberg

Recent Posts: