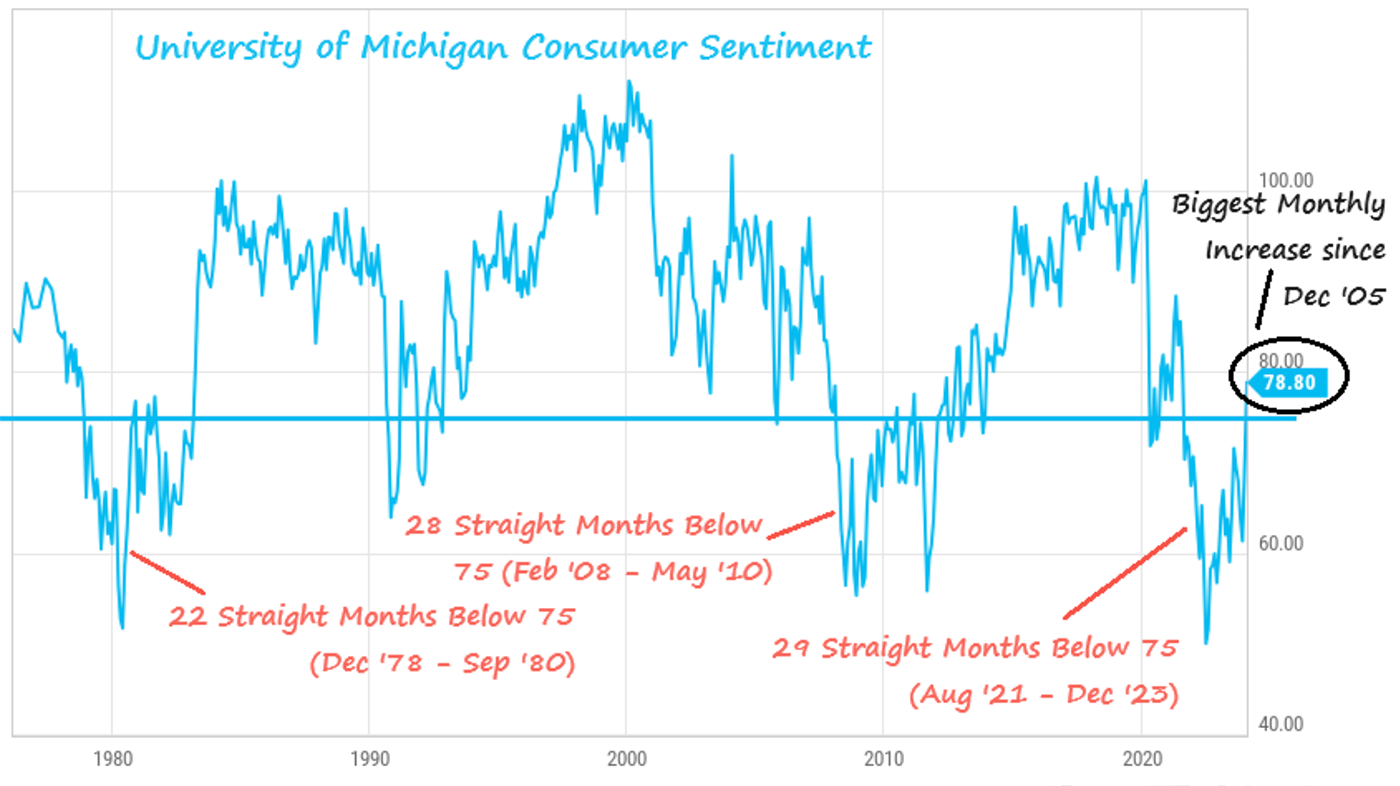

The most recent University of Michigan Consumer Sentiment survey for January, Barron’s reported, “jumped 9.1 points to 78.8, the largest increase since 2005, as inflation expectations fell to their lowest level in three years and expectations for better financial conditions increased.”

Barron’s added, “Retail sales jumped 0.6% from November to December, the largest increase since September 2023, and first-time jobless claims fell 18,000 to 187,000, the lowest in 16 months.”

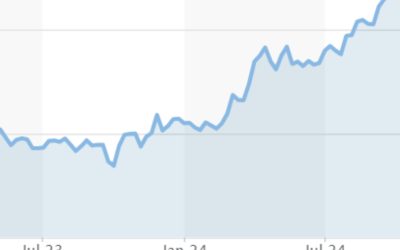

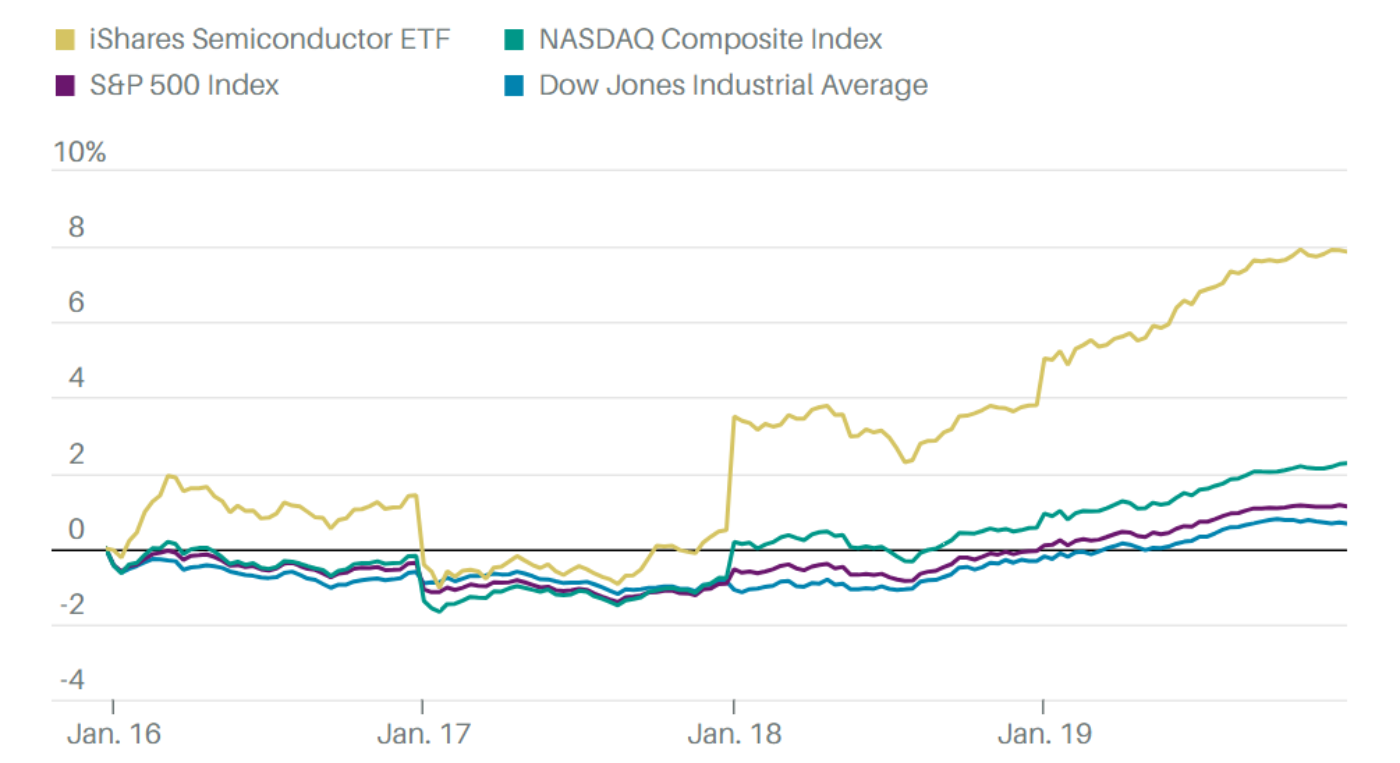

Against this backdrop last week, the S&P 500 Index gained 1.2% and the Dow Jones Industrial Average (DJIA) rose 0.7%, with both indexes hitting new all-time highs (along with the NASDAQ 100 Index). The NASDAQ Composite outpaced both the DJIA and S&P 500, with a weekly return of 2.3%. The tech sector, up just over 4% for the week, drove the markets, as it did toward the end of 2023. The iShares Semiconductor ETF SOXX gained close to 8% in the week ending Jan. 19.

FIGURE 1: WEEKLY PERFORMANCE FOR MAJOR INDEXES AND THE SEMICONDUCTOR SECTOR THROUGH JAN. 19

Sources: Barron’s, FactSet

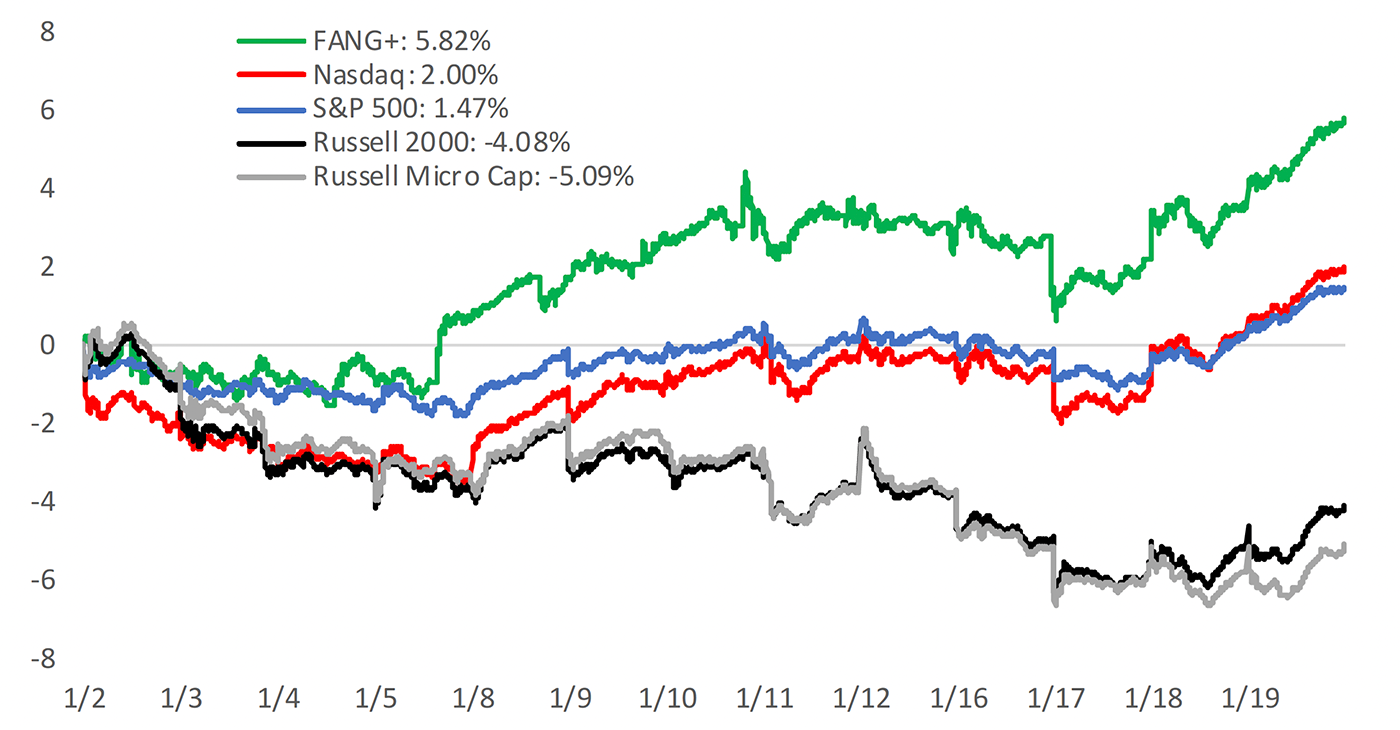

Bespoke Investment Group commented on the continued dominance of large-cap stocks, especially those in the tech sector, while small caps continue to lag:

“After the last two months of 2023 where other stocks besides the ‘magnificent seven’ not only managed to rally but even outperform the major indices, 2024 has been a return to normalcy of sorts where the megacaps are once again in pole position, and just today pushed the S&P 500 to a new all-time high. … Through Friday, the S&P 500 and Nasdaq were both sitting on gains between 1% and 2%, while the FANG+ Index, which is comprised of mega-cap ‘tech like’ stocks has surged over 5.8%. Small caps, as proxied by the Russell 2000, were down over 4% and microcaps were down even more with a decline of over 5%.”

FIGURE 2: US EQUITY INDEXES—YEAR-TO-DATE PERFORMANCE (%) THROUGH JAN. 19

Source: Bespoke Investment Group

Consumer sentiment improves significantly

The University of Michigan’s Surveys of Consumers Director Joanne Hsu commented the following in a press release on preliminary January consumer sentiment results:

“Consumer sentiment soared 13% in January to reach its highest level since July 2021, showing that the sharp increase in December was no fluke. Consumer views were supported by confidence that inflation has turned a corner and strengthening income expectations. Over the last two months, sentiment has climbed a cumulative 29%, the largest two-month increase since 1991 as a recession ended. For the second straight month, all five index components rose, with a 27% surge in the short-run outlook for business conditions and a 14% gain in current personal finances. … Sentiment has now risen nearly 60% above the all-time low measured in June of 2022 and is likely to provide some positive momentum for the economy. Sentiment is now just 7% shy of the historical average since 1978.

“Year-ahead inflation expectations softened to 2.9% after plunging in December. The current reading is the lowest since December 2020 and is now within the 2.3-3.0% range seen in the two years prior to the pandemic. Long-run inflation expectations edged down to 2.8% falling just below the 2.9-3.1% range seen for 26 of the last 30 months. These expectations remained slightly elevated relative to the 2.2-2.6% range seen in the two years pre-pandemic.”

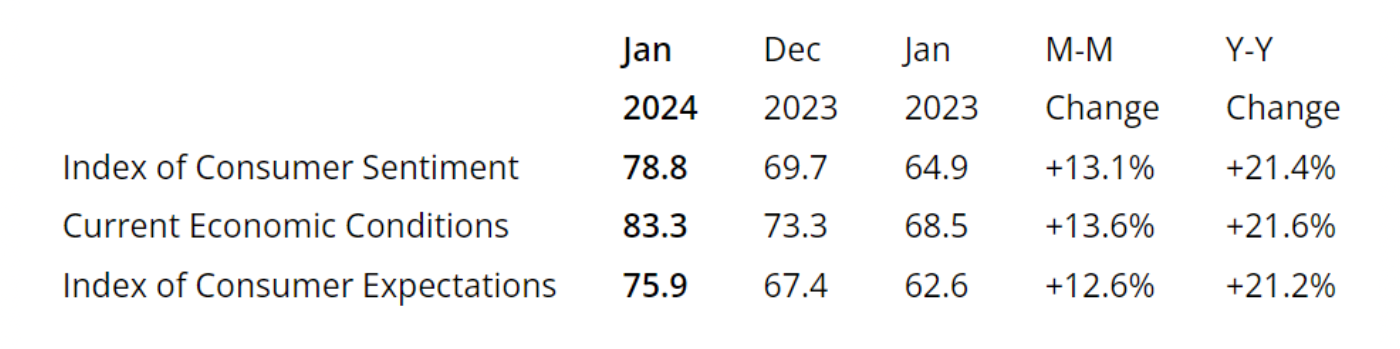

TABLE 1: PRELIMINARY CONSUMER SENTIMENT RESULTS FOR JANUARY 2024

Source: University of Michigan

FIGURE 3: CONSUMER SENTIMENT POSTS LARGEST MONTHLY GAIN SINCE DECEMBER 2005

Sources: University of Michigan, Creative Planning

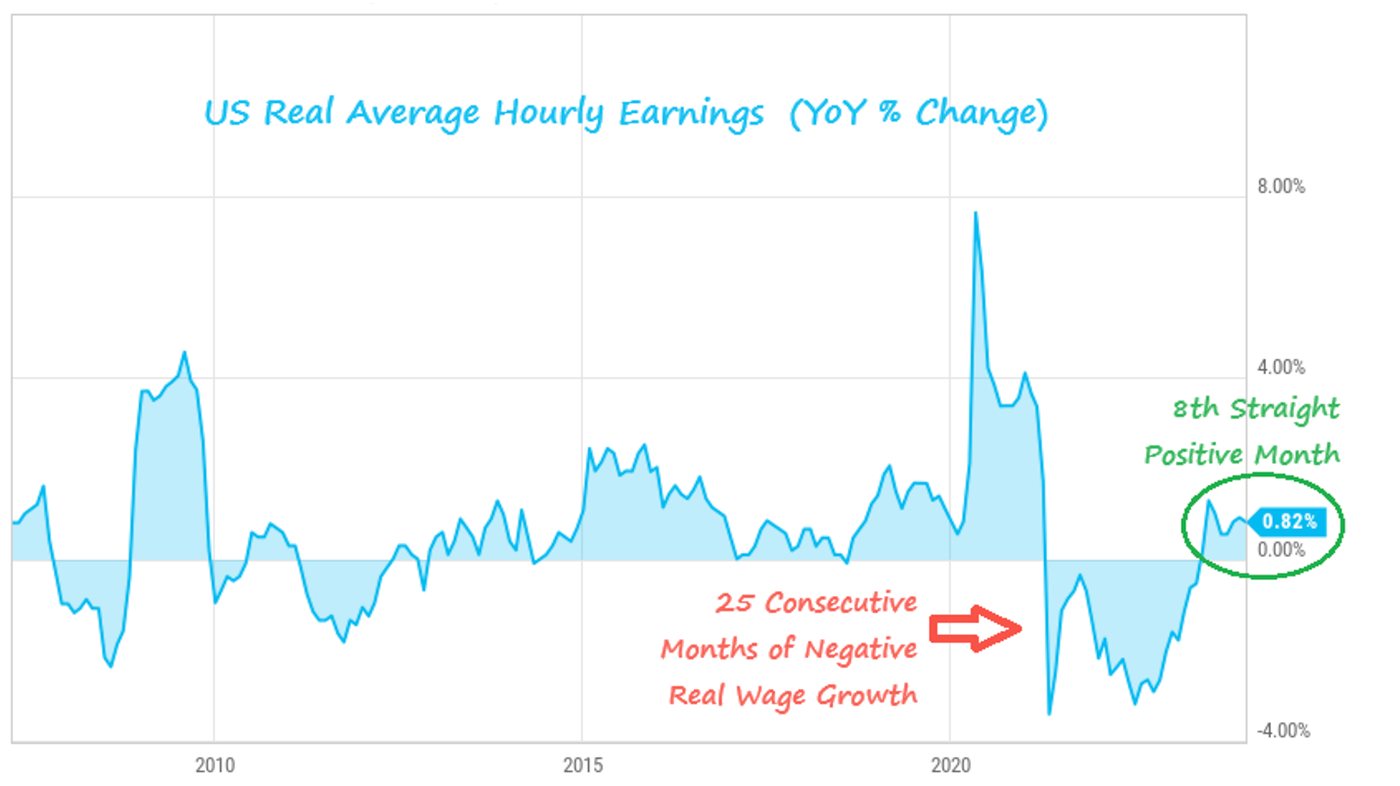

Strategist Charlie Bilello at Creative Planning notes that beyond lower inflation expectations, one of the main drivers of consumer sentiment gains is wage growth outpacing inflation for eight consecutive months, after “a record 25 consecutive months of negative real wage growth.”

FIGURE 4: POSITIVE REAL WAGE GROWTH FOR EIGHT MONTHS

Sources: Creative Planning, Bureau of Labor Statistics

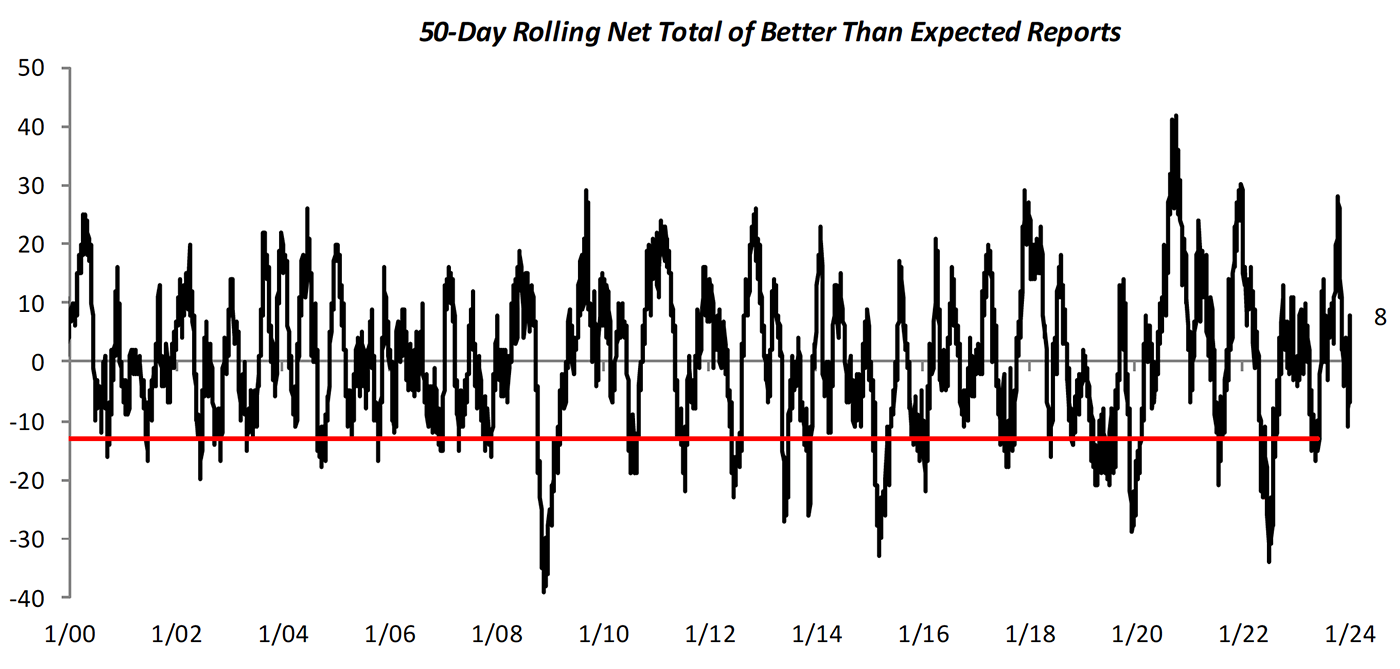

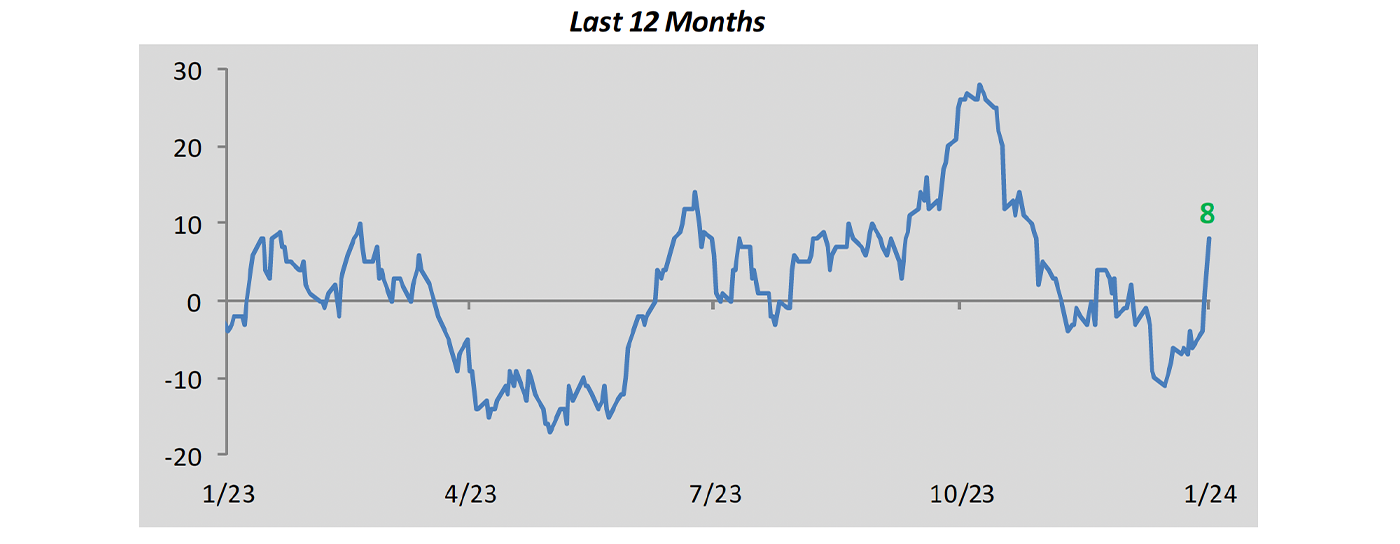

Bespoke Investment Group also points to a distinct improvement in economic data, as measured by their proprietary Economic Indicator Diffusion Index:

“While strong economic data has been kryptonite for the market since the Fed started talking about hiking rates in late 2021/early 2022, now that the Fed has pivoted and is more biased towards cutting rates than hiking rates, good economic news is good again. This was on display this week as the market rallied to new highs even as the pace of better than expected data surged.”

FIGURE 5: BESPOKE ECONOMIC INDICATOR DIFFUSION INDEX: HISTORICAL VIEW AND LAST 12 MONTHS

Source: Bespoke Investment Group

RECENT POSTS