While the prospects of a slowing economy and issues in the banking sector led some analysts to view the Q1 earnings season with caution, the early reporting has been more positive than expected. However, Q1 earnings overall are still anticipated to be negative year over year, and the decline will likely be the largest reported since Q2 2020.

Yahoo Finance reports,

“We are off to a good start to the 2023 Q1 season, with no signs yet of the long-feared earnings cliff. The picture emerging at this early stage is one of resilience and stability, with an above-average proportion of companies beating estimates and providing a good-enough outlook in an uncertain macro environment.

“For the 53 S&P 500 members that have reported Q1 results, total earnings are up +2.9% on +9.3% higher revenues, with 83% beating EPS estimates and 71.7% beating revenue estimates.

“This is a better performance than we have seen from this group of 53 index members in other recent periods, both in terms of the growth rates as well as the beats percentages.”

Some of the most-watched results for Q1 were from the banking sector.

Yahoo says,

“Bank earnings results have proved to be much more resilient and reassuring relative to what many in the market appeared to fear. … As a result, the Finance sector’s Q1 earnings are now expected to be up +7.6% from the year-earlier period, a significant improvement from the +0.3% growth expected a week ago ahead of the results.

“The three most prominent players in the space—JPMorgan (JPM), Bank of America (BAC), and Citigroup (C)—not only handily beat top- and bottom-line estimates on the back of strength in their lending businesses but also provided favorable commentary on that count for the coming periods.”

The analysis goes on to note that several of the large regional banks have also reported generally positive Q1 results in line with the larger banks, but the smaller regional banks have yet to report.

Overall highlights for Q1 earnings to date: S&P 500 companies

FactSet compiled the following key metrics about the Q1 2023 earnings season in its Earnings Insight:

- “Earnings Scorecard: For Q1 2023 (with 18% of S&P 500 companies reporting actual results), 76% of S&P 500 companies has reported a positive EPS surprise and 63% of S&P 500 companies have reported a positive revenue surprise.

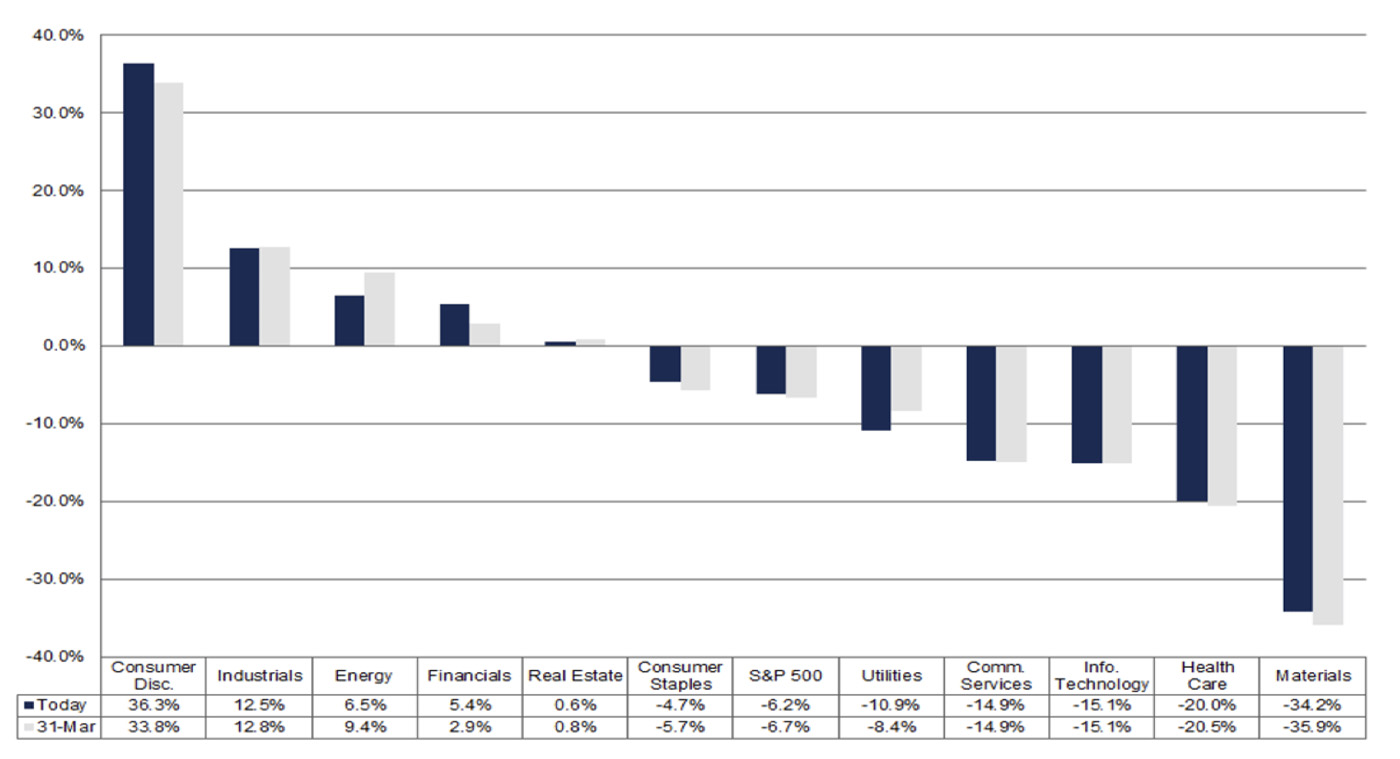

- “Earnings Decline: For Q1 2023, the blended earnings decline for the S&P 500 is -6.2%. If -6.2% is the actual decline for the quarter, it will mark the largest earnings decline reported by the index since Q2 2020 (-31.6%).

- “Earnings Revisions: On March 31, the estimated earnings decline for Q1 2023 was -6.7%. Six sectors are reporting higher earnings today (compared to Mar. 31) due to positive EPS surprises.

- “Earnings Guidance: For Q2 2023, 9 S&P 500 companies have issued negative EPS guidance and 5 S&P 500 companies have issued positive EPS guidance.

- “Valuation: The forward 12-month P/E ratio for the S&P 500 is 18.2. This P/E ratio is below the 5-year average (18.5) but above the 10-year average (17.3). …”

FactSet also reported the following additional findings for the Q1 2023 earnings season through April 21:

“The first quarter earnings season for the S&P 500 is off to a better start relative to the last two quarters. … The index is reporting higher earnings for the first quarter today relative to the end of last week and relative to the end of the quarter. On the other hand, the index is still reporting the largest year-over-year decline in earnings since Q2 2020. …

“In terms of revenues, 63% of S&P 500 companies have reported actual revenues above estimates, which is below the 5-year average of 69% but equal to the 10-year average of 63%. …

“… The blended revenue growth rate for the first quarter is 2.1% today, compared to a revenue growth rate of 1.9% last week and a revenue growth rate of 1.9% at the end of the first quarter (March 31). …

“If 2.1% is the actual growth rate for the quarter, it will mark the lowest revenue growth rate reported by the index since Q3 2020 (-1.1%). …

Looking at specific sectors, FactSet notes,

“Five of the eleven sectors are reporting year-over-year earnings growth, led by the Consumer Discretionary and Industrials sectors. On the other hand, six sectors are reporting (or are expected to report) a year-over-year decline in earnings, led by the Materials, Health Care, Information Technology, and Communication Services sectors.”

FIGURE 1: S&P 500 PROJECTED EARNINGS GROWTH (Q1 2023)

Source: FactSet

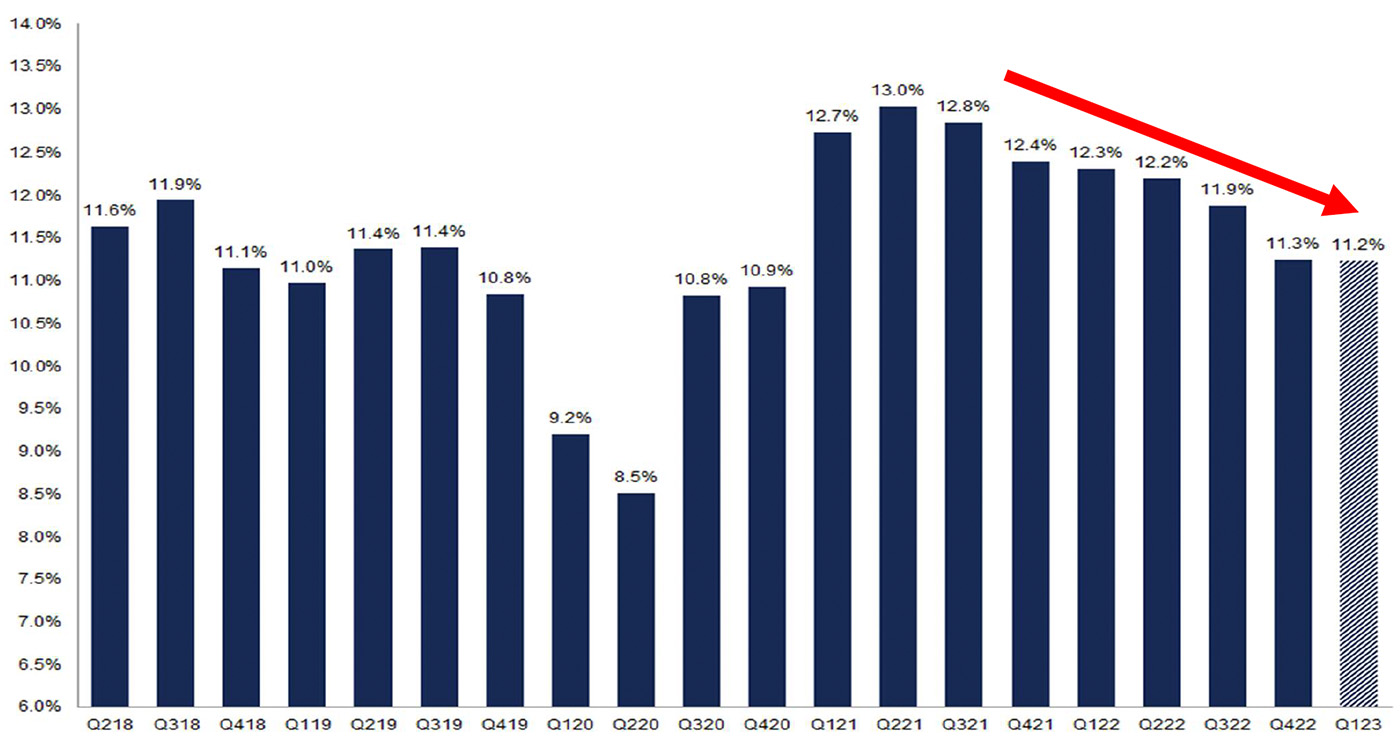

FactSet also notes that S&P 500 companies are projected to report a lower net profit margin for the seventh quarter in a row:

“The (blended) net profit margin for the S&P 500 for Q1 2023 is 11.2%, which is below the previous quarter’s net profit margin, below the year-ago net profit margin, and below the 5-year average net profit margin (11.4%). … It will also mark the lowest net profit margin reported by the index since Q4 2020 (10.9%).”

FIGURE 2: S&P 500 NET PROFIT MARGIN (Q2 2018–Q1 2023)

Source: FactSet

Outlook moving forward

On a more positive note, FactSet sees the earnings picture improving in the second half of 2023:

“Looking ahead, analysts still expect earnings growth for the second half of 2023. For Q2 2023, analysts are projecting an earnings decline of -5.0%. For Q3 2023 and Q4 2023, analysts are projecting earnings growth of 1.6% and 8.5%, respectively. For all of CY 2023, analysts predict earnings growth of 0.8%.”

Looking at the broader universe of stocks, Barron’s notes that next year may see significant earnings improvement:

“About 76% of companies in the MSCI USA Index have seen upwardly revised earnings estimates for the next year, according to Ned Davis Research. That’s the highest level in 10 months and up from a recent low of just under 60%, and it could be a sign that estimates have bottomed and are ready to rebound.”

New this week: