While U.S. equity markets cheered the news on vaccine developments last week, Federal Reserve Chairman Jerome Powell gave a more sobering assessment.

According to Bloomberg,

“Three of the world’s top central bankers warned Thursday [Nov. 12] that the prospect of a Covid-19 vaccine isn’t enough to put an end to the economic challenges created by the pandemic.

“‘We do see the economy continuing on a solid path of recovery, but the main risk we see to that is clearly the further spread of the disease here in the United States,’ Federal Reserve Chair Jerome Powell said during a panel discussion at a virtual conference hosted by the European Central Bank. ‘With the virus now spreading, the next few months could be challenging.’

“Powell was joined on the panel by Bank of England Governor Andrew Bailey and ECB President Christine Lagarde. Both echoed his caution, and added to recent warnings from other central bankers against complacency.”

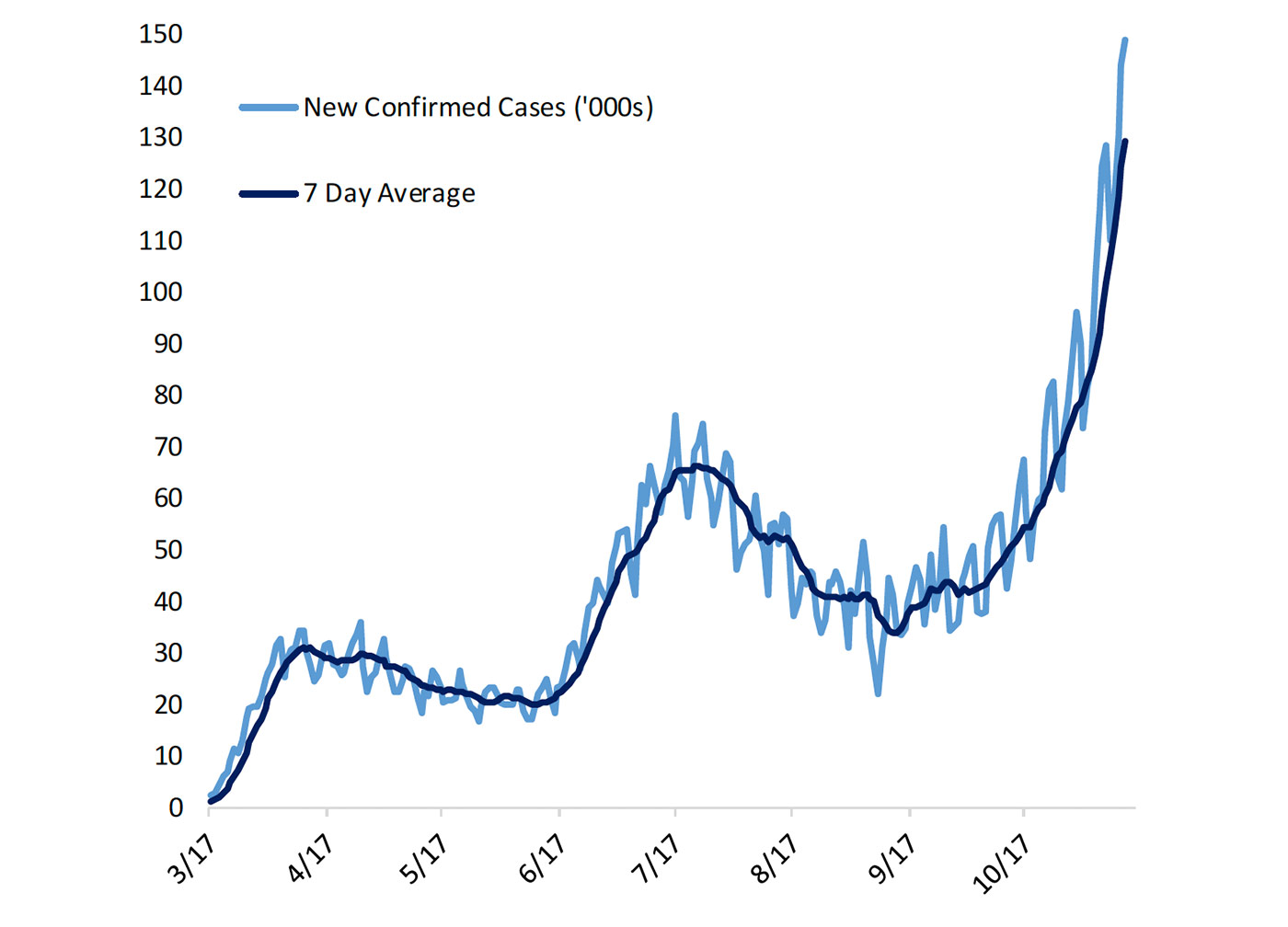

Powell’s comments came as various U.S. economic indicators have mostly seen improvement over the past few months, while COVID-19 cases have recently accelerated their rise in the U.S. and around the world.

Source: Bespoke Investment Group; data as of 11/12/2020

Source: Bespoke Investment Group; data as of 11/12/2020

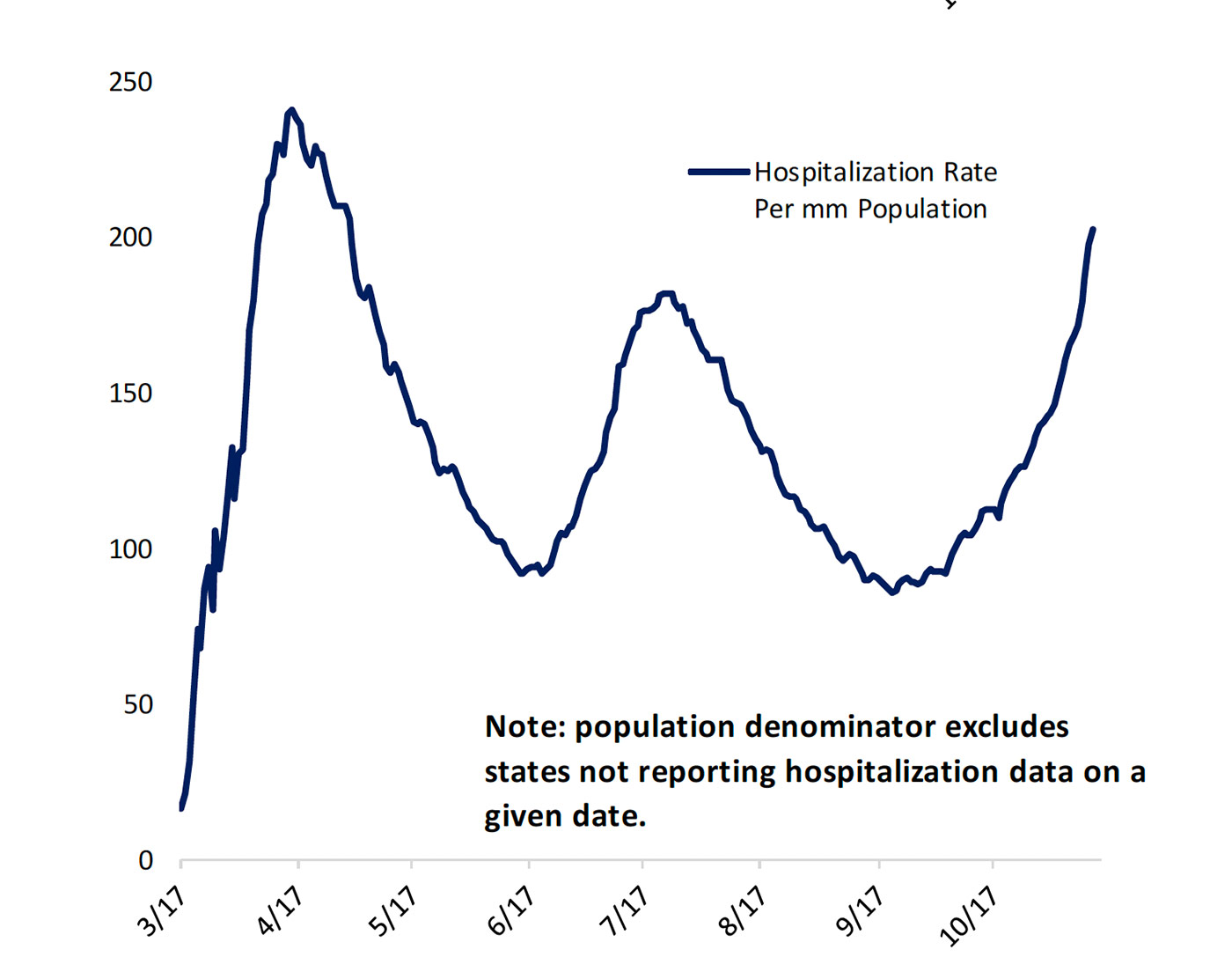

FIGURE 3: CONFIRMED GLOBAL DAILY COVID CASES

Source: World Health Organization; over 54 million confirmed global cases as of 11/16/2020

Despite these disturbing pandemic numbers, U.S. equity markets largely rallied last week on the back of vaccine news. The Dow (DJIA) was up 4.1% and the S&P 500 gained 2.2%. The Russell 2000, more directly reflecting the prospects of the economy returning closer to “normal” over the next 12–18 months, was up 5.4%. The NASDAQ Composite was the only major index to fall, declining 0.6% (perhaps reflecting the beginning of a rotation to those stocks hurt most during the COVID-19 crisis).

To this point, according to Barron’s, on Monday, Nov. 9, the day of the large vaccine-driven rally, “… [A portfolio constructed] by buying stocks with the most momentum and selling the stocks with the least would have dropped nearly 14%, notching its worst day on record.”

Barron’s also noted over the weekend (prior to further market gains on Monday, Nov. 16),

“Another striking statistic: The stock market has done better since this U.S. election than over any equivalent period following a U.S. presidential election since the data began being recorded in 1928. Since Nov. 3, 2020 the S&P 500 has gained 6.4%, narrowly beating out the 6.3% gain in the ten days following Ronald Reagan’s victory over Jimmy Carter in 1980.”

Some stronger economic indicators have further added to the positive sentiment in the markets.

Bespoke Investment Group says, in looking at a broad universe of companies reporting this earnings season,

“With earnings season slowing down, this has been the best quarter for EPS beat rates in the history of our data: almost 80% of companies have reported higher EPS than estimated by analysts. … Turning to guidance, this has also been a fantastic quarter for outlooks provided by reporting company management teams. 16.5% of companies have raised guidance, the best for this cohort since the mid-2000s, reversing the huge drop in guidance raises associated with the start of the COVID pandemic.”

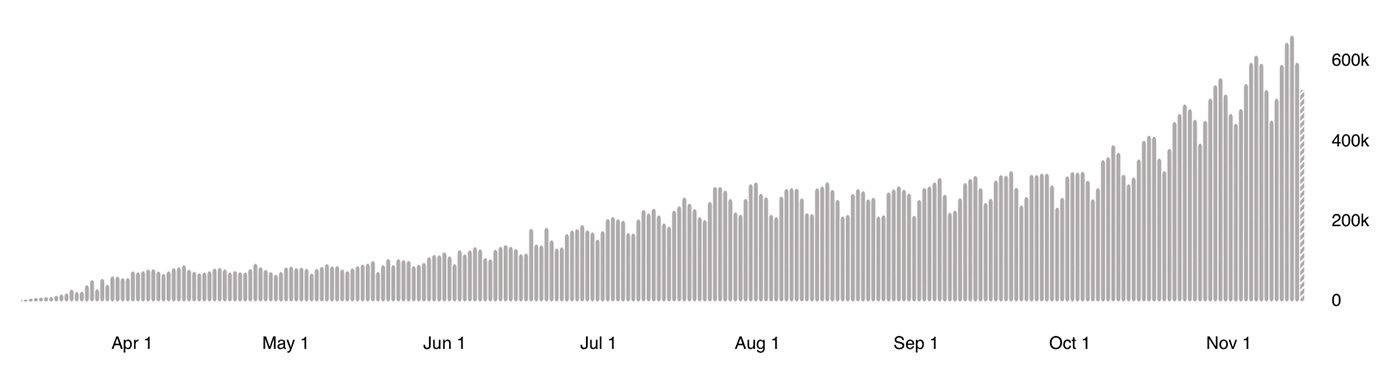

And, according to the Institute for Supply Management,

“The October Manufacturing PMI registered 59.3 percent, up 3.9 percentage points from the September reading of 55.4 percent and the highest since September 2018 (59.3 percent). This figure indicates expansion in the overall economy for the sixth month in a row after a contraction in April, which ended a period of 131 consecutive months of growth.”

Sources: Institute of Supply Management, Trading Economics

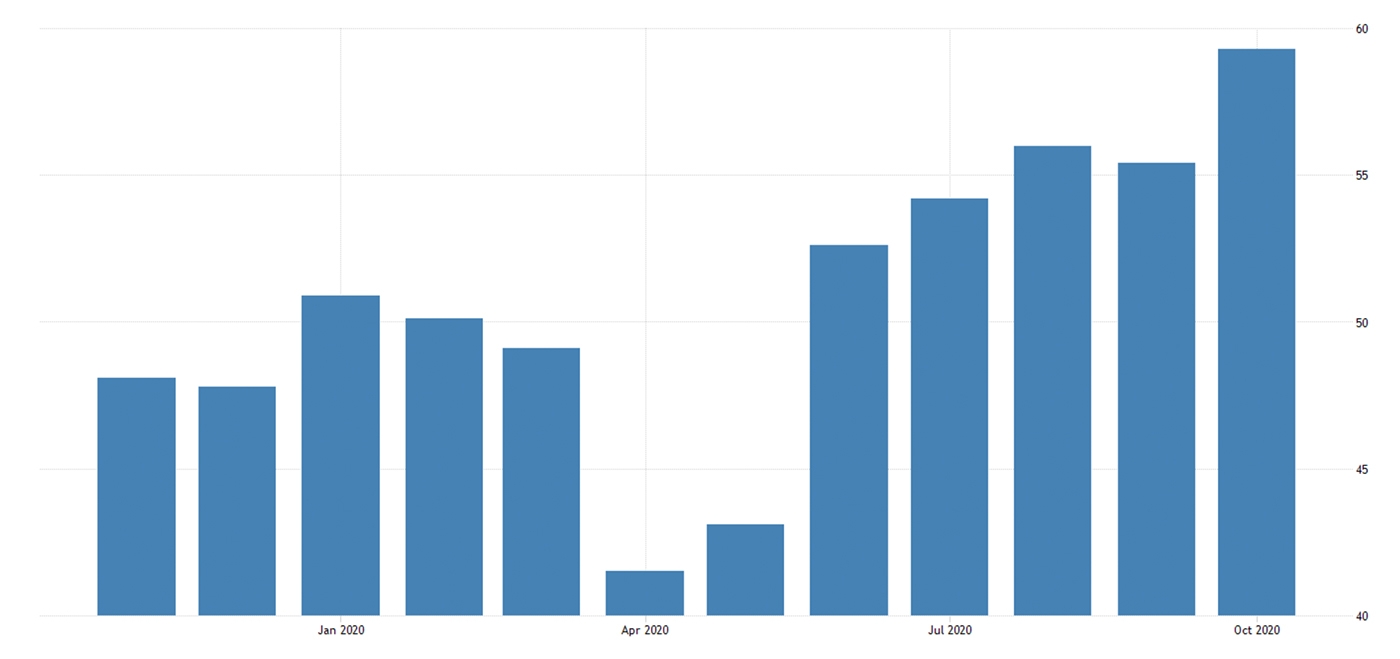

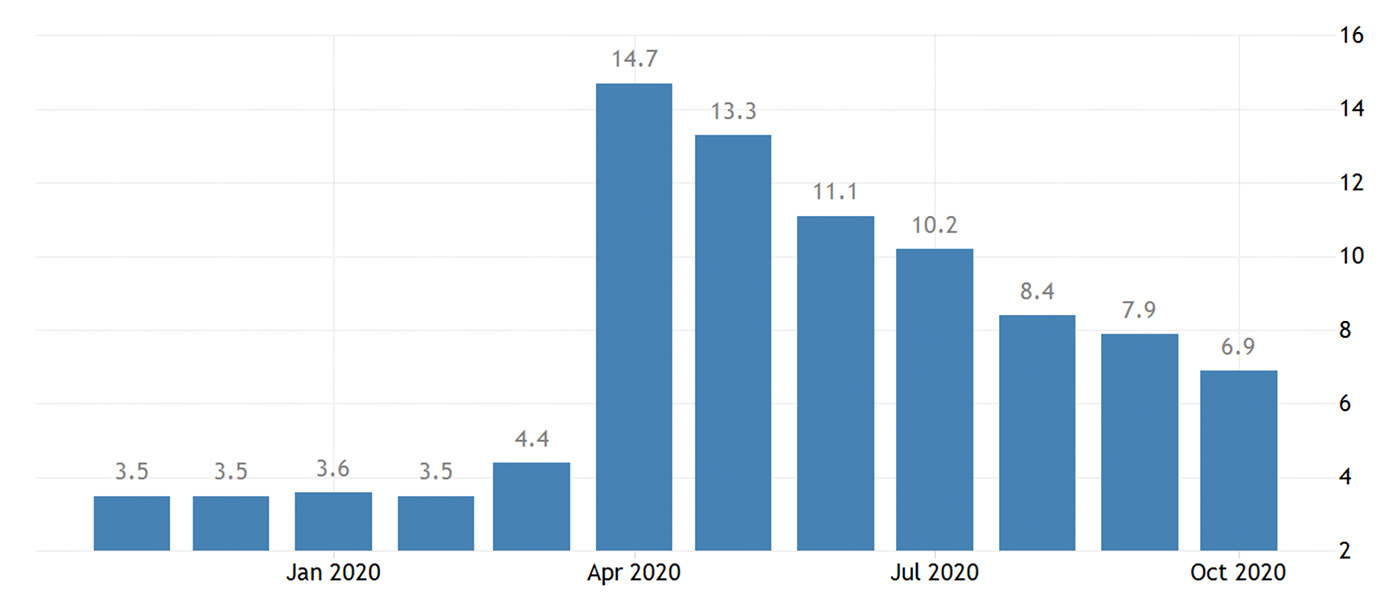

Sources: U.S. Bureau of Labor Statistics, Trading Economics

“We also have surging COVID case counts and their negative economic impact to contend with; some private trackers suggest consumer spending has dropped materially and that half a million jobs have been lost in the month of November. Of course, those trackers could be wrong, but given the explosive rise in prevalence for COVID in large swathes of the U.S. and the re-start of restrictions to prevent its spread, the magnitude of Q4’s economic advance may be under pressure.”