The unabated buzz around AI (artificial intelligence) has had a major impact in 2023 on the stocks of companies with direct or indirect AI exposure.

Reuters noted on May 19,

“Recent advances in artificial intelligence are fueling optimism over how businesses can operate more productively in the years ahead. They are also providing a big boost to the stock market.

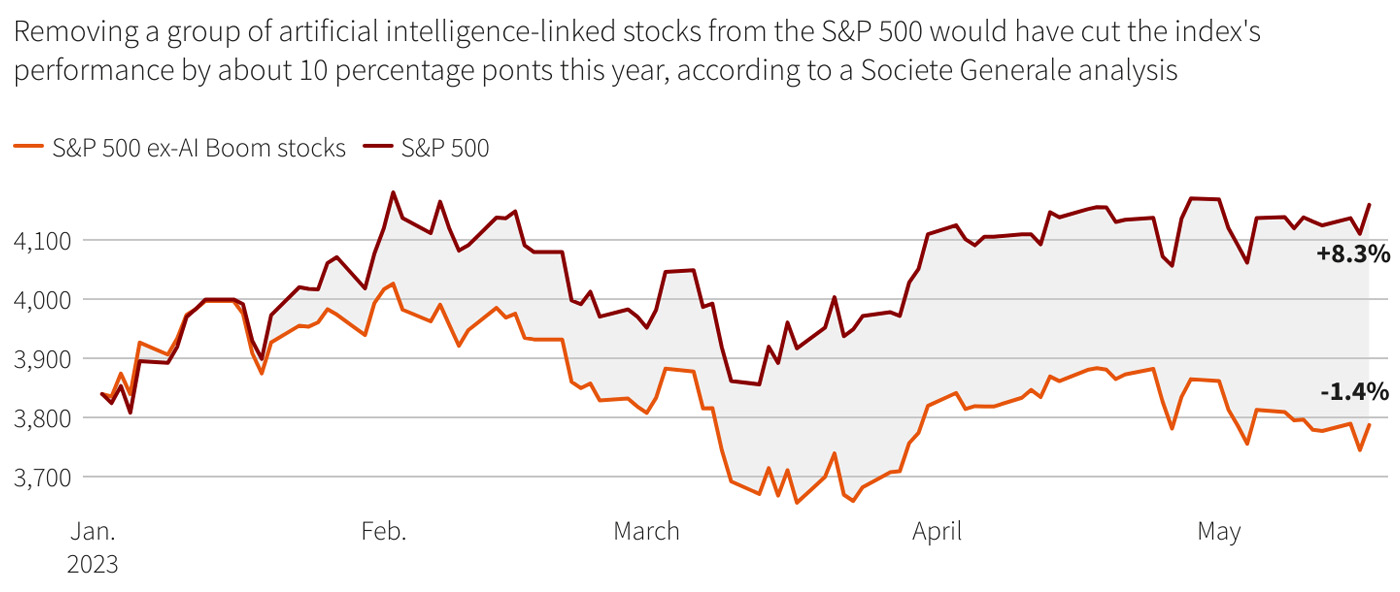

“The S&P 500’s 9% rally this year has been driven by a handful of the index’s biggest stocks, a number of which are at the center of the AI frenzy that has spread in the wake of the chatbot sensation ChatGPT.

“Removing those stocks from the S&P 500 would reduce the index’s performance by roughly 10 percentage points, putting stocks in negative territory for the year, SocGen’s analysis showed.

“‘It’s the AI-driven stocks that are getting the strongest returns,’ said Manish Kabra, head of US equity strategy at SocGen. ‘As a secular theme, for sure, it’s attractive.’

“The rush of AI developments has analysts licking their lips at the profit potential stemming from new revenue opportunities and productivity improvements.

“Goldman Sachs strategists estimate that generative AI could create productivity gains that result in S&P 500 companies expanding profit margins by about 4 percentage points in a decade following widespread adoption.”

David Moenning at Heritage Capital Research adds dimension to the discussion of the dominance of AI stocks this year in the recent article “AI or Bust!,”

“I was asked recently to sum up the action in the stock market as succinctly as possible. As long-time readers are likely aware, brevity is not exactly my strong suit. But after giving it some thought, I did manage to come up with a three-word summary, which also doubles as the title of this week’s market missive: ‘AI or Bust!’

“In short, if you are investing in the big AI (artificial intelligence) names such as Nvidia (NVDA), Microsoft (MSFT), Alphabet (GOOGL), or even some of the next-tier AI themed companies such as Meta (META), Advanced Micro Devices (AMD), Synopsis (SNPS), Amazon.com (AMZN), Palantir (PLTR), Salesforce (CRM), or more recently ServiceNow (NOW), congrats, you are having a great year!

“More specifically, Deutsche Bank noted this week that their basket of ten megacap tech names (MSFT, AAPL, AMZN, GOOGL, META, V, MA, NVDA, NFLX, ADBE) sported a YTD gain of +33.3% as of Wednesday’s close, while the S&P 500 index was up +8.0%.”

FIGURE 1: AI STOCKS BOOSTING U.S. STOCK MARKET

Sources: Societe Generale, Reuters; data as of 5/17/2023

Looking at one highly rated ETF in the AI space, the iShares Robotics & Artificial Intelligence Multisector ETF (IRBO), it becomes apparent that 2022 was a difficult year, as it was for most of the tech sector. But 2023 has seen a significant rebound, with IRBO currently up about 18% year to date.

FIGURE 2: 3-YEAR PERFORMANCE FOR ISHARES ETF IRBO

Source: MarketWatch; data as of 5/22/2023

Beware of an AI “bubble”?

Despite the performance of AI-related stocks in 2023 and overall excitement surrounding artificial intelligence, a recent note from Bank of America (BofA) advises some caution. According to Yahoo Finance,

“Artificial intelligence is this year’s investment craze and experts say the profit potential is huge, but this period could be transformed by a messy pop à la the dot-com bust if the Federal Reserve makes one particular mistake, says Bank of America.

“AI is in a ‘baby bubble’ for now, Michael Hartnett, chief investment strategist at Bank of America Global Research, wrote on Friday [5/19]. …

“Bubbles, whether they’re in the ‘right things’ such as the internet or the ‘wrong things’ like housing, are always started by easy money and are ended by rate hikes, Hartnett said.

“The Fed may be on the way to pausing its run of rate hikes at its June 14 gathering. This month, it bumped up its benchmark rate for the 10th consecutive time to beat down inflationary pressures.

“But a pause would be a policy error, and the Fed attempting to fix it by restarting rate hikes could burst the AI bubble, Hartnett said, recalling similar conditions in the dot-com era.”

New this week: