Maybe not what investors want, but probably what they need

Maybe not what investors want, but probably what they need

Maybe not what investors want, but probably what they need

There are trade-offs involved with both active and passive investment strategies. Understanding the risk-reward profile of any portfolio approach is critical in maintaining long-term investment discipline.

Investing successfully for the long term requires a balance between give and take, choosing the pros and the cons of different investment approaches, taking the good with the bad, and accepting the risks with the rewards of investing.

In other words, you can’t have it both ways. You can’t have your cake and eat it too; you will have to make some trade-offs between what you want and what you need. Some investors expect to have all of the good without any of the bad, to get the rewards but not take the risks, to participate in all the upside and avoid all the downside. That is not possible and never will be.

Chasing investments or investment strategies that promise the reward without the risk is foolish and will always lead to disappointment. It is much better for you to make an honest assessment of what trade-offs you can tolerate and invest accordingly.

If you are the type of investor who likes to have your investment accounts at all-time highs whenever the market is making all-time highs, you should probably just be a passive index fund investor. You can do this with low-to-no-cost ETFs that give you exposure to the same market indexes discussed on the financial news networks every day.

When the news proclaims the market is at all-time highs, if all of your money is in an S&P 500 Index ETF, then you will feel great that your account is also at all-time highs. Of course, when the S&P 500 is in a bear market, your account will be too.

It is important to realize, though, that choosing to be a passive investor tied to a particular index doesn’t free you from having to make trade-offs with your investments—you are still accepting the good and bad of passive investing and making a trade-off with all the other ways one could invest.

The “good” is the long-term returns of the index, the strong bull market periods, never underperforming the market, and having your account at all-time highs when CNBC is lauding the market highs. The “bad” is that you will never beat the market, you’ll have high volatility, you’ll have periods of sheer terror when massive drawdowns occur during bear markets, and there will be long periods of time spent just recovering losses after a bear market has bottomed with a drawdown of 30%, 40%, or 50%.

If you want the “good” listed above, you have to be willing to accept the “bad” too. You can’t have one without the other.

The trade-offs between passive and active investment approaches

People often choose to invest differently from a passive, index-based portfolio in hopes of having their allocation change drive some outperformance to the market. It takes effort to do things differently, so unless there is an expected benefit, why else would one attempt it?

The reasons could be numerous, but at the end of the day, if you do anything different from passive index investing, you are implicitly (or explicitly, for some) making trade-offs in these good and bad aspects of investing. You are changing what risks you are willing to accept for the returns you seek.

If you are an investor with a typical benchmark 60% stock (SPY) and 40% bond (AGG) allocation, you have many portfolio-construction levers to pull (i.e., trade-offs to make) in your effort to “beat the market.”

You may stay passive and choose to incorporate allocations to other index ETFs, such as the NASDAQ Composite or to the Russell 2000, because you think they’ll outperform the large-cap stocks of the S&P 500. That outperformance could come from larger upside returns or smaller downside returns.

Some trade-offs you just made are that you may not be at all-time highs at the same time as the S&P 500 but you may have lower volatility because your portfolio is more diversified. You could also change your bond allocation away from AGG by incorporating longer- or shorter-duration bonds, or higher or lower credit quality, and so on.

These are all trade-offs you are making with the “free and easy” benchmark portfolio, and you should be aware of them and why you are willing to make them.

Maybe instead of passive investing you move to a more active strategy that involves stock picking, like trying to invest in a subset of S&P 500 stocks that will outperform the index. Stocks could be selected based on fundamental analysis, technical setups, or factor-based screening.

You are still trading benchmark performance, with its specific risk and reward profile, for a different investment approach that may or may not have better returns or risks. You should assess if the new risk and reward profile is desirable and justifies the difference from the benchmark. You also should understand the trade-offs made and if they are acceptable—that is, if you can tolerate the difference from the benchmark.

We think it is very important to have a good understanding of why you may want to be invested differently and the trade-offs that are being made with the different allocation. Knowing and understanding how and why your portfolio will behave differently than the benchmarks is key to having the discipline often required to stick with something that is different.

We choose to invest differently because we know that the “bad” that comes with passive investing is just not acceptable to the vast majority of investors. We primarily use strategies that are rules-based and 100% tactical. This means that we can move from being 100% invested in the stock market to being 0% invested in the stock market (100% defensive) based on the rules of our tactical ETF strategies.

Why do we choose to invest this way? For two main reasons: (1) the math of compounded returns, and (2) we believe it is what investors need, whether they recognize it or not.

#1. The math of compounded returns

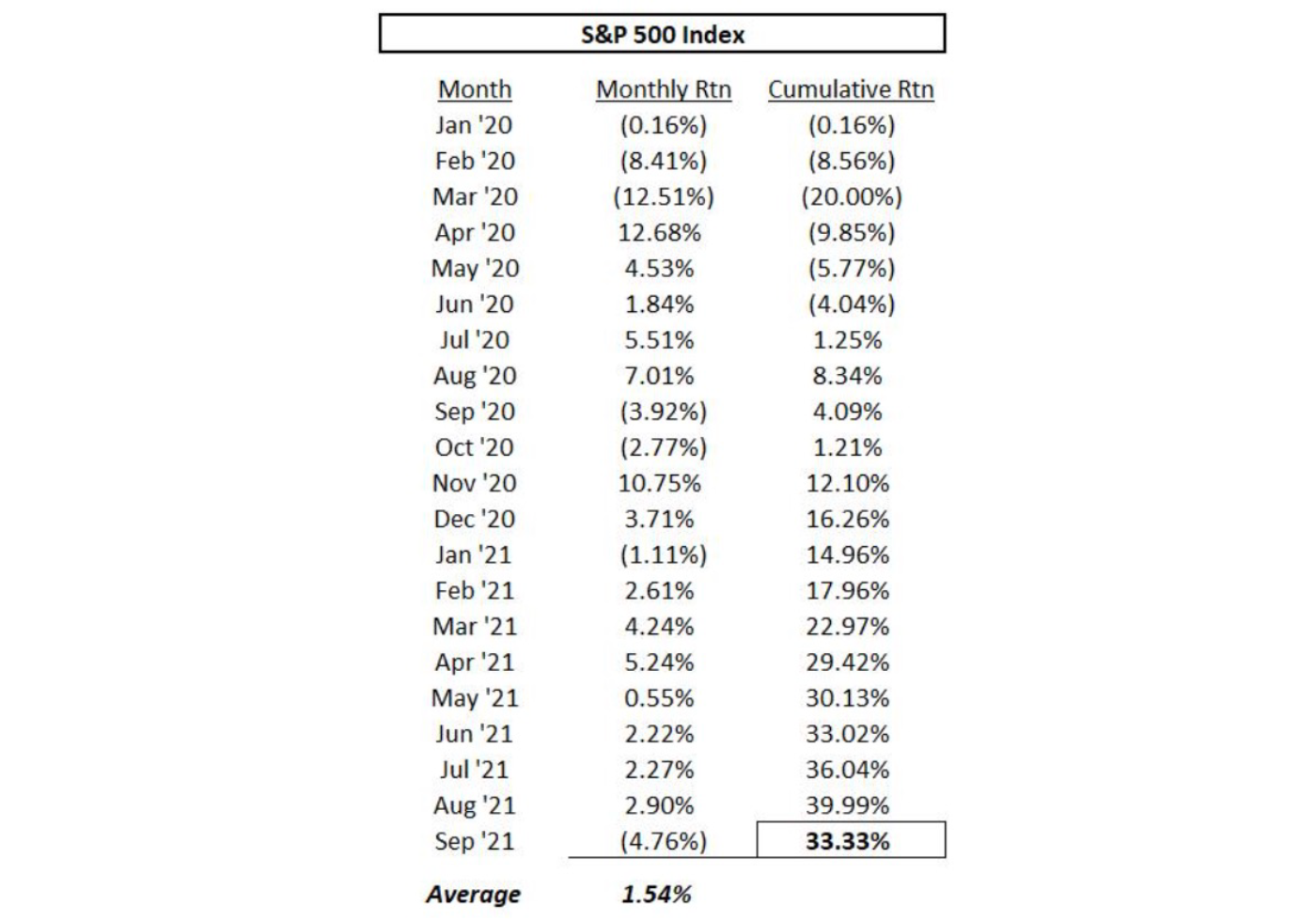

Let’s use a real-world example to illustrate. The U.S. stock market had its first bear market in more than 11 years during 2020, due to the global pandemic. Here are the monthly returns of the S&P 500 for all of 2020 and the first nine months of 2021, and the average and cumulative compounded returns during this period.

TABLE 1: S&P 500 MONTHLY AND CUMULATIVE RETURNS DURING THE COVID PANDEMIC (1/2020–9/2021)

Sources: Market data, G. Morris

The S&P 500 had an average monthly return of 1.54%, while the cumulative compounded return over this time period was 33.33%.

A trend-following strategy did very well at getting out of the way of the COVID bear market and avoided all of the drawdown that occurred during the first half of 2020.

This strategy approach had an average return each month of 1.50%, while the cumulative compounded return over this time period was 34.45%.

While this trend-following strategy had a smaller average monthly return than the S&P 500, the compounded return is greater—and compounded returns are what matter to investors. This result is what we mean by the “math of compounded returns.”

If you can avoid large negative months (or quarters, or years), your returns can compound at a higher rate over time since large negative numbers destroy compounding—it’s just math. This is the same as the trend-following truism that says, “If you are able to miss most of the bad times, you don’t have to participate as much on the upside to still come out ahead.”

#2. What investors need

For reason #2, we have found that most investors cannot tolerate large drawdowns. They need an investment approach that focuses on risk management rather than what they say they want, which is typically to achieve outsized returns. Most investors cannot successfully ride the bear market down 33.9% (like we saw the S&P 500 drop in 2020) and continue to hold on to their position until the market fully recovers.

In theory, this type of investor must exist (academic finance is entirely based on their existence), but in practice, we never find them. The losses in bear markets are far too great to withstand. This is especially true for investors who are nearing retirement or already retired.

Bear market losses can completely devastate your retirement plans when time isn’t on your side to wait for a recovery. Thus, investors need risk management and a way to avoid the devastation of bear markets, while still getting “good” returns during bull markets.

Over the same months shown in the table above, when the S&P 500 suffered the 33.9% drawdown, the trend strategy maximum drawdown was only 10.7%. This happened in October 2020, just after the S&P 500 had fully recovered from the bear market (notably, the drawdowns for trend strategies occur at different times than the market’s).

We firmly believe that drawdown is the best measure of risk (as discussed in previous articles), and so this trend strategy was able to deliver higher compounded returns over this time period while taking significantly lower risk—that is why we invest differently.

There is no such thing as an investment strategy that gets it right all the time or has all the good without any bad. People always look for the holy grail of investing, something that provides the upside returns of the S&P 500 and somehow avoids the downside.

It doesn’t exist. What can exist is an acceptance of which risks and “bad” results investors can tolerate, then find the strategy that provides the best returns based on accepting those risks.

The trade-offs we make through tactical strategies are numerous, and we have to fully accept the “bad” aspects of this approach.

We suffer whipsaw trades and often underperform the benchmark portfolios, we frequently are not at new highs in a trend strategy when the market is making all-time highs, we have down days and months when the market is up, and so on, and so on.

We are willing to make all of these trade-offs in order to achieve the results that we, and investors, need, even if it’s not always what we want.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

This article by Greg Morris, originally titled, “Maybe not what you want, but probably what you need,” was first published at StockCharts.com on Oct. 28, 2021. Many thanks to the author and StockCharts.com for permission to republish an edited version of the article. Please see frequent commentaries by Mr. Morris on the blog Dancing with the Trend.

Greg Morris has been a technical market analyst for over 50 years. His experience includes analysis software development, website analysis and education, and money management. He has a long history of understanding market dynamics and portfolio management and has written four books: “Candlestick Charting Explained” (and its companion workbook), “The Complete Guide to Market Breadth Indicators,” and “Investing with the Trend.” He has educated institutional and individual clients on the merits of technical analysis and why he utilizes a technical, rules-based, trend-following model. Mr. Morris has authored numerous investment-related articles, speaks often in front of investment groups, and has frequently appeared on financial news programs.

Greg Morris has been a technical market analyst for over 50 years. His experience includes analysis software development, website analysis and education, and money management. He has a long history of understanding market dynamics and portfolio management and has written four books: “Candlestick Charting Explained” (and its companion workbook), “The Complete Guide to Market Breadth Indicators,” and “Investing with the Trend.” He has educated institutional and individual clients on the merits of technical analysis and why he utilizes a technical, rules-based, trend-following model. Mr. Morris has authored numerous investment-related articles, speaks often in front of investment groups, and has frequently appeared on financial news programs.

RECENT POSTS

SUGGESTED ARTICLES