Is the yield curve’s predicted recession arriving?

Is the yield curve’s predicted recession arriving?

Elon Musk’s recent feud with President Trump received a lot of media attention. As one of the salvos in this feud, Musk posted on X, “The Trump tariffs will cause a recession in the second half of this year.”

I agree with the forecast, although not necessarily with the cause he cited. If a recession was going to happen anyway, and tariffs merely make it worse, then did the tariffs cause the recession? That is a rhetorical question for which there can be no satisfactory answer.

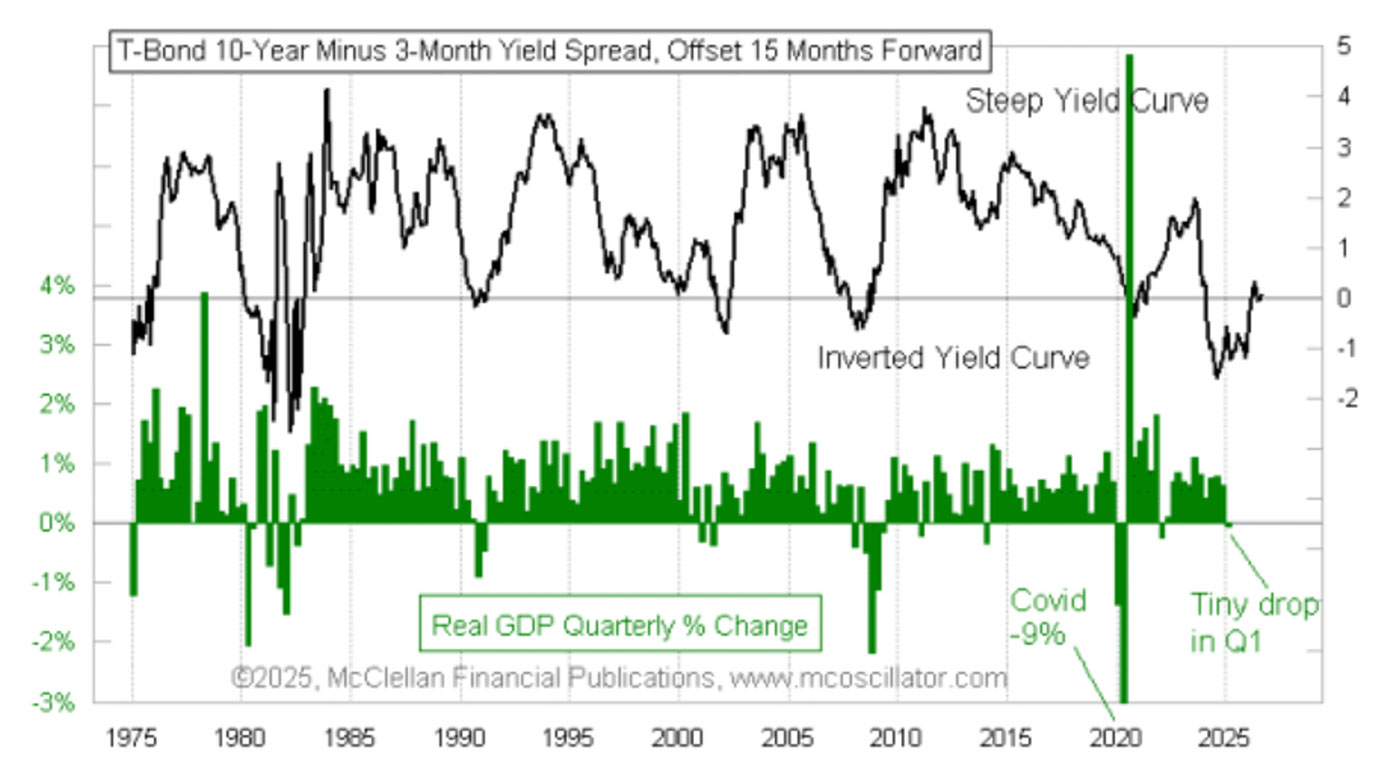

The yield-curve inversion that ran from November 2022 to November 2024 has been telling us to expect a dip in the economy. Inversions typically lead recessions by about 15 months, though the actual lag can vary slightly. The current economic slowdown appearing in the latest real GDP numbers is a bit late in getting started.

YIELD CURVE VERSUS REAL GDP QUARTERLY CHANGE (%)

Source: McClellan Financial Publications

If we count 15 months forward from the last month of inversion in the 10-year to 3-month Treasury yield spread, we arrive at February 2026. A recession appearing anytime between now and then would still be right on time. And remember: The actual lag time can vary by a few months—that is normal.

Back in 1974, Julius Shiskin published an article in The New York Times proposing that a recession be formally defined as two consecutive quarters of negative GDP growth. Shiskin, a prominent economist and former commissioner of the Bureau of Labor Statistics, offered this rule of thumb as a practical way to identify recessions based on GDP data.

The concept was not entirely new. Economists had long used declines in economic output to describe recessions. But Shiskin’s formulation popularized the specific two-quarter metric. It has never become the “official” definition, though, as economists would rather retain the prerogative of declaring recessions based on their own preferred metrics.

The first quarter of 2025 saw a tiny decline in “real” GDP, meaning adjusted for inflation. The “nominal” GDP numbers still showed growth but at a rate below the inflation rate used in those calculations. If the second quarter also shows a contraction, it would meet Shiskin’s definition. (The last time that occurred was in 2022, though the National Bureau of Economic Research elected not to call that an official recession). Such an outcome would likely reignite the debate over whether Shiskin’s definition is the proper one—and almost certainly spark political arguments over whether Trump is screwing up the economy or simply inherited an already troubled one. That is not an argument GDP numbers alone can resolve.

Historically, yield-curve inversions have an unbroken record of forecasting economic recessions. So, it would be quite unusual if we did not get a recession in 2025. That is an important point to keep in mind as we evaluate various tariff proposals and the commentary surrounding them. The politicians in Washington have a small ability to change that, for better or for worse. The Federal Reserve has more of an effect when it allows the yield curve to invert. Thankfully, the yield curve is no longer inverted, but we are still waiting for the 15-month lag to play out.

This is an edited version of an article that first appeared at McClellan Financial Publications on June 6, 2025.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com

RECENT POSTS