Can tariffs replace the income tax?

Can tariffs replace the income tax?

Donald Trump is back in the Oval Office, and tariffs have once again taken center stage in U.S. economic policy. With a renewed push to protect American industries, his administration is ramping up import tariffs, reigniting debate over their economic impact.

Supporters see them as a catalyst for domestic manufacturing and a potential windfall for government revenue, while critics warn of rising costs, disruptions to supply chains, and retaliation from key trading partners.

As these policies take shape, the question remains: Will tariffs be the economic powerhouse Trump envisions, or will they introduce new uncertainties into an already fragile global market?

In this “Three on Thursday,” we explore the historical role of tariffs as a revenue source and assess whether they could ever replace the U.S. income tax.

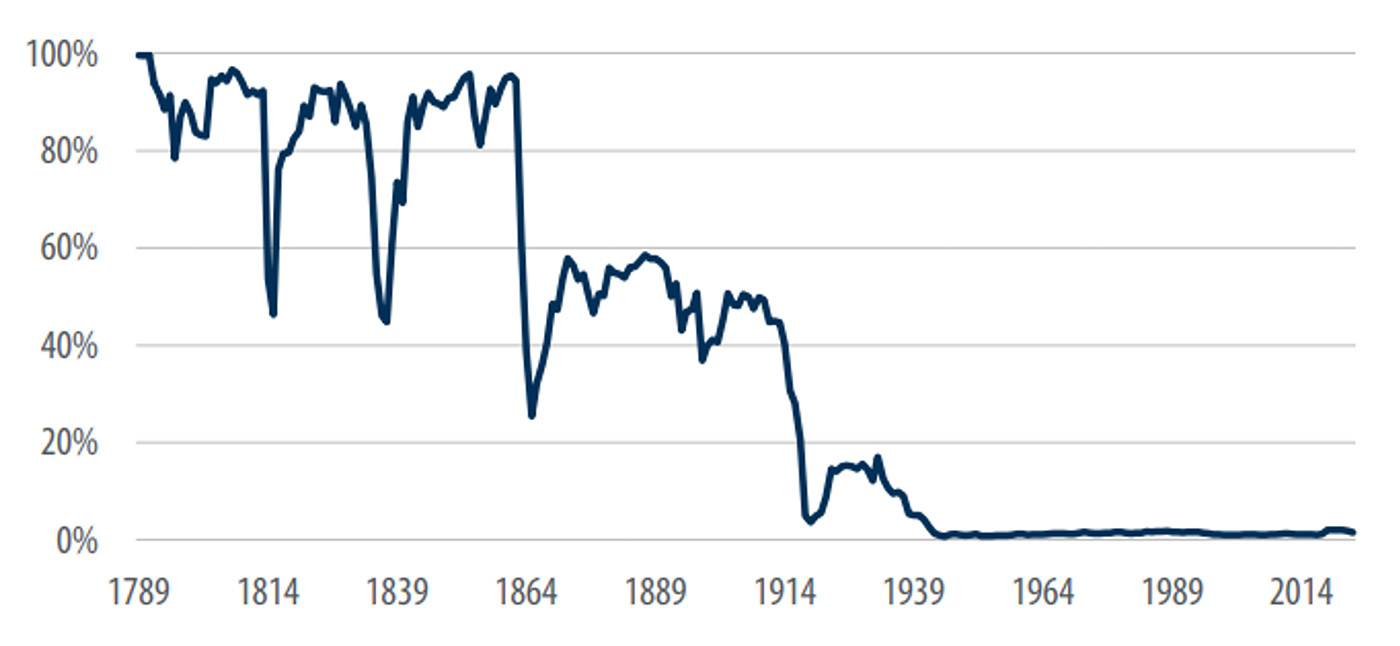

Tariffs revenue as a share of total federal receipts

For much of early U.S. history, tariffs were the federal government’s primary revenue source. That changed with the 16th Amendment in 1913, which introduced the federal income tax, now the dominant revenue stream.

Back then, though, revenues didn’t need to be huge, as government spending was minimal in peacetime. From 1790 to the Civil War, federal spending averaged just 1.5% of GDP, rising slightly to 2.6% by World War I. Even in the 1920s, spending averaged just 4.1% of GDP. Since then, however, government expenditures have surged, now consuming around 23% of GDP—nearly a sixfold increase as a share of GDP.

Sources: Census Bureau, White House Historical Tables, First Trust Advisors. Annual data 1789–2024.

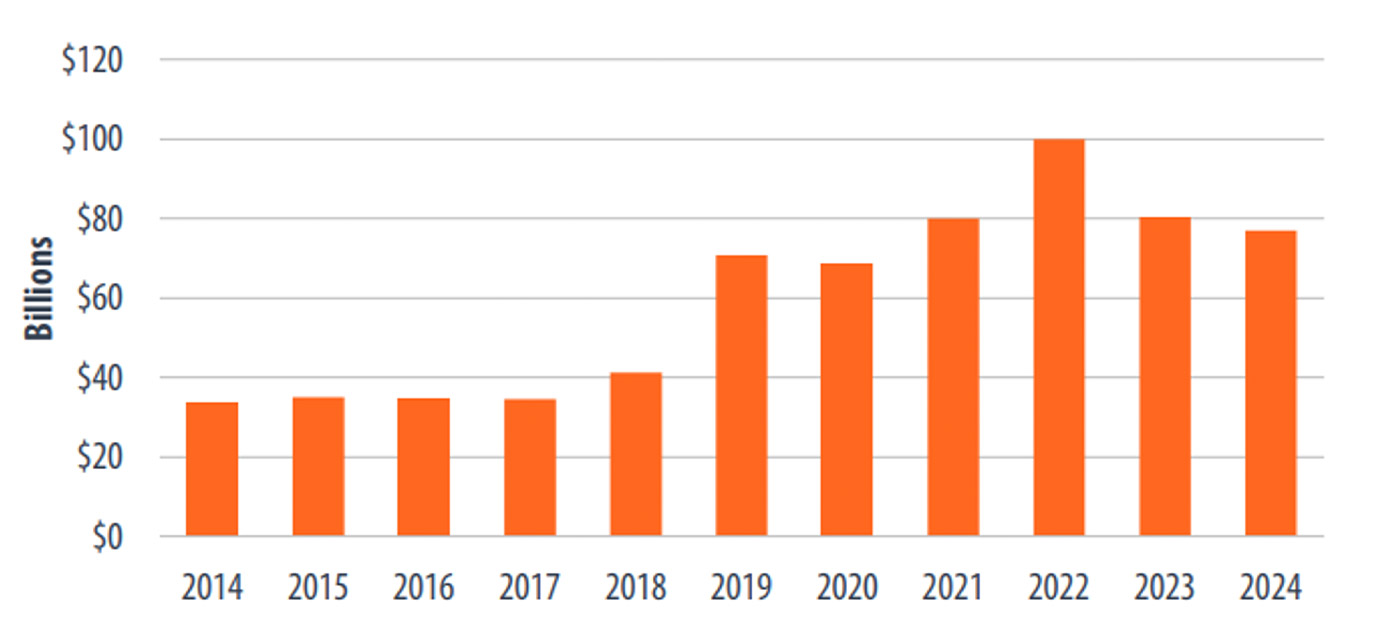

Federal receipts: Customs duties

Since President Trump’s first term, customs duties—including tariffs and other import-related fees—have more than doubled, rising from $34 billion to $77 billion in 2024. This surge is largely due to Trump’s tariff hikes during his first term, which remained in place under former President Biden.

However, even at $77 billion, these revenues account for just 1.6% of the federal government’s $4.92 trillion in total tax revenue. In contrast, individual income taxes alone contribute over 49% of total federal revenue.

Sources: Office of Management and Budget, First Trust Advisors. Annual data 2014–2024.

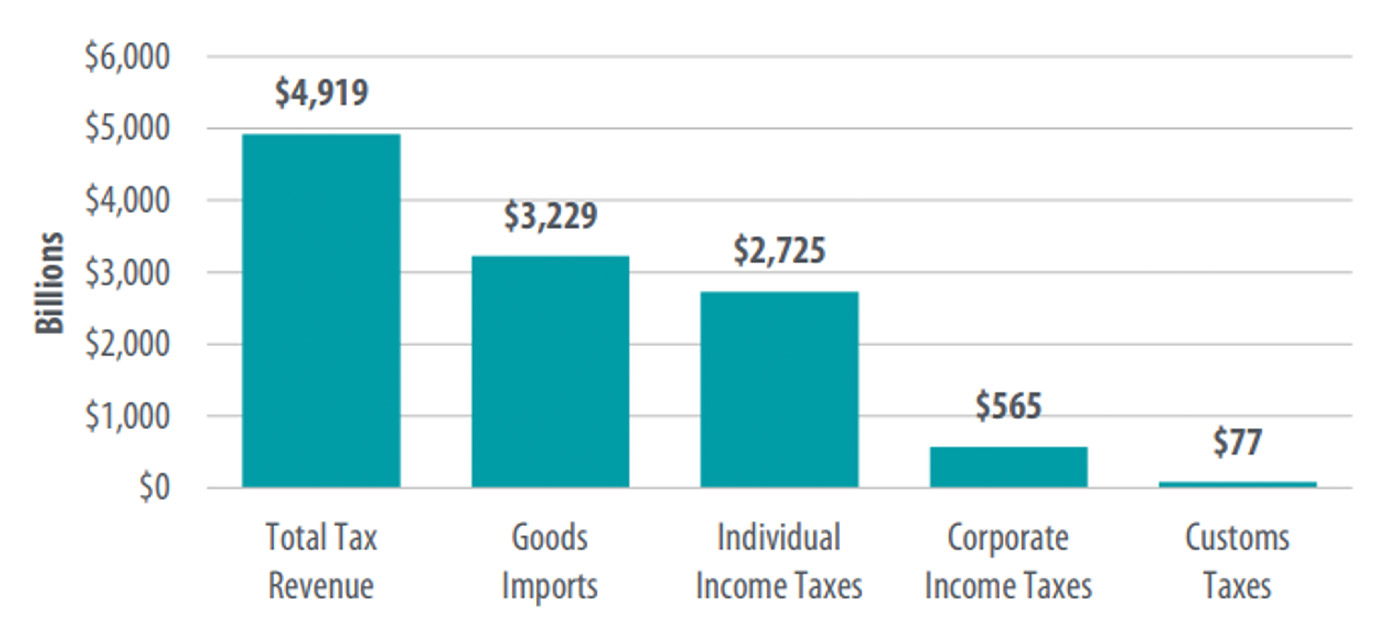

Replacing income taxes with tariffs

In 2024, individual and corporate income taxes raised $3.29 trillion, while U.S. imports totaled $3.23 trillion. Replacing income taxes with tariffs would require an effective tariff rate of more than 100% on imported goods.

But as imports become prohibitively expensive, demand would drop, forcing even higher tariffs to make up for the shortfall—well exceeding 100%. This would devastate businesses reliant on global supply chains, burden consumers (especially low-income households), and spark trade wars and retaliation. The result? Slower economic growth and ultimately, less tax revenue—not more.

Sources: Office of Management and Budget, Census Bureau, First Trust Advisors. Fiscal year data for 2024.

Editor’s note: Brian Wesbury is chief economist at First Trust Advisors LP. He and his team prepare a weekly market commentary titled “Monday Morning Outlook,” as well as frequent research reports and the recurring feature “Three on Thursday.” Proactive Advisor Magazine thanks First Trust for permission to republish an edited version of this commentary, which was first published on Feb. 27, 2025.

There is no guarantee that past trends will continue or projections will be realized. This report was prepared by First Trust Advisors LP and reflects the current opinion of the authors. It is based on sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

First Trust Portfolios LP and its affiliate First Trust Advisors LP (collectively “First Trust”) were established in 1991 with a mission to offer trusted investment products and advisory services. The firms provide a variety of financial solutions, including UITs, ETFs, CEFs, SMAs, and portfolios for variable annuities and mutual funds. www.ftportfolios.com

RECENT POSTS