The fourth-quarter earnings season is in progress, with much of the spotlight so far on results from major financial firms and several mega-cap tech companies. Many analysts anticipate earnings growth will broaden in 2025, with large-cap tech’s dominance on earnings beginning to moderate.

BlackRock Investment Institute recently commented,

“Companies are beating expectations so far, with overall S&P 500 earnings expected to grow roughly 11% for Q4 2024, LSEG Datastream data show. Analysts see earnings jumping 14% this year. That number may tick down as typically happens in most years as early optimism fades, but all sectors—even the struggling energy, materials and healthcare sectors—are expected to see growth. That’s powered by resilient economic growth as consumer spending has held up. …”

“Corporate earnings beats have set the tone for the Q4 season in swing. Even with higher-for-longer interest rates, we think U.S. stocks can keep outperforming this year. We stay overweight. Resilient economic growth is helping sectors beyond tech. That’s partly driven by artificial intelligence (AI) spurring earnings beyond the initial winners during an economic transformation and policy change, we think. Yet we eye risks to risk appetite changing this year depending on earnings and policy. …”

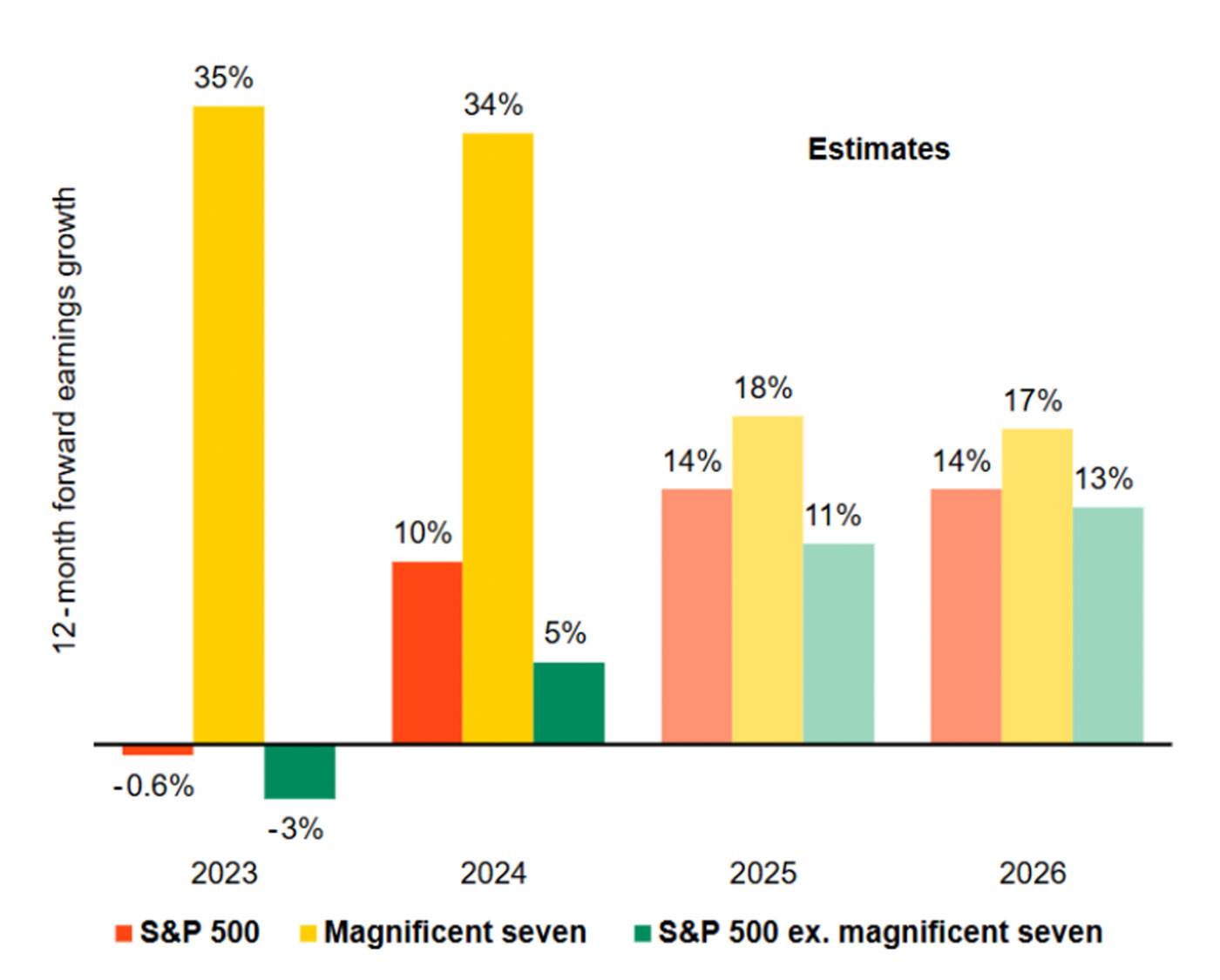

“The ‘magnificent seven’ of mostly mega cap tech companies have driven earnings growth in recent years. Yet policy shifts, a low earnings base for the rest of the market and more non-tech contributors to the AI buildout over time could spur strength to broaden. Analyst forecasts reflect that: The gap between magnificent 7 earnings and those for the rest of the market is expected to shrink in 2025. See the chart. Yet our U.S. equity overweight is not contingent on broadening. We see concentration in mega cap tech as a feature of the economic transformation driven by mega forces like AI—a reason we still like the magnificent seven.”

FIGURE 1: 2025 EARNINGS GROWTH EXPECTED TO BROADEN

12-MONTH CHANGE IN EARNINGS, HISTORICAL AND ESTIMATED, 2023–2026

Source: BlackRock Investment Institute, with data from Bloomberg and Bloomberg US Large Cap Magnificent 7 index. January 2025.

According to a MarketWatch article this week,

“… A team of strategists led by David Kostin suggests shifting around in the hot AI sector after finding an oddity while peeking under the hood of the current earnings season for major technology companies.

“‘This marks the first quarter with no positive sales surprises for the [‘Magnificent Seven’] since 2022,’ Kostin and his team told clients in a recent note.”

The article also noted,

FIGURE 2: PROGRESSION OF MAGNIFICENT SEVEN’S QUARTERLY SALES GROWTH VS. GOING-IN ESTIMATES

Sources: FactSet, Goldman Sachs Global Investment Research

Earnings in focus: Financials and large tech

Financials

Major financial firms reported mixed to highly positive Q4 2024 earnings results, reflecting a complex economic environment. Leading banks like JPMorgan Chase and Goldman Sachs saw robust revenue growth, driven by strong performance in investment banking and wealth management. However, some firms, such as Citigroup, faced challenges with higher-than-expected loan loss provisions and slower consumer banking growth—though they still delivered positive results.

Overall sentiment was cautious, as financial firms closely monitor interest-rate trends, possible regulatory changes, and the policy initiatives of the new administration and Congress. Despite many unknowns, firms generally expressed optimism about 2025, highlighting strategic investments in technology and digital transformation as key drivers for future growth.

FactSet’s initial preview for the financial sector was bullish:

“The Financials sector is predicted to report the highest year-over-year earnings growth rate of all eleven sectors for the fourth quarter at 39.5%.

“At the industry level, four of the five industries in the sector are expected to report year-over-year earnings growth, led by the Banks industry at 187%.”

Emarketer summarized key earnings results from large banks:

- “JPMorgan reported a record annual profit of $58.5 billion—becoming the first bank to top $50 billion in annual profit, per CNN.

- “Citibank recorded a $2.9 billion profit in Q4 2024, a strong departure from its $1.8 billion loss in Q4 2023.

- “Goldman Sachs, Morgan Stanley, and Bank of America reported Q4 2024 profits that more-than doubled since Q4 2023, per Yahoo Finance.

- “Wells Fargo’s Q4 2024 profits were 1.5 times higher than those in Q3 2023, per Banking Dive.”

Major tech companies

Major tech firms reported generally strong Q4 2024 earnings results, but earnings calls highlighted the dynamic and ever-changing nature of the industry.

Amazon posted strong revenue growth, driven by robust performance in its cloud computing and e-commerce segments. Microsoft also saw significant gains, particularly in its Azure cloud services and productivity software. However, Meta faced challenges with declining ad revenues, despite growth in its metaverse initiatives. Apple reported steady sales, with notable success in its services division, although hardware sales were slightly below expectations. Overall, the tech sector has demonstrated resilience, with many companies emphasizing their strategic investments in AI and cloud technologies as key drivers for future growth.

On Feb. 5, Zacks Research noted,

Zacks also commented on the tech sector’s continued huge capital investments:

“Alphabet became the latest member of the Mag 7 club to stick to its ever-rising spending on building out its artificial intelligence infrastructure. This is in line with the trend we saw earlier from Microsoft and Meta Platforms, who showed no inclination of having second thoughts on their equally aggressive AI-focused spending plans in the wake of China’s DeepSeek results. …

“Capex questions aside, we must remember that the Mag 7 players are extraordinarily profitable and still growing impressively. Alphabet’s Q4 earnings increased +28.3% from the year-earlier period to $26.5 billion on a +12.9% increase in revenues to $81.6 billion. In comparison, Microsoft’s Q4 earnings were up ‘only’ +10.2% from the year-earlier level to $24.1 billion, with Meta earnings also increasing +48.7% to $20.8 billion.

“In essence, the primary justification that these companies have put forward for these huge capex plans is to ensure their primacy in the coming artificial intelligence world, which will be critical to the sustainability of their enormous earnings power.”

Q4 2024 earnings season to date

In its Feb. 7 earnings season blog update, FactSet noted, “At this stage of the fourth quarter earnings season, S&P 500 companies are reporting strong results relative to expectations.”

FactSet also provided the following key metrics:

- “Earnings Scorecard: For Q4 2024 (with 62% of S&P 500 companies reporting actual results), 77% of S&P 500 companies have reported a positive EPS surprise and 63% of S&P 500 companies have reported a positive revenue surprise.

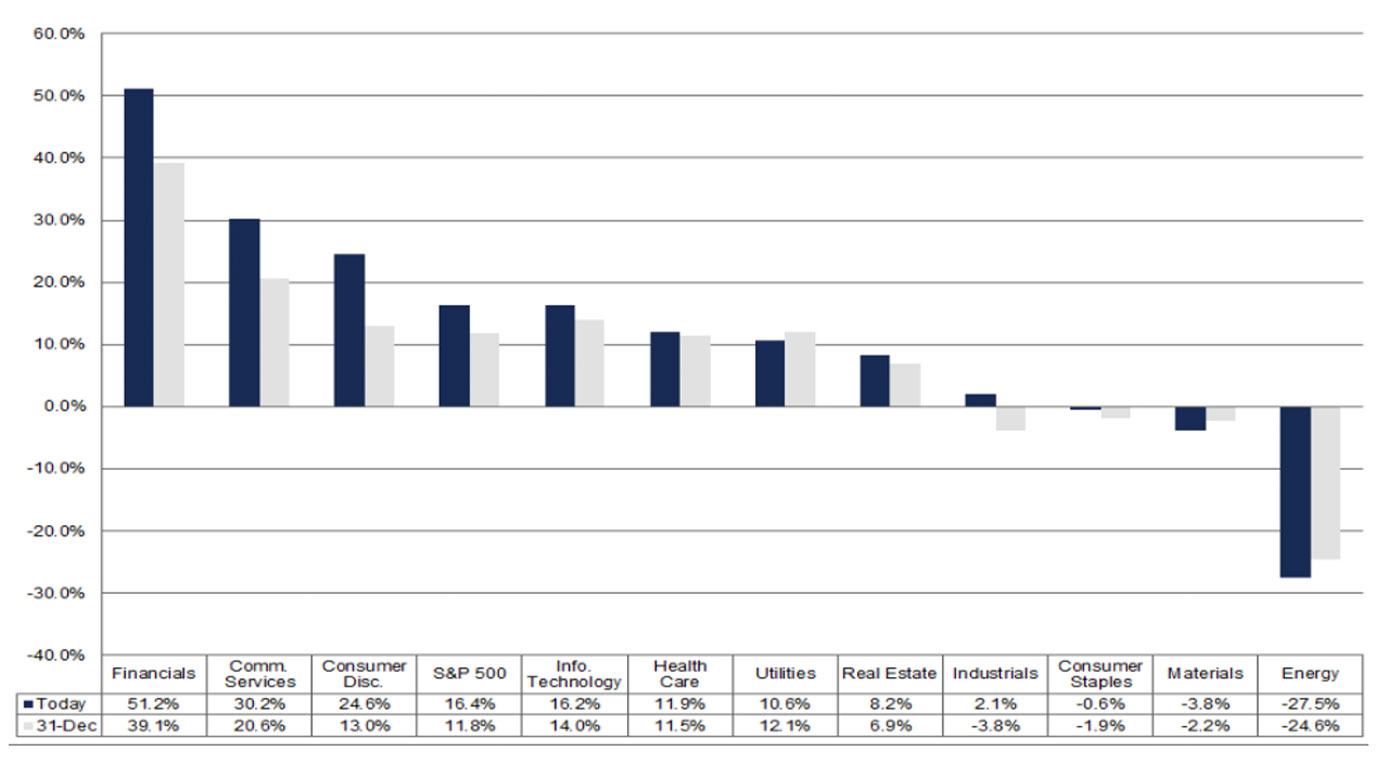

- “Earnings Growth: For Q4 2024, the blended (year-over-year) earnings growth rate for the S&P 500 is 16.4%. If 16.4% is the actual growth rate for the quarter, it will mark the highest (year-over-year) earnings growth rate reported by the index since Q4 2021.

- “Earnings Revisions: On December 31, the estimated (year-over-year) earnings growth rate for the S&P 500 for Q4 2024 was 11.8%. Eight sectors are reporting higher earnings today (compared to December 31) due to positive EPS surprises.

- “Earnings Guidance: For Q1 2025, 34 S&P 500 companies have issued negative EPS guidance and 21 S&P 500 companies have issued positive EPS guidance.

- “Valuation: The forward 12-month P/E ratio for the S&P 500 is 22.1. This P/E ratio is above the 5-year average (19.8) and above the 10-year average (18.2). …

“Eight of the eleven sectors are reporting year-over-year earnings growth for Q4. Six of these eight sectors are reporting double-digit growth: Financials, Communication Services, Consumer Discretionary, Information Technology, Health Care, and Utilities. On the other hand, three sectors are reporting a year-over-year decline in earnings for the quarter. Only one of these three sectors is reporting a double-digit decline: Energy.”

Figure 3 provides a look at current projections for Q4 2024 sector earnings growth by sector.

FIGURE 3: S&P 500 EARNINGS GROWTH BY SECTOR (Y/Y)—Q4 2024

Source: FactSet

RECENT POSTS