What do rising new lows for the NASDAQ suggest for the market?

What do rising new lows for the NASDAQ suggest for the market?

Some relationships work “normally” most of the time, and when they do, it is not very remarkable. But when those relationships break down or act differently, it gets our attention.

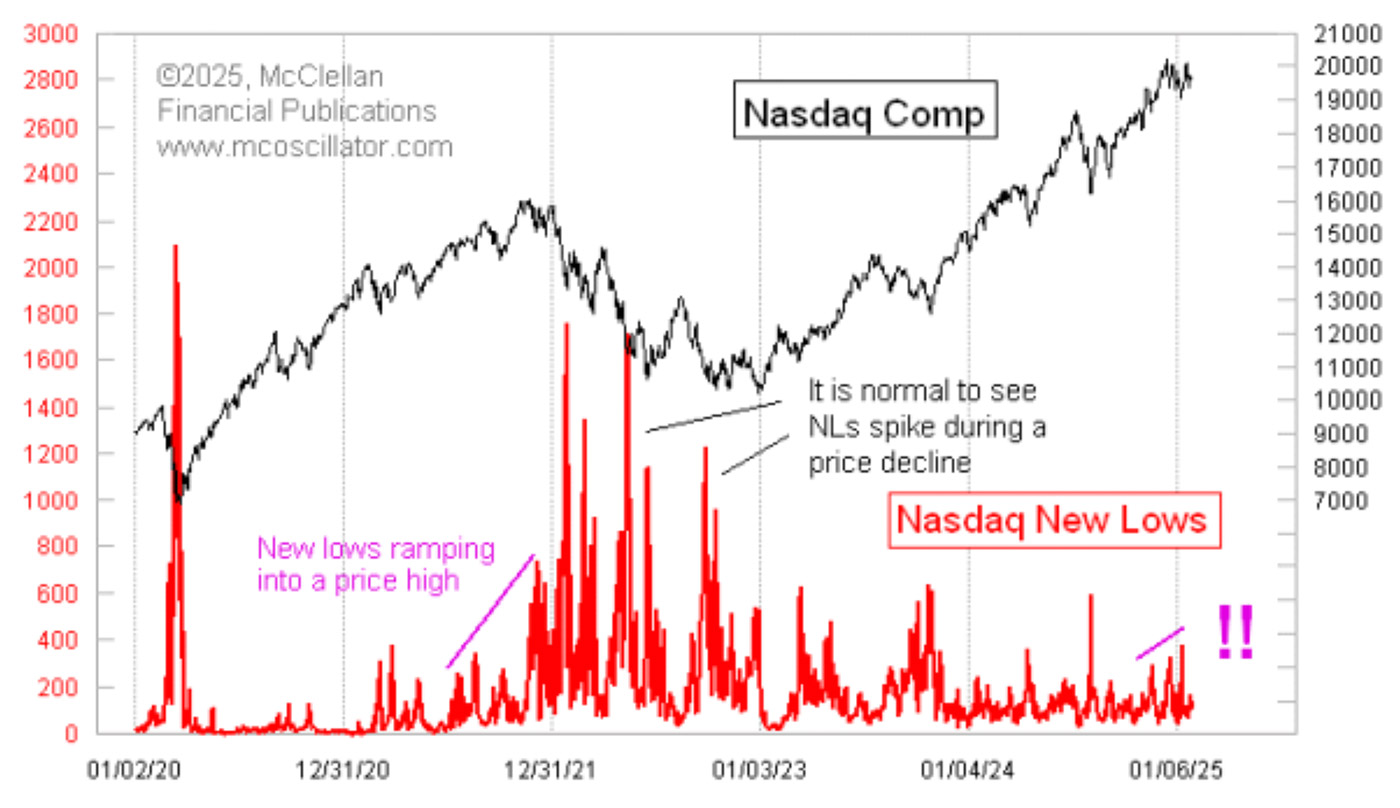

The following chart highlights one of those relationship “breaks”: The number of NASDAQ stocks making 52-week new lows has been rising recently. That is unusual to see while prices are continuing to push to higher highs. Typically, when prices are higher, new lows go down, and then during a sell-off, these numbers spike. Since 2022, this relationship has generally held. But in late 2024, the pattern started to break down, as the chart highlights.

TREND FOR NASDAQ NEW LOWS

Source: McClellan Financial Publications

We saw a similar rise in NASDAQ new lows in late 2021, just before the 2022 bear market. This does not mean we will see the same outcome this time, but it serves as a warning that things are not acting normally—at least based on this data.

When most people think of “market breadth,” they think of advance-decline (A-D) statistics. But new highs (NH) and new lows (NL) offer another way of getting information from the broad list of stocks as opposed to just looking at the capitalization-weighted price indexes. For A-D data, I do not give much weight to the NASDAQ’s A-D Line because it has such a persistent negative bias. Why? The NASDAQ has looser listing standards than the NYSE. Stocks that are moving toward an IPO but then go broke are more likely to do that on the NASDAQ than on the NYSE. This skews the A-D stats over time.

Some technical analysts like to look at NH minus NL, but I do not find that helpful. I prefer to look at NH and NL separately so that the result does not get skewed by price surges in either direction.

A stock making a new 52-week price low is in a downtrend. So if you want to know about how the bottom of the roster is doing, then comparing that number to the 52-week NH number will contaminate the message. That is why the chart above shows just the NL data.

One other interesting point about NH and NL data: Many years ago, NH and NL data were tabulated differently. Before computers, clerks tracked the price history for each stock using paper ledgers, maintaining a different ledger for each stock and each calendar year. So the stats that were reported for NH and NL were really about whether a stock was making a new high or low for the calendar year. This methodology would understandably get into trouble in early January when there was little history for comparison. To address this, statisticians would include the prior year’s histories for a while before switching to the new year’s ledgers around April. This meant that the lookback period for evaluating whether a stock was making a new high or new low ranged from four to 16 months.

That all changed in 1980 when computers allowed statisticians to switch to a more uniform 52-week rolling lookback period, which is the method used to this day. While NH and NL data from before 1980 exist, they are not comparable to post-1980 data due to the differences in calculation methodology.

If tinkering around with the NH-NL data for the NASDAQ and NYSE is something you are interested in doing yourself, we offer a data file for purchase at McClellan Financial Publications.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

This is an edited version of an article that first appeared at McClellan Financial Publications on Jan. 30, 2025.

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com

RECENT POSTS