Real GDP increased at a 2.8% annual rate in Q3

Real GDP increased at a 2.8% annual rate in Q3

Topline summary

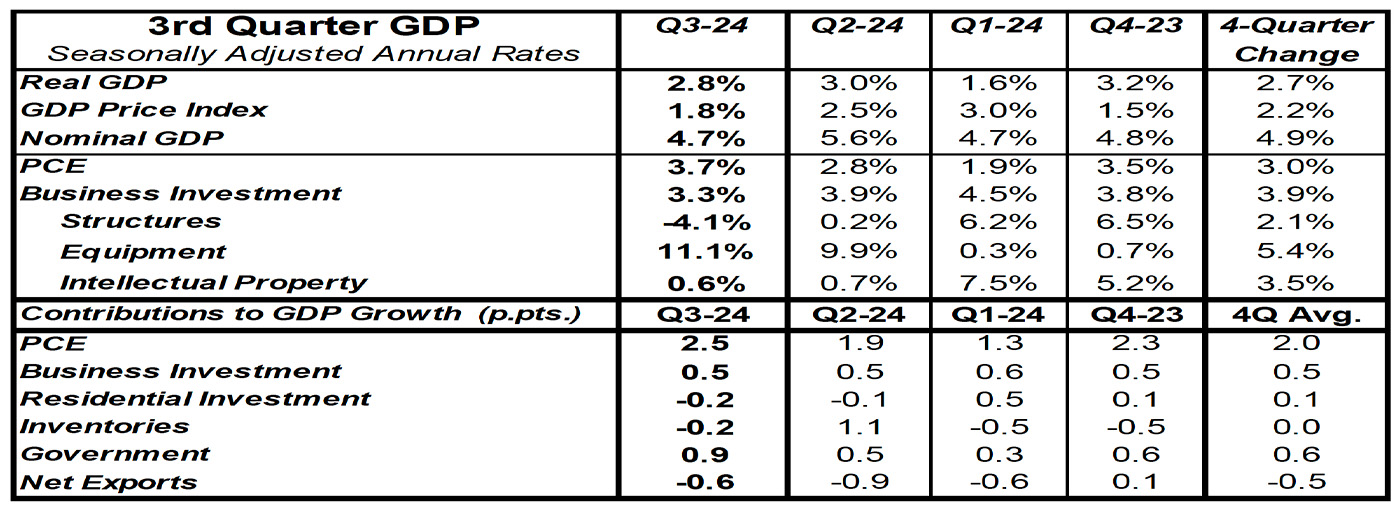

- Real GDP increased at a 2.8% annual rate in the initial reporting for Q3 2024, narrowly lagging the consensus expectation of 2.9%.

- Personal consumption was the largest positive contributor to real GDP growth in Q3, with large gains also seen in government purchases and business investment in equipment. Net exports were the largest drag on growth, with additional declines from home building, inventories, and commercial construction.

- “Core” GDP—a combination of personal consumption, business fixed investment, and home building—rose at a 3.2% annual rate in Q3.

- The GDP price index increased at a 1.8% annual rate in Q3 and is up 2.2% from a year ago. Nominal GDP (real GDP plus inflation) rose at a 4.7% annual rate in Q3 and is up 4.9% from a year ago.

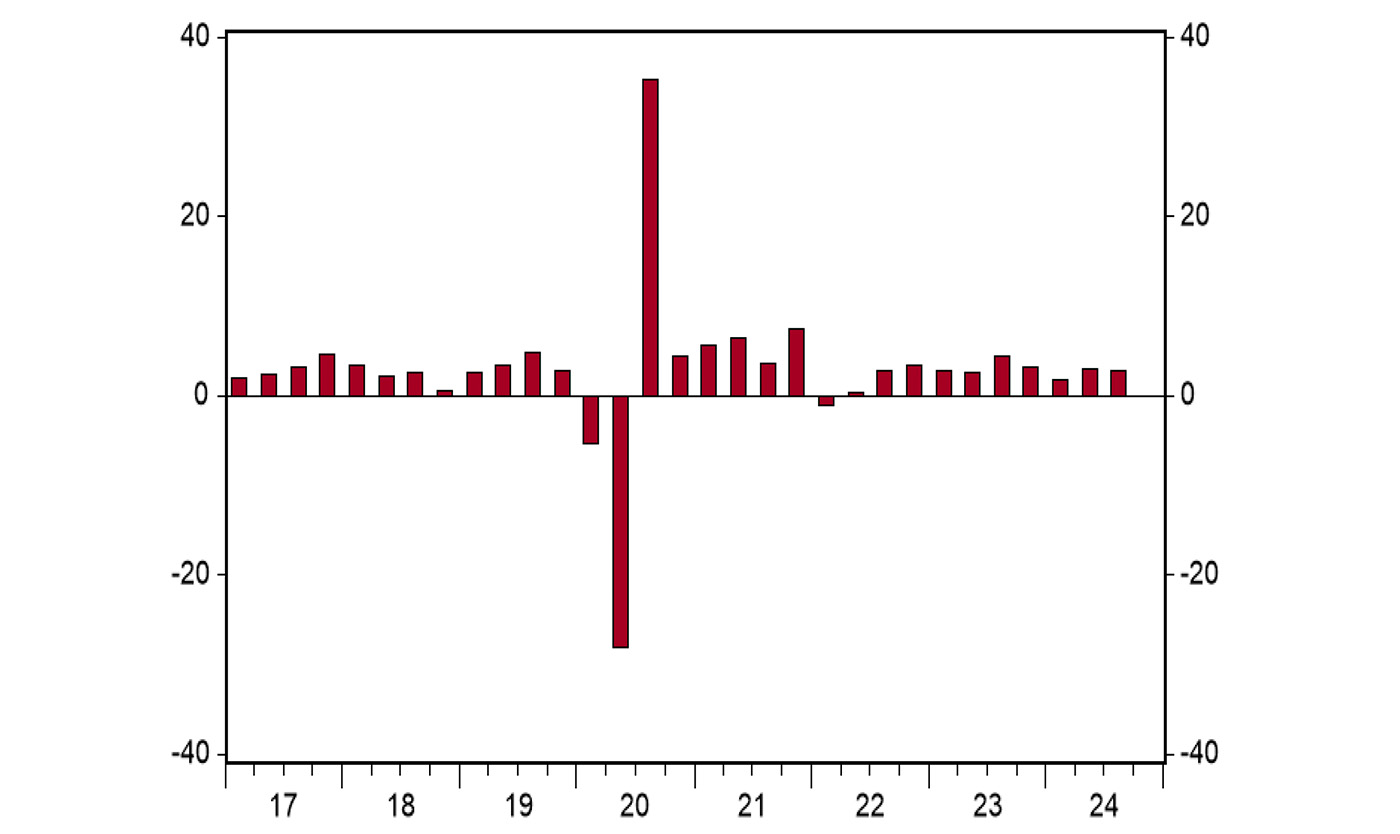

FIGURE 1: Q3 2024 REAL GDP GROWTH (% CHANGE—ANNUAL RATE)

Sources: Bureau of Economic Analysis, Haver Analytics

Implications

The U.S. economy continued to grow at a solid pace in the third quarter. Real GDP rose at a 2.8% annual rate and is up 2.7% from a year ago, with consumer spending driving the vast majority of the growth.

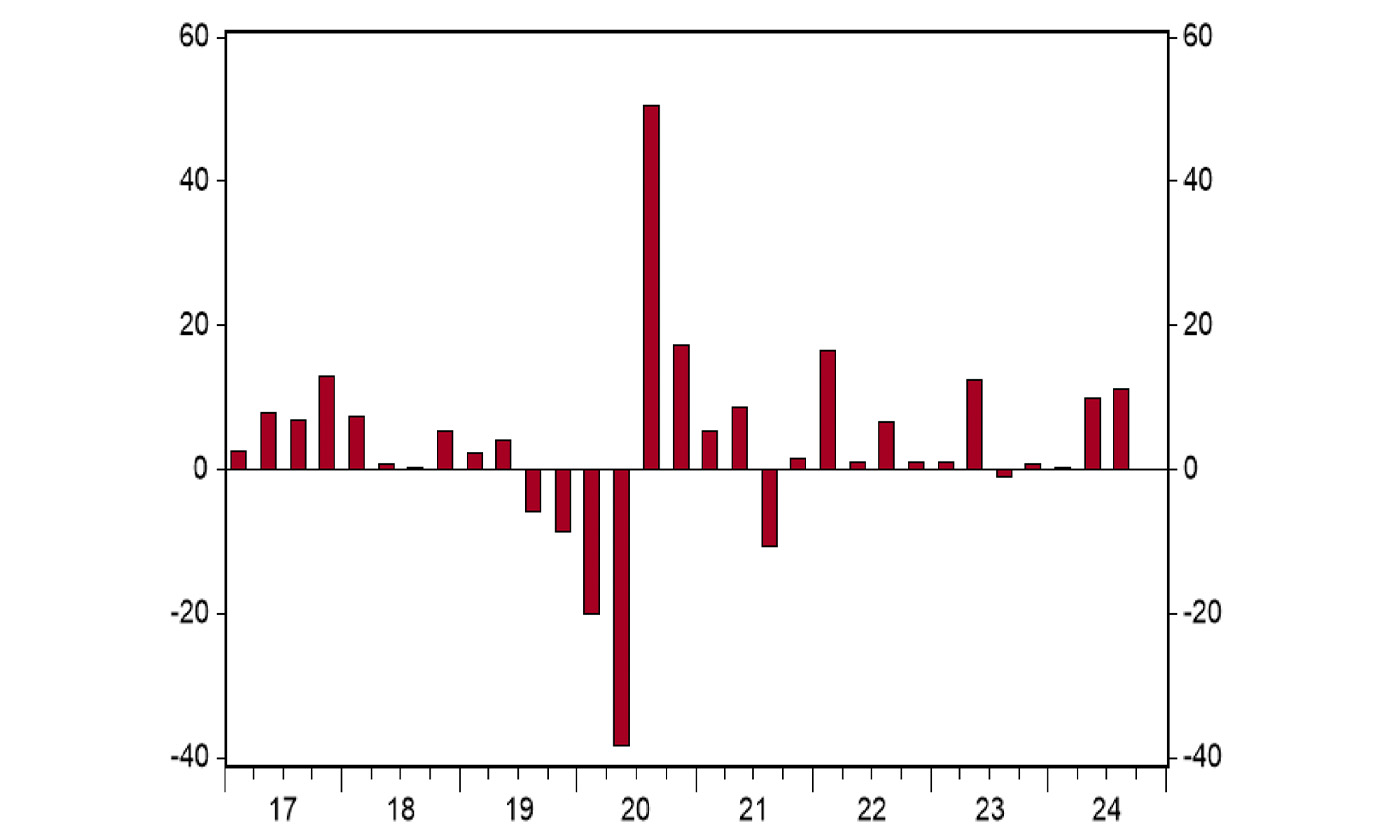

Perhaps the best news was that business investment in equipment grew at an 11.1% annual rate and is up 5.4% from a year ago (likely AI and chip related).

FIGURE 2: REAL EQUIPMENT INVESTMENT (% CHANGE—ANNUAL RATE)

Sources: Bureau of Economic Analysis, Haver Analytics

However, we can’t help but notice the abnormally large contribution from government spending in the third quarter, mostly from the federal government, without which real GDP would have grown at only a 2.0% rate. This is not a brand-new phenomenon. In the past year, real GDP rose by 2.7%, but it would only be up 2.1% without this major surge in government spending. Eventually, the rapid growth in government has to end, and the economy will pay a price.

In addition, there are other reasons to think the growth of the U.S. economy may slow in the year ahead and that the risk of a recession has not gone away. The personal saving rate, the share of after-tax income that consumers did not spend in Q3, was 4.8%. This is well below the roughly 7.0% pace of personal saving in the year before COVID.

Given that household savings related to government COVID spending is now largely running dry, if consumers increase their savings rate back to the pre-COVID norm, consumer spending growth will slow. The businesses that have invested and structured themselves to sell to them will be in for some pain.

![]() Related Article: A deep dive into the latest BLS payroll revision

Related Article: A deep dive into the latest BLS payroll revision

Meanwhile, the tightening of monetary policy over the last couple of years has not yet had its full effect.

GDP prices were up at a modest 1.8% annual rate in Q3 and up 2.2% from a year ago, showing some of the impact of tighter money, although we are not yet consistently at the Federal Reserve’s 2.0% target.

Nominal GDP—real GDP growth plus inflation—rose at a 4.7% pace in Q3 and is up 4.9% from a year ago, suggesting some room for the Federal Reserve to cut short-term rates from here.

In other recent news, the national Case-Shiller and FHFA indexes showed the exact same results for home prices, up 0.3% in August and up 4.2% in the past year. We expect continued modest gains in home prices in the year ahead given a shortage of housing around the country.

TABLE 1: TRENDS FOR RECENT GDP DATA

Source: Bureau of Economic Analysis

Editor’s note: Brian Wesbury is chief economist at First Trust Advisors LP. He and his team prepare a weekly market commentary titled “Monday Morning Outlook,” as well as frequent research reports and the recurring feature “Three on Thursday.” Proactive Advisor Magazine thanks First Trust for permission to republish an edited version of this commentary, which was first published on Oct. 30, 2024.

This report was prepared by First Trust Advisors LP and reflects the current opinion of the authors. It is based on sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

First Trust Portfolios LP and its affiliate First Trust Advisors LP (collectively “First Trust”) were established in 1991 with a mission to offer trusted investment products and advisory services. The firms provide a variety of financial solutions, including UITs, ETFs, CEFs, SMAs, and portfolios for variable annuities and mutual funds. www.ftportfolios.com

RECENT POSTS