Last week, the U.S. equity markets were focused on the start of the Q2 2024 earnings season, two key inflation reports, and Federal Reserve Chairman Powell’s testimony before Congress. The combination of a CPI (consumer price index) reading that showed the pace of inflation was slowing and Powell’s more positive tone contributed to modest market gains for the week. The Dow Jones Industrial Average gained 1.6%, the S&P 500 was up 0.9%, and the NASDAQ rose 0.3%.

CNN provided an overview of Powell’s testimony, which occurred before both of last week’s inflation reports:

“Inflation has come a long way since reaching a four-decade peak two years ago, Federal Reserve Chair Jerome Powell said Tuesday. However, central bank officials still want to see more progress before cutting interest rates, he noted, though they are also keeping a close eye on the job market. …

“‘The most recent inflation readings, however, have shown some modest further progress, and more good data would strengthen our confidence that inflation is moving sustainably toward 2%,’ he added. …

“Powell expressed throughout the hearing that the Fed is fully aware that it is dealing with ‘two-sided risks’—one is of inflation heating back up because the central bank cut rates too soon, and the other is of the labor market weakening sharply because the Fed waited too long to cut rates. Both risks would result in consequences for Americans and the overall US economy.”

Consumer sentiment slips

Despite some improvement on the inflation front, the University of Michigan’s preliminary reading on consumer sentiment dipped to an eight-month low.

MarketWatch reported the following on consumer sentiment:

“The first reading of the consumer sentiment index in July dropped to 66.0 in July from 68.2 in June, the University of Michigan said Friday. It was the fourth decline in a row and the weakest reading since November.”

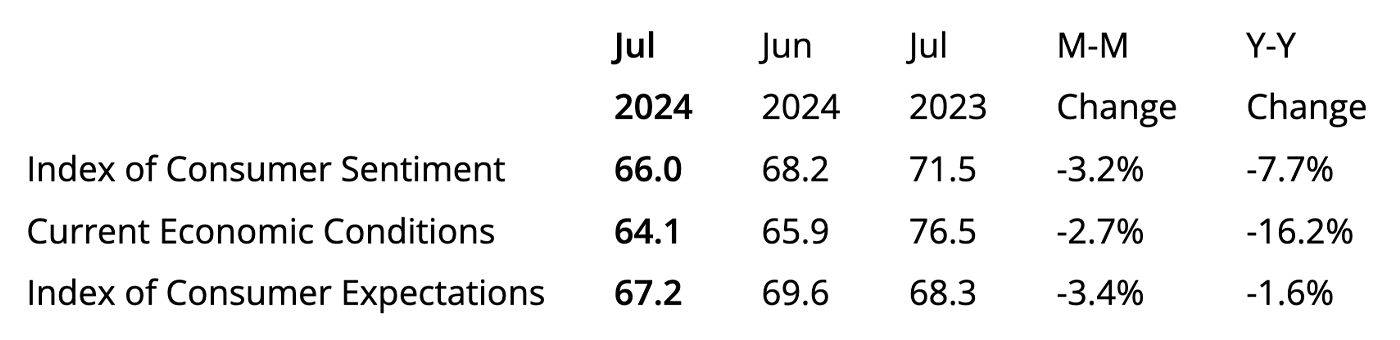

TABLE 1: PRELIMINARY CONSUMER SENTIMENT RESULTS FOR JULY 2024

Source: University of Michigan Surveys of Consumers, July 2024

MarketWatch added,

“The index also stands well below a prepandemic reading of 101 from February 2020. …

“A gauge that measures what consumers think about the current state of the economy slipped to 64.1 in July from 65.9 in the prior month. That’s the lowest level in 19 months.

“A measurement of expectations for the next six months slid to 67.2 from 69.6 and touched an eight-month low.”

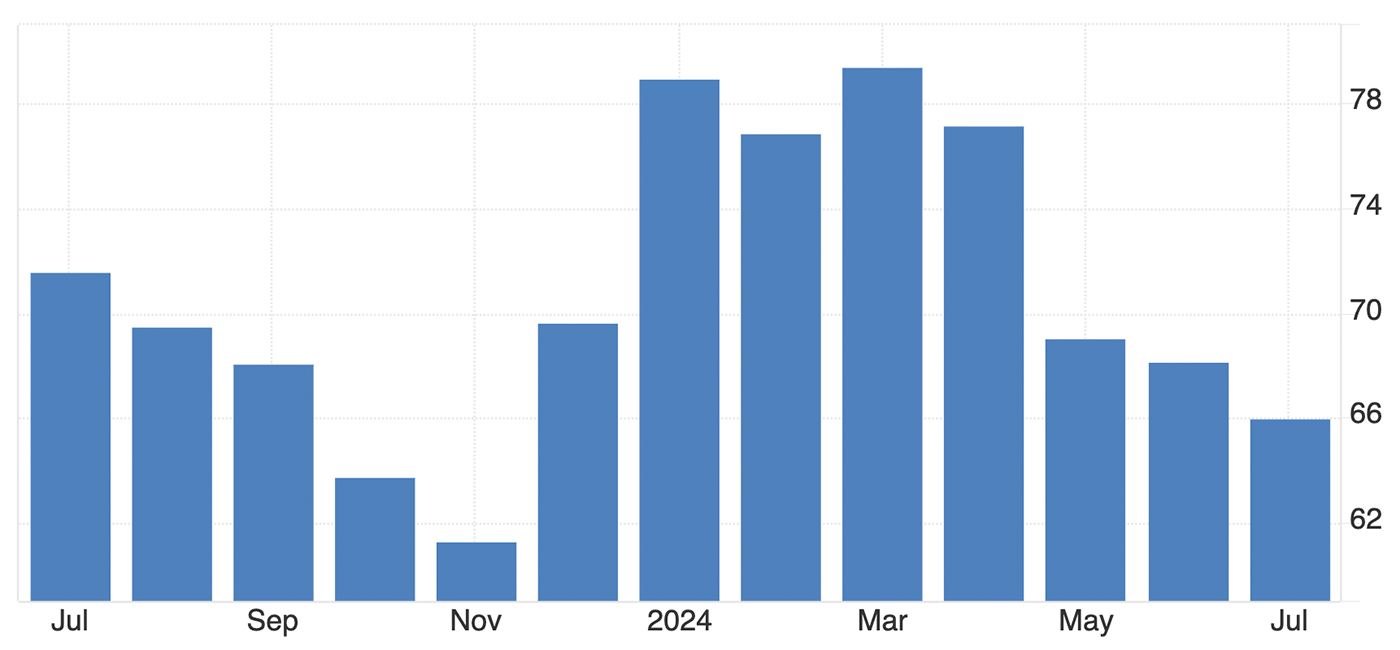

FIGURE 1: CONSUMER SENTIMENT ONE-YEAR TREND

Source: Trading Economics, University of Michigan

Surveys of Consumers Director Joanne Hsu remarked,

“Although sentiment is more than 30% above the trough from June 2022, it remains stubbornly subdued. Nearly half of consumers still object to the impact of high prices, even as they expect inflation to continue moderating in the years ahead. With the upcoming election, consumers perceived substantial uncertainty in the trajectory of the economy, though there is little evidence that the first presidential debate altered their economic views.

“Year-ahead inflation expectations fell for the second consecutive month, reaching 2.9%. In comparison, these expectations ranged between 2.3 to 3.0% in the two years prior to the pandemic. Long-run inflation expectations came in at 2.9%, down from 3.0% last month and remaining remarkably stable over the last three years. These expectations remain somewhat elevated relative to the 2.2-2.6% range seen in the two years pre-pandemic.”

![]() Related Article: The yield curve’s 15-month lag

Related Article: The yield curve’s 15-month lag

The most recent inflation data is mixed

Nationwide senior economist Ben Ayers told MarketWatch,

“Weaker sentiment has become a trend to watch as consumer feelings on the economy have turned more dour in recent months.

“This has happened despite easing inflation readings and falling expectations for price increases over the next year—suggesting that squeezed budgets and concerns about a weaker labor market are seeping into spending behavior.”

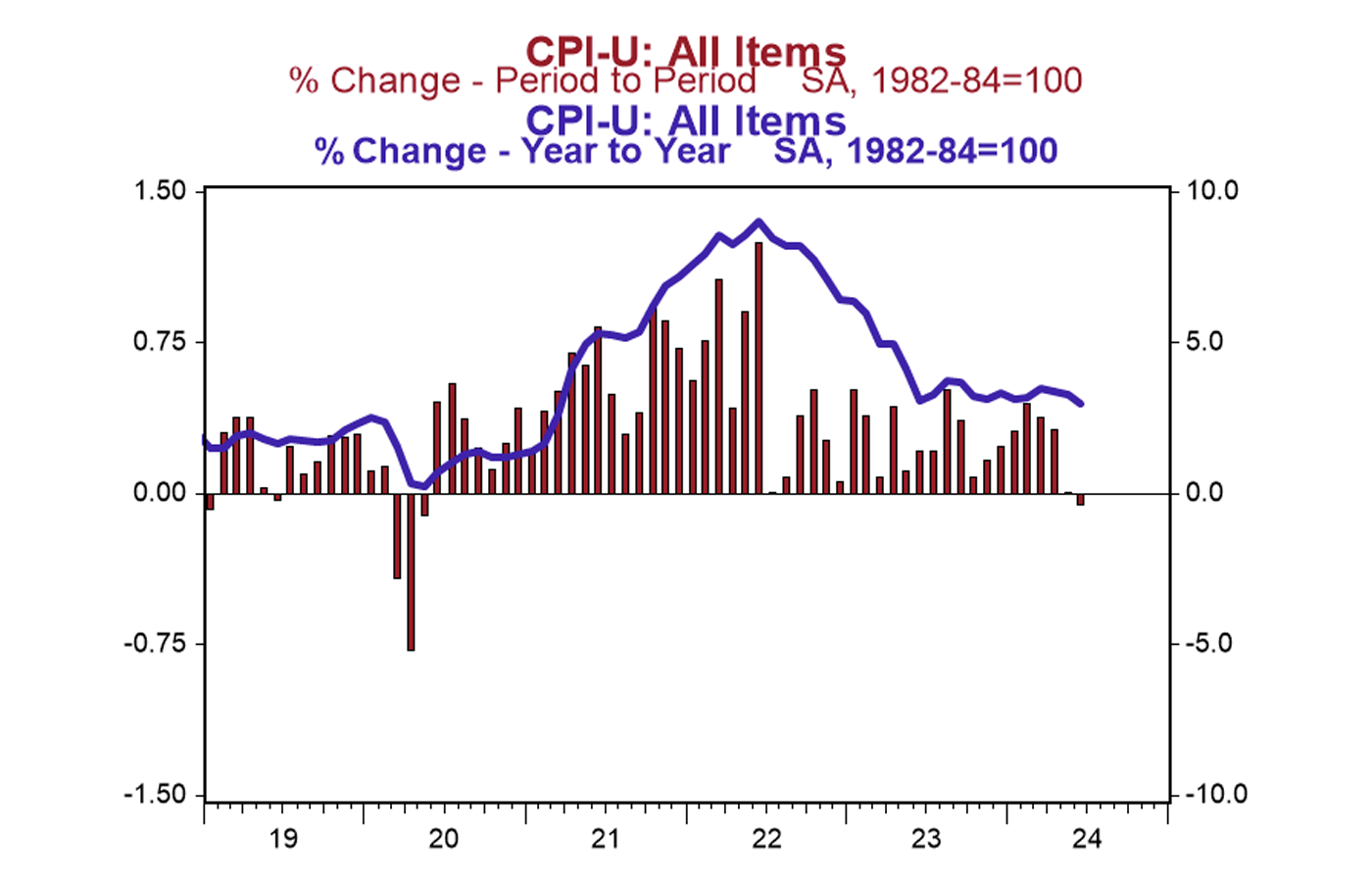

The most recent reading for consumer prices came via the June CPI report. This showed that the CPI declined 0.1% in June, below the consensus expected +0.1%.

First Trust noted,

“Inflation came in softer than expected for the third straight month in June, posting the first outright monthly decline since the early months of COVID. This will add to the Federal Reserve’s confidence that inflation, still running at 3.0% on a year-ago comparison basis, is eventually heading back down to the 2.0% target, which means cuts in short-term interest rates are likely to start in September. … Now it appears that inflation has resumed its downward trend, a lagged response to the drop in the M2 measure of money compared to early 2022. Looking at the details of today’s [July 11] report, June inflation was held down by energy prices, which declined 2.0% on the back of lower prices for gasoline (-3.8%). Stripping out energy and its often-volatile counterpart (food), ‘core’ prices also came in softer than expected, rising 0.1% for the month, the smallest advance since August 2021.”

FIGURE 2: THE CONSUMER PRICE INDEX (CPI) DECLINED 0.1% IN JUNE

Sources: First Trust, Bureau of Labor Statistics, Haver Analytics

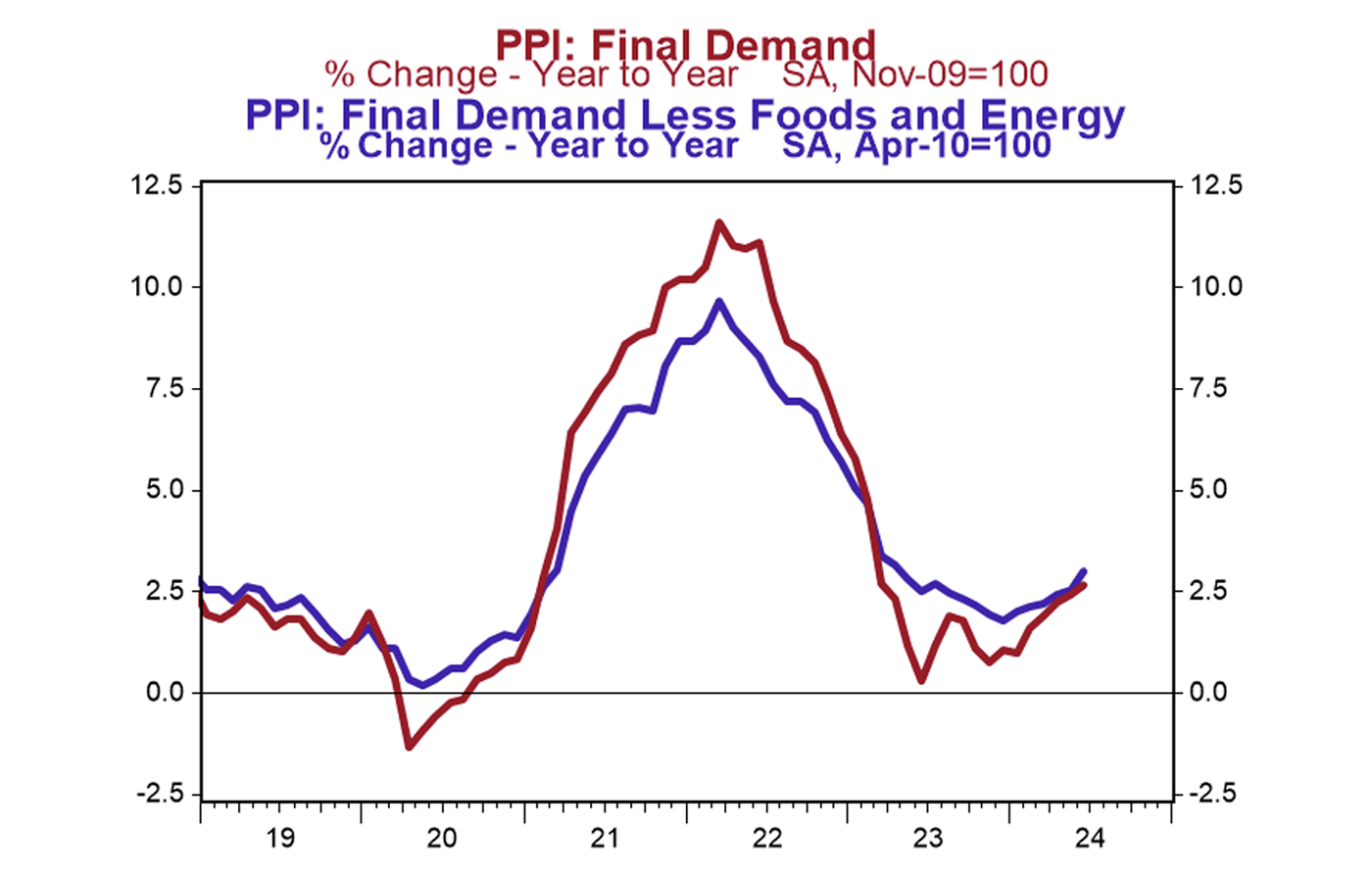

In contrast to the CPI report, the producer price index (PPI) data released on July 12 was less favorable, rising 0.2% in June.

First Trust reported,

“Following a breather in May, producer prices were back on the rise in June, cutting a contrast to the consumer price index report out yesterday [July 11]. Producer prices rose 0.2% in June, are up 2.6% in the past year (the highest twelve month reading since early 2023), and the pace of producer price inflation has accelerated since the start of the year, up at a 3.2% annualized rate over the past six months. The June rise came despite a 2.6% decline in energy prices in June, and a 0.3% drop in food prices. Stripping out these typically volatile food and energy components shows ‘core’ prices jumped 0.4% in June and are up 3.0% in the past year. That also represents the highest twelve month increase in more than a year, and a clear shift from the moderation in producer price inflation in 2022 and 2023.”

FIGURE 3: THE PRODUCER PRICE INDEX (PPI) ROSE 0.2% IN JUNE

Sources: First Trust, Bureau of Labor Statistics, Haver Analytics

First Trust summarized its point of view regarding inflation and future rate policy as follows:

“We do anticipate easing in inflation will come should the Fed have the patience to let tighter monetary policy do its work, and weakening economic data show higher rates and the delayed impact of the decline in the M2 supply starting to bite. But inflation risks an eventual re-acceleration should the Fed panic and ease policy too quickly at signs of economic trouble.”

RECENT POSTS