The recent GDP report released on April 27 was disappointing, adding fuel to the forecasts for a 2023 recession—with varying levels of severity predicted, depending on the analyst or media source.

CNBC reported,

“Growth in the U.S. slowed considerably during the first three months of the year as interest rate increases and inflation took hold of an economy largely expected to decelerate even further ahead.

“Gross domestic product, a measure of all goods and services produced for the period, rose at a 1.1% annualized pace in the first quarter, the Commerce Department reported Thursday. Economists surveyed by Dow Jones had been expecting growth of 2%. The growth rate followed a fourth quarter in which GDP climbed 2.6%, part of a year that saw a 2.1% increase.”

CNBC added,

“Slumping inventories and a general decline in private investment held back early year gains.

“Inflation was higher than expected in the quarter, with the PCE price index rising 4.2% against the 3.7% estimate.”

FIGURE 1: U.S. GDP GROWTH RATE—PAST 3 YEARS

Sources: Trading Economics, U.S. Bureau of Economic Analysis

Trading Economics provided further detail on the GDP report:

“It was the weakest pace of expansion since Q2 2022, as business investment growth slowed down, inventories declined and rising interest rates continued to hurt the housing market. Residential fixed investment contracted for the 8th consecutive period (-4.2 percent vs -25.1 percent in Q4) and private inventory investment subtracted 2.3 pp from the GDP (compared with an addition of 1.47 pp in Q4). At the same time, nonresidential fixed investment growth slowed sharply (0.7 percent vs 4.0 percent). Still, consumer spending growth accelerated to 3.7 percent (vs 1.0 percent in Q4) despite stubbornly high inflation and public spending increased at a faster 4.7 percent (vs 3.8 percent). Net external demand has also contributed positively to the GDP as exports rose more than imports.”

Recession talk heats up

Coming into 2023, the Associated Press reported that a majority of economists surveyed expected a recession to start over the next 12 months. In an updated survey published in February, AP says,

“Fifty-eight percent of 48 economists who responded to a survey by the National Association for Business Economics envision a recession sometime this year. …

“A third of the economists who responded to the survey now expect a recession to begin in the April-June quarter. One-fifth think it will start in the July-September quarter.”

With the Fed’s rate-hike cycle still in place, the economy is seeing not only slowing economic growth but lingering concerns on the banking sector and debt-ceiling negotiations, lower corporate earnings versus 2022, and some signs of weakness in the labor market—despite headline strength.

First Trust noted this labor anomaly in comments on last week’s employment report:

“Yes, payrolls rose 253,000, but they were also revised down 149,000 for the prior two months, bringing the net gain to a tepid 104,000. Meanwhile, civilian employment, an alternative measure of job growth that includes small business start-ups, increased 139,000, also a tepid number. The modest growth in employment resulted in a decline in the unemployment rate because it was paired with a 43,000 decline in the labor force, which is not good news. At this point in the business cycle it’s important to separate two different angles on the labor market: the level versus the direction. The level of the labor market is strong: unemployment is low, businesses are still hiring, and it’s relatively easy to get a job. However, improvements in the labor market have slowed down and we expect that trend to intensify to the point where jobs are declining and unemployment rising later this year.”

On specific recession concerns, The Conference Board recently reported,

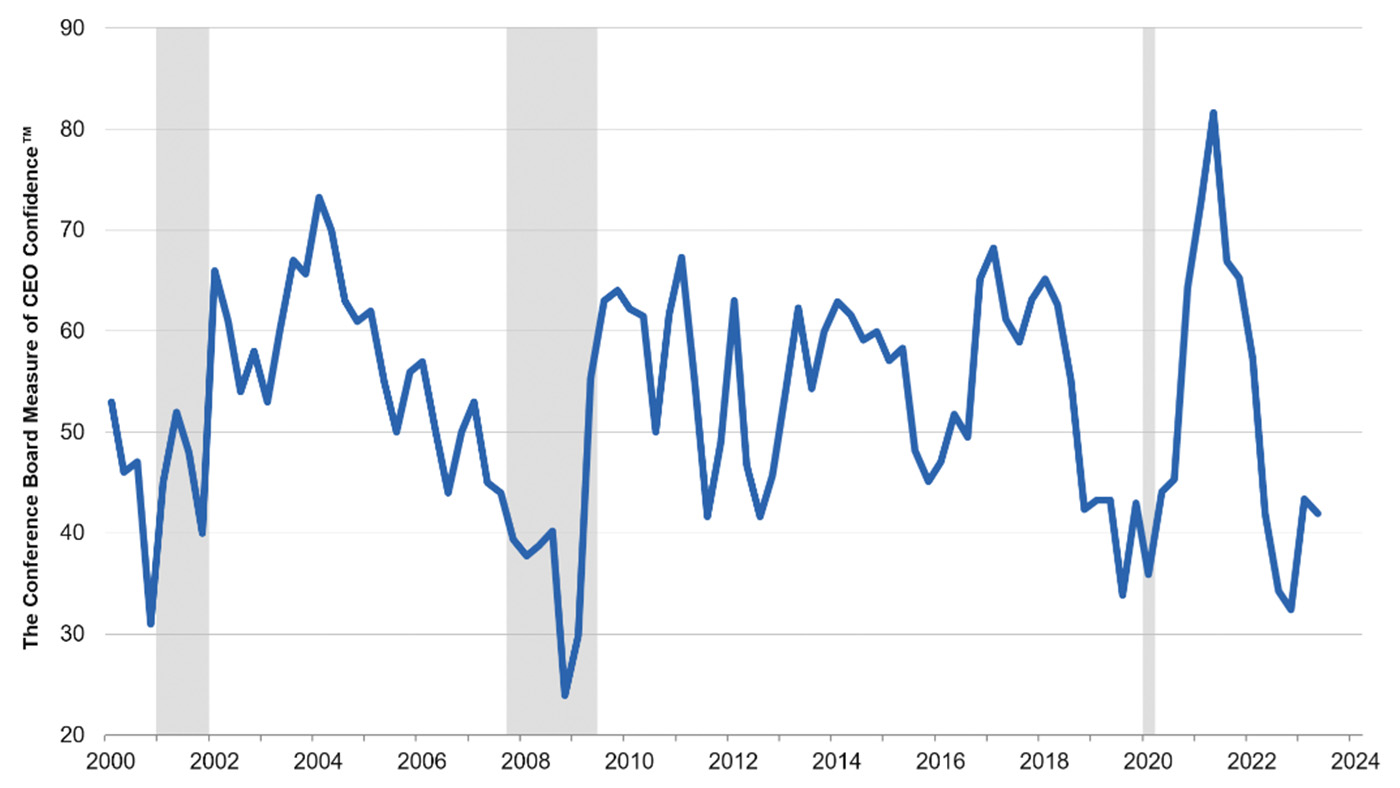

“The Conference Board Measure of CEO Confidence in collaboration with The Business Council declined slightly to 42 in Q2 2023, down from 43 in the first quarter of the year. The Measure is still below a reading of 50, which suggests CEOs remain largely pessimistic about what’s ahead in the economy. …

“CEOs are still pessimistic about the downturn to come. Similar to last quarter, 93% of CEOs still report they are preparing for a US recession over the next 12–18 months. Indeed, 87% believe the recession will be brief and shallow with limited global spillovers and 6% expect a deep US recession.”

FIGURE 2: CEO CONFIDENCE TICKED DOWN IN Q2 2023

Note: Shaded areas indicate periods of recession.

Sources: The Conference Board, The Business Council, NBER

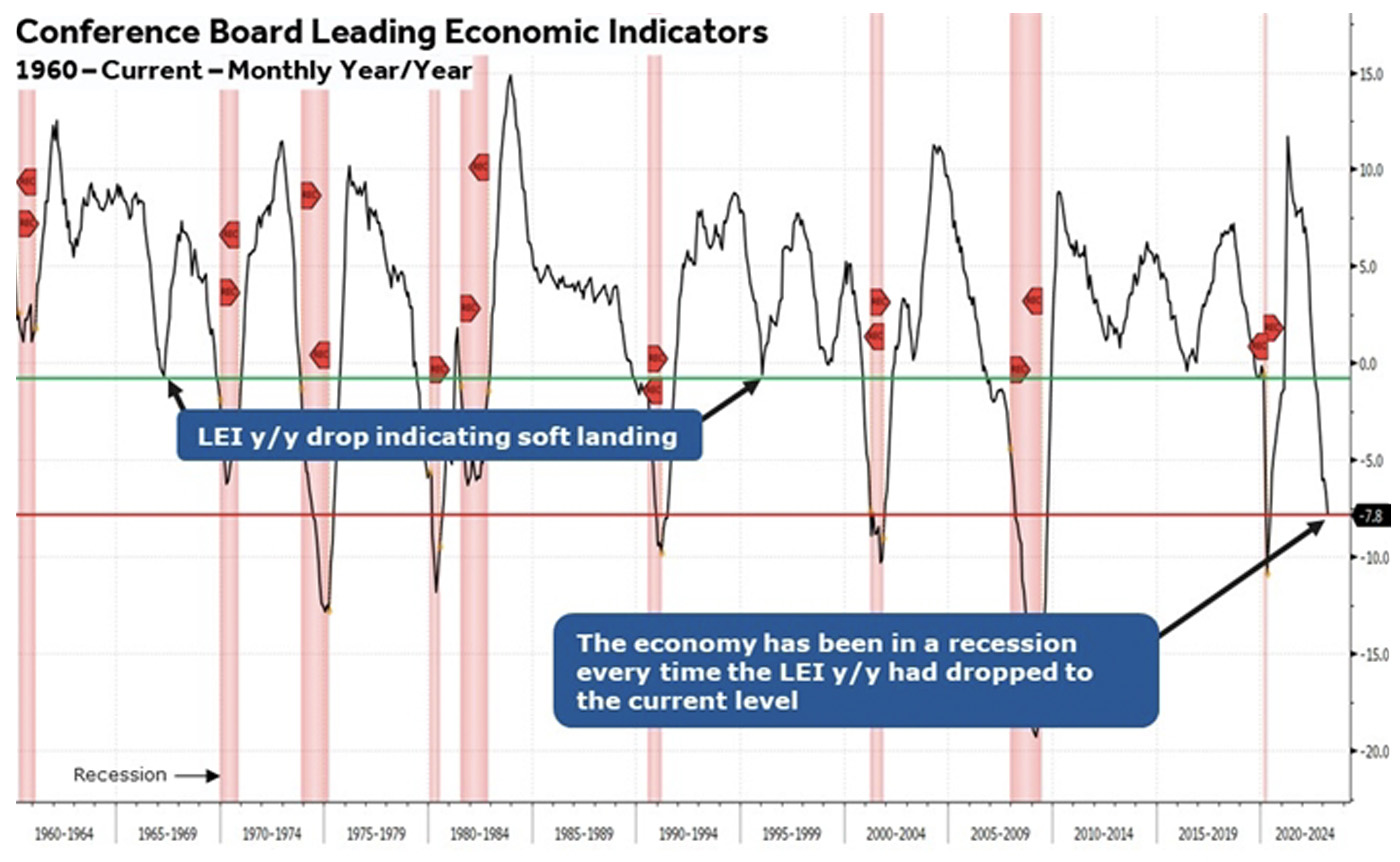

Canaccord Genuity’s Tony Dwyer, a frequent contributor to this publication, said last week in a client note, “In our view, many leading economic indicators are at levels where we can say the economy is either just entering or near recession.”

Dwyer makes some compelling observations, with exhibits in the original note supporting each data point:

- “The yield curves have never been inverted to this degree without signaling a recession. …

- “Bank lending standards have never been this tight without signaling a recession. …

- “The Leading Economic Indicators have never been this negative without close signaling a recession [See Figure 3]. …

- “The Employment Trends Index has never been this weak without signaling a recession. …

- “The weekly Continuing Jobless Claims ROC [rate of change] has never risen this much without signaling a recession. …”

Dwyer concludes, in part,

“Since the 1950s, it would be historically unique for the market to make a recession-based low before the economic downturn even began, so we stand ready to take advantage of any weakness below the 10/22 low if/when bad news becomes bad news.”

FIGURE 3: LEADING ECONOMIC INDICATORS SIGNALING RECESSION

Sources: Bloomberg, Canaccord Genuity

New this week: