Advisors make the case for active investment management

Advisors make the case for active investment management

Financial advisors favor third-party active investment management for a wide variety of reasons: access to modern analytical strategies, emphasis on risk mitigation, and the ability for client portfolios to be responsive to changing market conditions over full market cycles.

Our editorial staff has interviewed dozens of successful financial advisors from every region of the nation. Their advisory firms represent many different business models in the industry and come in all “sizes and shapes.” But these advisors all share a commitment to bringing leading-edge portfolio management strategies and approaches to their clients.

This has been especially important over the last several years, as financial markets have contended with a number of challenges:

- The pandemic shutdown, ensuing recession, and equity bear market in 2020

- New all-time market highs in 2021 against a backdrop of sporadic economic recovery, rising inflation, and supply-chain disruptions

- The consequences of international instability—most notably Russia’s war with Ukraine and the Middle East conflict—on the energy sector

- Heightened inflationary pressures, leading to aggressive rate hikes from the Federal Reserve

- Volatile markets throughout 2022, with another bear market and steep drawdowns, especially for the tech sector and cryptocurrencies. “Traditional” 60/40 portfolios faced a very challenging period, with a higher-than-normal correlation of equities and bonds

- A highly contentious domestic political environment, with unprecedented government spending programs, record-setting federal budget deficits, and the run-up to the 2024 elections

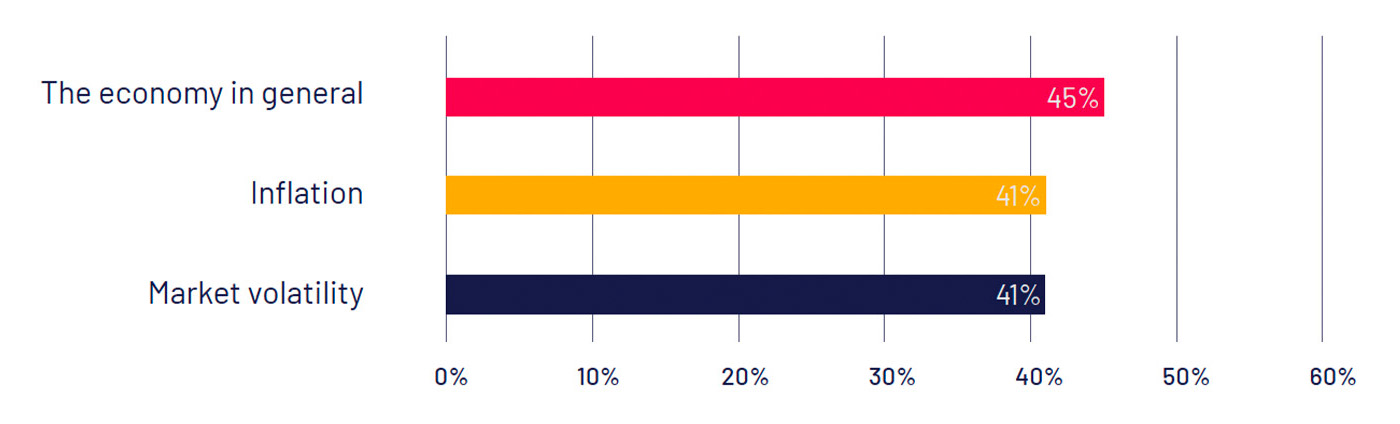

The impact of all of these factors could be seen cumulatively in broad areas of concern for advisors as they considered their clients’ investment approaches.

TOP 3 REASONS TO REEVALUATE ASSET-ALLOCATION

STRATEGIES IN 2022

Source: 2022 Trends in Investing Survey, conducted by The Journal of Financial Planning and

the Financial Planning Association (FPA)

In helping clients navigate this ever-changing financial landscape, advisors we have interviewed share a strong desire to find investment solutions for their clients that will stand the test of time. Simply put, this means employing strategic approaches that can generate competitive returns in both bull and bear markets through the use of strong risk-management techniques. It also means adopting a planning and investment philosophy that can accommodate investors all along the risk spectrum and with varying levels of financial sophistication.

An article in our publication by Guggenheim Investments reinforced the need for advisors to consider more sophisticated risk-management approaches in addressing clients’ portfolio objectives and allocations. In the article, Guggenheim writes,

“How diversified are investor portfolios? The answer is that, when diversification is needed most, portfolios may not be as diversified as investors assume.

“The Great Recession, which included 2008, taught investors this valuable lesson. …

“… It is more difficult than ever for investors to balance risk and return using traditional strategic asset-allocation strategies. Unlike strategic asset-allocation strategies, which maintain static allocations to bonds and ‘risk’ asset classes in good times and bad, tactical asset-allocation strategies seek to increase or decrease a portfolio’s risk exposure, based upon current market conditions.”

In addressing the issue of managing risk through greater use of tactical investment strategies, we asked advisors to provide their perspective on this question:

What drives your firm to seek active asset-management solutions for your clients?

Bradford D. Creger • BFF Financial Inc. • Glendale, CA

Bradford D. Creger • BFF Financial Inc. • Glendale, CA

Read full article

“We assist clients in identifying their investment objectives, evaluating their risk tolerance, and analyzing their current portfolio. We help them determine appropriate asset allocation and explore alternative investment strategies that could play a valuable role. We do not have a predetermined investment approach. We build each client portfolio according to the plan objectives. …

“Whether a portfolio strategy is managed directly by our firm or we are providing oversight of strategies provided by sophisticated third-party managers, we prioritize risk management through actively managed strategies.

“Active money management can provide rules-based strategies that react to changes in the market environment. Client portfolios can be managed to mitigate the risk associated with steep market declines. We can also employ active strategies that can go inverse to the market and make money even in a down market. As opposed to a long-only approach, we believe there are times to play defense and times to play the offensive side of the risk cycle. Why? The math of market declines for those in retirement, or nearing retirement, shows that losses at the wrong time can be difficult to recover from. I believe this is a major differentiator for our firm—seeking growth opportunities when market conditions are favorable and seeking to reduce risk at technical market tops or when heading into unfavorable markets.”

Shannon LaRosse • Informed Family Financial Services • Birdsboro, PA

Shannon LaRosse • Informed Family Financial Services • Birdsboro, PA

Read full article

“While risk management can be beneficial to an accumulation plan, it becomes essential in retirement distribution planning. It ties back into the sequence-of-returns risk—and knowing that a client will be able to pull their income, regardless of how the stock market performs. …

“We use the services of third-party investment managers for active, risk-managed strategies. These managers have been carefully vetted and have robust strategy, research, and management teams. Their sole responsibility is the daily management of their firm’s investment strategies. We carefully examine their performance in different types of market environments. We look to see if they can produce competitive returns in positive markets and—importantly—strive to mitigate losses in poor market conditions.

“We believe in approaches that take advantage of market trends, not ‘market timing.’ And, even in volatile markets, we believe our managers can find growth opportunities. From the point of view of a client’s long-term portfolio growth, we believe it is not always about trying to outperform an index. It is also about mitigating losses. Many people erroneously think that taking on more risk will lead to higher returns. Occasionally, that is true. But for less volatile, long-term portfolio growth, we think actively risk-managed strategies can play an important role.

“Our investment managers can provide risk-managed strategies that should be suitable for any of our clients, from those with conservative risk profiles to clients who want a fairly aggressive approach. Another benefit is that several of the active strategies we use can go inverse the market, use leverage, actively rotate to stronger-performing sectors, or simply reduce or increase market exposure—if the market situation is appropriate for any of those approaches. Those are things that a passive, buy-and-hold strategy will just not offer.”

David L. Rhodes • The Rhodes Financial Group • Bryan, TX

David L. Rhodes • The Rhodes Financial Group • Bryan, TX

Read full article

“First, I would qualify the answer by saying it depends on their financial plan and the agreed-upon objectives and criteria that have helped shape it. I have clients of similar age and assets who have vastly different investment plans based on their personal parameters. Bottom line, there may be a role for both active and passive strategies.

“That said, I am a believer in active investment management, and I educate clients on the potential benefits of professional money management. I have reviewed extensive research on many types of actively managed investment approaches and believe the holistic portfolio approach of certain managers can deliver highly desirable risk-adjusted performance over full market cycles.

“That is not to say that they are always going to outperform a broad index in any given year. But I educate clients on both sequence-of-returns risk and the mathematics of recovering from bear market losses. Few clients realize, for example, that it takes a 100% gain to make up for a 50% investment loss. If losses in poor market conditions are mitigated, that allows a portfolio to become reinvested as conditions improve from a higher overall portfolio value, which can provide a significant compounding advantage over time.

“I also discuss with clients other potential benefits of active management. These include the ability for managers to use their models and experience to identify trends in the market, both in a broad sense and in distinguishing between sectors or particular categories of stocks that should perform better in any given market environment. …”

Edgardo Castro • Aragon Capital LLC • Fort Lauderdale, FL

Edgardo Castro • Aragon Capital LLC • Fort Lauderdale, FL

Read full article

“Most people are conditioned to think, ‘I am just going to set my investments up initially and not touch them. I may lose money over some periods but eventually my account will grow.’ I do not think that is an appropriate approach for investors, and especially those who are getting close to their retirement age. I introduce them to the concept of managed money, where professional money managers can employ research, sophisticated models, and risk-managed strategies on behalf of the client. That is usually a real eye-opener for most people and, once they understand the basic principles, something they are very interested in. While there are no guarantees, I can say that tactical money management, at least for my clients, performed as it was intended to during the downturn in the first quarter of 2020. Overall, clients were very pleased to see that.

“Active, tactical investment strategies have various tools to manage risk, including the ability to change portfolio allocations with changing market conditions; increase or decrease exposure to the overall market, sectors, or asset classes; or even move 100% to cash. The majority of my clients are conservative investors and are not looking to outperform the S&P 500. When the market’s doing well, they want to participate in those gains. The important thing is that their investment plan is staying on track over the years. When the market is doing poorly and declines are in the headlines, that is when my clients get concerned. I think tactical money management has helped me greatly in managing expectations and addressing concerns about downside exposure. That risk-oriented approach fits both the attitudes of my clients and the objectives of their long-term plans.”

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

New this week:

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.