Softening the blow

Softening the blow

Why avoiding bear market losses is so important.

Today’s modern definition of active management has at its core the principle of dynamic risk management. This is achieved through a proactive, market-sensitive approach, strategy and asset-class diversification, and the goal of capturing a reasonable portion of market gains while avoiding the better part of market downturns.

Why is this so important?

The retreat of the broad U.S. equity market over January and early February 2014 (an S&P 500 drop from recent highs of close to 6%) reminded portfolio managers and retail investors alike that, no, “trees do not grow to the sky.”

The S&P 500’s 5.8% drop from its January 15, 2014, record high of 1,848 through the close on Monday, February 3, 2014, at 1,741 marked its 19th pullback of 5% or more in the current bull market, according to Bespoke Investment Group. The 2.3% drop on that Monday was the index’s worst start to February since 1933.

Market corrections, such as the early 2014 move lower, are to be expected as part of the normal ebb and flow of any equity market over virtually all market cycles. But the roaring bull market since 2009 lows has been exceptional in many regards, with few corrections of 10% or more and not many much higher.

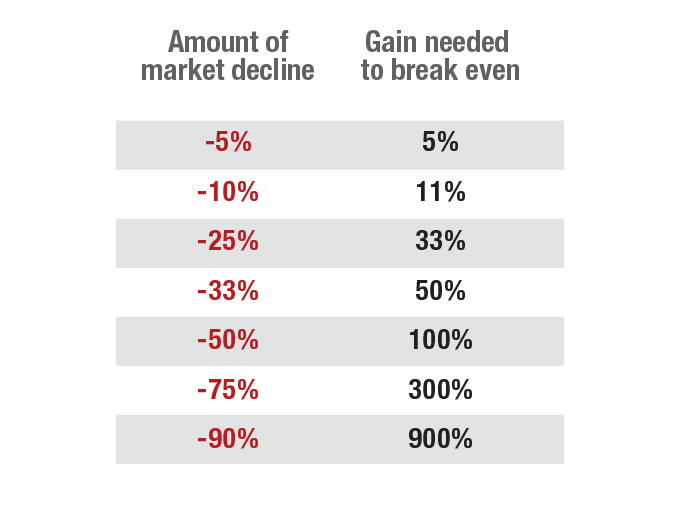

Recovering from portfolio losses is daunting, as gains required to recoup losses scale up on an exponential basis.

The last S&P 500 correction in the neighborhood of a 20% decline from prior highs ended in early October 2011. And 2014’s quick January/February pullback was still below the average 8.2% pullback the S&P has suffered in its five-year uptrend.

So, why should active managers be so concerned with risk? Haven’t we put behind us the threat of another portfolio-destroying pullback?

Simply put, no.

Active managers recognize the mathematical difficulty of recovering from major drawdowns to portfolios and understand that the next big move downward may always be lurking just around the corner, with catalysts coming from virtually any part of the globe.

It takes longer than most investors think to recover from bear markets. There were 15 bear markets, defined as those periods when the S&P 500 fell at least 20%, between 1929 and 2009. Omitting the 1929 crash, it took 3.5 years on average to break even after a crash.

Accompanying the pain of each and every bear market period is the uncertainty and generally lengthy path to “breakeven” for most investors. The mathematics of recovering from portfolio losses is daunting, as recovery gains required to recoup losses scale up on an exponential basis.

Mathematics of declines and gains

That is a big reason why today’s practitioners of active management are so concerned with risk and focused on avoiding those large drawdowns in the first place.

While recovering from portfolio losses can be challenging, the flip side is how the math can work to benefit investors who are able to reduce drawdowns during times of market stress. Those investors will have more money to invest as the market cycle turns back to positive, allowing compounding to further work in their favor over time.

Market loss mathematics

Let’s look at two hypothetical portfolio examples: Portfolio A is an actively risk-managed strategy that seeks modest gains in favor of limited risk, while Portfolio B represents a traditional, passive buy-and-hold strategy that may yield strong bull market gains but also endures the bear market losses.

A risk-managed portfolio may not capture 100% of gains during roaring bull market periods, as shown. But many active managers have a pretty simply stated goal (while implementing some very sophisticated strategies to achieve it): capture a fair share of market gains while lessening periods of losses, and let math and the magic of compounding take care of the rest.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.