Building wealth by avoiding emotional errors

Building wealth by avoiding emotional errors

Emotional investing errors are a significant impediment to building wealth over the long term. What are two of the most debilitating errors, and how can financial advisors help their clients avoid them?

Many investors wait until they have “enough” money or for when it’s “a good time” to invest in the market. Making regular contributions regardless of these concerns is one of the most powerful ways to build wealth.

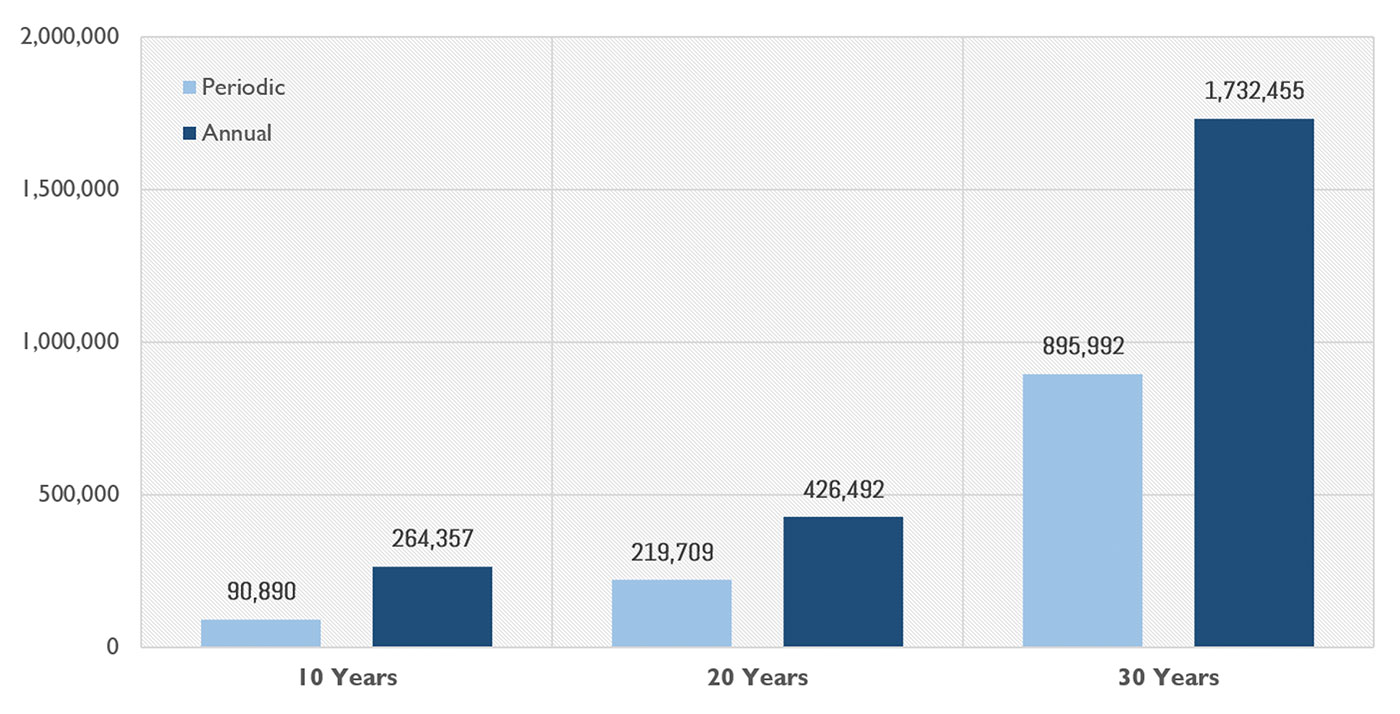

Figure 1 highlights the value to individuals of making regular contributions compared to periodic contributions over 10-, 20- and 30-year periods. Even though the same principal amount is invested, the result is dramatically different—with nearly twice the wealth creation.

FIGURE 1: RESULTING VALUES OF PERIODIC VERSUS ANNUAL CONTRIBUTIONS

(S&P 500 TR INDEX JAN 1991–DEC 2020)

Note: 10-year return is 1991–2000, 20-year return is 1991–2010, and 30-year return is 1991–2020. Periodic = investing $100,000 every 10 years. Annual = investing $10,000 annually.

Sources: AthenaInvest Inc. and S&P Dow Jones Indices LLC

Figure 1 highlights two investors over a 30-year period: annual investor A (who invests $10,000 every year) and periodic investor B (who invests $100,000 at the end of every 10 years). Regular contributions benefit from investing earlier and the subsequent compounding. Over longer periods, the results are dramatic with roughly twice the wealth creation for 10-, 20- and 30-year periods.

Rather than worrying about if they have “enough” or when it’s “a good time” to invest, clients would be better served by being advised to invest whatever they can as consistently as possible. Behaviorally, it is much easier for clients to “pay themselves first” and learn to live within a sound, though pared down, budget than to sporadically make larger investments in an effort to time the market. Consistent actions are more important than short-term market conditions in building long-term wealth, assuming that a client’s financial plan and time horizon support a longer-term outlook for their investments.

After the year we have had with the pandemic, it’s easy to understand how investors may have become fatigued and disoriented. Taking a step back and looking at things over a longer period can help to regain a sense of balance and perspective.

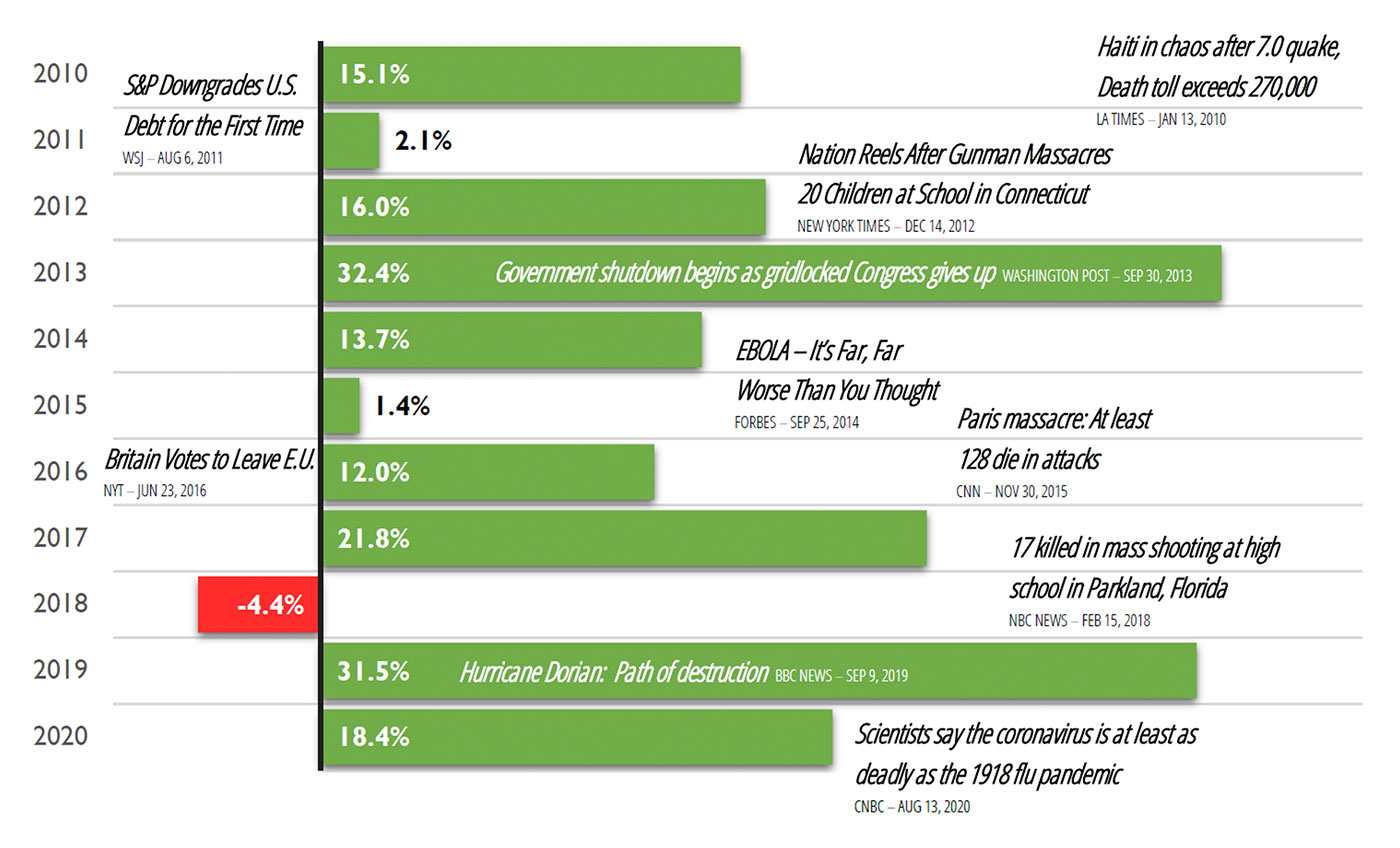

The ability to look past today’s headlines is another key to wealth building. Over the 10 years from 2010 to 2019, the market generated an annualized return of 13.6%. That is impressive, but you might not have expected those results based on many of the headlines over that period.

Sources: AthenaInvest Inc. and S&P Dow Jones Indices LLC

Investors often worry about whether some event is going to turn into a market rout. They agonize over whether they should stay invested or get out and stay on the sidelines. For those who exit, they wonder whether they should get back in the market—and when. Of course, pundits, commentators, and social media fuel the fire by issuing warnings about everything that goes wrong with the world, the economy, markets, and other potential disasters.

Meanwhile, politicians, economists, and experts give conflicting predictions about the consequences from the same data. Altogether, these unsettling world events are amplified by opinion and media hype, creating an underlying state of constant worry.

But for all the headlines and mouse clicks, usually the right thing to do is to stay fully invested according to a disciplined investment plan’s parameters. It is not that these events are not important, it is just that reacting to them is not a reliable way of making long-term investment decisions.

History has shown that the U.S. economy and stock market are incredibly resilient with the capacity to weather the storm of a wide range of events. While pullbacks are inevitable, history shows the best course of action is for investors to focus on their long-term goals.

What is going on?

- Investing is an exercise in delayed gratification that requires taking an action now for some benefit in the future. Unfortunately, we are hardwired for instant gratification.

- We underestimate the long-term value of regular contributions and compounding. We think we need a substantial amount before we can invest and are poor at estimating long-term probabilities and results.

- Events and the constant chatter about them create a negative availability bias, in which a never-ending stream of dramatic events has the potential to change everything. While this is good for cable ratings and social media clicks, it creates anxiety for investors.

- Pundits and media opinion trigger our social-validation and herding instincts, which cause us to be on the lookout for danger and prepared to flee. While useful on the Serengeti, this is not particularly helpful in making sound investment decisions.

- We overestimate our abilities to determine when to exit and when to get back into the market. On the other hand, we underestimate the true randomness of world events. This overconfidence bias results in emotional buying and selling or sitting on the sidelines and missing out on subsequent returns.

- Fear, loss aversion, and potential regret create emotional turmoil and a tendency to delay contributions or even get out of the market altogether.

How can financial advisors guide clients in addressing these issues?

- Advisors can lead the process in developing needs-based planning that separates short- and long-term investments. This can help insulate client emotions from short-term market events while allowing long-term investments the time they need to build.

- Clients should pay themselves first by contributing early, regularly, and often. Encourage clients to supplement regular contributions, if possible, with excess funds (such as a bonus) or windfalls (such as an inheritance) to accelerate the process of growing wealth.

- The key to ignoring the constant chatter and media hype is to have a disciplined approach that allows clients to experience emotions while not responding to them. An empathetic attitude helps, as we all experience some emotions and doubt when markets are volatile. (Of course, turning off the media also helps!)

- In this regard, a risk-managed portfolio strategy is a valid approach to “keeping clients in their seats,” which is essential for building as much wealth as possible.

An experienced financial advisor, who has lived through many market environments, can also provide valuable perspective and coaching that can help clients stick to their plan and stay focused on long-term goals.

C. Thomas Howard, Ph.D., is the founder, CEO, and chief investment officer at AthenaInvest Inc. Dr. Howard is a professor emeritus in the Reiman School of Finance, Daniels College of Business at the University of Denver. Dr. Howard is the author of the book “Behavioral Portfolio Management” and co-author of “Return of the Active Manager.” AthenaInvest applies behavioral finance principles to investment management and also provides advisor coaching and educational resources.

C. Thomas Howard, Ph.D., is the founder, CEO, and chief investment officer at AthenaInvest Inc. Dr. Howard is a professor emeritus in the Reiman School of Finance, Daniels College of Business at the University of Denver. Dr. Howard is the author of the book “Behavioral Portfolio Management” and co-author of “Return of the Active Manager.” AthenaInvest applies behavioral finance principles to investment management and also provides advisor coaching and educational resources.