Why 2020 was a rare opportunity to judge an active manager’s performance

Why 2020 was a rare opportunity to judge an active manager’s performance

We often say that to judge an active manager’s performance, you need to evaluate it over at least an entire market cycle. That usually takes years, but 2020 represented a rare exception.

When you go to a restaurant (remember those?), you know if you had a good meal. And you know if the service is above average and deserving of a larger tip than usual. Your five senses give you all the answers.

But what about your investment manager? How do you know if he or she or they are doing a good job of managing your investments for you? The easy answer is, “Look at their performance.”

But do most people know the difference between good and bad performance? After 40 years in the financial advisory business and over 50 years of managing money, I’d say the answer to that question is, “Maybe not.”

When evaluating investment performance, many people begin with, “Show me the bottom line. Did I make money or lose money?” Unfortunately, the answer to that question alone isn’t enough to determine if your performance was good or bad. It’s just part of the story. The rest of the answer is more nuanced than that.

Of course, your return is a good place to start. And, obviously, positive is better than negative and higher is better than lower.

But “better” raises the question, “Better than what?”

If you are trying to judge investment skills, you first need to realize that performance is relative. A good question to ask is, “In what kind of market environment did it occur?”

When the stock market fell 25% on one day in 1987, our clients did not make much money. Being in a money market doesn’t provide a significant return. But they were all happy to be there when the market fell off a cliff. Relative to that market environment, that performance was excellent.

When you take that first sip of soup at the restaurant, you know right away whether you like it or not. You’ve had soup many times before. You can draw on a rich store of experiences—good and bad—to measure against that first taste.

Experience in the financial markets makes a big difference in judging performance too.

But when you gained your experience can make a huge difference in your perception of success.

At the start of 2020, if you had been investing for the last 10 years, you might have thought that you were an experienced investor. Yet, at that time, you were at the apex of an 11-year bull run in stocks. Bonds had been rising for more than two decades. There were no 20%-plus corrections in either asset class.

If you had been an investor during that time, you probably made money no matter what you did. Everyone’s a hero in a bull market. Everyone’s an expert.

However, you are to be congratulated because you were invested. So many investors, based on the previous nine years (2000–2008), were not. But in such an environment, did just having a positive bottom line demonstrate expertise in investing?

For so many even more experienced investors (those that were in stocks during those nine chaotic years), thinking about investing in 2009 was like trying to decide to dine at a restaurant where they’d already had a series of bad meals. Fifty percent losses not once but twice in less than a decade can spoil anyone’s appetite!

However, if they learned to avoid stocks during that market experience, did that make them skilled investors for the next 12 years?

Of course, these are just comparisons to the general market. In answering the question “Better than what?” we can do, well, better.

Our OnTarget Investing Monitor compares an investor’s actual performance to a custom benchmark built just for them. It is based on the same research reports and proposals they and their advisor saw before they invested in our strategies.

In other words, we really hold our feet to the fire. We make sure advisors and their clients know whether they are getting the same kind of performance as was demonstrated when they signed up with us.

Traditional performance metrics show only the performance between two points in time. Lost in that one-dimensional return number is the experience investors had to endure to get that result.

For example, long-term results shown on a research report can look terrific if you focus only on the return number. But if you examine the fine print and see that you had to endure multiple 50% drawdowns to get there, it should make you think twice about whether you want to sign up for the trip.

Why? Because most investors can’t stomach such drawdowns. Most will abandon their investments in the face of such losses whether they are paper losses or actual. They will never achieve the returns being “sold” to them. This unaccounted-for failure is one of the great fallacies of passive, buy-and-hold investing.

This behavioral response is why we try to smooth out the investment experience. Our goal is to reduce drawdowns to levels investors can tolerate, helping them stick with the plan and realize the success investing can bring.

We often say that to judge an active manager’s performance, you need to evaluate it over at least an entire market cycle, which typically takes many years. This is easy to say, but it is often difficult for advisors and investors to do.

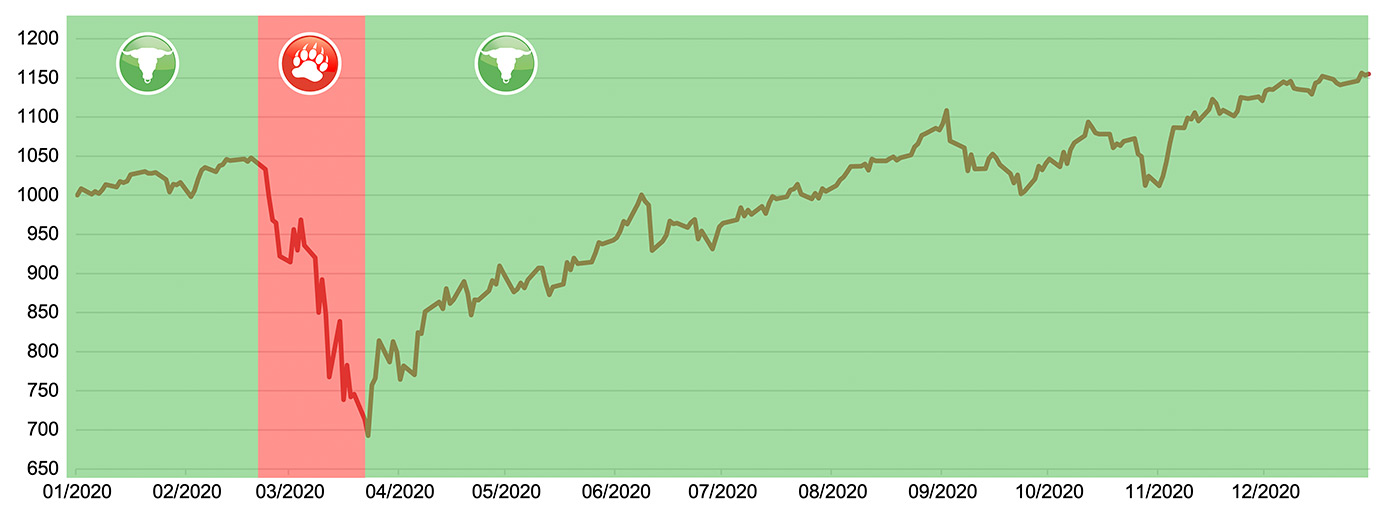

A “market cycle” is defined as an investment period encompassing both a bull market (defined by a rise of 20% or more) and a bear market (characterized by a decline of 20% or more).

A substantial part of an active manager’s performance is usually attributable to how much of the drawdown they avoid. This focus on avoiding losses is supported by basic math: If your investments fall 50%, it takes a 100% return after that to get back to breakeven. If you lose just 20%, you only need a 25% return.

Avoiding losses is the most significant attribute of successful investment performance. To paraphrase prominent investor Warren Buffet, the first rule of investing is don’t lose money. The second rule is to follow the first rule.

However, another important factor is how much of the market gains you achieve when the market is not declining. Avoiding as much of a market crash as possible is essential. But if you don’t return to the market after the crash, much of the value added by the avoidance will dissipate.

Unfortunately, the complete market cycle that an investor requires to evaluate their investment manager can take a long time to develop. Before this century commenced, a market cycle tended to last four to seven years. That’s a long time to hold off judgment on whether your active manager is delivering skillful performance.

In the first decade of this century, investors could easily make that evaluation every four years, as we went through those nine years (2000–2008) that included two 50%-plus drawdowns. Since 2008, it has not been so easy. For 11 years, no 20%-plus corrections occurred to culminate a market cycle. That’s a long time to wait to be able to tell whether your investment advisor provides superior performance.

Source: Flexible Plan Investments Research

The stock market completed an entire market cycle in one year, giving investors the rare ability to judge their managers’ performance based on only a single year of results.

How skillfully did the manager mitigate the losses during the 34% decline from Feb. 19 to March 23? If they avoided some of the decline, how quickly did they return to a fully invested position after the fall? How much of the year-end gains did they manage to earn?

Some investors with passive managers held on in the face of a global pandemic and a bear market slide that sliced through 11 years of bull market profits like a hot knife through butter. How did they fare riding the roller coaster throughout that tumultuous year? Did they stay on for the whole ride? Did they enjoy the ride?

When one year encapsulates so much, the returns earned and how they were made can provide much of the information investors need to measure investment skill.

The many possible strategy combinations our firm offers in dynamic, risk-managed portfolios reduced the risk on the downside during the bear market. They also, on average, achieved a substantial part of the bull market period’s gains, delivering competitive returns for the whole year while providing a smoother investment journey. When we look only at individual tactical strategies, the performance results were even more striking, on both an absolute and risk-adjusted basis.

***

2020 was a terrible year for most of us personally. It brought a global pandemic, losses of life that we will never forget, depression-level unemployment, the shuttering of businesses, the travails of working from home, and a tumultuous election.

Yet, for investors, it has also turned out to be a rare year. After just 12 months, we can ascertain the actual skill of investment managers. It also provided a real-time, real-life demonstration of the value of dynamic, risk-managed investing versus buy-and-hold, passive index investing. You be the judge.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

For more detail on 2020 investment performance referred to in this article, and accompanying disclosures, please see the original version of this article here.

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine many risk-managed strategies within a single account. FPI's fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. flexibleplan.com

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine many risk-managed strategies within a single account. FPI's fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. flexibleplan.com