With Walmart (WMT) delivering its earnings report last Thursday (Feb. 18), the majority of major company earnings releases for Q4 2020 have been delivered.

Bespoke Investment Group called the reaction to Walmart’s report “a relatively fitting end to the earnings season.”

What Bespoke means is that the market’s immediate reaction to many earnings reports was more negative than usual, despite an overall very positive trend for earnings and revenues coming in above expectations.

Bespoke adds,

“Despite trouncing revenue estimates, WMT missed EPS forecasts by a relatively wide margin and dropped more than 6% in reaction to the report in what was the second worst earnings reaction for the stock in the last 20 years.

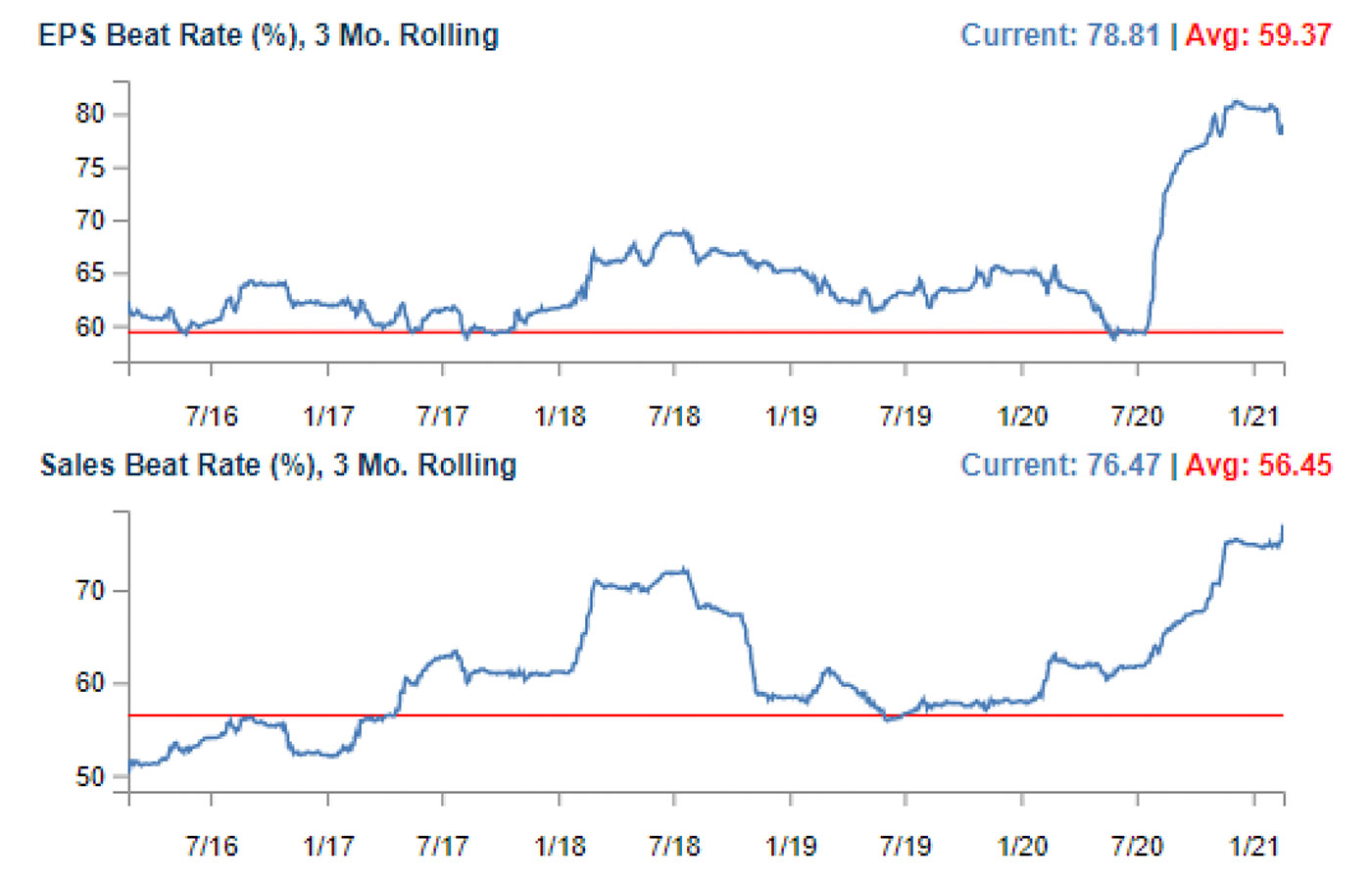

“While this earnings season wasn’t nearly as disappointing as WMT’s report, it was a bit of a letdown. … In terms of the EPS beat rate, while the pace has ticked down a bit, it remains right near its record levels. The rate of revenue beats has been even more impressive and is actually at new record highs. Finally, the percentage of companies raising guidance has dropped a bit from its record highs, but at a net of 27.9% also remains right near its recent record highs.

“Based on actual results relative to analyst expectations, this earnings season did not disappoint! While companies had no problem topping analyst forecasts, investors were looking for more.

“Of the 1,209 [largest] companies that have reported earnings since mid-January, they have gapped up an average of 0.36% at the open, but from there the sellers have stepped in, taking the stocks down an average of 0.93% from the open to close for a full-day decline of 0.59%.”

Source: Bespoke Investment Group

Last week, FactSet issued the following key metrics for the Q4 earnings season for S&P 500 companies:

- “Earnings Scorecard: For Q4 2020 (with 83% of the companies in the S&P 500 reporting actual results), 79% of S&P 500 companies have reported a positive EPS surprise and 77% have reported a positive revenue surprise. If 79% is the final percentage, it will mark the third-highest percentage of S&P 500 companies reporting a positive EPS surprise since FactSet began tracking this metric in 2008.

- Earnings Growth: For Q4 2020, the blended earnings growth rate for the S&P 500 is 3.2%. If 3.2% is the actual growth rate for the quarter, it will mark the first quarter in which the index has reported a year-over-year earnings growth since Q4 2019.

- Earnings Revisions: On December 31, the estimated earnings decline for Q4 2020 was -9.3%. Nine sectors have higher earnings growth rates or smaller earnings declines today (compared to December 31) due to positive EPS surprises.

- Earnings Guidance: For Q1 2021, 31 S&P 500 companies have issued negative EPS guidance and 53 S&P 500 companies have issued positive EPS guidance.

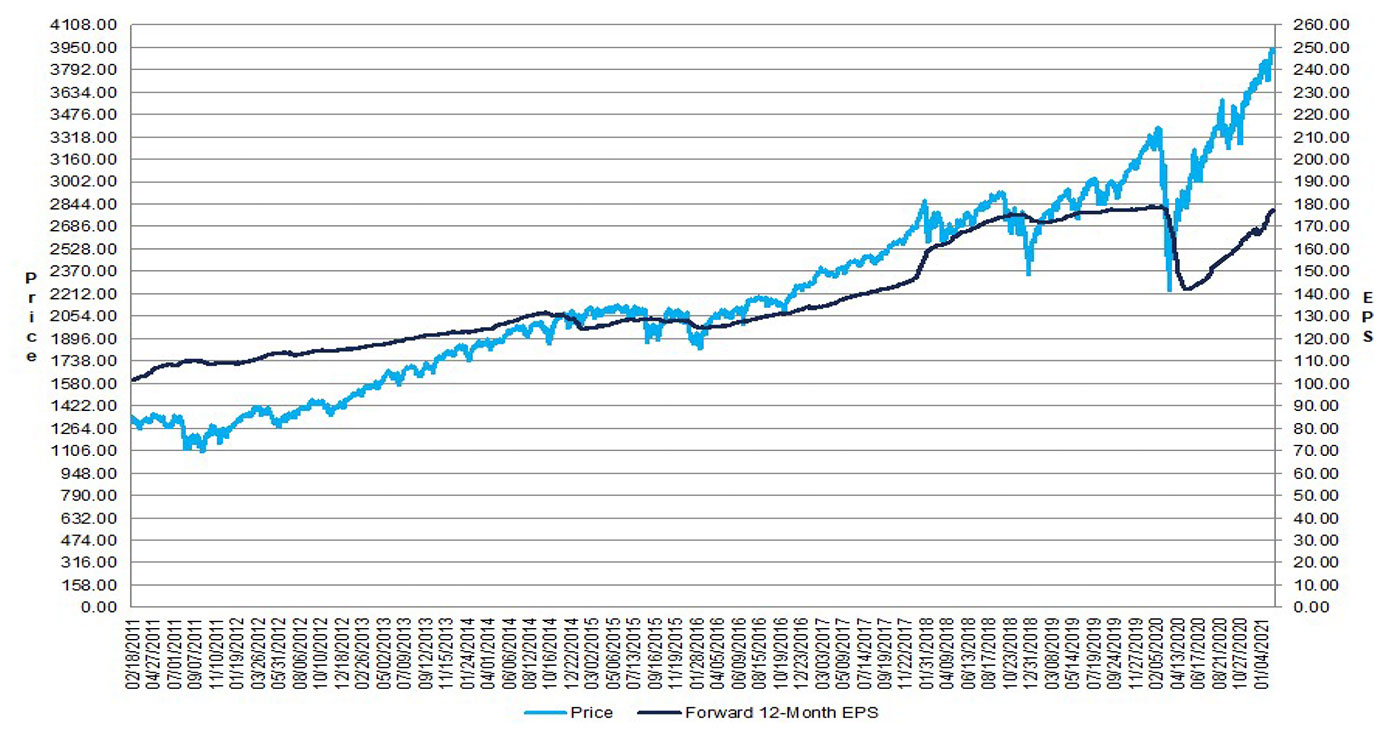

- Valuation: The forward 12-month P/E ratio for the S&P 500 is 22.1 [Figure 2]. This P/E ratio is above the 5-year average (17.7) and above the 10-year average (15.8).”

Source: FactSet

Over the weekend, Barron’s asked how the S&P 500 could show overall earnings growth for the fourth quarter, while the U.S. economy declined by about 2.5%.

Barron’s answer lies mostly in how the composition of the S&P 500 and the dominance of a relatively few companies affects the overall results:

“This past week, David Kostin, the U.S. stock chief at Goldman Sachs, told me why he thinks that the getting is still good, and that the S&P 500 index will end the year at 4300—up about 10% from here, and 14% for the full year. …

“‘I think you’re really going to see the acceleration in the second quarter,’ says Kostin. He recently raised his estimate for 2021 earnings underlying the S&P 500 to $181 from $178. The new number is 10% above the 2019 record.”