Despite last Friday’s (March 13) impressive relief rally following the update on the U.S. government’s coordinated response to the COVID-19 outbreak, U.S. equities are firmly in bear market territory.

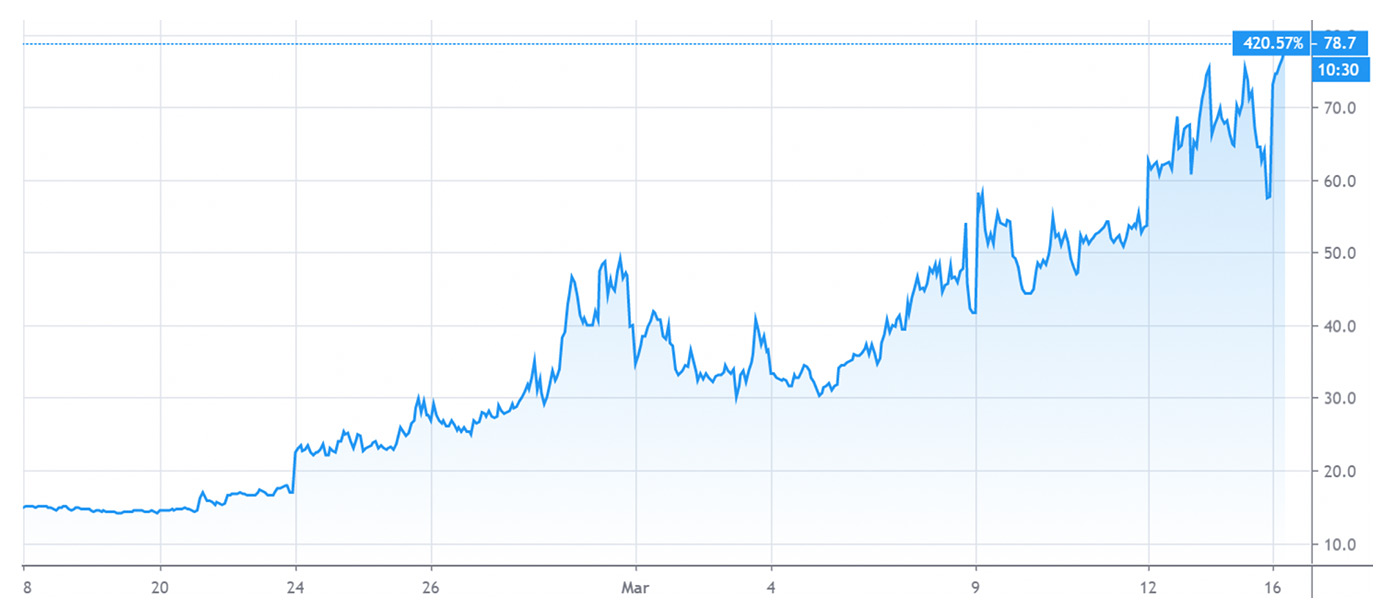

As of this writing, the CBOE Volatility Index (VIX) remains highly elevated, indicating investors can continue to anticipate large swings.

Bloomberg reported earlier this week,

“A measure of fear in U.S. stocks surged on Monday as an emergency move by the Federal Reserve to ease policy did little to calm markets over the spreading coronavirus. The CBOE Volatility Index jumped as high as 76.3 in early trading, according to data compiled by Bloomberg. That was just shy of its highest level since the 2008 financial crisis, which it posted during last week’s turbulence. Futures contracts on the gauge that expire on Wednesday also hit a historic 72.8.

“Monday’s surge is the latest extreme move amid the sell-off engulfing markets as investors fret the impact of the virus. U.S. stocks fell so fast they hit a trading pause for the third time in a week. The S&P 500 last week recorded the biggest plunge since the crash on Black Monday in 1987.”

Source: Trading View, data as of March 16, 2020

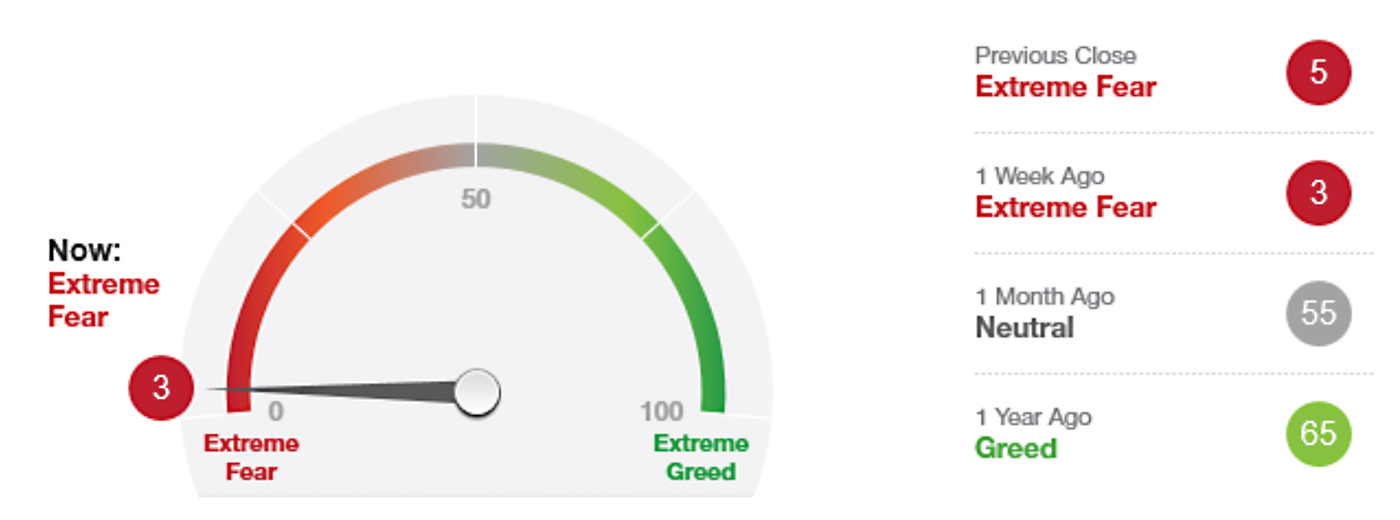

CNN’s Fear and Greed Index tracks seven indicators of investor sentiment:

- Put and call options: CBOE five-day average put/call ratio.

- Market volatility: VIX current level and its 50-day moving average.

- Stock price breadth: Based on the McClellan volume summation index.

- Safe-haven demand: Difference in 20-day stock and bond returns.

- Junk-bond demand: The yield spread between junk and investment-grade bonds.

- Market momentum: S&P 500 level versus its 125-day moving average.

- Stock price strength: New 52-week highs and lows on the NYSE.

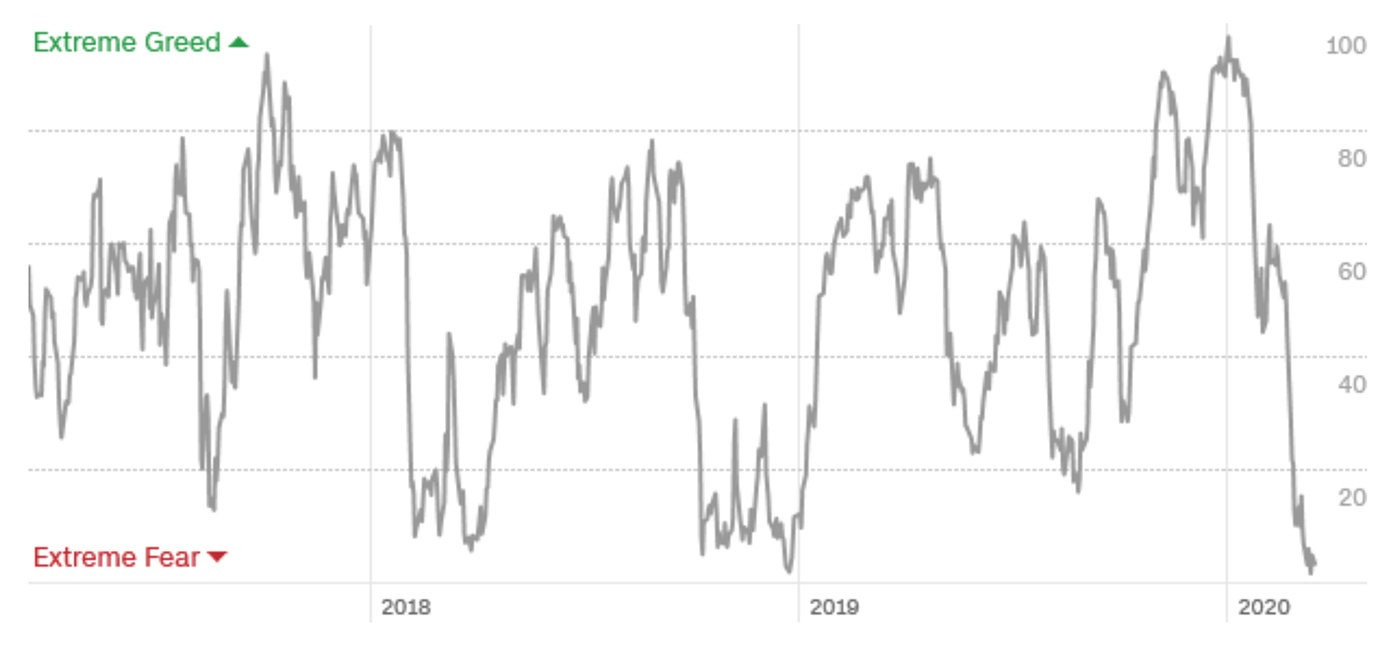

All of these individual measures are showing “Fear” readings, according to the methodology of the Index. Combined, they are showing a market mood of “Extreme Fear”—about as pronounced as it can get on this scale. Note in Figure 3 that the fourth quarter of 2018 produced levels almost as extreme, as the S&P 500 lost close to 20% from its prior high in a relatively short period.

Source: money.cnn.com., data as of March 16, 2020

Source: money.cnn.com, data as of March 16, 2020

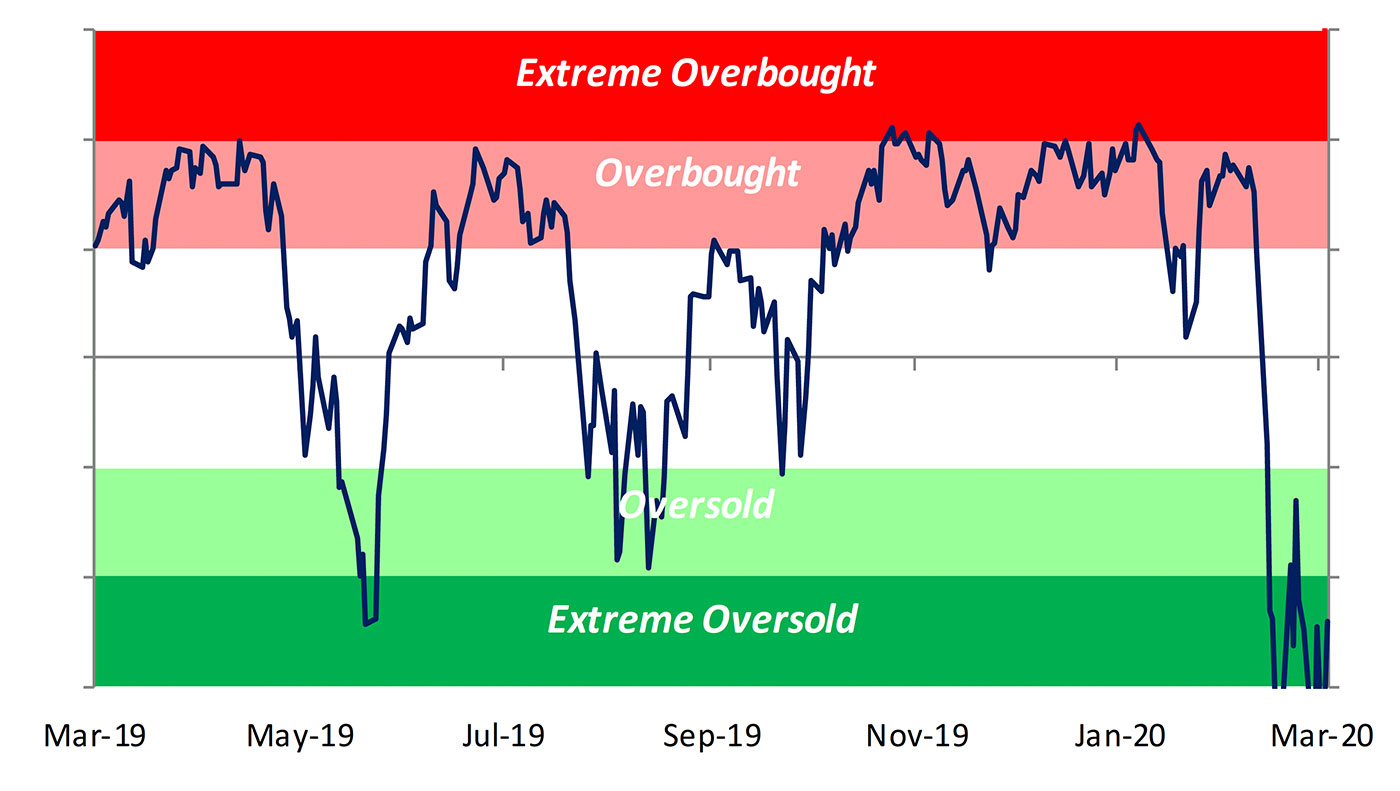

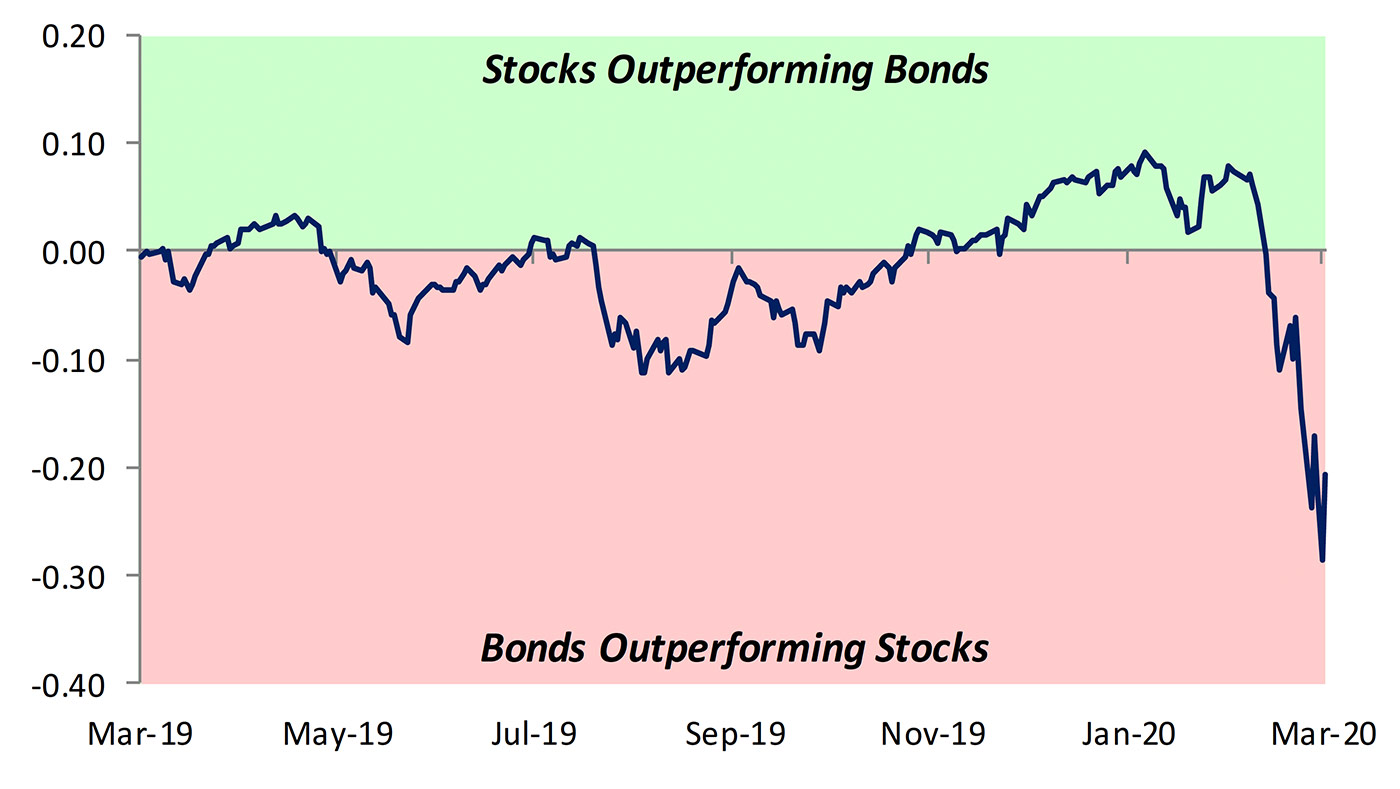

Not surprisingly, U.S. stocks, as of this writing, are in an extreme oversold condition, according to Bespoke Investment Group. This is also true for almost all major asset classes, with the notable exception of U.S. Treasurys.

FIGURE 4: S&P 500 50-DAY MOVING AVERAGE SPREAD

Source: Bespoke Investment Group

FIGURE 5: RELATIVE STRENGTH OF STOCKS VERSUS BONDS

Source: Bespoke Investment Group

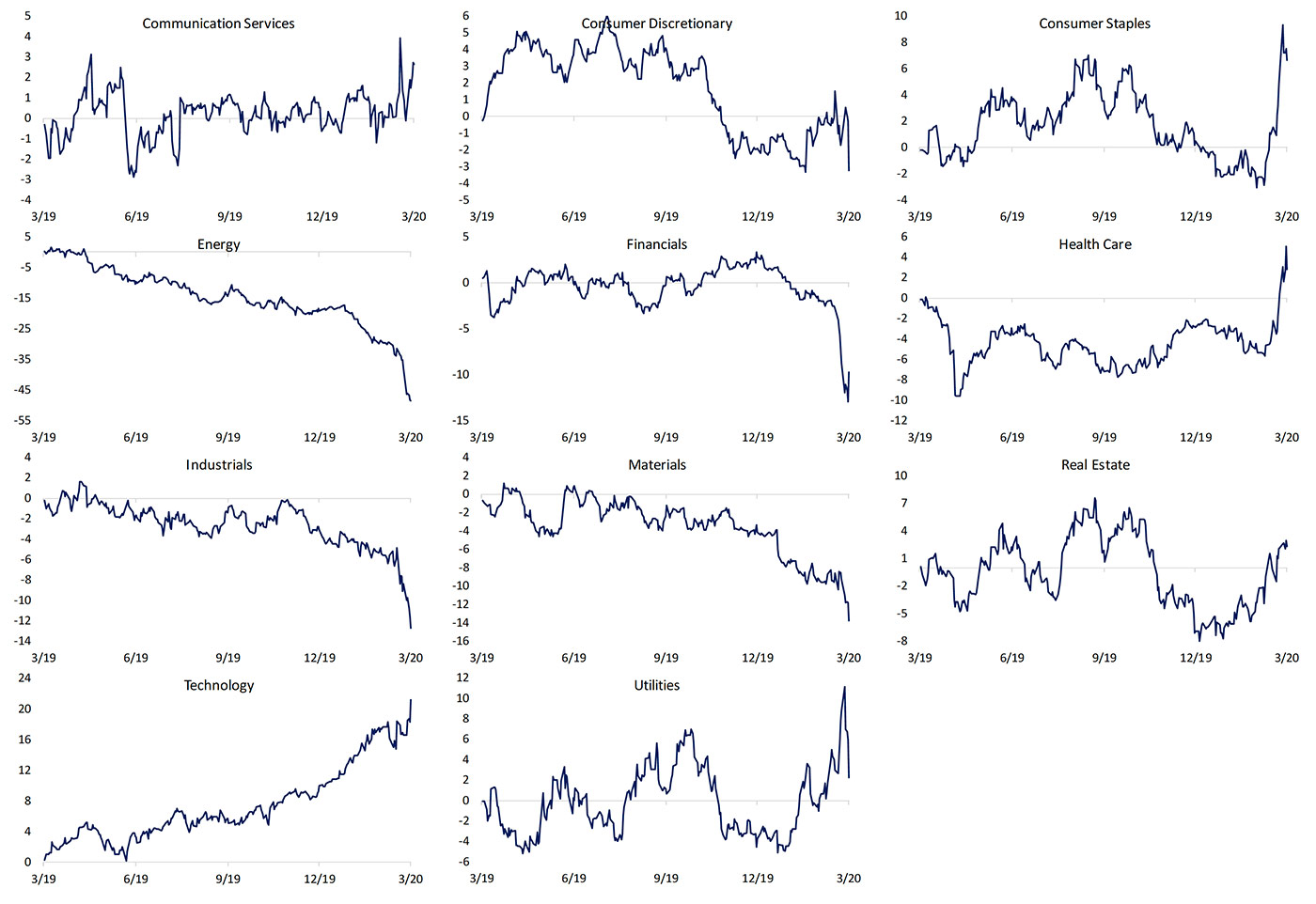

Although every major equity sector has been affected by the broad market sell-off, there have been large discrepancies in those that have been hit the hardest versus those showing better relative strength versus the S&P 500’s average performance.

As of March 13, the weakest U.S. sector ETFs (SPDR) (ranked from worst performing to best performing) have been Energy (-46.4%), Financial (-25.1%), Materials (-24.3%), and Industrials (-22.7%). The best-performing sector ETFs have been Technology (-8.2%) and Real Estate (-8.7%).

FIGURE 6: SECTOR RELATIVE STRENGTH VS. S&P 500—PAST YEAR

Click Image to Enlarge

Source: Bespoke Investment Group, data through March 13, 2020.