The stock market sell-off since the last new all-time high on July 26 has brought the bears out, and they have been trading a lot of put options. Some trade those as an outright bearish bet, and some as a hedge on portfolio risk. Whatever the motivation for those trades, persistently higher trading of put options versus call options is a sign that prices may have bottomed.

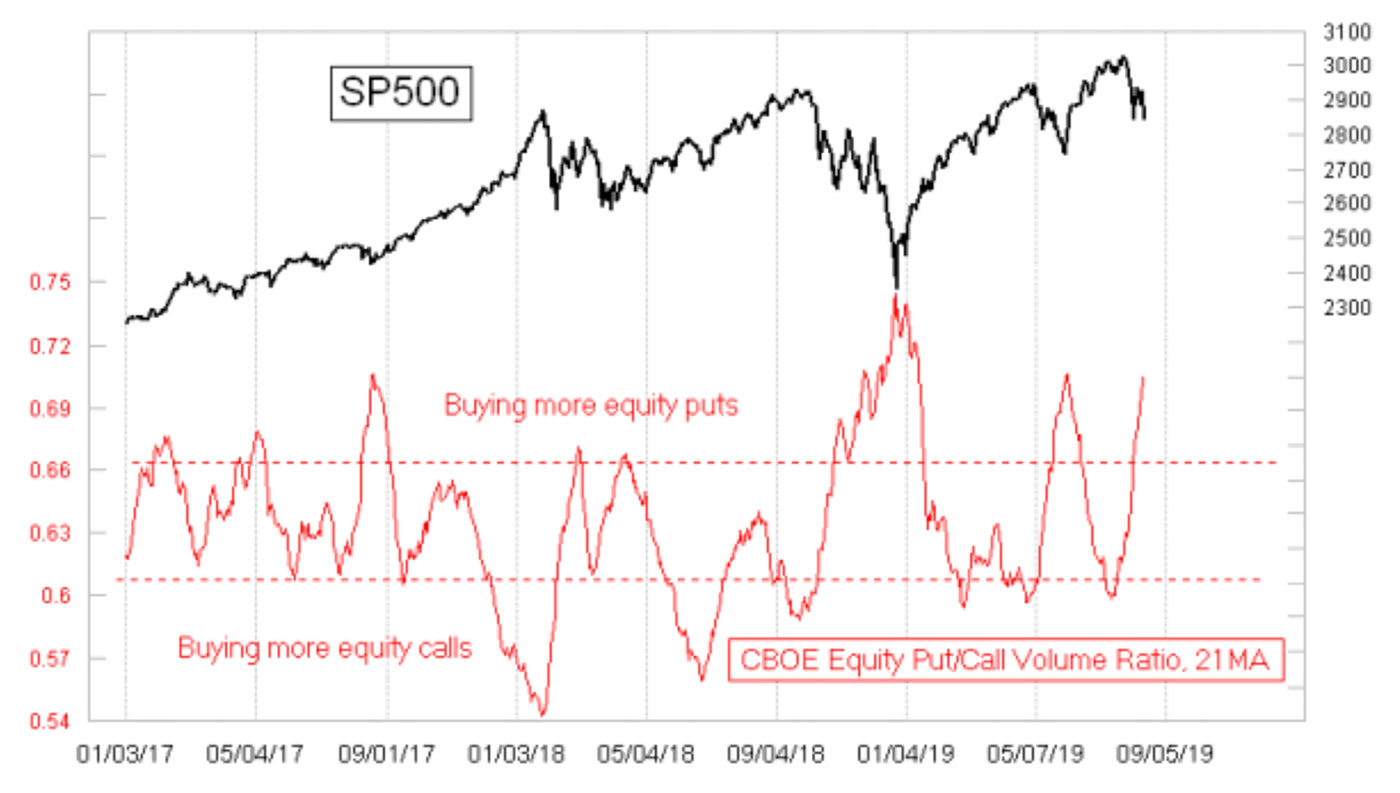

Figure 1 looks at a 21-day moving average (MA) of the daily CBOE Equity Put/Call Volume Ratio. Twenty-one trading days is roughly one month, and so it can make for a useful lookback period for this purpose. It smooths out the daily spikes and allows us to see what the put/call numbers have been doing more broadly. When it gets to an extended level, either high or low, it says that prices should be at a meaningful turning point. This appeared to be the case on Aug. 14–15.

Source: McClellan Financial Publications

Other lookback periods can also be useful. I like to use a 5-day MA for this purpose as well.

One problem is identifying “high” and “low” reading thresholds. The horizontal dashed lines are arbitrarily placed on the chart in Figure 1 using the LAR (“Looks About Right”) method. And there can be some drift over time, as some periods see generally higher or lower numbers than other periods.

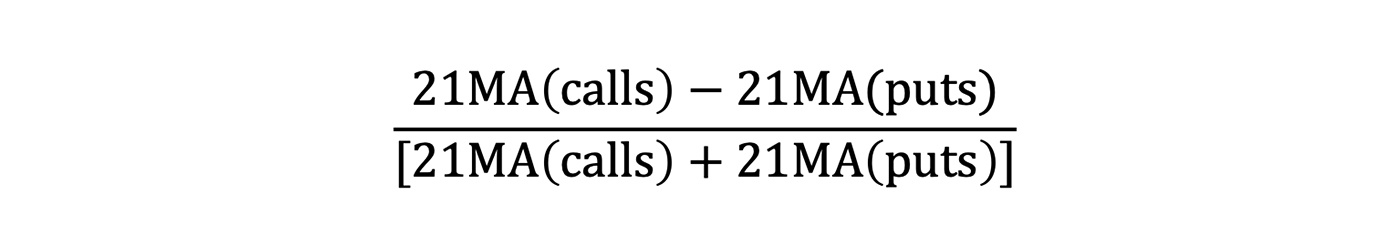

To address this, years ago I did some tinkering and came up with an indicator that involves a lot more computations but is based on the same raw data. The formula for this indicator is as follows:

Then I calculate a 50-day MA (50MA) of that ratio. Finally, I measure how far that ratio is away from its 50MA to get the indicator you see in Figure 2.

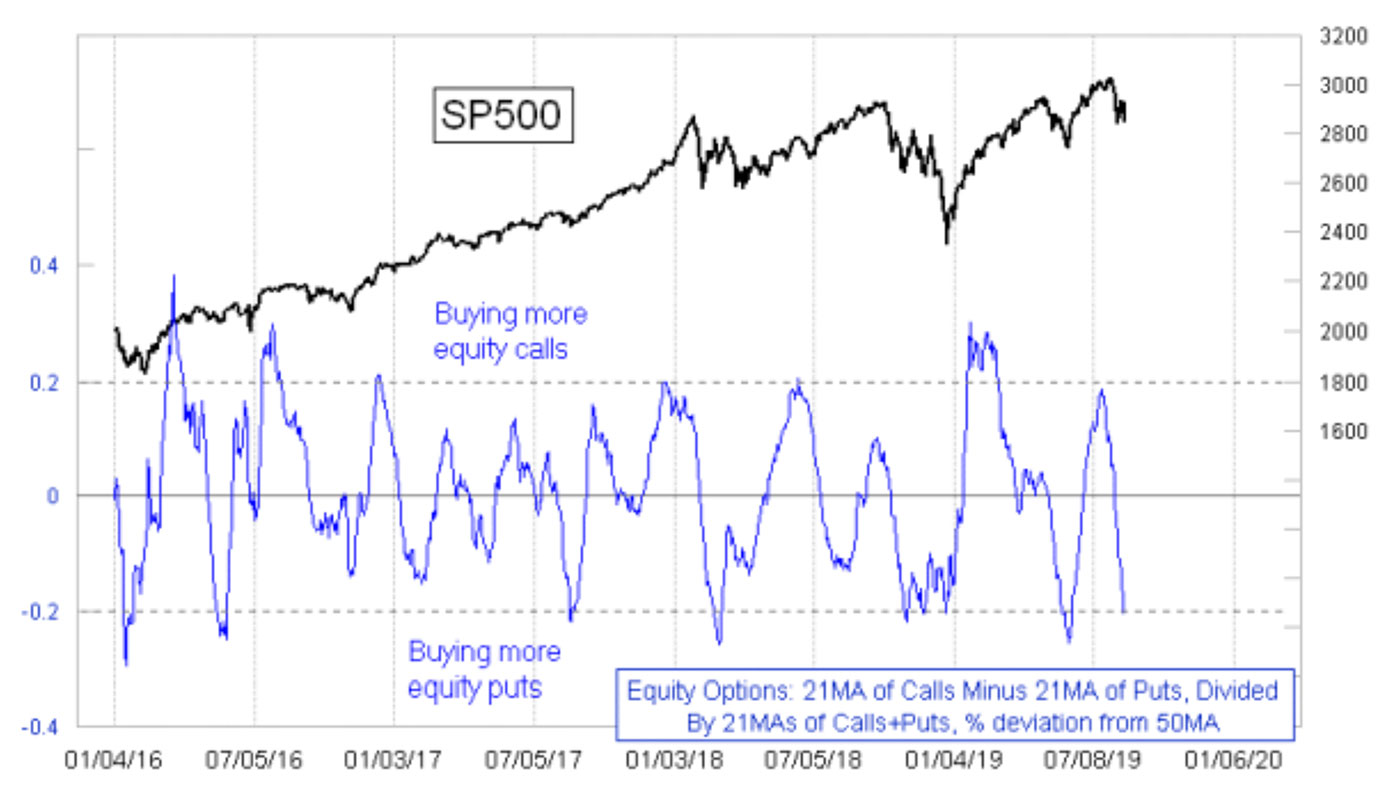

Source: McClellan Financial Publications

Averaging the numbers of calls and puts separately first keeps days with greater volume from being washed out into the daily ratios. By placing calls ahead of puts in the formula, instead of the normal put/call ratio, I am flipping the orientation of the plot to better correlate with how prices behave. And by measuring the deviation from the 50MA, I am correcting for any drift over time in the normal levels of puts and calls, making for a nice clean oscillator with more well-defined boundaries of “normal” range behavior.

My interpretation is that the net result is the same in terms of showing us an extended condition right now. As previously stated, I have set the dashed horizontal lines using the LAR method, and that seems OK for this purpose. Others who replicate this indicator could come up with a more scientific method of designating “high” and “low,” and I would not quibble with that.

The immediate message of this indicator now is that equity options traders have been a whole lot more interested in trading puts lately versus calls. That is a sign of trader pessimism—and when pessimism (or optimism) goes too far, it gives us a useful message.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

A version of this article was first published by McClellan Financial Publications on Aug. 15, 2019.

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com