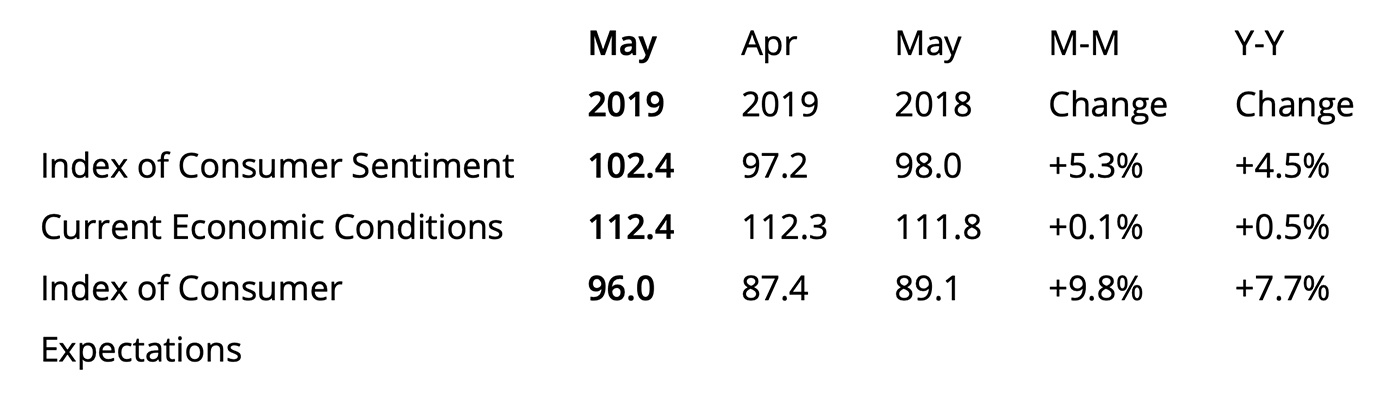

According to the University of Michigan’s Index of Consumer Sentiment, U.S. consumers are feeling more positive about the combination of current and future economic conditions than at any other period in the last 15 years.

The consensus estimate was for an index reading of 97.5, and the actual figure came in at 102.4 last Friday (May 17), far exceeding estimates. The component measuring consumer expectations for the future showed a far more significant bounce from April than the component for current conditions, rising 9.8%.

Source: University of Michigan

Surveys of Consumers chief economist, Richard Curtin, commented on the survey results release,

Source: University of Michigan

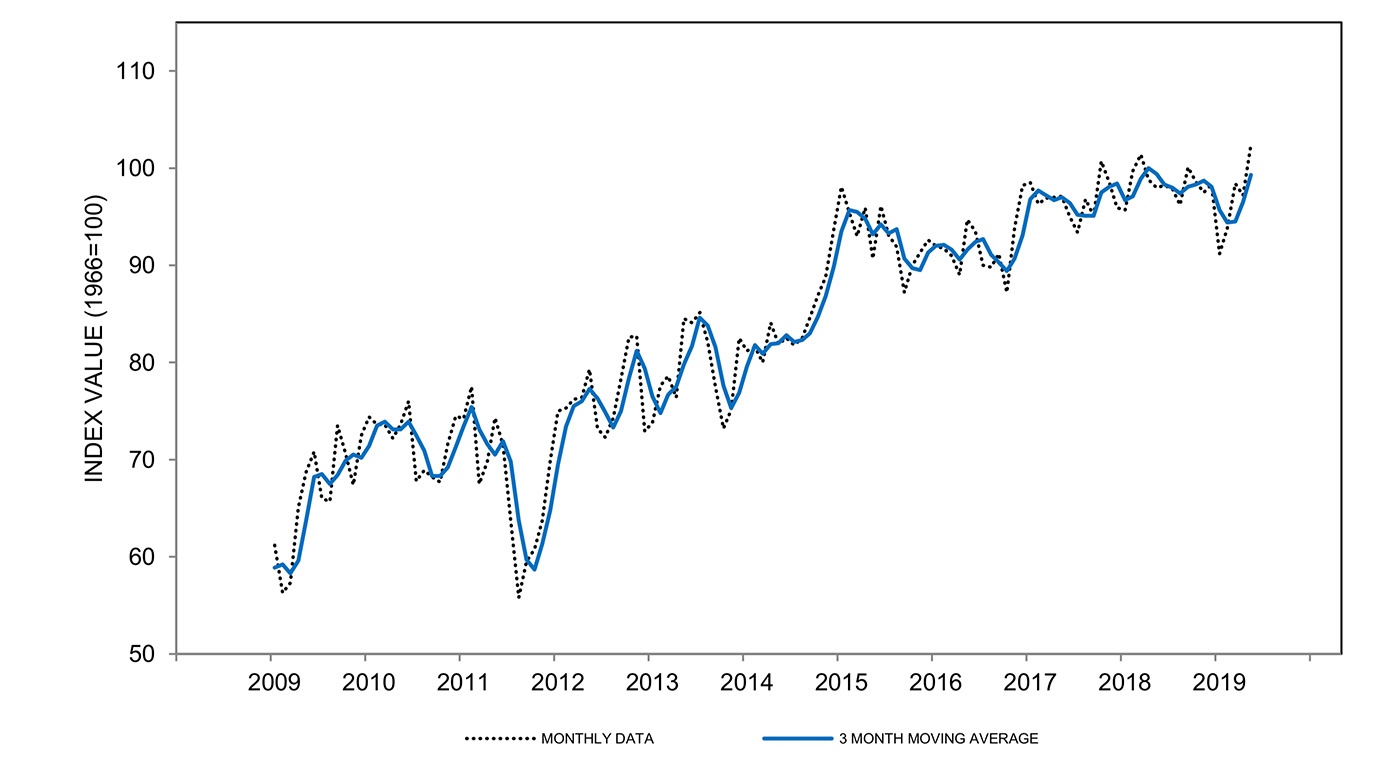

Mr. Curtin also notes that the while this data does not reflect the impact of the recent stalled trade negotiations with China, concern over the tariff issue has been steadily dropping among consumers since “the initial imposition of tariffs” back in July 2018. He expects that a stepping up of the trade war will undoubtedly impact consumer sentiment in the future if it continues without resolution and fosters an increasingly tense relationship between the governments of the U.S. and China.

He writes,

Source: University of Michigan

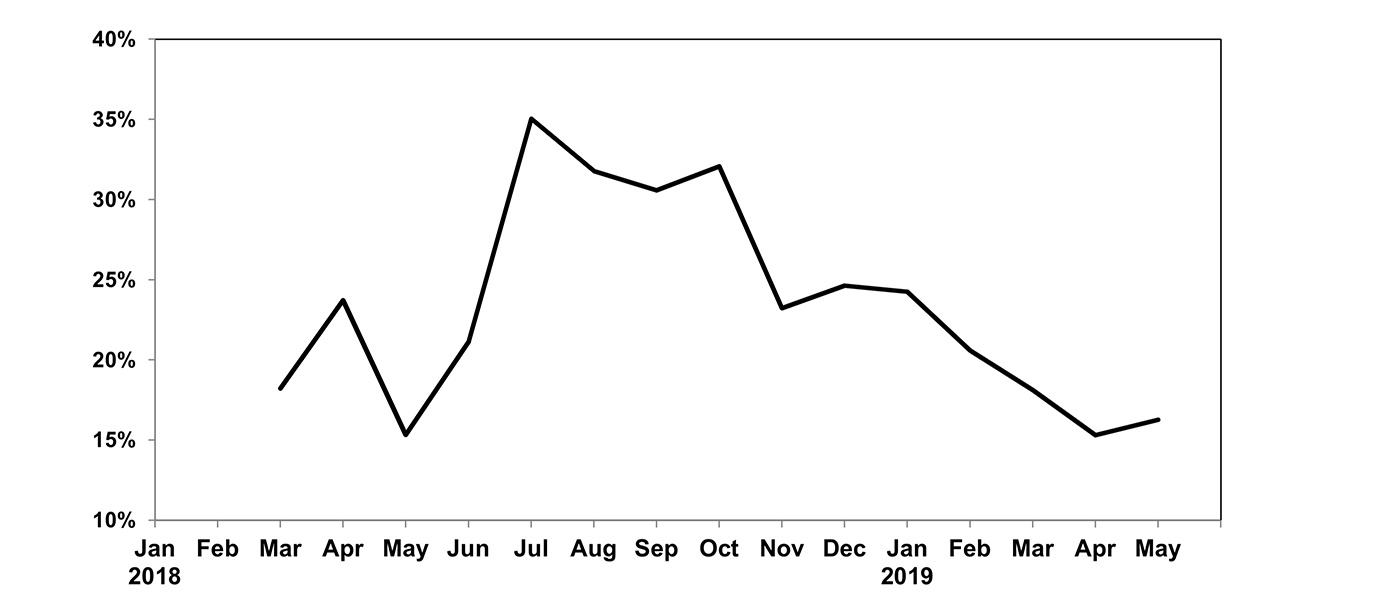

Despite the very positive consumer sentiment readings, retail sales in April disappointed.

MarketWatch reported comments by Neil Dutta, head of economics at Renaissance Macro Research:

MarketWatch also noted,

That said, Trading Economics notes that the disappointing data for April retail sales came after very positive March data where “upwardly revised 1.7 percent growth in March … was the biggest increase in sales for one-and-a-half years.”

FIGURE 3: U.S. RETAIL SALES DATA, PAST 12 MONTHS

Source: tradingeconomics.com, U.S. Census Bureau

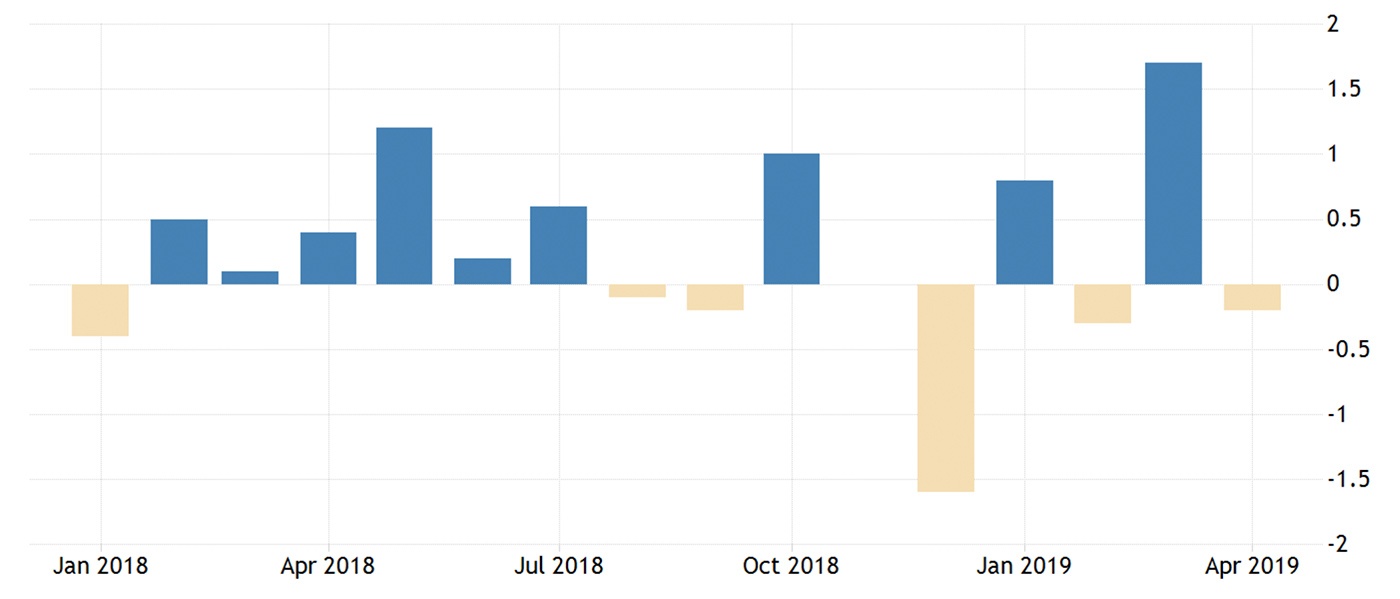

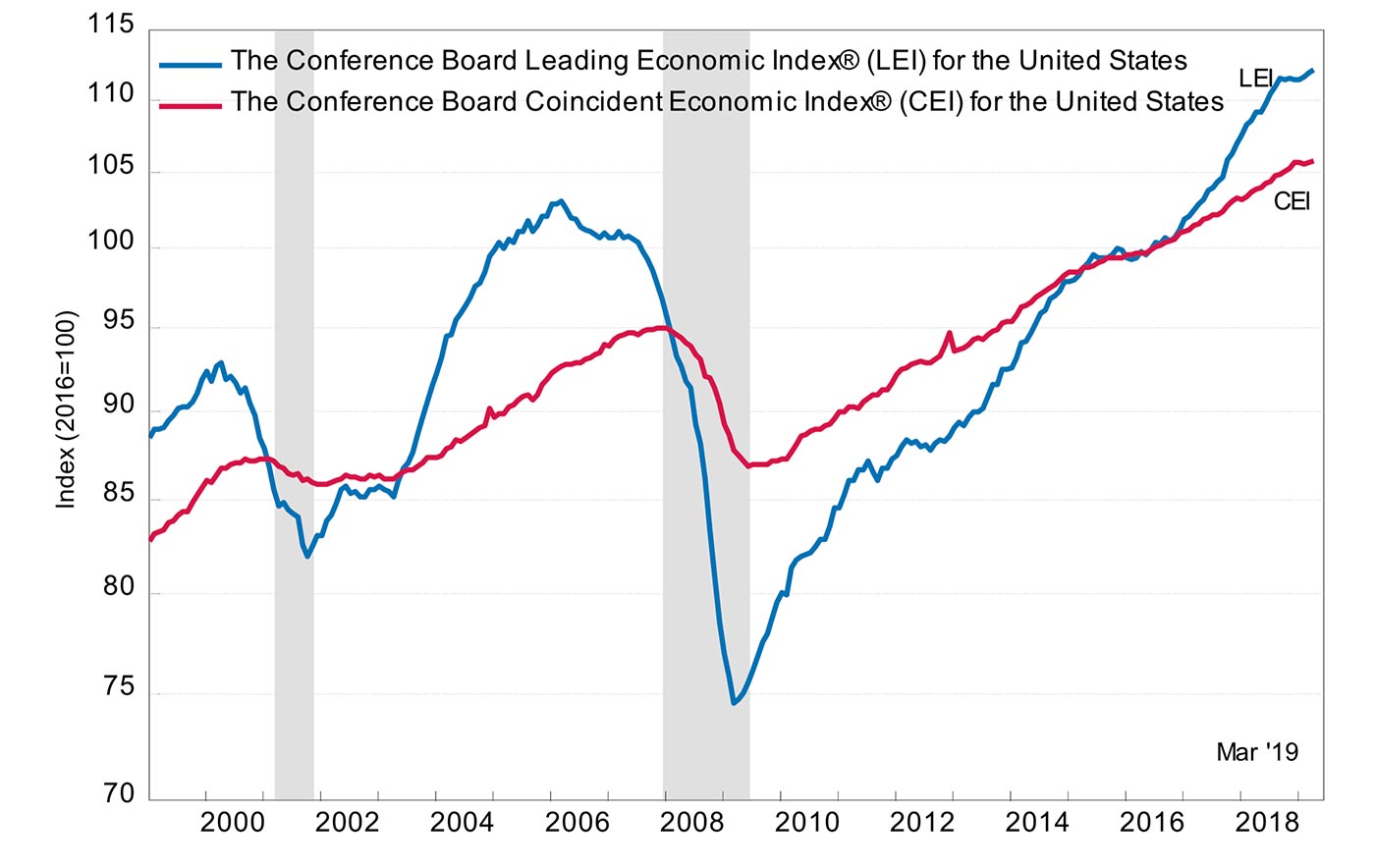

Last Friday also saw the release of The Conference Board’s Leading Economic Index (LEI), which showed its positive trend continuing for now:

“‘The US LEI rose in April, the third consecutive increase, with a majority of the leading indicators making positive contributions,’ said Ataman Ozyildirim, Director of Economic Research at The Conference Board. ‘Stock prices, financial conditions, and consumers’ outlook on the economy buoyed the US LEI, although the manufacturing sector showed continuing weakness. The Conference Board expects economic growth to moderate toward 2 percent by year end. The current expansion will enter its 11th year in July, becoming the longest expansion in US history.’”

FIGURE 4: CONFERENCE BOARD LEADING ECONOMIC INDEX RISES FOR

THIRD CONSECUTIVE MONTH

Source: The Conference Board