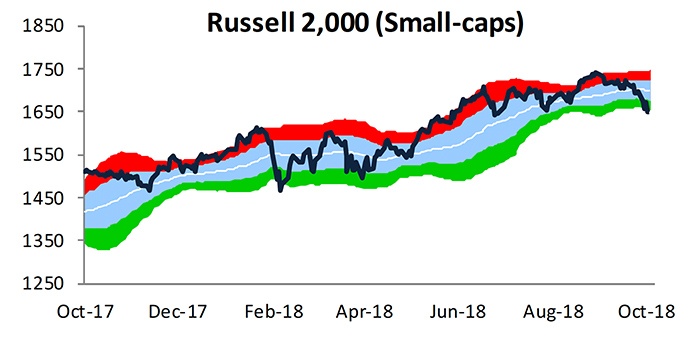

While small-cap stocks (Russell 2000) were showing relative strength throughout much of 2018, their recent weakness in both September and October has led to underperformance versus the S&P 500.

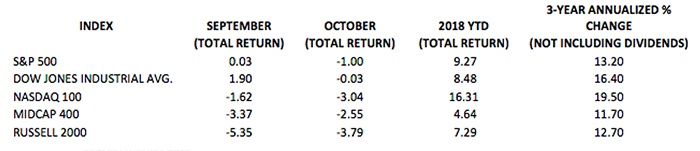

Table 1 looks at major index total returns for September, October, the year to date through Oct. 5, as well as the three-year annualized change for each index.

TABLE 1: COMPARISON OF RECENT/THREE-YEAR MAJOR INDEX RETURNS

Source: Market data

The Russell 2000 was trading at oversold levels as of Oct. 5 (see Figure 1).

FIGURE 1: SMALL-CAP RUSSELL 2000 (1-YEAR TREND)

Source: Bespoke Investment Group

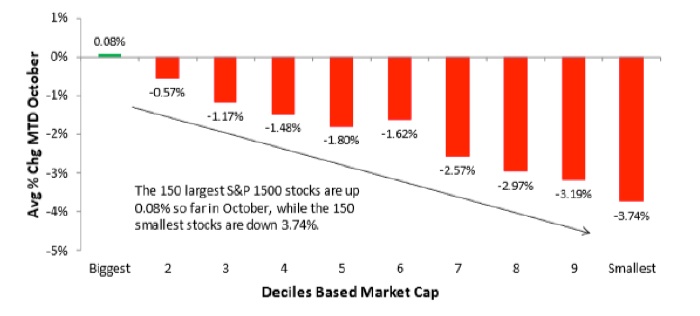

Bespoke Investment Group noted the performance discrepancy between large and small caps last Friday (Oct. 5):

“October has been a horrific month for small caps already. Below we break the S&P 1500 (composed of large, mid, and small-caps) into deciles based on market cap. As shown, as market cap gets smaller, performance so far in October gets worse. The decile of the smallest stocks in the S&P 1500 is already down an average of 3.74% this month!”

FIGURE 2: S&P 500 DECILE PERFORMANCE BY MARKET CAP (OCTOBER 2018)

Source: Bespoke Investment Group

One school of thought holds that rising interest rates adversely impact small-cap stocks because smaller companies are usually more dependent on shorter-term financing and adjustable-rate loans than large caps. Further, the argument goes, the larger dividends generally paid by large-cap companies enhance returns on a relative basis versus small caps—an important factor when bond yields improve.

There is a counterargument, says Investopedia, that should benefit small caps in a rising-rate environment. In a 2016 article quoting Sam Stovall, U.S. equity strategist for S&P Global Market Intelligence, they wrote,

“A rate increase would also strengthen the price of the U.S. dollar, which would in turn raise the price of exports to other countries. This would most likely have a larger effect on large-cap companies that have extensive overseas markets and holdings, whereas the small-cap sector is much more domestic.”

An August 2018 article in Seeking Alpha made the quantitative case that returns for small-cap stocks do not necessarily suffer during rising-rate environments—in fact, they outperform. Francis Gannon, Co-CIO at Royce & Associates, wrote,

“Once again turning to history as our guide, we find that periods of rising rates have been favorable for small-cap stocks on both an absolute and relative basis. When the 10-Year Treasury yield was rising, the Russell 2000 Index outperformed the large-cap Russell 1000 in 70% of trailing monthly rolling one-year periods for the 20-year period ended 6/30/18, with an average one-year return of 23.8% versus 19.2% for large-cap.”

FIGURE 3: SMALL CAPS VERSUS LARGE CAPS IN RISING-RATE ENVIRONMENTS (1998–2018)

Source: Seeking Alpha, “What Rising Rates Mean for Small-Cap Stocks,” August 2, 2018.

On a broader basis, when should investors start to worry that higher interest rates will have a significant impact on their overall stock holdings?

An April 2018 article from U.S. News and World Report offered a positive equity perspective for the current interest-rate environment and suggests there is a long way to go before rate increases become an issue for stocks—but suggests caution as well when relying on historical trends:

“If we geek out for a minute on Standard & Poor’s 500 index price-earnings ratios, we see that in practice, markets don’t always react as economic theorists might expect. Looking at data going back to the 1980s, valuations have been at their highest when 10-year Treasury yields stand between 4 and 6 percent.

“When rates climbed from a level under 4 percent, valuations have been well supported, but when they rose above 6 percent, valuations tended to fall. The current S&P 500 valuation is not cheap, but history suggests that a gradual rise in rates could lead to even higher valuations. In other words, rising stock prices.

“After taking a victory lap to celebrate the possible rise in your portfolio, you might suddenly realize: Perhaps this time will be different.”

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.