There are many tools traders can utilize to gain an edge. Fundamentals, technical indicators, sentiment, and seasonality are examples of the kinds of tools that traders may use to identify opportunities. All of them can provide value. And with regard to the tools, there are many “truths” traders learn about the markets as they go through their careers. But these truths are subject to change. Today I will use a seasonality example to demonstrate change in the market.

Starting in the late 1980s and early 1990s, the stock market began to show unusual strength on the first trading day of each month

relative to other days. This was not noticed by many market observers for several years, but eventually became fairly common knowledge. The most common explanation was that 401(k) plans began to gain popularity around that time. And since many people got paid at the end of the month, there tended to be mass inflows into mutual funds right around the first of the month. Fund managers would put that money to work, and the increased liquidity flow would often help elevate the market on the first.

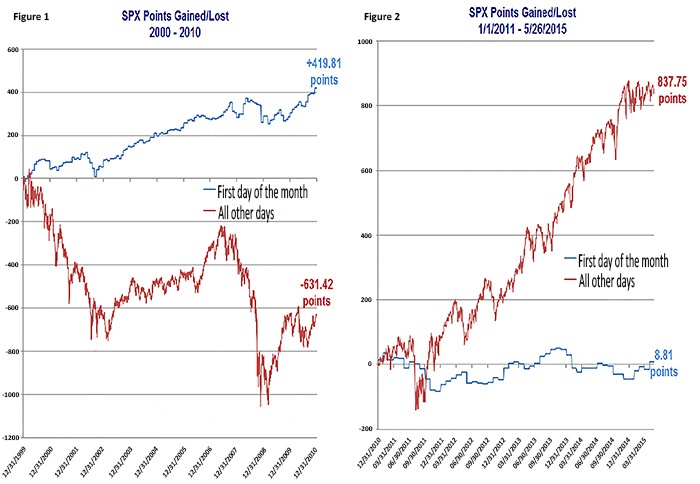

But first-of-the-month strength has not persisted in recent years. The charts here show just how drastic the change in market character has been. These charts compare the “first of the month” versus “all other days.” They show SPX (S&P 500) points gained (or lost) for two time periods: 2000-10 and 2011-present.

Source: QuantifiableEdges.com

The stock market generally struggled during the 2000-10 period. Looking at the chart, you can see that while the S&P 500 spent much of the time enduring two large bear markets, the first-of-the-month chart looks pretty bullish for most of the duration. Nearly 420 points were gained on the first of the month, while all other days combined to lose over 630 points.

That changed drastically around the beginning of 2011 (see Figure 2). Over the last 4.5 years, the market has been in a bull market for much of the time—gains have been exceptionally strong. But almost none of those gains were thanks to first-of-the-month action.

I have no good explanation for “why” the market has changed. Maybe the unusual strength was noticed by so many that the edge was traded out of the market. Regardless, strategies that looked to take advantage of it have likely faltered.

It will be interesting to see how this plays out in the months and years to come. If the former “strongest day” cannot manage gains in a bull market, how badly might it fare when the next bear market arrives? Is it a permanent change, or is it temporary? Will “first of the month” devolve into “worst of the month?” At this point, it is too soon to tell.

What is clear is that this particular market trend has not acted the same in recent years. Changes like this are not always obvious, but they are constant. For traders to be successful over the long term, they must identify changes that impact their strategies and adapt as market “truths” evolve.

The bad news is that adapting to change can be difficult. The good news is that changing market dynamics ensure there will always be more to learn, the market will always be interesting, and there will always be new opportunities to explore.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Rob Hanna has worked in the investment industry since 2001. He is the founder and publisher of Quantifiable Edges, a quant-based website where he also publishes a newsletter. After managing a private investment fund through Hanna Capital Management LLC from 2001 to 2019, Rob joined Capital Advisors 360, where he now serves as a registered investment advisor and focuses on short-term and quantitative strategies. quantifiableedges.com

Rob Hanna has worked in the investment industry since 2001. He is the founder and publisher of Quantifiable Edges, a quant-based website where he also publishes a newsletter. After managing a private investment fund through Hanna Capital Management LLC from 2001 to 2019, Rob joined Capital Advisors 360, where he now serves as a registered investment advisor and focuses on short-term and quantitative strategies. quantifiableedges.com

Recent Posts: