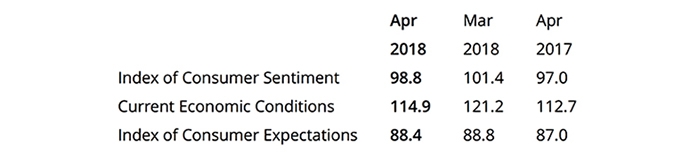

April’s report on consumer sentiment by the University of Michigan showed that sentiment slightly exceeded estimates and was higher than the comparable period last year, though still below March’s level.

TABLE 1: UNIVERSITY OF MICHIGAN CONSUMER SENTIMENT REPORT (APRIL 2018)

Source: University of Michigan

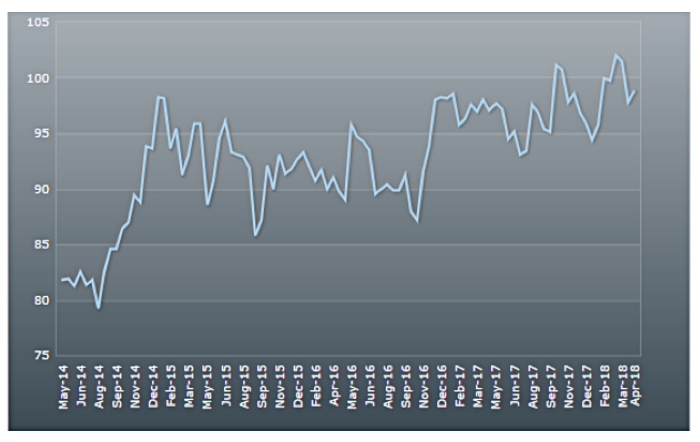

FIGURE 1: TREND FOR UNIVERSITY OF MICHIGAN SENTIMENT (2014–2018)

Source: Barron’s, Econoday

Richard Curtin, chief economist for the Surveys of Consumers, commented on the April report:

“Consumer sentiment improved slightly in the 2nd half of the month, shrinking the small overall decline for April. The final April figure was nearly identical to its 2018 average (98.9)—which was higher than any other yearly average since 107.6 was recorded in 2000 (which was, in turn, the highest yearly average in more than a half century).

“Tax reform and trade policies continue to spark spontaneous, or unaided, comments. The spontaneous comments about the tax reform legislation had a positive balance of opinion, but the trade tariffs generated a negative balance of opinion. …

“Aside from the offsetting impact of Trump’s tax and tariff policies, the best simple summary of the current state of consumer confidence is that the economy is ‘as good as it gets.’ While consumers do not anticipate an economic downturn anytime soon, the long expansion has made consumers (and economists) somewhat apprehensive about future trends. Overall, the data are consistent with a growth rate of 2.7% in real personal consumption in the year ahead.”

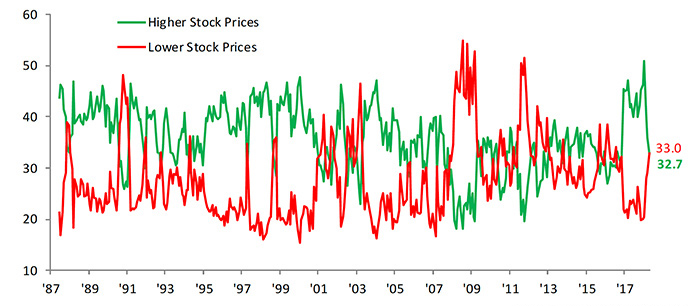

That “apprehension” is showing up in investor attitudes about the stock market.

Bespoke Investment Group had several observations last week about the Conference Board’s Consumer Confidence report as it pertains to the general public’s increasingly negative view toward the stock market—despite their overall Consumer Confidence Index showing an increase for April:

- “Just three months after sentiment towards the stock market in the monthly Consumer Confidence report hit record high levels, that same measure of sentiment has come crashing down.

- “Expectations for higher stock prices dropped from 36.0% down to 32.7%. That may not sound like much of a decline, but when you consider the fact that over half of U.S. consumers were bullish on the stock market just three months ago, it marks a continuation of a shift in sentiment not seen at any other point in the last 30+ years.

- “Bearishness towards the equity market has shot up from a multi-year low of 19.9% in November to 33.0% today.

- “For the first time since the election, more consumers expect stocks to go down than up.”

FIGURE 2: CONSUMER CONFIDENCE—HIGHER VS. LOWER STOCK PRICES (1987–2018)

Source: Bespoke Investment Group