How do advisors explain the benefits of active management to clients?

How do advisors explain the benefits of active management to clients?

Financial advisors favor third-party active management for a wide variety of reasons: access to modern analytical strategies, emphasis on risk mitigation, the ability to be responsive to current market conditions, and the ability to deliver high levels of client satisfaction over full market cycles.

Over the past four years, our editorial staff has interviewed dozens of advisors across the United States. They are a diverse group, representing many business models in the industry and whose firms come in all “sizes and shapes.” What they all share is a strong desire to find investment solutions for their clients that will stand the test of time.

Simply put, this means employing strategic approaches that can generate competitive returns in both bull and bear markets through the use of strong risk-management techniques. It also means adopting a planning and investment philosophy that can accommodate investors with different levels of financial sophistication and risk tolerance. For this, they turn to active investment management.

In today’s highly competitive arena of financial advice, developing a value proposition for an advisory firm is critically important. The vast majority of advisors we have interviewed believe that their use of third-party actively managed strategies for client portfolios is an important part of their firm’s value proposition.

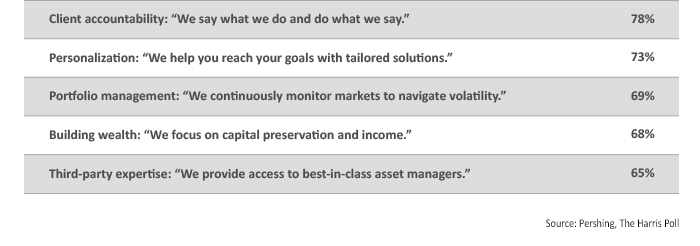

In fact, a 2014 study from Pershing, developed with research firm Harris Poll, provided “a data-driven perspective on unique value propositions—the clear statements that explain what sets an advisory firm apart.”

This study, “What Do Top Advisors Say—and What Do Investors Really Think? A Study of Advisor Value Propositions,” identified eight of the most powerful value proposition statements for advisory firms among high-net-worth investors. While all eight statements thematically reflect many of the beliefs of the advisors we have interviewed, five statement areas are of particular interest.

While this research on value propositions is very informative, how do financial advisors and wealth managers express their philosophical and pragmatic beliefs in active management to clients … in their own words?

For this issue, we looked at how several advisors have addressed the question:

David Quick • Dallas, TX

David Quick • Dallas, TX

Read full article

Jerry Ganz • Green Bay, WI

Jerry Ganz • Green Bay, WI

Read full article

Johnathon Davis • Lexington, KY

Johnathon Davis • Lexington, KY

Read full article

K.C. Crahan • Shelbyville, KY

K.C. Crahan • Shelbyville, KY

Read full article

Cheri Johnson • Gig Harbor, WA

Cheri Johnson • Gig Harbor, WA

Read full article

“I explain to clients that we need investment tools that are built for today’s market and tomorrow’s market. I show them a simple chart of the S&P 500 over the last 20 years, and it instantly becomes apparent to them how the market has gone through some dramatic cycles up and down. Why would one not want to try to take advantage of following major trends, when there have been at least five major established trends since the late 1990s? Of course, it is easy to see them with perfect 20/20 hindsight—not so easy when you are in the middle of them and a trend is in the process of shifting. This is why we employ the service of professional third-party active managers for client portfolios. They have very sophisticated models, employing a quantitative and analytical approach that attempts to stay in sync with the trends.”

Phylyp Wagner & Matt Quattlebaum • McLean, VA

Phylyp Wagner & Matt Quattlebaum • McLean, VA

Read full article

“One of the key components to building a successful financial-planning practice is to be the quarterback of the process, showing leadership and clear direction. We try to explain complicated financial-planning processes in simple language and motivate people to take action. Clients need to have a clear and realistic set of expectations, and part of that is demystifying Wall Street gibberish. We tell clients that there are only three technical terms they need to know, and then explain as simply as possible the concepts of alpha, beta, and R-squared. When we are done, they usually have a good idea of what we are trying to achieve: managing risk within their portfolios while trying to achieve competitive returns.”

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

This article first published in Proactive Advisor Magazine on August 3, 2017, Volume 15, Issue 4.