The perils of predictions

The perils of predictions

Market predictions generally tend to be worth about what you pay for them.The onslaught of 24/7 financial news, opinion, and market “noise” can often be detrimental to the health of investors’ portfolios. Can active investment management help?

In early July of 2014, Citigroup issued a thoughtful and nuanced market perspective to its clients. The chief U.S. investment strategist at Citi, Tobias Levkovich, is a well-respected and oft-quoted figure on Wall Street, and market participants take notice of his outlook. In this particular case, the note was obtained by the press and characterized in two very different headlines and leads by two of the most well-read financial news sources.

Bloomberg:

Concern Over ‘Severe’ Pullback Sends U.S. Stocks Lower. ‘Many investors wonder if the ride is over,’ Tobias Levkovich, chief U.S. equity strategist at Citigroup Inc., said in a report today.

Forbes:

Raging Bull Market Still Has Stamina, Citi Says. The firm’s chief equity strategist, who predicted in 2011 that the then-developing bull market would eclipse 2007 peaks, writes in a note Tuesday that the rally still has room to run.

Neither of these news sources necessarily “got the story wrong,” as Mr. Levkovich was reviewing both sides of market sentiment in his note and presenting a carefully hedged perspective. This case simply illustrates in one succinct example how a confusing and often contradictory flow of news and opinion is constantly washing across the investment landscape.

Warren Buffett is fond of saying, “Forming macro opinions or listening to the macro or market predictions of others is a waste of time. Indeed, it is dangerous because it may blur your vision of the facts that are truly important.”

Why might this matter to advisors and their clients? Simply because many of the principles of behavioral psychology—and their relationship to investing—have taken on increased importance during the dramatic market cycles of the past 15 years. Investors have seen two huge market troughs, each followed by raging and record-setting bull markets.

The time-worn fundamental beliefs in passive, buy-and-hold investing have been challenged, with often disastrous—or at least less-than-ideal—results. Even though markets in each bear market case cycled back up to new market highs, many investors have not reaped the full benefits of the market recovery in their portfolios.

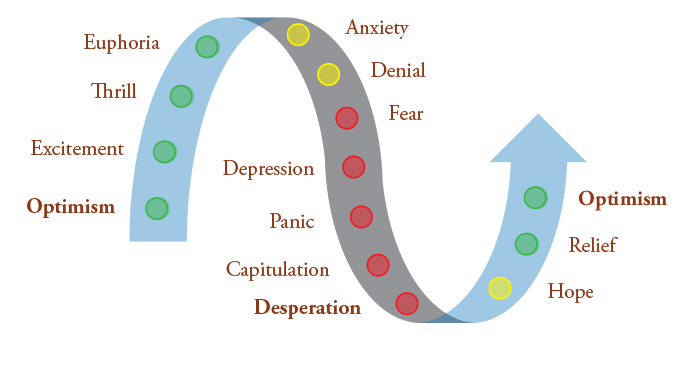

The Cycle of Investor Emotions

And that is understandable, as panic-stricken investors in 2008-2009 often sold out on the way down and have since been hesitant to wholeheartedly commit to equities—with some even “swearing off” the stock market forever. A recent MarketWatch column declared, “Buy-and-hold investing is impossible,” citing the extreme bias of basic human nature toward wanting to avoid pain—making the very long-term mean-reversion tenets of passive investing unrealistic for most.

The most recent run-up in the markets over the past five years has been called the “most unloved bull market of all time” for exactly those reasons. Too many investment professionals, advisors, and individual investors have either been “on the sidelines,” underallocated to equities, or spooked by market fears into a whipsawed in-and-out lack of commitment.

A confusing and often contradictory flow of news and opinion is constantly washing across the investment landscape.

The blaring headlines of the European debt crisis that reached crescendo levels throughout 2010-2012, combined with the threat of a U.S. government budget/debt ceiling crisis in 2012 and 2013, hardly have provided a backdrop fueling investor confidence through much of the current bull market. For example, the 2013 consensus forecast from the top 14 major Wall Street banks and investment houses for the S&P 500 was in an unusually tight and conservative range. This averaged out to a predictive call for 1,540 on the S&P by year-end 2013, for about an 8% annual gain. This fell far short of the index’s actual 30% gain, with the market finishing at 1,848.

Importantly, these universally understated forecasts were accompanied by the expected caveats, overviews of market risk factors, and generally less-than-upbeat outlooks—all of which received amplified treatment by the media. It was little wonder that investors entered 2013 under a strong cloud of pessimism and doubt—likely reflected in the portfolio actions of self-directed investors and, for those with financial advisors, in their advisor review sessions.

In another example, Bloomberg notes that in the beginning of this year, all 72 economists in their ongoing survey predicted higher interest rates and falling bond prices for 2014. At the time of their follow-up reporting in mid-July, Treasurys had rallied about 10% in 2014 as yields fell. Little wonder this particular article was titled, “Pro Forecasters Stink, but Individuals Are Worse.”

All of these factors play into those destructive behavioral traits that seem to doom many investors to chronic underperformance: chasing returns, entering at market tops, selling at market bottoms, acting on emotion, or overreacting to the latest headline. Behavioral psychology has many interrelated terms for these and other such actions, including the following:

Confirmation bias: Reaching conclusions first and finding supportive evidence for that point of view.

Loss aversion: While greed and fear of loss usually compete, studies indicate loss aversion can be over two times stronger and can lead to those panic decisions or, conversely, a fear of making any decision.

Herding: Following the crowd, or what appears in the media to be the crowd’s public opinion.

Recency bias: Extrapolating recent events or market performance into the future.

Disposition effect: The tendency to sell winners too early and hold on to losers too long.

Noise-trading effect: Overreaction to both good and bad news in the market.

Financial advisors have a difficult task in many ways, but perhaps nothing is more difficult than dealing with the psychological hurdles their clients often face. What if advisors had at their disposal a holistic and systematic investment approach that removed emotion from the decision-making process, paid little attention to market noise, and employed strong measures of risk management?

Perhaps nothing is more difficult than dealing with the psychological hurdles that clients often face.

Active investment management is making huge strides among the advisor community, not only for its less volatile and risk-managed performance over full market cycles, but for its very real benefits of helping to manage client satisfaction and expectations. This disciplined investment approach can provide competitive returns, while avoiding biased reaction to short-term market fluctuations.

Active management’s objective of removing the roller coaster of both portfolio swings and investor emotional highs and lows presents a compelling story to clients—a far more compelling and beneficial story than the ones they are seeing, reading, and hearing every day from the media.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.