85,000 on the Dow: Pipe dream or realistic possibility?

85,000 on the Dow: Pipe dream or realistic possibility?

“While managing market risk remains paramount, the biggest risk might be in missing the next great secular bull market.”—Marshall Schield and Trent Schield, “Dow 85,000! Aim Higher!”

No, “Dow” and “85,000” in the same sentence is not a typo. And this has nothing to do with Apple joining the Dow Jones Industrial Average (DJIA), propelling it to astronomical levels.

What this is all about is a recent book by authors Marshall and Trent Schield—“Dow 85,000! Aim Higher!”—that lays out the case for the next great secular bull market for stocks. And the rationale for a target as lofty as 85,000 for the Dow over the next 15 or so years.

Back in early 2000, record market highs were being made daily, money was easy, and brokerage ads were touting “make your fortune by day trading.” If someone had told you then that the party was over, and that for the next decade stocks would lose money, would you have listened? Probably not.

Similarly, what if sophisticated trading signals showed a way to avoid the majority of the declines in the 2007-2009 bear market, and those same signals turned bullish well before the market’s recovery became broadly apparent? Would you have followed that advice, difficult as it may have been to accept?

Of course, conviction around those indicators would have led to an extremely valuable course of action in all three cases. The father-and-son Schield team has rarely hesitated in letting their models guide them to bold (and profitable) calls on both the bearish and bullish sides of the market. So when they make a case for the Dow reaching 85,000 by 2030, and support it with a raft of logic and data, it is well worth listening to.

According to the authors, the market moves in long-term cycles, with lengthy underperformance followed often by even longer periods of outperformance. The decade of poor performance, they say, is behind us, and a new mega secular bull market has begun—one lasting decades and potentially producing 700%-plus gains. It is, they believe, a rare opportunity—and an opportunity that can be even further leveraged by the use of active portfolio management strategies and tools, adding to gains in cyclical bullish trends and minimizing losses during the inevitable cyclical bearish periods.

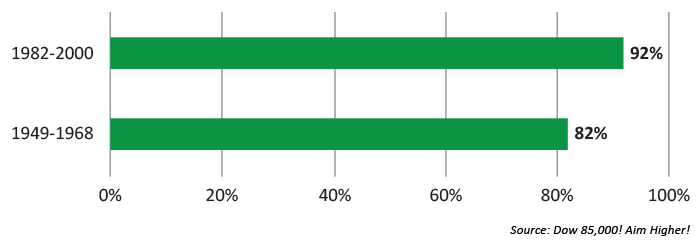

History shows just how persistent gains can be in periods of secular bull markets, even with corrections along the way.

Time spent in rising markets during mega bull markets

The new boom, the new secular bull market.

So what lies ahead? What will spark the next big boom? Despite market gains since early 2009, pessimism still runs high with investors and most are hard-pressed to envision a long secular bull market.

The authors believe all of this pessimism is unfounded: “Conventional wisdom that we are in an extended period of subpar growth is wrong. That many experts believe investors should be prepared for a ‘new normal’ of below average returns for the next decade is simply wrong.”

The Schields’ fundamental thesis is that big powerful bull markets (18-20 years or longer) are a “breed by themselves; not just rebounds in a secular bear.” These new bulls, they say, are the result of the world changing in surprising ways that fundamentally alter the future. They come as a pleasant surprise to investors, gradually changing their pessimism to optimism, and driving prices to new highs that are hard to imagine at the onset.

They cite historical technological breakthroughs and trends that helped trigger past secular mega bull markets, leading to stock market gains of 700% or better over decades. Their examples include Henry Ford’s initial leadership in manufacturing mass production, home construction innovations fueling the post-WWII housing boom and a new consumer-driven economy, and the great technology innovations of the 1980s and 1990s.

But what will fuel the next secular bull?

On Wall Street there is an old saying that states, “While the market doesn’t always repeat itself exactly, it often rhymes.” Applying that knowledge, it is easy to see that each of the new mega boom markets of the last century had some strong similarities.

First, the obvious. Each mega boom followed a terrible, long, grueling secular bear market that included several recessions, subpar economic growth, often war, and terrible stock market returns.

The new boom—What trends may trigger it?

Second, every new boom had a trigger. A new innovation or breakthrough is needed. The book offers several compelling arguments:

- Continued technology breakthroughs in domestic energy production, leading to increased American energy independence and “plentiful, dependable energy for decades to come.”

- Cheaper (and cleaner) energy in turn transforming a “Rust Belt” mindset into a manufacturing rebirth in the U.S., which will also trigger a reversal in the trend of outsourcing production and jobs abroad.

- The demographic trends of millennials providing a new investment tailwind, as peak earners 35-49 years old replace aging boomers.

- A secular bond bear market that will benefit stocks.

- An improving deficit situation that becomes a smaller percentage of U.S. GDP, coinciding with a lower ratio of imports to exports; the right slope of these “twin deficits” has forecast prior secular bull markets.

Why Dow 85,000?

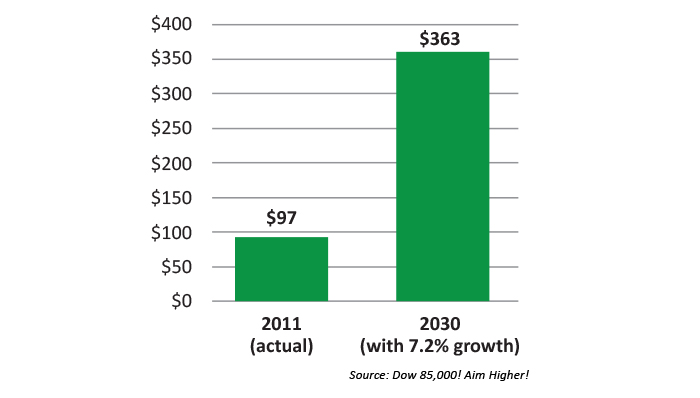

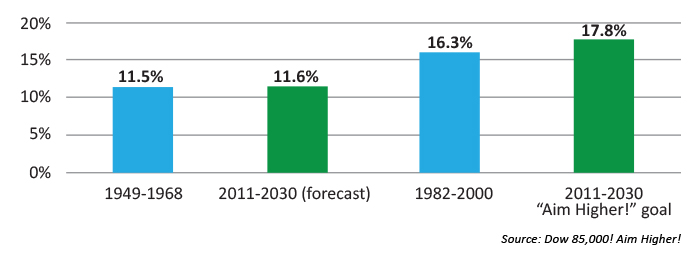

Here the Schields posit that growing U.S. manufacturing and GDP will lead to the levels of historical earnings growth and P/E expansion seen in prior secular bull markets. Using a conservative figure of 7.2% average annual earnings growth over the 2011-2030 period (compared to the 8.1% earnings growth rate of 1982-2000), and a P/E expansion less aggressive than that earlier period, they arrive at a rather remarkable, but logical, target for overall total U.S. earnings by 2030.

S&P 500 earnings forecast

Financial commentator Larry Kudlow is fond of saying, “Earnings growth is the nurturing milk that feeds the stock market.” Applying P/E assumptions to this 2030 earnings level and using some simple calculations, the Schields arrive at targets of 8,800 on the S&P 500 and 85,000 on the Dow for 2030.

But here is where it gets truly interesting.

Aim higher!

Marshall and Trent Schield have been studying and developing active portfolio strategies for decades. One of their core beliefs is that active investment management can lead to better performance over the long term than a passive investing approach.

While there are many components to their active strategies, it comes down to two basic principles: (1) taking action with conviction when their indicators signify a new trend is developing, whether that be bullish or bearish, and (2) employing systematic methods in bullish market trends to identify “market leaders.” They also apply a judicious use of leveraged tactics when conditions warrant, increasing returns during favorable environments.

Using their proprietary methodologies, the Schields focus on sectors with the highest probabilities of market outperformance. They cite an eye-opening statistic from actual results for 2013: leading market sectors were up on average 75%, while lagging sectors had average gains of just 20% (as the S&P 500 was up 32%). They argue, “Doesn’t it make sense to overweight the winning sectors while avoiding the laggards as much as possible?”

They combine these analytics with several other proprietary tools used by STIR Research LLC. One of these, STIR’s Market Environment Indicator (MEI), measures the trend and momentum of over 100 sector or industry groups, providing both a filter for sector selection, as well as an important gauge of the market’s overall health.

They write of MEI:

By combining numerous indicators measuring the trend and momentum of all the underlying parts of the market, we believe MEI gives a more timely and accurate view of the market’s direction and health than looking at one or two indicators. No indicator is perfect—it is impossible to sell consistently at the exact top or to buy at the exact bottom. A successful risk management indicator, however, is: (1) right more often than wrong, and (2) leads to participating in large gains and avoiding large losses.

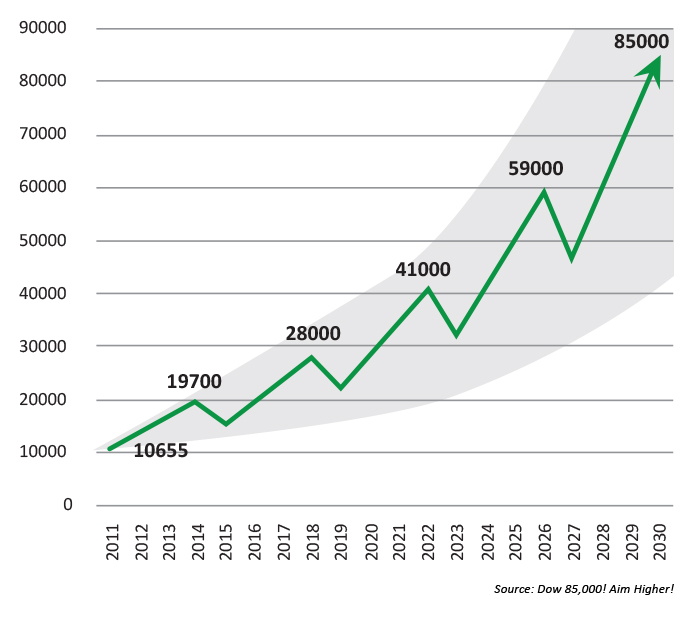

The bottom line

Marshall and Trent Schield believe, with supporting evidence, that markets have the potential to deliver mega secular bull market gains over the next 15 years. It might not be a steady path, as the chart shows, and it will still require serious risk management. But the bigger risk is perhaps missing out on the huge gains that may materialize.

Possible bull/bear moves within the DJIA 2011-2030

Within this secular bull market environment, they also believe that their specific proprietary strategies, grounded in active investment management, can deliver even greater gains than the overall market averages.

Secular bull annualized returns

Jerry Wagner, president of Flexible Plan Investments Ltd. and author of the book’s

foreword, provides a closing thought:

This book is unique. It presents a strong case for its end goal—Dow 85,000—just as other books have argued eloquently for their predictions. The difference is that Trent and Marshall present us with a quantitative methodology that not only seeks to improve on their prediction (with superior investment results), but also gives us a set of defensive tools to defend against cyclical bear markets, as well as the possibility their prediction does not come to pass.

Editor’s note: Readers can learn more about “Dow 85,000! Aim Higher!” at http://www.dow85000aimhigher.com/

Marshall Schield is the chief strategist for STIR Research LLC, a publisher of active allocation indexes and asset class/sector research for financial advisors and institutional investors. After graduating from college in three years, he became the youngest stockbroker in the nation in 1968 at age 21. As an active strategist for over four decades, Mr. Schield has received national recognition from several leading industry publications and services that track strategy performance. He is proud of the fact that he avoided much of the carnage of the early 2000s and 2008 while “participating in the majority of every major bull market since 1970.”

Trent Schield, Marshall’s son, is a product specialist with Flexible Plan Investments, Ltd., and was first introduced to investment management at his father’s firm. He has over 20 years of experience and has helped hundreds of advisors understand the concepts and principles of active strategies. His first love is active sector-allocation strategies, and he says, “Investors need to know they can do better, much better, than simply buy and hold.” Mr. Schield has the experience of working one-on-one with advisors and their clients and addressing groups well into the thousands at national conventions.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.