There is only one rule of thumb when piloting an aircraft in difficult conditions: trust your instruments. It doesn’t matter how wrong it feels or looks outside, you have to trust them or you compromise your process and potentially compound the problems. Although seemingly at high risk, our fundamental and tactical instruments are suggesting fear may well be worse than reality.

Since the Great Recession, we have gone through a number of recession scares but have averted one due to accommodative Fed policy, a positive yield curve, and moderate economic growth despite regional global turmoil and pronounced weakness in the commodity-related areas.

HISTORICAL SPX RETURNS WHEN OIL AND DJIT (TRANSPORTS)

EACH MAKE NEW LOW WITHIN A MONTH

Similar to the “echo crash” week in November 2011, when the SPX dropped roughly 8% in eight days, the current market has seen a sharp drop following a strong recovery from the August 2015 crash. Both the current and 2011 “echo crashes” were the result of a surprise announcement that threw the global currency, fixed-income, and equity markets into chaos.

If you remember, the cause for that November 2011 swoon was a surprise Greek referendum that caused shockwaves through the European equity and fixed-income markets. The weakness following the referendum announcement was enough to call into question the feasibility of saving Italy and Spain, or even the euro itself. Obviously, Greece isn’t as big as China, but surely the eurozone is close.

A unique study reinforces our view of bottoming process and no recession

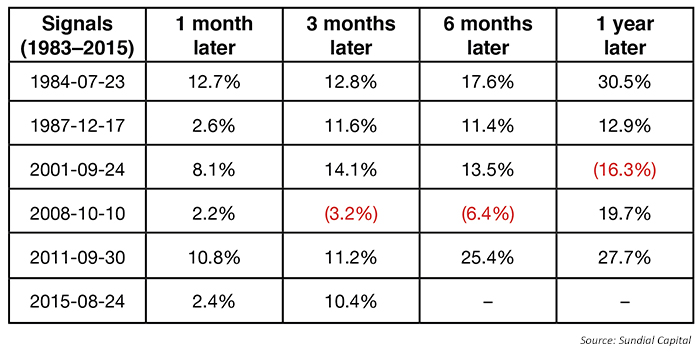

There is growing fear that a recession must be close given the pronounced weakness in crude oil, and the segment of the market that stands to benefit the most from it—the Dow Jones Transportation Index (DJIT). According to our partner at Sundial Capital, when these two indexes have made a new 52-week low within a month of each other, it has been a better buy than sell signal. This has only happened six times since 1983, when crude futures began to trade.

Since 1983, all six instances showed a positive SPX return over the next month, with a median gain of 5.4% (see table). Clearly, those positive one-month returns have not been realized since the latest instance on December 18, 2015. However, one must take note of the generally positive (and significant) three-month, six-month, and one-year returns following such occurrences. It is interesting to note that only the 2008 period was in the context of a recession, and even then it was in the tail stages and not a leading indicator of economic weakness ahead.

Could a friendlier-sounding Fed be on the way?

After ending QE2 in June 2011, the Fed embarked on “Operation Twist” in September 2011, which went a long way in taking a less friendly Fed out of the equation. Importantly, the eight-day swoon happened in November, so it took some time, increased global market turmoil, and weak data to believe the Fed was going to stay with an easier stance. Given the recent weak domestic and global economic data (except payrolls), and global market turmoil, it wouldn’t be out of context for the Fed to take a more market-friendly tone in discussing the pace of tightening at the January FOMC meeting. Given past precedent, we find it highly unlikely it will fiddle while the world burns, similar to our view in 2011.

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com