5 client questions (and answers) about investment performance

5 client questions (and answers) about investment performance

When we have a year like 2018, managing risk becomes a bigger priority than “beating the market.” Do your clients understand how they should be managing their investment expectations—in good market times and bad?

Last year was challenging—especially after the run the market has had in one of the longest bull markets in history.

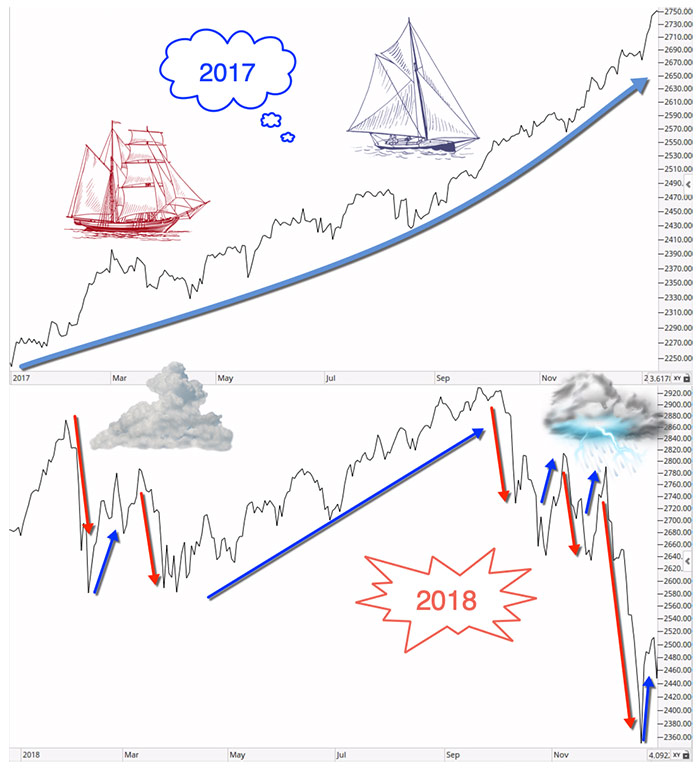

The previous year, 2017, was very different. In fact, 2017’s market action represented the lowest volatility recorded in the entire history of the S&P 500. The broad U.S. equity never experienced even a single significant pullback, let alone a “normal” correction. But when market volatility stays so low for so long, the metaphorical rubber band gets stretched and stretched—until we find ourselves in a market like we saw in 2018—one that included basically three corrections in one year.

FIGURE 1: S&P 500 VOLATILITY FOR 2017 AND 2018

Click Image to Enlarge

Source: Libertas Wealth Management, market data.

Market downturns of 15%–20%—as we saw in December 2018—have been uncommon over the past 10 years. They tend to cause clients, especially newer and prospective clients, to ask more questions and express more concerns than usual—even though we spend a great deal of time on client education. We help them think through and define their overall financial-planning and investment objectives, providing a framework that will enable them to manage their investment expectations and evaluate their investment performance.

But no matter how the market is doing in any given year, our firm regularly fields many timeless questions related to how individuals and couples should think about their investment returns over the long term.

Here are five of the most common questions we heard this year related to the concepts of market benchmarks, “beating the market,” and performance expectations—and short versions of the typical answers we provide.

This is a three-part answer.

First, the vast majority of those who own an investment portfolio have fees associated with their accounts. Those fees have to do with investment management, retirement planning, trading or fund costs, or administrative fees in a 401(k). Whatever your account value is for any given year, it is on a net-value basis after the fees and costs associated with your portfolio. That doesn’t mean you cannot “outperform” the stock market, just that trying to achieve the results of a benchmark index such as the S&P 500 becomes more difficult when fees are considered, as they should be.

Second, it’s absolutely crucial to understand that there are more investments out there than just stocks, and most people owned other types of investments in 2018.

For example, if you had any amount of your portfolio invested in bonds, there’s a good chance your investment returns were not helped. In 2018, 20-year Treasury bonds (as represented by the iShares 20+ Year Treasury Bond ETF—TLT) were down 4.2%. (This is why we moved our model portfolios away from bonds over the summer and put the proceeds in a high-interest-bearing money market instead.)

To make matters worse, commodities (as represented by the Invesco Commodity Tracking Index—DBC) were down 12.8% in 2018, international large-cap stocks (as represented by the iShares MSCI EAFE ETF—EFA) were down 16.4%, and international emerging markets (as represented by the iShares MSCI Emerging Markets ETF—EEM) were down 17.1%.

If you passively owned a “buy and hold,” traditionally diversified portfolio of U.S. stocks, international stocks, bonds, and maybe some commodities, chances are your retirement portfolio was down this year. And perhaps a little more than the S&P 500’s loss of 6.2%.

However, while no loss is pleasant, one key question to ask is, “Within a difficult (or any) market environment, did my portfolio employ some exposure to actively managed strategies that have the opportunity to adjust to a changing market environment (similar to the bond adjustment mentioned previously)?”

Third, did your overall portfolio have a strong focus on risk management? Had the market truly been on its way to a crash, would real-time adjustments be made to your portfolio that could mitigate the worst impact of a steep market drawdown?

One of our most important client principles relates to our overall investment philosophy: “Defense first.” When it comes to managing money, we focus first on defending portfolios from losses, only then seeking competitive returns. We do not believe that strong risk management and portfolio growth are incompatible.

- Focus on the asset classes that are performing the best among U.S. stocks, international stocks, bonds, commodities, currencies, or cash.

- Drill down into the best asset classes and, within these asset classes, pick the best sectors: Technology, Health Care, Pharmaceuticals, Energy, Utilities, etc.

- Consider the investment objectives and risk profile: Our selection parameters for a very aggressive portfolio would be different from those of a very conservative portfolio, balancing risk and reward appropriately for each client.

- For a managed portfolio approach, technical analysis and quantitative decision-making are at the foundation of our philosophy of risk management. Our portfolio strategies are not meant to identify absolute bottoms of the market or absolute tops. We use a variety of strategies and principles of diversification, and our strategies are actively managed. Many are in the trend-following—or momentum—category. Imagine the concept when thinking about the market’s continuous cycles of seeking “maximum up-capture, minimum down-capture.”

I welcome clients to come for an office visit during market corrections. Don’t get me wrong—the reason they’re in our office is that they’re nervous and scared. But it’s better for people to sit down and discuss what’s concerning them than it is to continue stressing about it.

I welcome clients to come for an office visit during market corrections. Don’t get me wrong—the reason they’re in our office is that they’re nervous and scared. But it’s better for people to sit down and discuss what’s concerning them than it is to continue stressing about it.

Many areas of my career fulfill me, but one of the most gratifying moments is when someone walks into my office feeling like the sky is falling and walks out feeling so comfortable and confident that they ask if they should be in a more aggressive portfolio! That means they really get the concept of active management and having risk-mitigation tools working behind the scenes for their portfolio.

Few people call when the market is going up. But when we have a year like 2018, clients, especially newer ones, are going to be nervous, and they should reach out to us if they are not perfectly clear on their investment expectations and how their portfolio is designed to perform in various market conditions. We cover these areas comprehensively in review sessions with clients, but a little reinforcement goes a long way.

A couple came into our office terrified about the state of the market after October 2018. They had no idea that we had already started selling investments, going to cash, and positioning portfolios to take advantage of the market no matter what scenario played out (whether it came back and shot higher or headed in the other direction and bottomed out). Your portfolio should be only as aggressive as your financial plan dictates and no more. From there, it’s all about managing risk.

The American Enterprise Institute did a study last year and found that, over the one-year period studied, 63% of large-cap portfolio managers underperformed their index. When you observe the studies done over longer periods, the numbers get worse. Over five years, 76% of large-cap portfolio managers underperformed, and over 15 years, that number rises to 92%.

While this is a huge generalization, and doesn’t include all of the information you’d really need, the concept of outperformance is basically an enormous misunderstanding. Over what time frame do you want to beat the market? Five years? One year? Six months? What’s reasonable? Or is it reasonable to want to beat the market at all?

The data above tells us that outperformance is possible, but there are two things I have observed:

- Those who are able to accomplish outperformance in the short run typically don’t repeat the next year.

- Over time, it becomes more and more difficult to outperform.

I share an opinion with many others in our industry: If you’re going to benchmark your financial advisory firm’s performance or your clients’ investment performance, it should be done over a full market cycle. This is defined as either trough-to-trough or peak-to-peak for the market. Examples would be 2000–2007 (peak-to-peak) or 2002–2009 (trough-to-trough). This cycle is typically equivalent to around seven years, but this time around it’s lasted a lot longer as we’re currently in the 10th year of this second-longest bull market in history.

By this point, 95% of those reading this article or hearing our answers in person will “get it”—meaning, you wouldn’t even be asking this question at this juncture. The other 5%, for whatever emotional or behavioral reason, are likely married to the idea that if they’re paying a firm, they need for that firm to beat the market, regardless of the cards being stacked against them.

So, what should you compare your portfolio to?

First and foremost, without exception, you should compare the performance and future expectations of your portfolio to the average annualized performance of your investments as compared to the minimum rate of return (ROR) required to hit every item on your bucket list. Said more simply, you should make enough money over time to meet or beat the minimum required ROR based on the output of your written, comprehensive retirement plan.

If you don’t have a plan, how do you know if you’ll run out of money in retirement or how much risk you should take in stocks, bonds, etc.? Once your plan is complete, you need to follow it! A plan that’s not followed is worthless.

The investment portfolio needs to match the goals laid out in the plan—and the plan needs to be monitored and updated at a minimum of once per year, or whenever there is a material change in your family’s lives (whichever is first).

Lastly, at least at our office, once we have the plan in place, our philosophy is to participate in as much of the upside that the market will give us, all while avoiding the worst of market crashes (which average losses of 42% over roughly 18 months).

To be specific, that does not mean that if the market enters a 10% to 15% correction that we’re going to avoid the correction. That will almost never happen. Corrections happen too quickly, and we’re long-term investors at our office, not day traders.

But take one thing away from this discussion: The most important deciding factor when it comes to the success or failure of your financial plan is the plan itself, not a market benchmark. Your plan ensures that you have the correct risk profile to match your investment personality, that you appropriately employ risk management in all areas of your financial life, and that you optimize the probabilities for meeting your financial goals.

Adam Koos, CFP, CMT, CFTe, CEPA, is the president and portfolio manager at Libertas Wealth Management Group Inc., a NAPFA-affiliated, fiduciary registered investment advisor firm in Columbus, Ohio. Since founding the firm in 2001, he has earned local and national recognition, including being named one of the Top 100 Most Influential Financial Advisors in the U.S. by Investopedia and receiving the Torch Award for Ethics and Trust from the Better Business Bureau. Mr. Koos holds B.S. degrees in finance and behavioral psychology from The Ohio State University. www.libertaswealth.com

Adam Koos, CFP, CMT, CFTe, CEPA, is the president and portfolio manager at Libertas Wealth Management Group Inc., a NAPFA-affiliated, fiduciary registered investment advisor firm in Columbus, Ohio. Since founding the firm in 2001, he has earned local and national recognition, including being named one of the Top 100 Most Influential Financial Advisors in the U.S. by Investopedia and receiving the Torch Award for Ethics and Trust from the Better Business Bureau. Mr. Koos holds B.S. degrees in finance and behavioral psychology from The Ohio State University. www.libertaswealth.com