Editor’s note: Tony Dwyer, U.S. portfolio strategist for Canaccord Genuity, and his colleagues author a widely respected monthly overview of market conditions, technical factors, and future market outlook called the “Strategy Picture Book.” The following provides an excerpt from their Dec. 6, 2017, report on the macro market outlook.

There are two major influences that are throwing increased uncertainty into the market: (1) the proposed tax legislation and (2) the flattening of the yield curve to under 60 basis points. Ultimately, our core thesis remains firmly in place, our S&P 500 (SPX) earnings per share (EPS) and target are likely to move higher following clarity on proposed tax legislation, and any correction should prove very temporary until well after an inversion of the yield curve.

20% corporate tax rate would add 10.5% to 2018 operating EPS

According to a study conducted on our behalf by Thomson Reuters I/B/E/S, a 20% corporate tax rate would add 10.5% to the current 2018 SPX operating EPS consensus estimate. At this point, it is unclear if President Trump would accept anything higher than 20%, but in a similar study we found a 25% corporate tax rate would add 3.8% to the current consensus. Using the same range of percentage increases, our 2018 SPX operating EPS estimate of $140 would rise to a range of $145–$155 per share, depending on the tax rate that gets completed.

We see no reason to change our multiple assumption of 20x, so if the tax package is passed, our SPX target would move to a range of 2,900–3,100, again depending on final legislation. The biggest beneficiaries would be the Financial and Energy sectors, which would see an increase to the current estimates of 18.5% and 21.3%, respectively, per Thomson Reuters I/B/E/S.

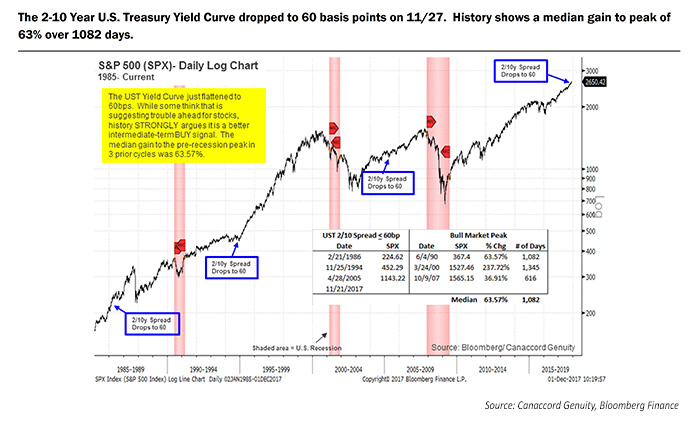

Initial flattening of the yield curve to the current level has historically been an intermediate-term buy signal

The U.S. Treasury 2-10-year yield curve has flattened to under 60 basis points. Although many believe a flattening of the curve to the current degree is a sign of market and economic trouble ahead, history tells a different story. Over the past three economic and market cycles, when the curve dropped to 60 basis points, the median gain to “the” market peak was 63.57% and a recession was at least two years away. Over the past two cycles, the Financial, Info Tech, and Industrial sectors outperformed following the initial drop to 60 basis points. Although there will be corrections along the way, prior instances strongly suggest they are temporary and should be bought.

FIGURE 1: FLATTENING 2-10-YEAR CURVE IS A BUY SIGNAL

Summary

Despite the possibility of a near-term correction, our core thesis keeps us focused on our 2018 SPX target of 2,800, which we expect might be front-end loaded and likely to rise once we have further clarity on pending tax legislation. In our view, the market has not adjusted expectations up enough to reflect the current tailwinds for growth. These include (1) a global synchronized recovery, (2) accelerating domestic activity, (3) capital spending plans improving, (4) real household median incomes jumping with strong employment, (5) a demographic-driven push higher in homeownership, and (6) the strong possibility of a cut in corporate tax rates in 2018.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com