Wealth transfer equals opportunity for advisors

Wealth transfer equals opportunity for advisors

Advisors who can differentiate and add value via their financial-planning and practice management approach should reap the benefits of the upcoming “greatest transfer of wealth.”

Advisors who are not actively courting younger generations may be in for a rude awakening, as the country continues to witness the greatest wealth transfer in history.

A 2021 study by Cerulli Associates estimates that over $84 trillion is expected to change hands in the next 25 years, according to Financial Advisor. The publication noted earlier this year,

“Cerulli says the wealth transferred through 2045 will total $84.4 trillion, adding that $72.6 trillion will go to people’s heirs, while $11.9 trillion goes to charity. Baby boomer households will generate $53 trillion of the transferred wealth, or 63% of all transfers. ‘Silent Generation households and older stand to transfer $15.8 trillion, which will primarily take place over the next decade,’ Cerulli said.”

One of the lead authors of the Cerulli report, Chayce Horton, told Financial Advisor that “the $84 trillion figure through 2045 ‘was a surprise to the upside.’” Horton added that $30 trillion is going to go to Gen X households over the next 25 years, while $27 trillion will go to millennial households.

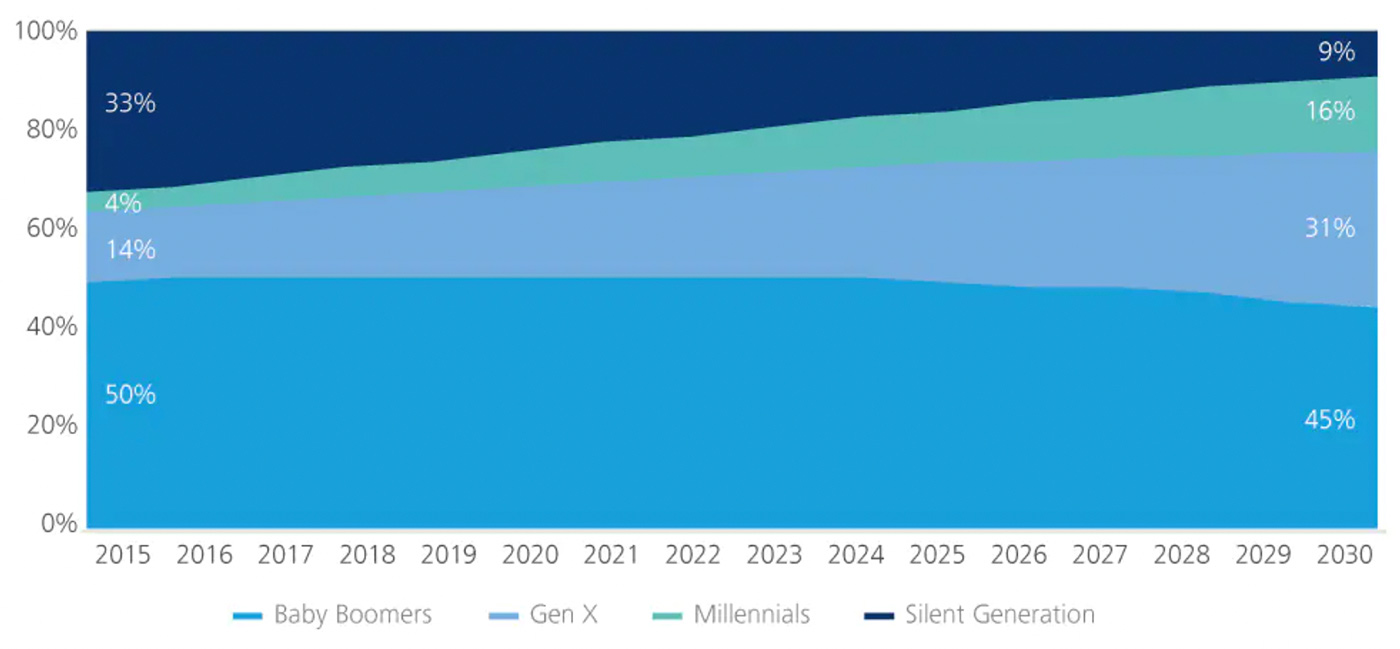

As can be seen in Figure 1, the estimated changes in ownership of wealth by generation will already show significant shifts by 2030.

FIGURE 1: PROJECTED GENERATIONAL SHARE OF NET HOUSEHOLD WEALTH (%)

Source: Deloitte Center for Financial Services

Most advisors are still giving the bulk of their attention to older clients who already have significant assets and not enough attention to younger generations. Savvy advisors are realizing that it may be equally advantageous to cement lifelong relationships now with the younger set before that wealth transfer begins to accelerate.

A white paper by SS&C Advent notes the disturbing fact that “studies show as many as 88% of heirs don’t consider their parents’ financial advisor after receiving an inheritance. … If advisors don’t have strong existing relationships with their clients’ heirs, the chances of retaining assets are low.”

The white paper also notes the lack of preparedness on the part of many financial advisors for adequately addressing the changing nature of how younger generations prefer to do business—through largely interactive technologies. Says the report, “These characteristics have significant implications for how a client’s heirs will collect information and make decisions around inherited wealth.”

Advisory firm solutions for capitalizing on the generational wealth transfer

Increasingly, many industry thought leaders are addressing the issue of how advisors can best position their firms for generational wealth transfer—and the differentiating characteristics of various types of potential future clients:

- Capital Group’s comprehensive 2022 benchmarking study compares the attributes of high-growth advisory firms to those exhibiting lower growth. The study notes, “Our study found that better indicators of above-average growth are practices that create multigenerational engagement and wealth-transfer plans. Not surprisingly, they have a higher proportion of multigenerational households and are twice as likely to achieve high growth. … Highest-growth advisors provide a broader range of services in value-added areas such as tax, estate, and education planning, and generational wealth transfer.”

-

Deloitte noted several years ago that advisory practices would be wise to offer differentiated tiers of service for different age and wealth segments, rather than one-size-fits-all offerings. The firm believes, for example, that the Silent Generation is often overlooked, yet needs careful and personalized one-on-one stewardship.

And the Silent Generation may bequeath their still significant wealth to multiple generations within the same family. Says Deloitte, “Building the right relationships with the heirs of Silent Generation clients could help wealth managers build more stickiness in their customer base. The heirs themselves, if currently not very profitable to serve, might become so once they come into their inheritance.”

In contrast, Deloitte’s prescription for millennials entering the workforce, less-affluent older millennials, and Gen Xers is for “low-cost services that provide wealth management tools and basic financial advice, … almost fully tech-driven to keep operations efficient.”

-

In a 2020 report, McKinsey explored a wholly different avenue regarding wealth transfer. While somewhat depressing, the firm noted the differences in life expectancies for boomer men and women, and concluded from the data that “an unprecedented amount of assets will shift into the hands of U.S. women over the next three to five years, representing a $30 trillion opportunity by the end of the decade.”

-

Truelytics, a division of Envestnet, presents very specific guidance for advisory firms seeking to attract new generations of clients. Its thoughtful piece says, “Just setting your mind out to attract younger clients isn’t going to be enough; it will require a deliberate marketing plan and approach. Think about going where the money will be, not where it is today.”

Truelytics offers the following practical action steps and insights:

- “Build relationships with ALL clients and their next of kin. …

- “The next generation thinks about wealth differently (they don’t see themselves as wealthy). Oftentimes they’re not sure if they’re qualified to work with a financial advisor; that advisors won’t want their business! …

- “Eliminate the use of jargon. … Proactively explain financial terms in layman’s terms to avoid alienating younger prospective clients.

- “Review the use of technology. … Those under the age of 40 are much more savvy, so your use of technology will need a review and potential update to meet their expectations. …

- “Bridge the existing generational gap. … Intergenerational conversations around inheritance tax and estate planning allow advisors to design financial plans that include everyone and help you build relationships with future clients. …

- “Be a financial coach, not an advisor. … Younger clients have different priorities than traditional wealth management clients. … Those concerns include buying a home, paying for a child’s tuition, taking care of an aging parent, and making sure their family is protected in the event of death or disability. …

- “Re-evaluate fee structures. … Consider monthly or annual flat fees—or even a ‘pay for advice’ or a subscription service for financial guidance. Review your fee structure and consider adding different levels of service at different price points.”

***

For this issue, we asked several successful advisors,

What is your approach to developing relationships with next-generation clients?

Larry Wall, CAP, CFP, managing director at Alabama-based WealthArc Advisors says his “Legacy Partnering Approach” not only includes clients’ children in the financial-planning process but also clients’ parents.

Larry Wall, CAP, CFP, managing director at Alabama-based WealthArc Advisors says his “Legacy Partnering Approach” not only includes clients’ children in the financial-planning process but also clients’ parents.

Wall remarks, “If this type of engagement is successful, it allows me to help different family members at various stages of their lives build the financial plans that are appropriate for their needs and objectives. It is also a sound practice management objective, allowing me to refresh my client base with a new generation of clients. That is very important given the changing demographics in our country.”

When bringing on new clients, Johnathon T. Davis, AIF, a financial advisor and managing principal at JT Davis Asset Management LLC in Lexington, Kentucky, also tries to find ways to interact with the rest of the family, “fostering relationships with them well before their parents or grandparents pass away.”

When bringing on new clients, Johnathon T. Davis, AIF, a financial advisor and managing principal at JT Davis Asset Management LLC in Lexington, Kentucky, also tries to find ways to interact with the rest of the family, “fostering relationships with them well before their parents or grandparents pass away.”

For example, Davis and his team are always open to the young adult child of a client “shadowing” for a few days at the firm to discover what the world of financial planning is all about. Davis and his team typically show the young adult the basics of what they do for clients and talk in general terms about how money is invested or deployed.

“I’m also a proponent of telling clients, if they haven’t done so already, to have ‘The Talk,’ and coordinate a frank discussion with their children when they are at an appropriate age about wealth preservation, stewardship, and giving back, particularly if they own a business,” he says.

When clients’ children are in their early teens, Davis may talk generally with them about saving, investing, and wealth preservation. But as they get older, he delves into more details, including talking about active investment management and risk management.

“Too often, Americans think about how much money they make in a particular year—but to best illustrate the concept of active management, I say it’s more about how much money they didn’t lose in a bad year,” he says.

Having young adults and even teenagers present at client meetings “always helps with breaking down any barriers,” says Divam N. Mehta, CFP, ChFC, AIF, CFEi, founder of Mehta Financial Group LLC in Richmond, Virginia.

Having young adults and even teenagers present at client meetings “always helps with breaking down any barriers,” says Divam N. Mehta, CFP, ChFC, AIF, CFEi, founder of Mehta Financial Group LLC in Richmond, Virginia.

For example, if the purpose of the client meeting is to discuss saving for a child’s college tuition, then Mehta finds it beneficial to have “the subject of the program present.”

“With this type of dynamic, the young adults can visualize what exactly is being discussed and how the family is planning for their education,” he says. “In addition, by having these type of introductory meetings, young adults are more apt to transition to becoming a client, as they have already had some exposure from you to personal finance.”

Investing on their behalf is always a great tool to get young adults engaged, Mehta says. While many of his clients remain the owner of accounts for education, they designate their children as the beneficial owner. “By having this vested interest, young adults are more apt to remain disciplined in managing future financial events in their lives,” he says. “Furthermore, the children will also look to the family’s financial advisor as the main point of contact for those future events.”

Kevin Brennan, principal advisor and founder of Michigan Financial Planning, takes an entirely different approach—having initially built his practice’s focus on “the next generation.”

Kevin Brennan, principal advisor and founder of Michigan Financial Planning, takes an entirely different approach—having initially built his practice’s focus on “the next generation.”

“When I first started out as a financial advisor, I saw that other advisors placed great emphasis on clients who were about to enter or already in retirement. Many advisors were using seminar marketing programs to develop prospects who fit this profile. That made sense from a business perspective, as retirement clients have a strong need for financial guidance in many areas.

“But I also saw an opportunity that I thought could work well for my own practice. I asked myself, ‘Who in my area is actively targeting younger clients?’ I thought it was an underserved area to explore, and it has since become the primary focus of our practice. Our ideal prospective clients are married couples with young children, approximately 30 to 45 years old, with a relatively high income. They may not necessarily have a large net worth, but they are decades from retirement and have many financial needs other than pure retirement-income planning. As I develop clients of this type, I feel confident they will be working with our firm for many years to come.

“We have found that sponsoring family-oriented events that are targeted at both children and their parents has been a very effective way to get our name out into the community and build our network of potential prospects. We explore opportunities of this nature in surrounding towns and get involved in many of these types of community events over the course of the year.”

***

Cerulli summarizes in its generational wealth report,

“As transfers lead to changes in family dynamics as well as engagement preferences, financial services providers across the wealth spectrum must adapt their business models. Winners of walletshare will need to be prepared for changes to their business model and open to evolving with the needs of a younger demographic.”

Some of the most effective advisory practice behaviors in this area, Cerulli says, are family meetings and regular communications crossing generations—“extending interfamily relationships to involve the entire range of stakeholders rather than just the current controllers of that wealth. …”

It makes sense for financial advisors to connect with their clients’ children, even when they are relatively young. Advisors can help parents educate children on the basics of saving and budgeting, adding more sophisticated topics—including the prudence of active portfolio management—as they get older.

Smart advisors also keep adult children in the loop on how their senior parents are managing their financial plan and their investments, which can generate additional goodwill for the advisory practice by demonstrating how the firm adds value for clients. Advisors should be well-rewarded for fostering long-term relationships with clients’ children and adapting their firm’s best practices. The next generation will then hopefully be more likely to consider becoming clients themselves when they eventually take their place as part of the great wealth transfer.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

New this week:

Katie Kuehner-Hebert is an award-winning journalist with more than three decades of experience writing about the financial-services industry. She has expertise in banking, insurance, financial planning, economic development, and employee benefits, and her work has appeared in many leading publications.

Katie Kuehner-Hebert is an award-winning journalist with more than three decades of experience writing about the financial-services industry. She has expertise in banking, insurance, financial planning, economic development, and employee benefits, and her work has appeared in many leading publications.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.