With the calendar turning to April this week, the Q1 2019 earnings season is not far behind.

Major companies from the S&P 500 will report earnings in mid-April and results will continue to flow for several weeks.

CNBC notes that the outlook is anything but encouraging, even after the S&P 500 Index finished the first quarter with a gain of 13.1%—the best performance for the quarter since 1998, according to Barron’s.

CNBC reported on Monday,

“Investors are bracing for a drastic earnings slowdown headed into the first-quarter reporting season — Wall Street analysts are projecting a 3.9 percent earnings decline for S&P 500 firms in the first quarter, the first year-over-year decline since the second quarter of 2016…

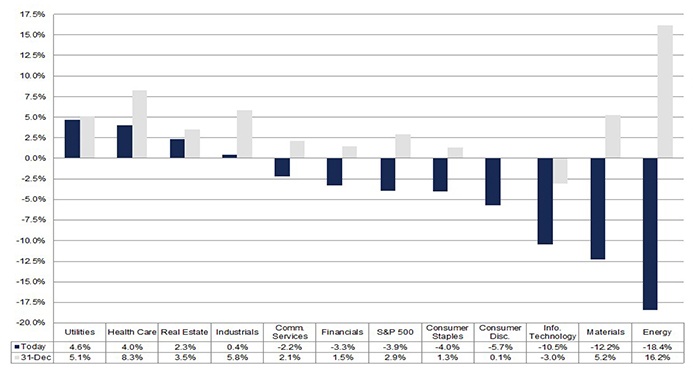

“‘All 11 sectors have experienced negative 2019 EPS revisions since the start of the year,’ Goldman chief U.S. equity strategist David Kostin said in a note on Saturday. ‘As margin pressures mount, investors should focus on companies that have demonstrated the ability to maintain margins through pricing power.’”

FactSet issued an updated look at Q1 earnings projections on March 29, with the following key metrics:

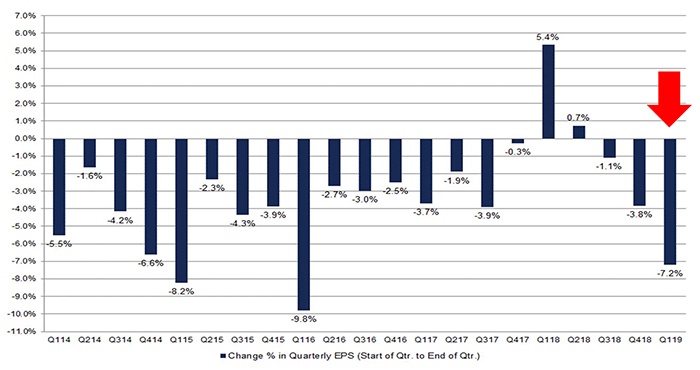

- “Earnings Growth: For Q1 2019, the estimated earnings decline for the S&P 500 is -3.9%. If -3.9% is the actual decline for the quarter, it will mark the first year-over-year decline in earnings for the index since Q2 2016.

- “Earnings Revisions: On December 31, the estimated earnings growth rate for Q1 2019 was 2.9%. All eleven sectors have lower growth rates today (compared to December 31) due to downward revisions to EPS estimates.

- “Earnings Guidance: For Q1 2019, 79 S&P 500 companies have issued negative EPS guidance and 28 S&P 500 companies have issued positive EPS guidance.

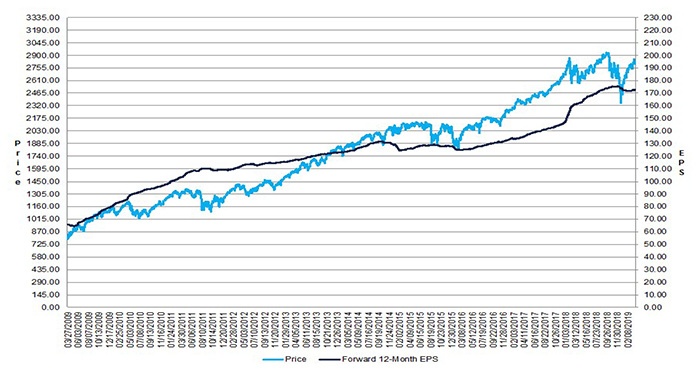

- “Valuation: The forward 12-month P/E ratio for the S&P 500 is 16.3. This P/E ratio is below the 5-year average (16.4) but above the 10-year average (14.7).

- “Earnings Scorecard: For Q1 2019 (with 20 companies in the S&P 500 reporting actual results for the quarter), 17 S&P 500 companies have reported a positive EPS surprise and 11 have reported a positive revenue surprise.”

Click Image to Enlarge

Source: FactSet

Click Image to Enlarge

Source: FactSet

Only four sectors are currently projected to have positive year-over-year earnings growth: Utilities, Health Care, Real Estate, and, just barely, Industrials. The sectors projected to show the weakest comparative growth rates are Information Technology, Materials, and Energy—all with double-digit declines.

Click Image to Enlarge

Source: FactSet