The millennial obsession

With the greatest wealth transfer of all time on the way, the profound interest in millennials’ financial attitudes is well-justified.

You cannot pick up a business publication, tune into a financial news program, or glance at any news website without confronting yet another story on millennials.

You cannot pick up a business publication, tune into a financial news program, or glance at any news website without confronting yet another story on millennials.

What are their career prospects? Do they have the work ethic of prior generations? How crushing is their student debt? Are they still living at home? And, of great interest to financial institutions of all kinds, what are their attitudes toward saving, financial planning, the housing market, and investing?

The interest in those born roughly between the years of 1980 and 2000 is not surprising—they represent the immediate future and workforce of the country and were born into a very different age of technology, global connectedness, and a changed economic landscape from that of their parents and grandparents.

For the financial-services industry, there is, of course, a very strong motivation to understand millennials—about $30 or $40 trillion reasons. This represents the estimated range from several sources of the largest generational wealth transfer in history over the next several decades, almost tripling the $12 trillion boomers will end up receiving from their parents.

Despite the significant impact of the Great Recession, boomers’ 401(k)s, pensions, real estate equity, savings, social security, and their own inheritances will fuel what some have dubbed “The Even Greater Wealth Transfer” (versus that of the boomers themselves).

“Over the next several decades, the largest generational wealth transfer in history—a massive $30 to $40 trillion—will be a defining issue for the wealth-management industry.”

In a recent study, consulting firm Accenture says, “At the peak between 2031 and 2045, 10% of total wealth in the United States will be changing hands every five years. The accelerating pace of this transfer, combined with the generational differences in the demands and expectations of wealth-management service providers, makes this massive transfer of wealth between generations a defining issue for the wealth-management industry.”

There is some debate over those $30 or $40 trillion numbers, as a recent article from TheStreet.com pointed out. Many boomers, whether forced by circumstance of retirement spending needs or by lifestyle choice, are “doing as much as possible to dip into that $30 trillion before completing the generational giveaway.” And certainly, there will be great discrepancies in where the money flows, as high-net-worth parents and their children will dominate the wealth transfer in disproportionate fashion.

No matter what the number, and where it exactly goes, it will certainly be significant. A good portion of the research on the topic unsurprisingly concerns the financial attitudes of millennials, with what seem to be several common themes:

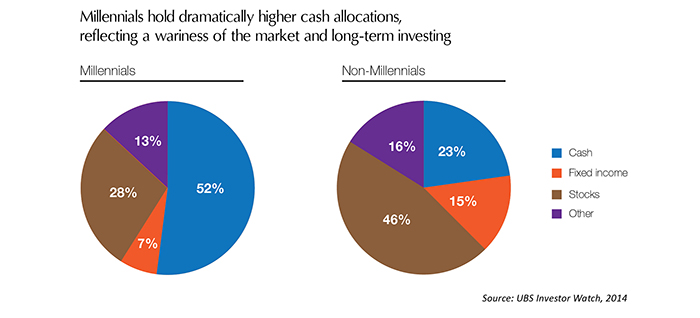

- Millennials are less inclined than their parents to be interested in investing and, having seen two stock market crashes in a decade, are very wary of the stock market. Some studies indicate they are the most risk-averse generation since their great grandparents, who witnessed the Great Depression.

- Millennials are less trusting overall of financial institutions (and financial advisors) than prior generations and, given the tough job market, wage compression, and student debt they have faced, want a great deal of value for their money in all areas of life.

- Millennials obviously have a greater affinity than their elders for technology and online solutions, and a desire for instant access to their financial information, including investment, banking, and 401(k) data.

We can leave the financial-services marketing and business plan implications of these findings to the dozens of articles and studies out there already addressing such issues. But there is one millennial implication that is especially pertinent to the world of active investment management.

If you believe these attitudinal findings, we have a generation that is (1) currently in need of making every dollar count and cannot afford a big financial “mistake”; (2) risk-averse and skeptical of traditional stock investing; (3) distrustful of the “old ways” of financial institutions; and (4) very attuned to finding technology-driven approaches and solutions in just about every area of their lives.

If you believe these attitudinal findings, we have a generation that is (1) currently in need of making every dollar count and cannot afford a big financial “mistake”; (2) risk-averse and skeptical of traditional stock investing; (3) distrustful of the “old ways” of financial institutions; and (4) very attuned to finding technology-driven approaches and solutions in just about every area of their lives.

This surely sounds like a generation that might be an excellent candidate for the disciplined, risk-managed, quantitative, and model-based approach of active investment management. The challenge for financial advisors (and the third-party money managers they employ) will be to engage this generation in such a way that they will have an opportunity to truly communicate the active management story.

Goldman Sachs just released a major study on millennials that covered both financial attitudes and more far-ranging behaviors and demographics. Some of their key findings:

- As a cohort of 92 million individuals, this generation overshadows the 60 to 65 million members of Generation X (early 1960s to early 1980s birth dates) and, a bit surprisingly, is almost 20% larger than the boomer generation (77 million).

- Goldman describes them as the first digital “natives,” social and connected, encumbered with debt and with little disposable income currently, and having markedly different priorities than other generations, such as the willingness to participate in the “sharing economy” (embodied in concepts such as Uber, Airbnb, or any number of so-called automated investment platforms or “robo-advisors”).

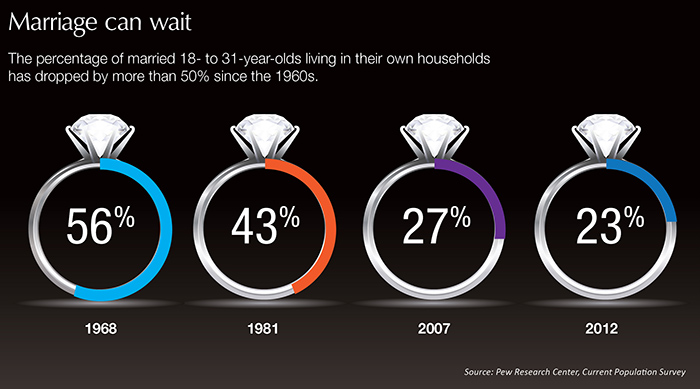

- While Goldman details several findings on financial services and spending consumption behavior similar to those cited above, they make an interesting counterpoint. As millennials grow older, their relative indifference to buying a house or a car, luxury brands, or investment services may change significantly, opening a vast demographic opportunity for businesses well-positioned to embrace the unique needs of the millennial generation.

But for now, the generational differences are seemingly overwhelming, as evidenced in part by the following illustration.

Whether you are an investment advisor, the parent of a millennial, an investor trying to stay on top of trends, or a business person looking to the future (or all of these), perhaps a healthy obsession with millennials is not such a bad idea. They have already started to color the marketing, business, economic, and investment landscape and will continue as a driving force for many years to come.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.