Editor’s note: Tony Dwyer, U.S. portfolio strategist for Canaccord Genuity, and his colleagues author a widely respected monthly overview of market conditions, technical factors, and future outlook called the “Strategy Picture Book.” The following provides a broad summary and excerpts from October’s market outlook, released October 12, 2016.

The issue for the market since mid-July isn’t the fundamental backdrop; it is the level of conviction to act on that fundamental backdrop when the market declines. It is so important during the corrective periods to remember that recessions are driven by sharply higher inflation expectations that drive the Fed to tighten enough to cause the yield curve to invert—thus shutting down credit.

Although many worry it will be different this cycle given the historic Fed policy, it hasn’t been despite all of the macro headwinds since 2009. In fact, (1) the economy and S&P 500 EPS inflected in Q1 2016, (2) any political reaction should prove temporary, and (3) the market setup is very different than before the December 2015 Fed rate hike.

Any election-based market moves should prove temporary. In this presidential election, there is no social mandate coming from economic dislocation, nor a likelihood of any party receiving a super majority that would cause major legislative change. As a result, any election-based movement—before and after—should prove temporary. Clearly, there is a lot of rhetoric, but that does not equal legislative success.

Hillary Clinton would like to raise taxes, and Donald Trump would like to lower taxes. What are the odds either actually passes through Congress as proposed, especially given the total lack of enthusiasm for either candidate? The market may react on the election, but again, we believe it would prove temporary.

A rate hike this year will not be a replay of December 2015. The second factor keeping folks on the sidelines is anxiety that a 25-basis-point hike by the Fed at the December meeting may invoke the same market response it did in December 2015. We find this highly unlikely because the environment heading into it appears opposite.

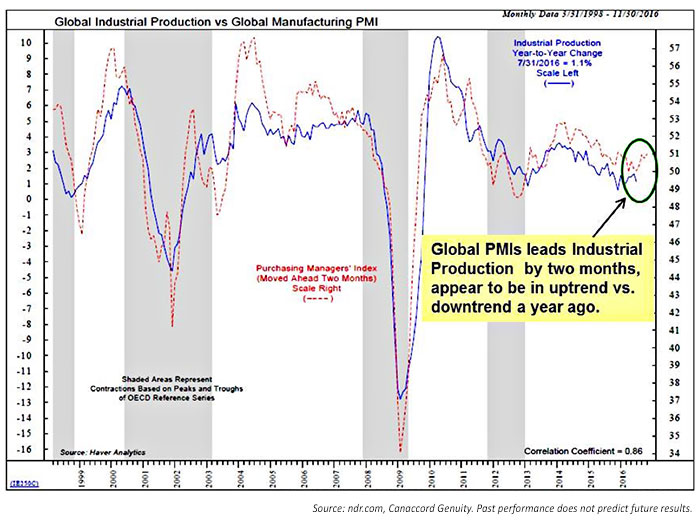

In August 2015, the global equity markets plunged on fears over the health of the Chinese economy, and its subsequent influence on the global manufacturing economy. Recently, the majority of the global PMIs were reported a bit better than expected, with the bulk of countries in “expansion” territory. According to our friends at Ned Davis, the Global PMI Index leads global industrial production by two months, with a correlation coefficient of 0.86%. (See Figure 1.) The recent turn in the global PMIs is a very different picture than was the case a year ago. Evidence of the difference from a year ago rests in the uptrend of commodities and emerging currencies, coupled with the historic improvement in corporate credit since early in the year.

FIGURE 1: ECONOMIC GROWTH—GLOBAL PMI TREND SUGGESTS BETTER

CAP SPENDING OUTLOOK

Global PMIs lead industrial production by two months. This suggests improved global capital spending outlook as we move into 2017.

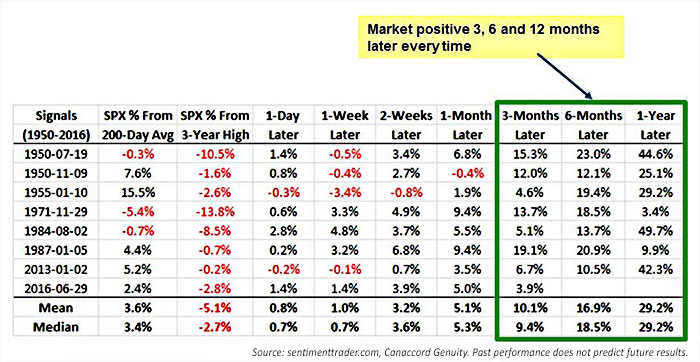

Still waiting on a catalyst to get more aggressive. That could either be getting the election behind us or a market move that forces investors to accept the solid fundamental backdrop. Even though we are looking for a bit more weakness given the political and FOMC anxiety, we want to use it to our advantage because (1) our positive fundamental core thesis remains in place (a big component of our thinking is related to the yield curve and availability of credit, driven by Fed policy that should remain extremely accommodative); (2) economic data and EPS should improve over coming quarters; and (3) since 1950, the SPX has never been lower six or 12 months after two 90% upside volume days (with the latest such signal on 6/29/16). (See Figure 2.)

In our view, we are nearing an end of the corrective period before the next leg higher toward our SPX 2017 target of 2,340, led by the more offensive sectors.

FIGURE 2: BREADTH THRUST BUY SIGNALS FOR THE SPX

Since 1950, when there are two 90% upside volume days in a row, the market was higher 3, 6, and 12 months later every time.

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com