Crude-oil prices and their effect on markets and the economy

To properly understand crude oil, one must have an appreciation for its complexity and link to the global economy. When we speak of oil at home, we are generally referring to West Texas Intermediate (WTI) and rarely, if ever, speak of Brent Crude.

Putting aside differences in sulfur content and origin, the important difference is that Brent has historically sold at a premium to WTI. However, today, the prices are within pennies of each other. When looking at both products together on a single chart, one notices that the historically wide spread has narrowed to almost nothing. This narrowing, which began mid-2014, reflects anticipated supply coming to the market from Iran. When Iran enters the market, flooding it with cheap crude, the effects are generally seen abroad. Naturally, this impacts the spread between WTI and Brent. The U.S. Dollar Index has exacerbated downward pressure on both products. Remember, as the dollar appreciates, it puts pressure on all commodities traded in that currency.

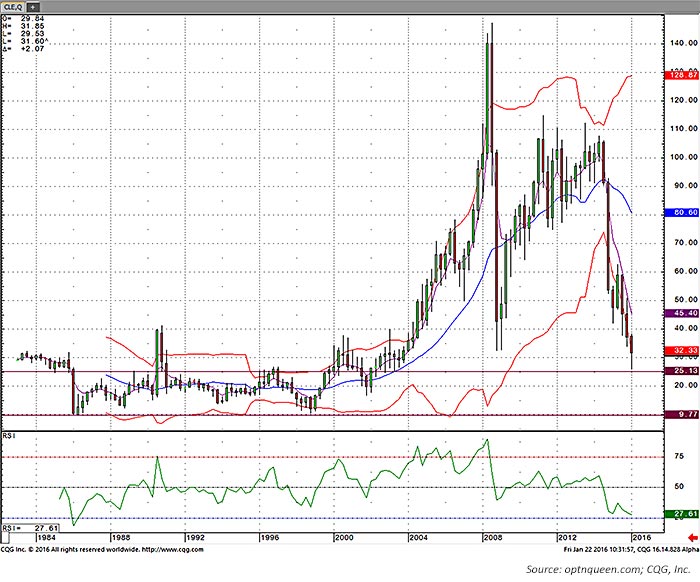

LONG-TERM VIEW OF CRUDE-OIL PRICES (1984-2016)

So, we should all expect cheap gas and a boost to economic activity, right? Once you understand how other industries are impacted by cheap crude, you begin to see the fallacy in this assumption. Beyond oil-specific industries, a negative impact is felt on the railroads. The rail industry’s growth since the financial crisis has, in large part, been attributed to the transportation of petroleum products. The rail industry has seen the biggest decline since August of 2009—15.6% in the last year alone. This screams trouble.

Cheap crude also causes reduced exploration. Rig counts are reaching new lows and oil-company failures are increasing. This has been limited to exploration, as the refiners are less concerned with the price of crude than the spread they make in converting it to other products. Many companies involved with oil exploration are overleveraged after years of capitalizing on low interest rates and being enticed by rising crude prices. Today’s crude price failure means many companies cannot service this debt. This will lead to further bankruptcies and mergers, as companies sell out to competitors on the cheap.

How will the U.S. economy come out of this mess? The huge drop in prices at the pump has not translated into the levels of new consumer spending many experts originally predicted. Low wage growth has been part of the problem here. Our economy needs the average worker to make and spend more money. (Perhaps it would help if the FOMC clawed back their December rate hike, which has the potential to stall what little expansion has been seen in this economy.)

Technical analysis of crude oil

Crude oil recently retreated again, printing a new low for the year and breaking support at $32. The retreat in crude has been organized, not erratic, showing continuous pressure to the downside. The quarterly chart of crude oil shows support at $25.13, $16.70, and $10.35. If one examines the point-and-figure chart (not shown), it has a first downside target of $25.43, which is essentially the same number seen on the quarterly chart.

Before jumping into a position in crude oil, think about some of the variables discussed here. Crude is very complicated and, although we see support at lower levels not far from here, “heroics” are generally not rewarded. Value (and dividends) may be found in stocks of refiners who do not drill for oil—they simply are not as impacted by the absolute price of oil. It is important to understand that “the trend is your friend.” For the future, we expect to see shortages appear in crude by 2017 and prices to likely advance then. There will be a bounce, but it might take some time.

Jeanette Schwarz Young, CFP, CMT, CFTe, is the author of the Option Queen Letter, a weekly newsletter issued and published every Sunday, and "The Options Doctor," published by John Wiley & Son in 2007. She was the first director of the CMT program for the CMT Association (formerly Market Technicians Association) and is currently a board member and the vice president of the Americas for the International Federation of Technical Analysts (IFTA). www.optnqueen.com

Jeanette Schwarz Young, CFP, CMT, CFTe, is the author of the Option Queen Letter, a weekly newsletter issued and published every Sunday, and "The Options Doctor," published by John Wiley & Son in 2007. She was the first director of the CMT program for the CMT Association (formerly Market Technicians Association) and is currently a board member and the vice president of the Americas for the International Federation of Technical Analysts (IFTA). www.optnqueen.com