How to ‘replicate’ your firm’s 10 best clients

How to ‘replicate’ your firm’s 10 best clients

Replicators have a prominent place in science fiction lore—but the concept can also help financial advisors repeatedly find the best clients for their practice.

Having an effective referral marketing strategy is a common challenge for advisors, Peter Muckley, vice president of marketing at Trust Company of America (TCA), said in a recent webinar.

When asked whether they have a systematic approach to getting high-quality referrals over time, many advisors confess, “no, not really,” or they respond, “If I remember to ask, I do,” Muckley says. Some may discover they are too busy serving their current clients to find time to pursue new prospects. Others may dedicate hours and considerable expense hunting for new business, only to come up relatively empty. They may find that the returns hardly justify the effort and expense, perhaps because the prospects they find are not a good fit for their business.

“What if you could just clone your 10 best clients?” he says. “Wouldn’t that be a good thing?”

Replicating your 10 best clients

To develop an ideal client profile, advisors first need to identify their top 10 clients. There are several methods for doing this, Muckley says. The traditional approach is to define top clients using the following criteria:

- The amount of assets under management (AUM) for each client.

- Total revenue per client.

- The growth potential for each client.

- The number and quality of referrals from each client.

- The potential for cross-selling other products and services.

- Access to centers of influence or target markets.

- The time required to service each client’s account.

- Personal qualities (i.e., are they enjoyable to work with?).

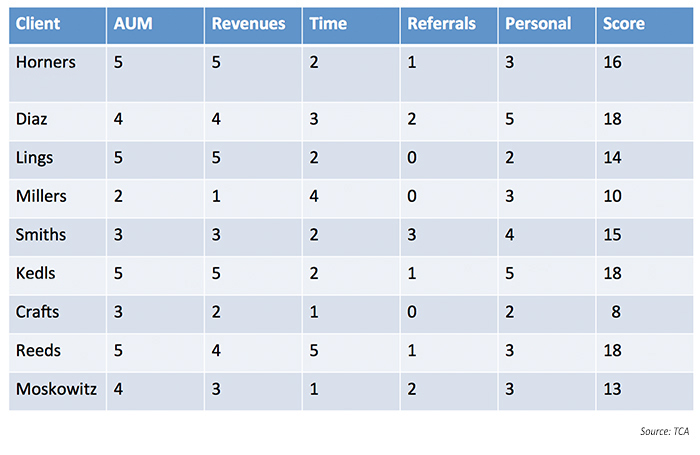

Advisors should choose roughly five variables from such a list to more easily segment clients. Then they should create a spreadsheet to score clients on a scale of 1 to 5, with 5 being the highest, to identify the best clients, Muckley says.

For quantifiable metrics, such as AUM, advisors should assign ranges. For example, AUM over $2 million could be the highest range, with a score of 5. Advisors should also determine how they’re going to score the more qualitative metrics, such as the number and quality of referrals from a client or the time it takes to serve a client.

FIGURE 1: EXAMPLE OF CLIENT SEGMENTATION SCORING

“This helps to define and refine your niche, which is important if you’re looking to replicate top clients,” Muckley says. “However, the problem with using the traditional method is that sometimes the biggest or most profitable clients may not always be the best clients for referrals or the easiest to service, so they may not be the best type of clients to replicate.”

A supplemental method for identifying top clients is to determine those who are the best cultural fit with one’s practice or who have provided referrals to prospects who have ended up being valued clients, he says. When using this method, advisors should first identify the clients that they enjoy working with the most.

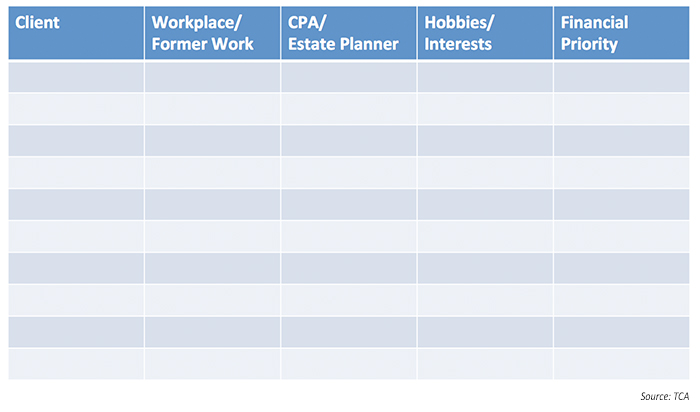

Muckley then suggests thinking about these “best clients” in a nontraditional fashion. What industry or profession are they part of or were employed in? Who do they work with as their CPA or estate attorney? What are their hobbies and interests? Are they involved with specific charitable endeavors or civic organizations? What clubs or social organizations are they involved with? And, perhaps most importantly, how do they see their financial priorities, and what are their concerns over future financial issues?

You may also want to assign a score for personal qualities. Do you enjoy spending time with this client? Do you have interests in common? This is an important consideration when it comes to refining your segmentation, especially if you’re looking for similar clients.

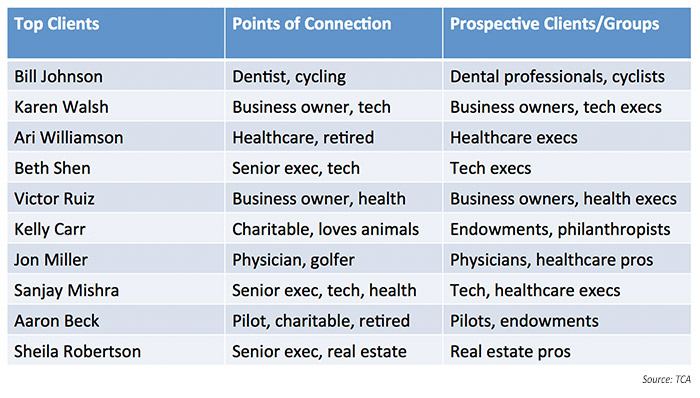

“This can help you identify the niches of your most important clients, so you can target markets, life stages, common interests, and common financial concerns,” Muckley says. Advisors can most readily determine this by developing a “referral inventory.” For each top client, advisors should include what they know about them and what possible points of connections they might have, he says. For example, if one top client is a prominent dentist who loves cycling and is involved with a cycling club, think through the following: Are there networking or referral opportunities with other dentists or cycling groups in your community? Could this top client help provide an entrée to either group?

FIGURE 2: EXAMPLE OF REFERRAL INVENTORY—COLLECT THE DATA FROM TOP CLIENTS

FIGURE 3: EXAMPLE OF REFERRAL INVENTORY—IDENTIFY POINTS OF CONNECTION

“The goal would be to start to identify what types of folks you’re good at serving and what their interests are,” Muckley says. “Is there a pattern you can develop your niche around? Do certain potential connections tend to repeat themselves? Or does a specific activity, profession, or charity offer you, the advisor, a way to build your own connection to a group? This will help you establish a successful referral marketing process.”

Jonathan Powell, managing principal at CEG Worldwide LLC in San Martin, California, writes on the firm’s blog that adhering to an ideal client profile will be crucial for “simplifying your practice, optimizing your profitability and enjoyment, and maximizing your chances of reaching your goals.”

“You also will use this ideal client profile to help assess existing clients and segment them to determine which ones you should work with moving forward,” Powell writes. “This will be an important step not only in working with the right clients but also in working with the right number of clients.”

Generating leads by ‘farming,’ not ‘hunting’

Once advisors devise their segmentation analysis, potential niches, and ideal client profiles, Muckley recommends that advisors think of lead generation as “farming” instead of “hunting”—planting seeds by building networks within their niches and systematically communicating their value proposition.

For example, if an advisor’s practice uses an active investment management approach that emphasizes risk management (and this has proven to be well-understood and appreciated by current clients), this might be an important component of their value proposition in positioning their services.

To overcome the hurdles of getting referrals, Muckley recommends that advisors change their mindset from thinking they are asking for clients’ help in getting new business to letting clients know that the advisor is in a position to best serve the financial needs of their friends, family members, and colleagues.

“Under this mindset, the golden words to say to clients are, ‘Don’t keep me a secret,’” Muckley says. “This phrase really works if clients truly appreciate what you’ve done. It’s a logical progression to ask, ‘Who else do you know that I can help?’”

He points out that research indicates 70% of advisors’ loyal clients are willing to provide referrals, but that only slightly more than 10% of advisors have a well-formulated referral marketing process. And when many advisors do ask for referrals, they are usually too vague in defining what kind of client they are looking for in a referral.

When asking existing clients for referrals, advisors need to be specific about who would fit the profile of their ideal client. Then advisors should assure existing clients that their friends, family members, and colleagues would not be harassed, but instead would receive “VIP treatment,” he says.

Advisors should also conduct a “won-sale” discovery meeting with new clients, asking them what led to their decision to use the advisor’s services (not why they decided), which makes them less defensive, Muckley says. Then advisors should ask, “Who do you know who recently experienced the changes that you just described, so they might also benefit from being a client of our firm?”

One excellent way to generate leads from client referrals is by holding low-key client “referral events,” asking top clients to bring one or two friends or associates, he says. Advisors should keep the event small and make sure it’s fun—such as attending a sporting event or holding a tequila-tasting party. While this also serves as a “client appreciation” event in many ways, the advisor should be upfront about the desire to be introduced to new potential prospects in a unique and memorable social setting.

Educational seminars, particularly multi-part workshops that generate momentum and provide truly useful financial information, have also proven to be successful. For example, this could be a three-part seminar on financial planning for medical professionals, or insurance strategies for estate planning, or succession planning for business owners.

Nurturing strategic alliances

Strategic alliances with “centers of influence,” such as CPAs or tax attorneys, can be one of the best ways to build financial-planning practices, but advisors should be aware that it can take months, sometimes years, to nurture the relationship—even before the topic of referrals is mentioned, Muckley says.

“You’ll want to build trust with them, take time to establish a comfort level with you,” he says. “You’ll want to educate them on your background, the nature of your business, how you work with clients, your unique niches—make sure they know you have a good financial-planning process that can meet clients’ needs.”

A good practice is for advisors to ask the other professionals if they would like to hear their typical client presentation, so the professionals can better understand the advisor’s financial-planning process and value proposition—and then ask for their client presentations as well, Muckley says. After the initial meeting, advisors should provide brochures about their firm and a link to their website, “to give them a better sense of who you are and your professionalism and credibility.”

If an advisor has mutual clients with a CPA or an attorney, they are much more likely to be receptive to forming a strategic alliance, he says. If appropriate, advisors should ask if the professionals want to meet jointly with a mutual client to discuss how forming such an alliance can help the client.

If an advisor has mutual clients with a CPA or an attorney, they are much more likely to be receptive to forming a strategic alliance, he says. If appropriate, advisors should ask if the professionals want to meet jointly with a mutual client to discuss how forming such an alliance can help the client.

Advisors should always offer personal resources to the clients of their strategic alliances, and offer to be available for phone calls, Muckley says. By continually offering to help, CPAs and attorneys will more readily recommend their clients to the financial advisor. “It can take a lot of time to make strategic alliances work, but they can make a huge difference in your business,” he says. “If it is appropriate, specific incentive arrangements with third-party professionals can also be utilized, but, at a minimum, referrals should be a two-way street.”

Bill Cates, president of the Laurel, Maryland-based Referral Coach International, tells Think Advisor that advisors should seek out younger CPAs and attorneys, as they generally are more enthusiastic about forging strategic alliances. While it may take time to nurture the relationship before the subject of referrals ever comes up, when that discussion does happen, advisors need to make sure they position themselves as resources for the other professional.

“How can you help them? Marketing ideas, serving as a knowledge resource, leading seminars for the partners or their clients—or both,” Cates says. The main point to remember: Advisors need to treat CPAs and attorneys as their clients—and serve as the chief relationship manager for mutual clients, he says.

Five key points in changing your mindset about referrals

Muckley summarizes what he sees as five of the most important actions advisors can take to change their mindset and approach to building a referral marketing program:

1. Continually plant seeds—“Don’t keep me a secret!”

2. Shift the emphasis to a benefit for current clients—“I want to bring service with real value to your friends, family, and associates.”

3. Remove the risk as much as possible for clients. Let them know how you are going to handle the referral process in a respectful manner.

4. Be specific—“I’m looking to meet other small-business owners like you …”

5. Look to “replicate” your best clients and use them as valuable networking and referral resources.

He adds:

“Appreciation is crucial to this process. In every interaction, let your clients know how much you appreciate their business. Follow up with personal notes thanking your clients for their time and effort, whether it’s for an actual referral, or just some conversation and feedback. Above all, let your clients know how much they mean to you, and how much you value their business. The best way to attract 10 new high-value clients is to make sure your current high-value clients remain satisfied.”

Editor’s note: Proactive Advisor Magazine would like to thank Peter Muckley, vice president of marketing at Trust Corporation of America (TCA), for permission to use content from a recent webinar. Mr. Muckley has more than 30 years of experience in marketing in the financial-services industry and leads the TCA team responsible for the company’s product-marketing efforts, brand positioning, qualified lead generation, and go-to-market strategies.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Katie Kuehner-Hebert is an award-winning journalist with more than three decades of experience writing about the financial-services industry. She has expertise in banking, insurance, financial planning, economic development, and employee benefits, and her work has appeared in many leading publications.

Katie Kuehner-Hebert is an award-winning journalist with more than three decades of experience writing about the financial-services industry. She has expertise in banking, insurance, financial planning, economic development, and employee benefits, and her work has appeared in many leading publications.