Marketing realities for financial advisors

Marketing realities for financial advisors

In a business where establishing trust is essential, it’s unwise to take shortcuts when communicating an advisory firm’s services and active approach to investment management. Consistent messaging and frequent points of contact are the keys to a financial advisor’s long-term marketing process.

Advisory firms are often looking for a “magic bullet” in prospecting for new clients. Will the latest seminar subject or technique be the answer? Should they hire the services of that third-party marketing company? Will search engine optimization bring in more prospects? Do they need a white paper? Should they start a blog?

What is too often missing from the discussion is an advisor’s long-term commitment to the marketing process. Marketing is much like investing. When you explain your investment philosophy to a prospective client there is no promise of instantaneous results.

This is especially true for advisory firms who are committed to offering risk-managed and active strategic solutions to clients. You should be consistently stating that this is a long-term investment approach and ask for a two- to five-year commitment, or explain that your approach is designed to excel over a full market cycle, which could take many years to play out.

A successful, active investment approach looks to mitigate downside risk in bear markets and achieve competitive returns in bull markets. It should be shaped by a client’s specific long-term objectives and risk tolerance, and will likely be diversified by strategies, asset classes, and, perhaps, different investment managers. It is not a series of individual “trades” over a few months or even a year. It is designed for clients as a total integrated approach to smooth out volatility over the long term. Marketing your firm’s services and investment philosophy must also be approached as a long-term process.

A conceptual framework for effective marketing communications

Market research continuously proves the obvious: the more impact a product or service has on a person’s life, the more that person needs to know the provider, their reputation, product performance, and long-term value before he or she is willing to invest their money. Effective marketing is a process of creating visibility, familiarity, and trust. The process is going to take time and it’s going to take a thoughtful approach that focuses on building a relationship before investments are made.

Marketing has traditionally been based on the “Rule of Seven”: a prospect needs to “hear” the advertiser’s message at least seven times before they will take action to buy that product or service. One account says the rule was developed by the movie industry in the 1930s. Studio bosses found that a certain amount of advertising and promotion was required to get someone to see a movie.

Dr. Jeffrey Lant’s “Rule of Seven” states that you must contact your buyers a minimum of seven times in an 18-month period for them to remember you. Marketing guru Jay Abraham also cites seven as the number of times you have to contact someone and ask for a sale before you get a “Yes!” One reason ongoing contact is effective in making a sale is that few companies stick with a disciplined marketing approach. By the time a company makes its seventh contact, the competition may have quit calling months ago.

Is seven really the magic number? In financial marketing, consistency over time can be more effective than “seven contacts and you’re no longer a prospect.” Advisory firms have some special marketing hurdles to overcome that typically require building familiarity and trust—that is extremely difficult with a drive-by marketing approach. Clients want a consistent and visible presence from their advisor, and that concept also translates to potential prospects.

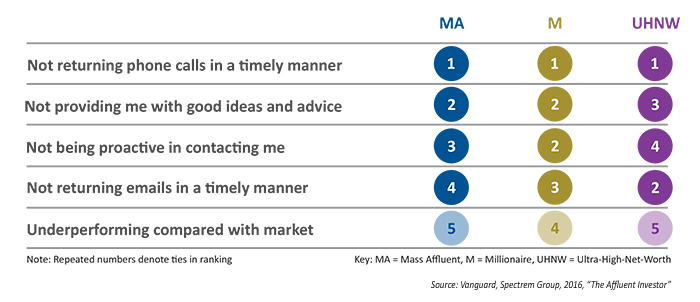

If your prospect already uses an investment advisor, changing advisors will take genuine unhappiness with the current advisor, overcoming inertia, and confidence that the individual is not making another “mistake.” A Vanguard/Spectrem survey of high-net-worth investors states that “the top four issues that would cause a client to change an advisor are communication-related. Each of these outranks performance concerns by a significant margin.”

TABLE 1: TOP FIVE REASONS TO CHANGE FINANCIAL ADVISORS (RANKED)

If your prospect does not currently use an advisor, you may face the following factors:

1. They may not believe that they need you yet. And if they only see your message once or twice, they may not remember it when they decide they do need an advisor. (Think about the way you consume automobile advertising and marketing, and how your attention level moves dramatically higher when you are “in the market” for a new car.)

2. They may not immediately see the value in your investment approach. The term “active investment management” is often misused by the financial media, and clients might misunderstand this concept on a surface level. An ongoing conversation may be needed on how active management works and why it is a very suitable approach to managing risk and return over the life of an investor.

3. They must have a reason to begin to trust the advisor’s judgment. The thoughtful articulation of your value proposition is critically important.

Practical tips for “drip marketing”

One of the most neglected marketing assets of the typical advisory or investment management firm is the prospect list. How often do these individuals get relegated to the back files after receiving a one-time information packet and a couple of phone calls? A marketing process should be designed as a multi-contact, multi-year plan with “opt-out” features that allow prospects to decide when they are no longer interested in the firm. Once a prospect expresses an interest and enters the marketing funnel, a plan of regular “drip” marketing that offers genuine value—not simply sales messages—begins with the goal of building trust.

Money matters. The process has to be affordable over the long run. This is where so many of the one-shot magic bullets fail. A great one-time mailing, one-time seminar, or one-time white paper that uses up the marketing budget in one grand gesture rarely succeeds. Few people will buy the first time they run across a marketing message. The main reason: they don’t know the company, and they have no reason to like and trust you. A good investor is a skeptic because there are too many messages across the media and in email marketing that simply aren’t true.

Content marketing is often billed as the latest, greatest marketing approach. In reality, there’s nothing new about the concept, and it is among the best ways to sell services that require explanation and ongoing reinforcement of the wisdom of the approach. One of the earliest examples of content marketing is John Deere’s The Furrow, originally a 10-by-13-inch newspaper launched in 1895 that combined John Deere advertising, reprinted articles, and agricultural tips targeted at 17 different regional markets. More than a century later, the magazine reaches 570,000 consumers in the U.S. and Canada, and about 2 million globally. (Early issues have also become collector’s items, which is quite a compliment to the marketing concept.)

Today’s content marketing is essentially the company newsletter transformed for digital delivery. It can be extraordinarily effective because it allows the firm or company to tell stories. Those stories may involve how an investment approach worked in prior markets, how the firm delivers services to clients, or address the value of active risk management versus a passive investing approach. Marketing messages that come in the form of useful content and stories create an emotional connection, and emotional connections shape buying decisions.

“After a presentation, 63% of attendees remember stories. Only 5% remember statistics.”

Much of today’s content marketing goes to unfortunate waste when it is buried in a website or blog-only format. Finding the content requires the prospect to search for the information. A more effective delivery mode is harvesting prospect email addresses and sending bursts of information directly to the individual’s inbox—as well as posting to the website. This also has vulnerabilities as a marketing tool from spam filters and the need to catch the prospect’s attention before the message is buried by incoming mail. Direct mail newsletters are beginning to see a comeback as companies recognize the advantages of a message that stays around in physical form and may be read at a later time.

Why should you develop a long-term marketing approach?

- Inertia rules. People only change investment advisors or seek one out when they have a need.

- You don’t know when a need will hit and someone will decide they need to call an advisor.

- An ongoing marketing approach keeps you in front of the prospect and builds retention by its simple consistency.

That last reason is a common problem for all marketing efforts. Unless the marketing message hits the prospect at the right time, it’s ineffectual—thus, the need for repetition. By providing thoughtful information to your prospects on a regular basis, you are building a solid relationship. Information-based contacts are more likely to be well-received because they are not sales pitches but an attempt to educate and help.

“63% of people requesting information on your company today will not purchase for at least three months (and 20% will take more than 12 months to buy).”

Finally, simplify or automate the process as best you can. Too many financial advisors only market sporadically because they are “too busy.” If you cannot block time on a regular basis to develop your own marketing outreach, hire a writer or firm to provide you with good content on a regular basis. And again, tell stories. Talk about how strategies fared in the last market downturn or how your clients are achieving their important financial and life goals. Long after a presentation, it’s not the pure facts and stats that people remember, but the impact of the stories.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Linda Ferentchak is the president of Financial Communications Associates. Ms. Ferentchak has worked in financial industry communications since 1979 and has an extensive background in investment and money-management philosophies and strategies. She is a member of the Business Marketing Association and holds the APR accreditation from the Public Relations Society of America. Her work has received numerous awards, including the American Marketing Association’s Gold Peak award. activemanagersresource.com

Linda Ferentchak is the president of Financial Communications Associates. Ms. Ferentchak has worked in financial industry communications since 1979 and has an extensive background in investment and money-management philosophies and strategies. She is a member of the Business Marketing Association and holds the APR accreditation from the Public Relations Society of America. Her work has received numerous awards, including the American Marketing Association’s Gold Peak award. activemanagersresource.com