While there is little doubt that the “Trump effect” (tax reform, deregulation, and an overall pro-business stance) has greatly influenced U.S. equity markets in 2017, market professionals will continue to take a hard look at fundamental factors for 2018. These include corporate earnings growth, the state of U.S. and global GDP growth, interest-rate policy and inflation, and the “health” of the U.S. consumer.

“Synchronized global growth” has been a term often used in 2017 to justify higher equity prices around the world. A Bloomberg analysis in March 2017 commented,

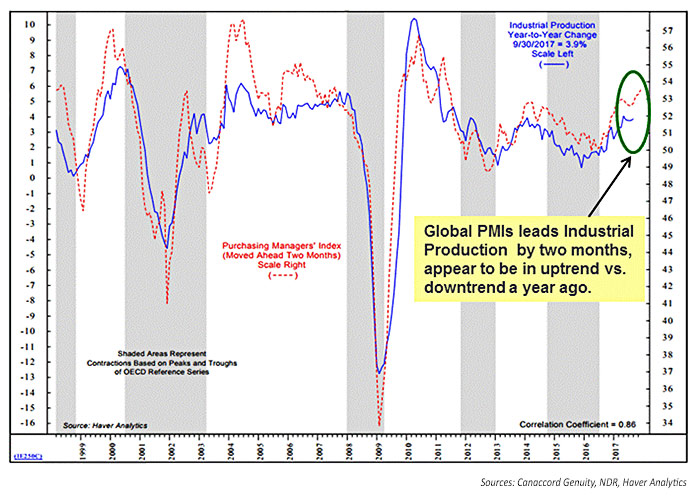

“This year is shaping up to be the most synchronized for global growth since the immediate aftermath of the last recession, in a development that could ease the burden on the U.S. as the world’s economic engine. From robust Chinese factory data to faster inflation in Germany, just about all major economies are running at a decent clip, if not accelerating. Look no further than the latest purchasing managers index (PMI) data, according to Reinhard Cluse, chief European economist at UBS Group AG in London.”

Recent global PMI data, as noted in a November 2017 Forbes article, has confirmed the trend higher. Forbes wrote, “Revenue and earnings growth are up year-over-year, not just in the U.S. but worldwide. Despite President Donald Trump threatening to raise tariffs and tear up trade deals, global trade is accelerating. World manufacturing activity expanded to a 78-month high of 53.5 in October, with faster rates recorded in new orders, exports, employment and input prices.”

FIGURE 1: GLOBAL PMI AT 78-MONTH HIGH IN OCTOBER 2017

Canaccord Genuity’s December Macro Strategy update says on a further encouraging note, “Global PMIs lead industrial production by two months. This suggests an improved global capital spending outlook in 2018.”

FIGURE 2: GLOBAL INDUSTRIAL PRODUCTION VS. GLOBAL MANUFACTURING PMI

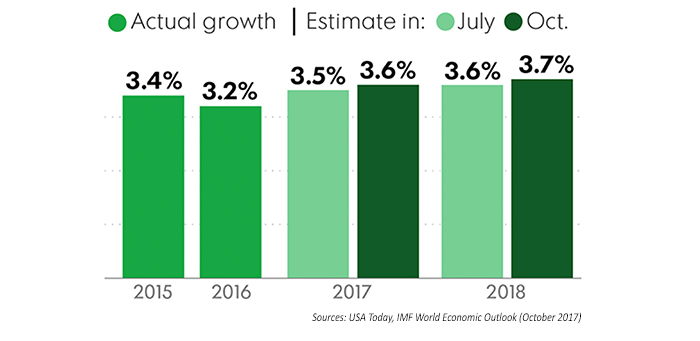

In October, the International Monetary Fund (IMF) raised its global growth forecast, saying,

“The earlier projected increase in growth is strengthening. Notable pickups in investment, trade, and industrial production, coupled with stronger business and consumer confidence, are supporting the recovery. With early 2017 growth generally stronger than expected, upward revisions to projections are broad based, including for the euro area, Japan, China, emerging Europe, and Russia, more than offsetting downward revisions for the United States, the United Kingdom, and India. After disappointing global growth over the past few years, this recent pickup provides an ideal window of opportunity for policymakers to undertake critical reforms to stave off downside risks, raise potential output, and improve living standards more broadly.”

FIGURE 3: IMF GLOBAL GROWTH FORECAST

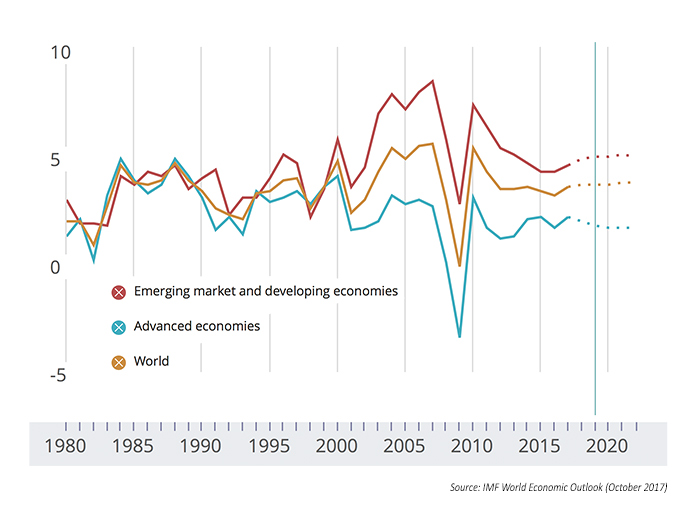

The IMF continues to see a large discrepancy between advanced economies and emerging and developing economies, with advanced economies seen to be stuck in the 2% (or lower) area for the next few years, while emerging economies will see slowly improving GDP growth at 5% or better.

FIGURE 4: EMERGING MARKETS VS. DEVELOPED ECONOMIES—GDP GROWTH FORECASTS

While the IMF might be calling for a lowered outlook on U.S. GDP growth in 2017 and 2018 (2.1% versus earlier projections in the 2.3% to 2.5% range), this flies in the face of the Trump administration’s optimistic projections and those of several major organizations, including The Conference Board. The Conference Board wrote on November 8, 2017,

“For the first time since the middle of 2014, the US economy has sustained 3 percent growth for two consecutive quarters, providing strong momentum into next year. The current Conference Board forecast calls for 2.8 percent growth during the final quarter of 2017 and 2.5 percent growth in 2018. This would represent the economy’s best 2-year run since 2005. … The economy enters 2018 in good position to maintain strong growth from 2017. … With growth prospects strong for 2018, profits should grow robustly as well, rewarding those businesses that increase investment levels.”

The Federal Open Market Committee (FOMC) also released new economic projections Wednesday (12/13), upping their estimate of 2018 GDP growth to 2.5% from 2.1%. If estimates from The Conference Board and the FOMC are more accurate than those of the IMF for U.S. growth prospects in 2018, global GDP forecasts would, of course, only look that much stronger.