Would your client portfolios benefit from ‘just in case’ risk management?

Would your client portfolios benefit from ‘just in case’ risk management?

Since 2000, there have been three S&P 500 Index bear markets—defined as a decline of 20% or greater—and two other drawdown periods close to 20%. True “just in case” investors, through their advisors, employ multiple risk-management techniques to help mitigate this type of market risk.

We all have insurance of some kind—health, auto, life, disability, renters, and/or home.

Just in case …

When we drive, we have our seat belts and lots of safety features for our car, like airbags, traction control, and backup cameras.

The roads have markings, safety engineering, and guard rails on the riskiest stretches.

Just in case …

When doing our taxes, we employ an accountant or use expert-prepared software.

When we sell or buy a house, most of us use a real estate agent or at least review Zillow or something like it to get an idea of value.

Need a new furnace or air conditioner? You call an HVAC company to make sure it is done right.

Just in case …

In the kitchen, the pantry has canned food, and maybe it’s stocked with bottled water.

If there are young children in the house, there may be covers on the outlets and latches on the cabinets.

If there’s a newborn that’s joined the family, there are likely to be apnea detectors and a room monitor.

If there’s an elderly person in the home, extra precautions in the bathroom, bed rails on the bed, and a necklace with a button to summon help are likely to be evident.

Just in case …

I could go on and on with examples of how we seek to protect ourselves and our loved ones from the common dangers of everyday life. And whole articles have been written about why each of the examples given is a wise step for us to take.

There are at least three elements common to all of the examples: (1) a real danger exists; (2) multiple, redundant protections are usually recommended; and (3) the need to act in advance of the danger is necessary to mitigate the danger.

Yet when it comes to investing, investors seem largely unaware of these elements. And the further investors progress into a bull market, the further the thoughts of the danger seem to recede from their consciousness.

Until, that is, we have a period like what we experienced in early 2020 in the stock market—then, the fears and anxiety surface.

Do your clients’ investments qualify for the “just in case” risk management that applies to much of our everyday life? Let’s look at the three elements.

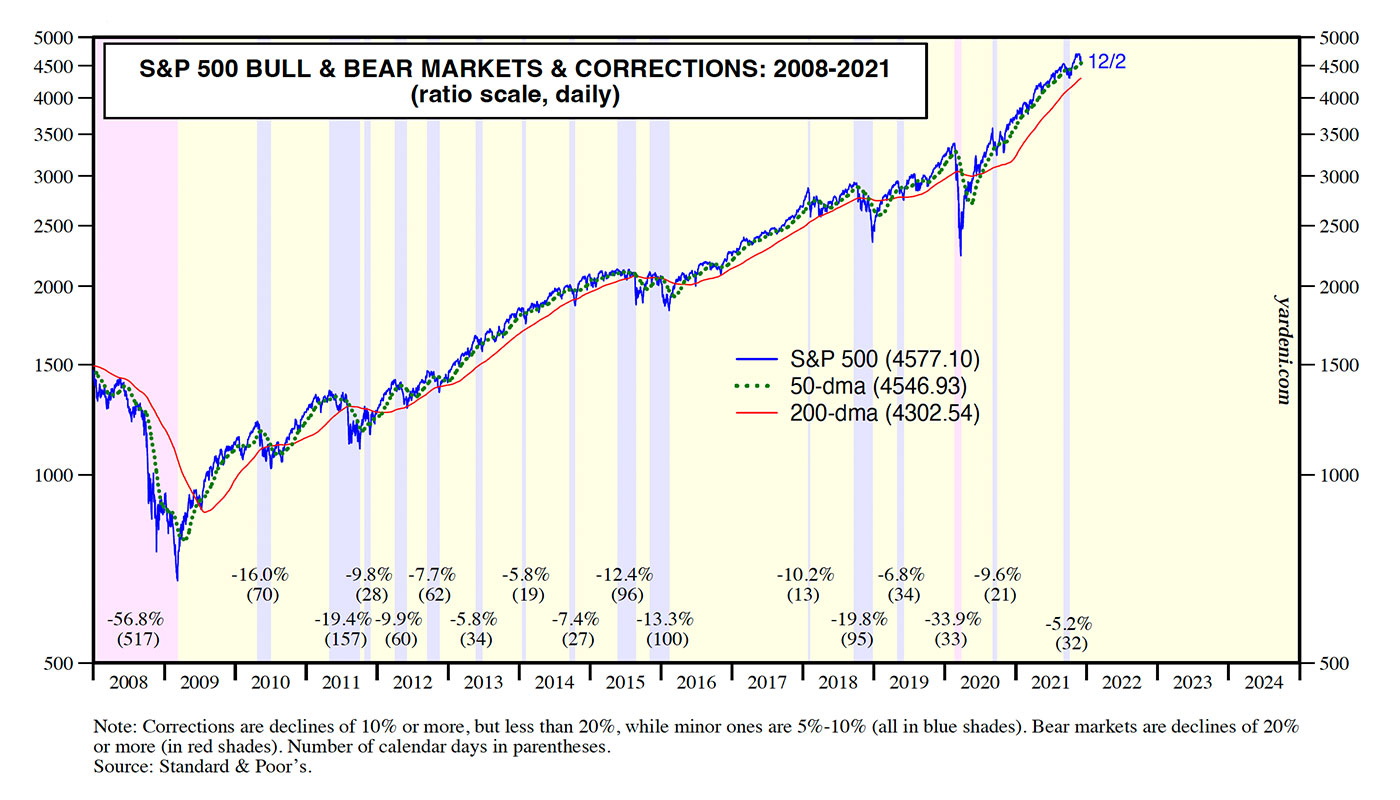

Since just 2008, there have been several “baby bear” market corrections equal to or greater than 5% (but less than 20%) in the S&P 500. Most of these have seen the uptrend quickly restored.

Source: yardeni.com

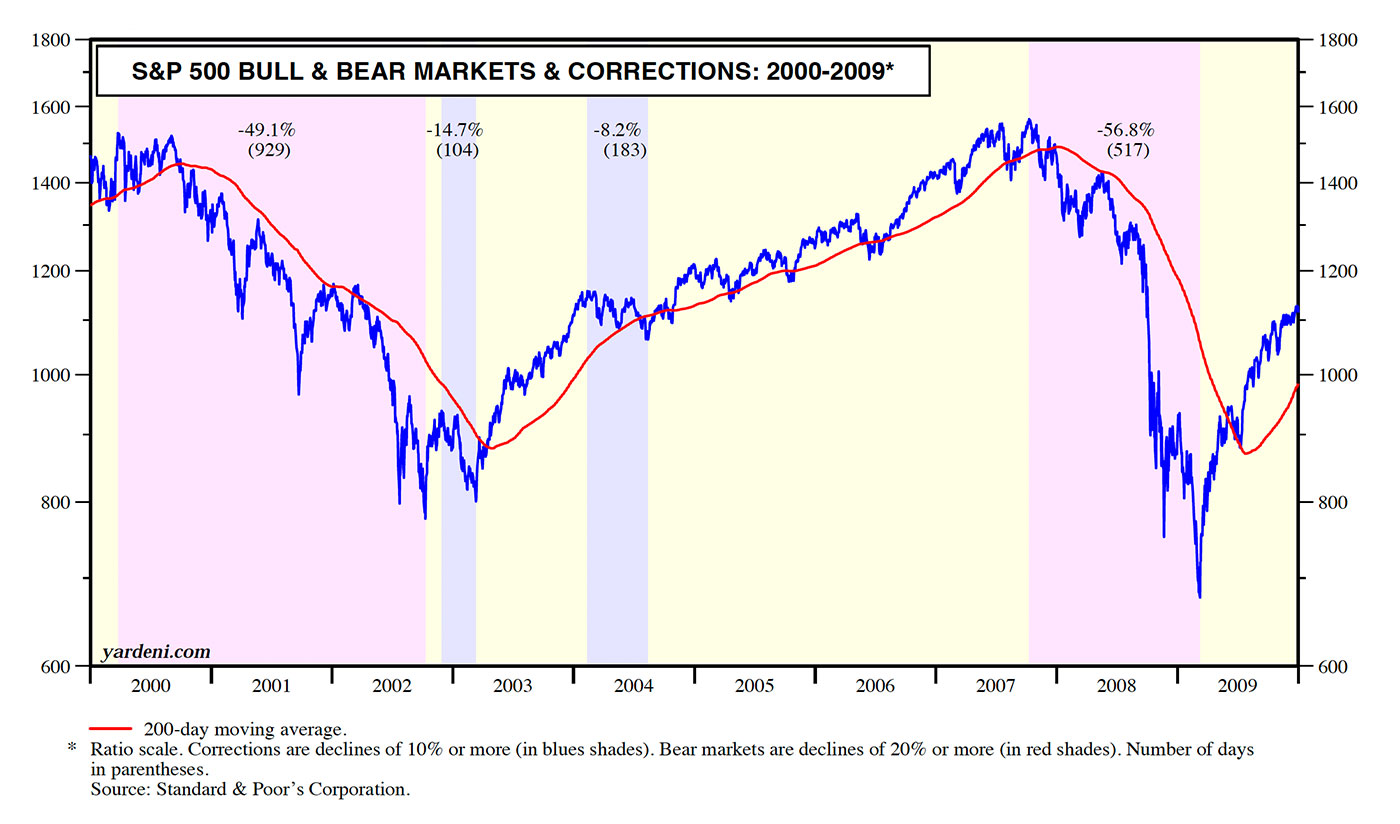

Since the beginning of 2000 (looking at Figures 1 and 2), there have also been three “grizzly bear” markets (declines of about 20% or greater)—and two other market periods with drawdowns over 19%. Two of the “grizzly bears” have resulted in principal losses around 50%, which can take years to recover.

The danger is real.

Source: yardeni.com

It has usually taken more than one type of risk management to mitigate this danger. Many investors choose to simply track the domestic stock market with their portfolio, usually with passive index funds that are clones of the S&P 500 and NASDAQ 100 Indexes. These indexes contain lots of stocks, thus diversifying the risk of investing in a single company where the loss can be total. Yet, just as they track the index to the upside, they also track the indexes on the downside (note that the NASDAQ 100 has fallen over 70% during some of the major declines this century).

Most investors using financial advisors and planners diversify a second way: among asset classes. Yet recent major corrections have taught a hard lesson. When the broad market indexes decline here in the U.S., most of the diversifying asset classes fall as much or more.

The only true diversifiers have historically been bonds, gold, and other commodities. Yet as a bull market progresses, the allure of having a higher and higher percentage of the portfolio in stocks grows. People adjust their answers to suitability profiling questionnaires to take on more risk. They fail to rebalance, and the equity percentage automatically grows higher. They see the indexes soaring while their diversified portfolio trails, and they ask their advisors to assume more risk.

When the inevitable bear market occurs, they learn what risk really is. They suffer losses closely approaching the indexes they were trying to catch a few months prior.

The true “just in case” investor employs more risk-management approaches than index investing and asset-class diversification. They build portfolios using dynamic, risk-managed strategies and strategic diversification (diversifying by actively managed strategies as well as asset classes). Their portfolios therefore always have a “plan B”—implemented through redundant risk-avoidance mechanisms.

These “just in case” investors realize that, like insurance, these protections have a cost. They understand that you can’t have one foot out the door and do as well as a market index that is always fully invested. They know that you can’t take suitability into account and always carry gold and bonds in your portfolio without trailing stocks when they are rallying. And when the market fakes them out and a “baby bear” doesn’t turn into a “grizzly bear,” they realize that the small loss that was taken was done to be correctly positioned if the grizzly bear market had occurred.

Finally, “just in case” risk avoidance requires the investor to put their preventative tools in place before the loss occurs. Just as one cannot wait for the auto accident to occur before buying the auto insurance, investors can’t wait to add risk management beyond diversification until after the market loses 20% or more. Just as risk is always with us in the financial markets, we’ve found that it’s best if these risk-management tools are always employed as well.

Just in case a 10% “baby bear” turns into a “grizzly bear.”

Just in case a 20% downturn in an index fund becomes 50%.

Just in case the time to get back whole takes years and years.

Are your clients, especially those near or in retirement, ready to embrace the long-term benefits of dynamic risk management for their portfolios … just in case?

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine many risk-managed strategies within a single account. FPI's fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. flexibleplan.com

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine many risk-managed strategies within a single account. FPI's fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. flexibleplan.com