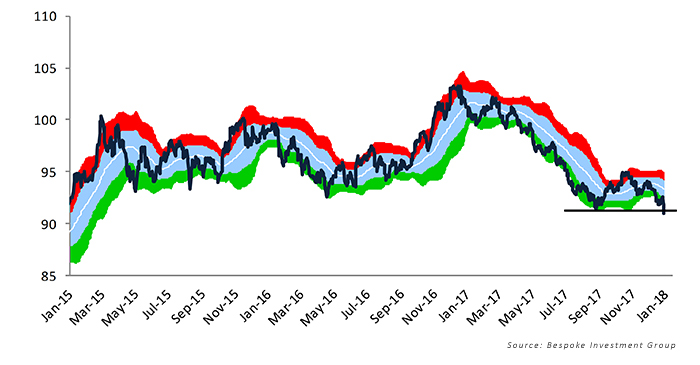

The U.S. dollar hit a three-year low against major foreign currencies earlier this week, after putting in about a 10% decline in 2017.

The Wall Street Journal recently wrote:

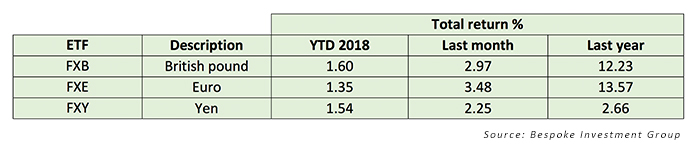

“The dollar’s January move is broad, slipping against the euro, the yen and the yuan among others. Taking 2017 and 2018 together, the big winner is the euro, up 16.5% and now close to $1.23, its highest since late 2014. Even the battered U.K. pound has joined in and is at a post-Brexit-vote high close to $1.38.”

Figure 1: U.S. DOLLAR INDEX (LAST THREE YEARS)

TABLE 1: RELATIVE PERFORMANCE OF SELECTED MAJOR FOREIGN CURRENCIES

Analysts note that the dollar’s decline has been somewhat surprising in the face of the Federal Open Market Committee’s plan for raising rates and the impetus for U.S. growth expected from the recent tax cuts.

On the flip side, they point to the acceleration of growth around the globe (especially emerging markets), the potential interest-rate increases to come from foreign central banks, and the resurgence of positive sentiment in the eurozone.

CNNMoney recently cited issues in Washington as a possible contributory factor for the dollar’s weakness:

“But the dollar’s slide can’t be pinned entirely on what’s happening overseas. Some analysts suggest that political dysfunction in the United States is also pushing the dollar down. Boris Schlossberg, managing director of foreign exchange strategy at BK Asset Management, said in a report Monday that ‘there is more to dollar weakness than just the global feel-good story.’

“Schlossberg said more investors are starting to believe there is a real chance of a government shutdown in Washington later this week. … ‘The weakness in the buck suggests that the move is political as well as economic as global investors grow increasingly concerned about the chaos in Washington DC.’”

The CNNMoney report, however, notes that President Trump on numerous occasions in 2017 remarked that he would not be upset by some weakness in the U.S. dollar. This has made U.S. goods and services more competitive in the global marketplace, further adding to the bottom lines of major U.S. multinational companies.

They concluded, “It’s true that a continued (and steeper) decline in the dollar could eventually become a problem. … But that scenario seems unlikely anytime soon. Despite the wackiness in Washington, most global investors still view the dollar as the world’s most stable reserve currency.”