Why it’s critical to teach clients the importance of ‘behavioral adherence’

Why it’s critical to teach clients the importance of ‘behavioral adherence’

Understanding the principle of behavioral adherence to investment policy—and being able to simply and persuasively communicate it to clients—may be a financial advisor’s most important task.

My daughter started kindergarten in September, and the teacher sent an assignment home to all of the parents. One of the questions asked was what we’d like our child to learn in kindergarten. My answer was easy: to follow the rules and stay out of trouble.

This is exactly what we as investment managers must find a way to master too, both for ourselves and for our clients.

When building portfolio allocations or investment policy for clients, we almost always rely on some form of a “backtest.” This is true whether it’s a strategic asset-allocation model relying on the long-term risk and reward characteristics of uncorrelated asset classes continuing into the future, or a tactical allocation model relying on the historical successes of its rotational signals continuing into the future.

These backtests form the foundation of portfolio expectations for everyone involved, from both a risk and reward perspective. But the conversation often overemphasizes the results of the backtest and underemphasizes the process we have to endure to have any chance of realizing the historical results of the backtest in the future.

This is where the conversation should take a sharp U-turn. We need to help our clients first fall in love with the process, or investment policy, embracing the good, the bad, and the ugly. This is important because exercising maniacal discipline in adhering to the process is the only way for the past performance of any portfolio to actually become future results.

I call this “behavioral adherence,” and it is critical to investing successfully over the full market cycle. I believe our most important responsibility as financial advisors and proactive investment managers is to help our clients optimize behavioral adherence.

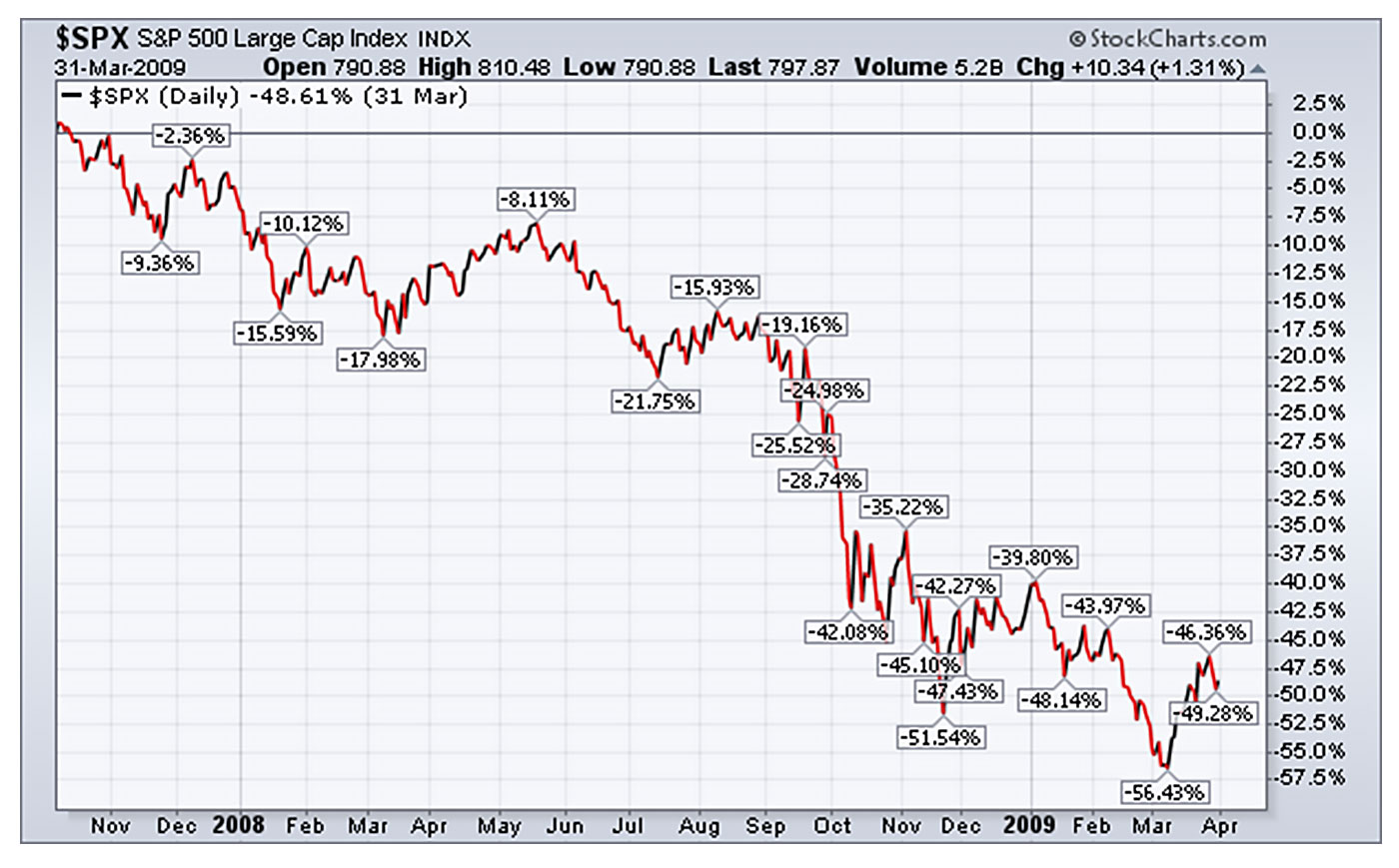

In March 2009, the S&P 500 traded down to a closing low of 676.53. The index had declined 56.43% over the trailing 17 months, falling from October 2007’s closing high of 1,565.15. In October 2007, many long-term investors undoubtedly had a long-term investment policy designed with a passive buy-and-hold approach to the equity allocation within their portfolio. By March 2009, more than half of their equity allocation had vanished.

FIGURE 1: S&P 500 DECLINE OVER 2007–2009

Source: Market data, StockCharts.com

Long-term investors had a decision to make: Stay the course, exercise discipline, and adhere to their long-term investment policy, or abandon the ship and try something new, perhaps something more active.

The internet was littered with articles with titles such as “Buy-and-Hold Is Dead.” Naturally, it’s easy to envision the majority of retail investors throwing in the towel and choosing to abandon the ship. Simultaneously, it’s then easy to see investment managers trying to appease their disgruntled clients by substantially changing their investment policies to maintain the client relationship.

(Note: This is by no means a case for passive, index-based investing. I am a firm advocate of actively managed strategies that are rules-based and have the ability to react to changing market conditions through both changes to asset allocation and exposure levels.)

Fast forward to 2019, with the S&P 500 currently hovering near the 3,000 level. It’s easy to see how the lack of behavioral adherence in and around March 2009 was a costly mistake, for both the client and investment manager.

Risk is often defined as downside portfolio volatility, or drawdown, leading to the permanent loss of capital. But a permanent loss of capital is generally a derivative of either negligent planning or a lack of behavioral adherence.

All that is guaranteed in the world of investing is risk. Therefore, it’s imperative that we design portfolios and investment policy by considering not only the minimum annualized rate of return our clients need to achieve their stated financial objectives in mind, but also their ability to stick with the portfolio, and adhere to the investment policy, over the full market cycle.

Put simply, we can’t help our clients earn the returns they need to achieve their financial goals if we can’t help them exercise flawless behavioral adherence to the underlying investment policy during the most challenging of market climates. Through these lenses, perhaps the biggest risk a long-term investor faces is not portfolio volatility, or drawdown, but instead the inability to adhere to their long-term investment policy during periods of portfolio volatility or drawdown. That’s when a permanent loss of capital often occurs.

Given where we are now in the business cycle, emphasizing behavioral adherence in all portfolio reviews and client communications is of the utmost importance.

Over the last 10 years, the S&P 500’s annualized rate of return is roughly 13.24% (through Sept. 30). Behaviorally speaking, there is a growing “bubble” among retail investors: the idea that investing, at least behaviorally, is as easy as passively buying and holding equities (specifically large-cap domestic equities). It’s as if investors believe equities always go up, diversification be damned.

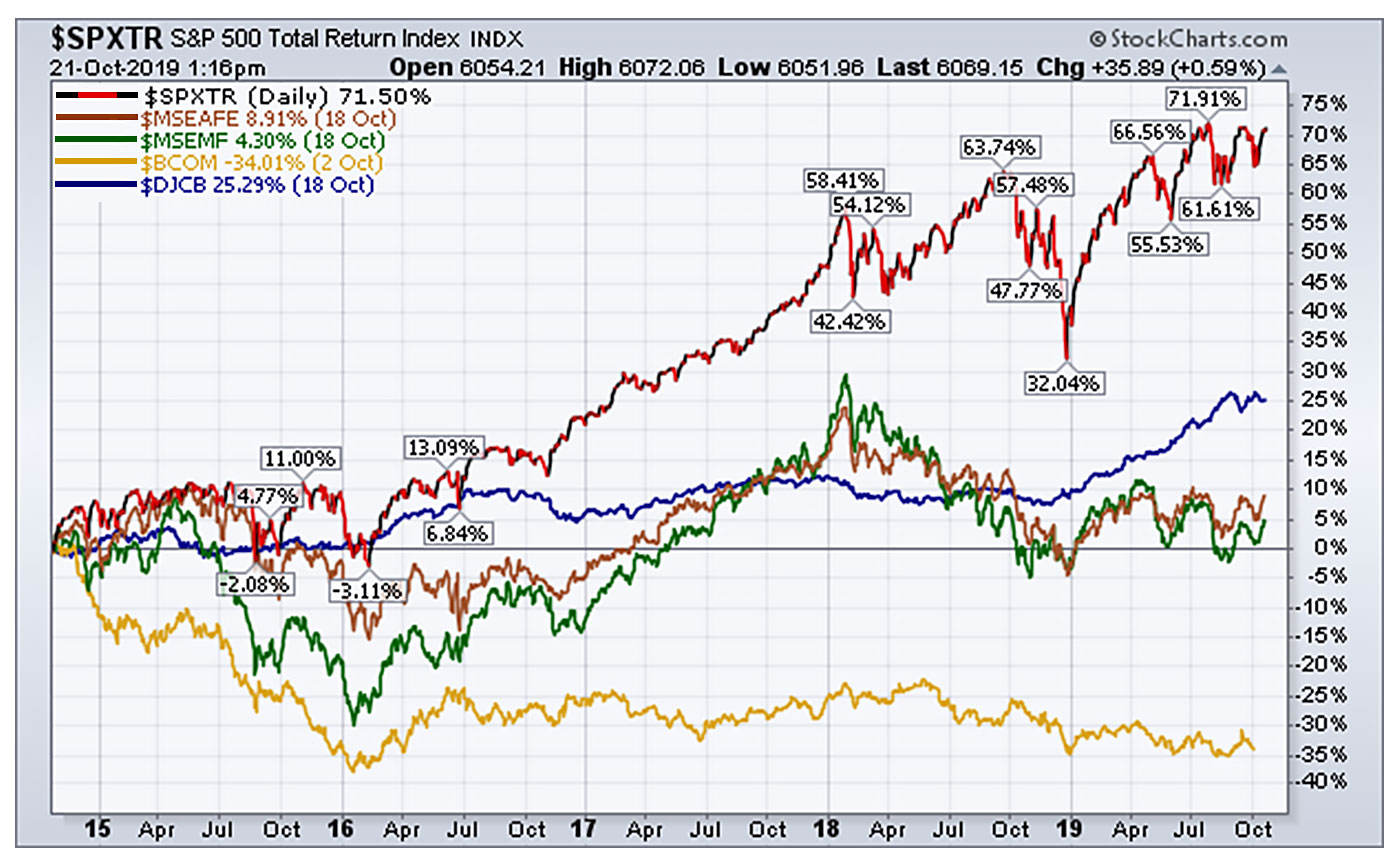

I imagine this is dominating most of the watercooler conversations. Figure 2 overlays the trailing five-year total returns of large-cap domestic equities, international stocks, emerging-market stocks, commodities, and fixed income. (See Figure 2 note for how these elements are measured.) Given hindsight, everyone wishes their portfolio’s asset allocation was 100% S&P 500 Total Return Index.

Note: Large-cap domestic equities are represented by the S&P 500 Total Return Index, international stocks are represented by the MSCI EAFE Index, emerging-market stocks are represented by the MSCI Emerging Markets Free Index, commodities are represented by the Bloomberg Commodity Index, and fixed income is represented by the Dow Jones Corporate Bond Index.

Source: Market data, StockCharts.com

While most investment managers understand this is the view through the rearview mirror, and not the windshield, the large-cap equity dominance of the last decade pulls and tugs at our clients’ emotions, and emotions are the kryptonite to long-term behavioral adherence. Therefore, it’s more important than ever to keep our clients glued to the rules of their long-term investment policy.

We want clients’ attention to focus on the process, rather than the historical results of one piece of their portfolio. If you don’t attempt to redirect their attention to focus on the process, they’re undoubtedly going to focus on the results, especially with the S&P 500 presently on pace to record a stellar calendar year. It’s in this scenario where our clients are tempted to consider leaving a prudent, intelligent, and diversified asset allocation and investment strategy due to recent underperformance, for a portfolio that’s allocated 100% toward the S&P 500. This is analogous to driving while looking through the rearview mirror, and that’s how accidents happen. We can’t let our clients make decisions in the present that increase the likelihood of an accident in the future.

How do we control the narrative and get clients to fully buy into the process? With proactive communication! Cyclicality and mean reversion are hallmarks in the world of investing, and it’s important to remind clients of the “why” behind their portfolio’s construction and investment policy. We need to tackle “recency bias” head-on.

- “If you don’t love me when I’m down, you don’t deserve me at my best.” It’s important to remind clients that what hasn’t worked in the present is often what’s best positioned to work in the future. Show your clients that while the S&P 500 Total Return Index is one of the single best-performing areas of the major asset classes during the last decade, it was one of the most lackluster areas of the investable universe the decade before. The only investors who have earned all of the S&P 500’s upside the last decade are those who demonstrated exceptional behavioral adherence with the index after its lost decade from 2000 to 2010 (or those who only began investing in 2009 or after—luck is real).

- “No pain, no gain.” Leverage and explain the meaning behind some relevant sayings, such as “Being diversified means always having to say you’re sorry” and “No pain, no gain.” Expanding on the chart in Figure 2, diversifying with sound evidence-based investment strategies has underperformed the S&P 500 meaningfully the last five years—from factors such as value, quality, and size, to global diversification, commodity exposure, master limited partnerships, liquid alternatives, and tactical asset-allocation models. In the eyes of our clients, these areas haven’t lived up to their expectations, and they’ve caused some “pain.” Remind your clients that enduring the “pain” is what’s required to earn the “gain.” There’s no free lunch. Abandon a sound investment or strategy that’s causing “pain,” and you’re eventually left with nothing but “pain” and no “gain.” That’s a bad trade.

- Blocking and tackling, planning and policy. Revisit your clients’ financial plan and investment policy statement. Revisiting the financial plan can help you measure portfolio performance against your clients’ personal benchmarks (i.e., the minimum annualized return necessary to achieve stated financial objectives) and not the S&P 500 Total Return Index. While revisiting their investment policy, remind them why they implemented the portfolio and investment policy they did, and help them understand that while the view through the rearview mirror is crystal clear, the view through the windshield can be foggy.

- Manage expectations going forward. Help your clients understand that equity returns aren’t linear. What’s worked best the previous decade is often what works worst the next decade. Remind them that while they love their large-cap domestic equity allocation more than anything else in their portfolios right now, they may sing a drastically different song over the years ahead. Remind them that in the world of investing, the game never ends—the score simply changes. Diversification’s down on the scoreboard right now, but it’s only a matter of when it regains the lead, not if.

- Walk the walk. Investment managers can’t help their clients optimize behavioral adherence if they also don’t optimize behavioral adherence. We have to fully embrace the portfolios and investment policy we build and implement, through the good and bad. Otherwise, we’re liable to fall victim to strategy jumping or chasing. This is where third-party asset managers (TPMs and TAMPs) can be an invaluable resource. I’d argue the primary benefit clients receive from hiring proactive investment managers is the outsourcing of discipline to achieve a level of behavioral adherence they’re unlikely to attain on their own. Financial advisors get the same value by outsourcing their strategy discipline to TPMs.

There’s no better time than now to be proactive in helping our clients avoid acting upon the “greed” associated with wanting to increase their allocation to the large-cap domestic-equities space. I think we need to plan for the day when the “fear” of the large-cap domestic-equities space causes our clients to want to abandon their fundamental investment policy.

It takes discipline to win over the long term. As they like to teach us as early as kindergarten, when you follow the rules, you stay out of trouble. Nowhere is this more applicable than in the world of long-term investing.

Steve Deppe, CMT, is a principal and senior market strategist and wealth advisor at Nerad + Deppe Wealth Management, based in San Diego, California. He began his career with American Express Financial Advisors and was a manager for several years with Ameriprise Financial. Mr. Deppe is a CMT (Chartered Market Technician) charterholder and a member of the CMT Association. He is also a member of the American Association of Professional Technical Analysts (AAPTA).

Steve Deppe, CMT, is a principal and senior market strategist and wealth advisor at Nerad + Deppe Wealth Management, based in San Diego, California. He began his career with American Express Financial Advisors and was a manager for several years with Ameriprise Financial. Mr. Deppe is a CMT (Chartered Market Technician) charterholder and a member of the CMT Association. He is also a member of the American Association of Professional Technical Analysts (AAPTA).