Why advisors favor risk-managed strategies—in good times and bad

Why advisors favor risk-managed strategies—in good times and bad

Financial advisors cite the many benefits of an investment approach incorporating dynamically risk-managed strategies.

Over the past 18 months, I have interviewed different advisory teams for Proactive Advisor Magazine that are relatively new to the world of dynamically risk-managed strategies and the overall philosophy of holistic active portfolio management. (For simplicity, I have mainly paraphrased their comments here.)

Their somewhat deliberate approach to introducing risk-managed strategies to their clients’ accounts over several years, they say, accelerated in late 2020 and early 2021—largely based on the performance they witnessed in 2020 and how these strategies, in the words of one advisor, “did almost exactly what they were supposed to do.” The feedback I have received in 2022 has been similar as advisors guided clients through a challenging first half of the year.

Although they have performed due diligence on many third-party investment managers, they happen to be allocating a good portion of their clients’ accounts to rules-based and algorithm-driven strategies. These strategies are largely designed to adapt to changes in the overall market environment and the relative strength and weakness of different asset classes and sectors.

Aside from the broad performance story, advisors see many benefits to an investment approach incorporating dynamically risk-managed strategies.

For their clients who are near or in retirement, they say that protection strategies and risk management are often the number one priority they discuss in reviewing clients’ financial and investment-planning needs. They note that the behavioral and emotional benefits of having an investment approach that gives clients a greater level of comfort are significant and can help clients stay committed to their plans—a real win-win for the advisor and the client.

Financial advisors also say that they offer a lot of education about sequence-of-returns risk, which is a new concept for many of their clients. This becomes far more important for clients as they enter the distribution phase of their retirement plan, and it becomes a pretty clear argument between what one advisor characterized as “rolling the dice with a passive approach versus actively managing the risk.”

They also particularly like the incorporation of noncorrelated strategies and alternative asset classes in an overall risk-managed approach. They discuss the merits of a higher level of diversification with clients versus the more traditional approaches of the past, which they believe do not deal well with periods of market dislocation.

They do not entirely disregard passive or indexed strategies, saying that both active and passive may have a valid long-term strategic role in a portfolio. They often develop a blended approach that depends on each client’s risk tolerance, plan objectives, tax situation, time horizon, and income needs.

However, for many clients, the emphasis is on actively risk-managed strategies, which are uniquely suited to making adjustments based on what is going on in both the markets and the economy. One advisor said, “Today’s market environment and volatility make it difficult with passive investments to avoid downturns or make money in sideways markets.” As a group, they particularly appreciate that sophisticated managed money approaches are available to clients at a far more competitive fee structure than in the past.

The ascendancy of active risk management (again?)

Following the 2007–2009 financial crisis, many advisors turned to fee-based managed accounts, seeking out a new risk-managed portfolio approach for their clients. After two 50% drawdowns for passive strategies in a relatively short period (-49.1% in 2000–2002 for the S&P 500 and -56.8% in 2007–2009, according to Yardeni Research), financial advisors not surprisingly experienced a high degree of client dissatisfaction, a reluctance to recommit to equity markets on the part of clients, and (unfortunately) client defections.

Many advisors who “found” a new risk-managed investment approach following the financial crisis were very satisfied with both the performance and behavioral benefits for their clients. But, as the bull market marched on, very low-cost index funds for client portfolios grew in popularity again, making it more challenging to convert new advisors to an actively risk-managed approach. From a behavioral-finance perspective, it was a case of “recency bias” for many advisors, where there were short memories about the ever-present risk that lurks for passive investors.

That pendulum started to swing the other way again in 2020, influenced in no small degree by that year’s roller-coaster market volatility.

According to a SmartAsset survey conducted in March 2021, 42% of advisors cited stock market volatility as the number one reason clients reached out to them over the prior year. A study conducted by The Journal of Financial Planning and the Financial Planning Association (FPA) showed that 76% of advisors’ clients actively contacted them about market volatility in 2020.

It was interesting to note that the FPA’s 2021 tracking study showed a distinct rise in the percentage of financial advisors exclusively using active strategies versus those exclusively using passive strategies. When the study was repeated in early 2022, the relationship had flipped back to a slightly stronger bias toward passive strategies, no doubt influenced by the strong year-end performance of the S&P 500 in 2021 and the relatively benign volatility for much of last year.

Nonetheless, 69% of advisors reported that they either used a blend of active and passive strategies or exclusively active strategies. Most also report that they remain vigilant when it comes to their clients’ asset-allocation strategies, with some specific concerns rising to the top this year.

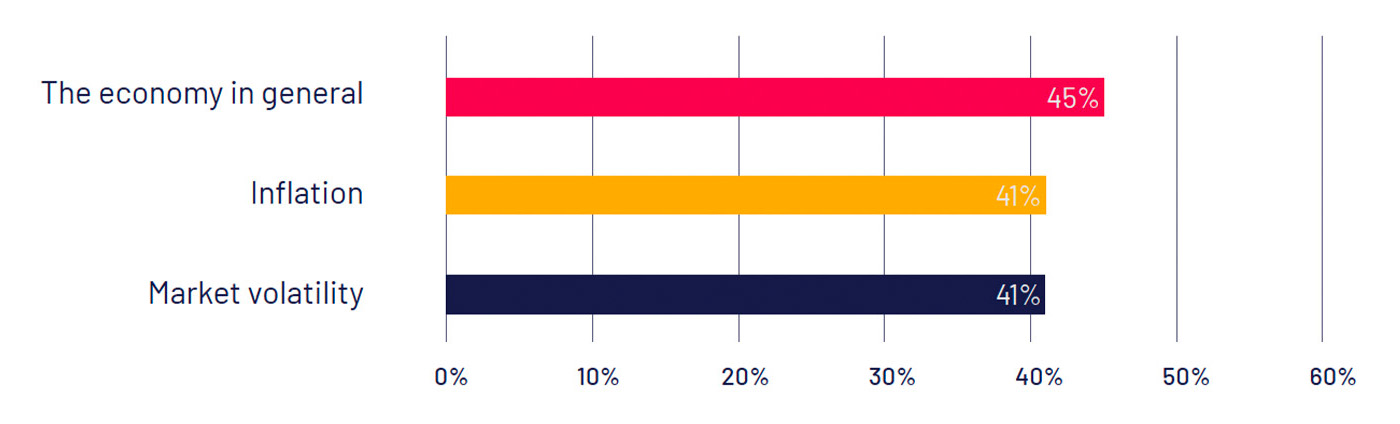

FIGURE 1: TOP 3 REASONS TO REEVALUATE ASSET-ALLOCATION STRATEGIES IN 2022

Source: 2022 Trends in Investing Survey, conducted by The Journal of Financial Planning and the Financial Planning Association (FPA)

The reversion to increased use of passive index funds by the end of 2021 was also noted in a 2022 study conducted in late 2021 by Natixis among global institutional investors, which stated,

“… Institutional investors see the large flows into index funds and ETFs and caution against overreliance on these vehicles. … Six in ten (57%) say the popularity of passive has increased systemic risk. Another six out of ten (58%) among institutional investors say the growing use of passive shows the market is ignoring the fundamentals. Half go so far as to say passive distorts risk/return tradeoffs. …

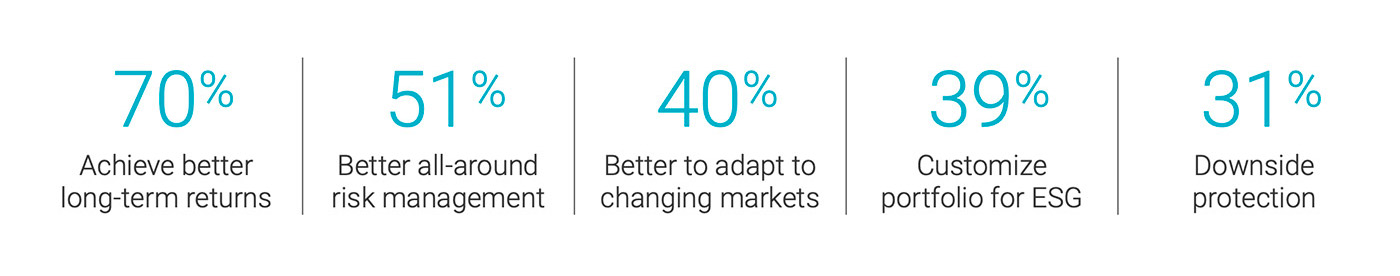

“… The rationale for active is clear in the eyes of institutional investors, as 70% say they will invest in active funds to achieve better risk-adjusted returns. Half also report that active provides better all-around risk management, and another 40% say active helps them to better adjust to changing market trends. …”

FIGURE 2: WHY INSTITUTIONS INVEST IN ACTIVE STRATEGIES AND FUNDS

Source: 2022 Natixis Institutional Investor Outlook

The bottom line

In general, financial advisors we have interviewed tell us that third-party money management provides several benefits for their practice and their clients:

- Enhanced risk management/diversification.

- Mitigation of market volatility.

- Sophisticated, rules-based strategies that take emotion out of the investment equation.

- A turnkey approach to strategy implementation and execution.

- Professional investment management that frees up their time for client planning and service.

Specific to the benefits of active portfolio management, one senior financial advisor put it particularly well: “It is my belief and experience that clients are far more willing to stick with an investment plan if a significant percentage of their portfolio incorporates active, or tactical, risk-managed strategies.”

That alone is a very good reason for a likely return to the ascendancy of active risk management.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

New this week:

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.