What is your investment style?

What is your investment style?

Today’s universe of investment products provides active managers with a vast palette of tools for

strategic diversification.

What is your investment style? I’m old enough to remember a time when an investment manager’s response to this question was quite different than what is typical today. Perhaps you are too.

There was a time when such a query would invoke responses such as deep value, aggressive growth, earnings momentum, dividend growth, growth at a reasonable price, or other descriptive terms. Additionally, various styles and investment approaches might include focusing on highly leveraged companies, turnaround plays, takeover targets, spin-offs, or other special situations.

You might be thinking these investment styles never went away and are still with us today. You would be correct. However, whereas these might have been among the most likely descriptions 25 years ago, something happened in the interim to lower the probability of receiving such a response.

The Morningstar Style Box became the primary method of determining and classifying investment styles.

A little bit of history

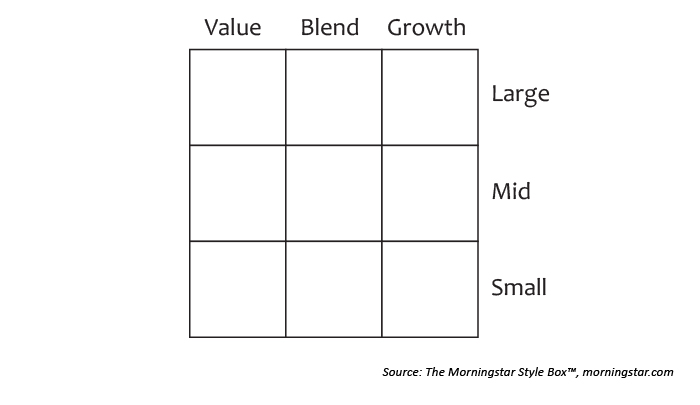

The “thing” was the arrival of the Morningstar Style Box. Although it may seem like it has been around forever, the Morningstar Style Box wasn’t introduced until 1992. The nine-square matrix was, and still is, an excellent visual tool. It divides the domestic equity universe into three capitalization stratifications (large, medium, and small), which form the horizontal rows of the matrix. Next, Morningstar separates the stocks within each capitalization segment into three groups based on various growth and value characteristics. Stocks with a predominance of value characteristics are placed on the left, growth stocks on the right, and those with a blend of value and growth characteristics occupy the middle.

Fund investment style

The simplest solution is often the best, and the Morningstar Style Box is genius in that respect. It is both easy to understand and visual. The upper left-hand box of the three-by-three matrix represents large-cap value stocks, the lower right-hand corner is for small-cap growth, and the rest is intuitive. With this classification methodology, the stock holdings of mutual funds and investment portfolios are systematically measured, aggregated, and then placed inside one of the nine boxes. Morningstar has evolved the tool over the years and has a similar-looking framework for fixed-income funds.

The tool became so popular that it quickly developed into the primary method of determining and classifying investment styles. Managers formerly known as deep value investors landed on the left side of the matrix, as you would expect. However, they were further split into large, medium, or small categories based on the average market capitalization of their holdings. This may seem quite logical at first glance, but consider a manager whose methodology typically selects small company stocks, yet a couple of large-cap stocks suddenly meet his selection criteria. Since the market capitalization of these big stocks is dramatically larger than the small-cap holdings, a classification methodology based on “average” size could label it as “mid-cap value” though it doesn’t hold any mid-cap stocks.

ETFs and mutual funds are recognized by active managers as tools—not strategies in and of themselves.

A twist of fate

Problems arose as the tool evolved from being a means of measurement into being the actual investment criteria. For example, an earnings momentum manager may be in the small-cap growth box during one phase of an economic cycle and in mid-cap value during another phase. While sticking to his style, the tool would say this manager was drifting. Eventually, many large institutional investors began hiring managers based on their ability to outperform their peers while staying inside their box. No longer did they want to hire an earnings momentum specialist or a turnaround analyst. Instead, they sought out mid-cap growth and small-cap value managers. Many of these new style box managers were said to have a “mandate” for the particular box they were in, and some were subsequently fired for straying too far outside their assigned box.

Exchange-traded funds (ETFs) have revolutionized much of the investment landscape, and industry growth has been rapid. There were fewer than 200 ETFs available to U.S. investors a decade ago, and today there are more than 1,650 listed for trading. Not surprisingly, many of the first 1,000 products targeted one of the nine style boxes or well-known indexes. This area of the investment landscape quickly became saturated with products, forcing ETF sponsors to look for new ways to distinguish their new funds.

What’s old is new again

“Factor investing” is an idea that has recently become popular with ETF sponsors, and although it may seem like something new, it is very much akin to “style” investing before the age of the Morningstar Style Box. Today, there are ETFs available that focus their selection criteria on specific factors, and they sound very much like the lost investment styles of yore. Factors targeted by new-generation ETFs include volatility, current yield, dividend growth, beta, revenue, price momentum, and company size.

In addition, there are many special situations that can be identified, quantified, and used in selecting securities. Special situations targeted by ETFs include spin-offs, buybacks, splits, mergers, and IPOs.

Tools for active management

Whether you prefer to use the 1980s definition of investment style, the Morningstar Style Box, or today’s factor and special situation definitions, one thing remains constant—each goes through periods of being in favor, followed by periods of being out of favor.

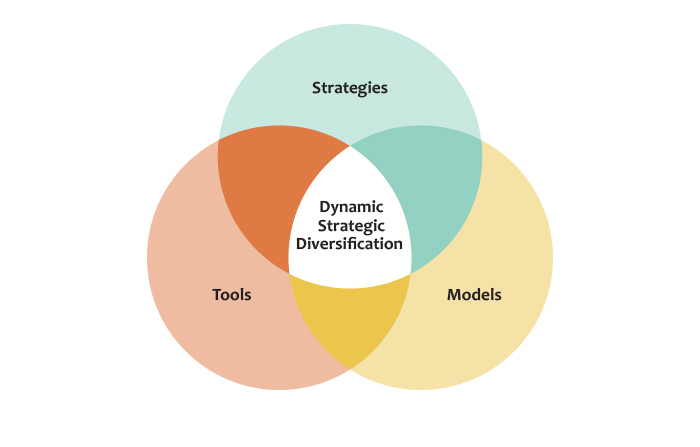

Each specific style (whether executed via ETFs or mutual funds) can potentially be thought of as a valid stand-alone investment approach, but today’s sophisticated active managers prefer to think of them as tools. An active manager may believe there are times to own some of these style-based products and times to avoid them as determined by a nonemotional, quantitative-based approach. Multiple diverse strategies, each with many “tools” available, are critical to the process of active and strategic portfolio diversification. The orientation of considering the universe of ETFs and mutual funds to be tools—instead of end products—provides active managers with the potential to respond to current market conditions and to better meet the needs of advisors in portfolio construction and implementation.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Ron Rowland is the founder and former executive editor of the online investment advisory services All Star Investor and Invest with an Edge. He is also a former portfolio manager for Flexible Plan Investments. Quoted widely in the financial press, Mr. Rowland is an industry expert for insight on sector rotation and actively managed ETF strategies.

Ron Rowland is the founder and former executive editor of the online investment advisory services All Star Investor and Invest with an Edge. He is also a former portfolio manager for Flexible Plan Investments. Quoted widely in the financial press, Mr. Rowland is an industry expert for insight on sector rotation and actively managed ETF strategies.