Editor’s note: Warren Buffett is not called the “Oracle of Omaha” without good reason. Countless books have been written about his personal story, his investing style, and his team’s unique success in building the multinational holding company Berkshire Hathaway since the early 1960s. According to the 2015 shareholder’s letter from Berkshire, the company has achieved an average annual increase in per-share compounded book value of 19.2% over the period 1965–2015. It is always interesting to read Meb Faber’s take on things, especially when it comes to trying to emulate Mr. Buffett’s investing strategy and success.

How long have people known that Warren Buffett is a great stock picker? After he closed his hedge fund in the 1960s? Or perhaps 10 or 20 years later in the 1970s or ‘80s? Certainly by the 1990s, right?

Almost everyone in the world knows that he is a great investor. Heck, he has to be a great investor to rank among the top five richest people in the world. So why don’t people simply follow along and ride his coattails?

Because it’s hard. Let me explain.

You could simply allocate to Buffett’s top 10 stock picks and rebalance that portfolio each quarter. He doesn’t trade much, so there shouldn’t be a lot of turnover. How would the results tracking his portfolio have performed?

According to Morningstar, his picks would average a return of more than 9% per year and would have beaten about 98% of all stock mutual funds in the United States. This also excludes “dead funds,” which makes his results even better.

And you wouldn’t pay any fees. So why don’t people simply follow along and ride his coattails?

Because it’s hard. (It’s also boring for many investors, nowhere near as much “fun” as trading Facebook, Apple, or the biotechs.)

The reason Buffett is successful is not because he has a magic stock wand, but rather because he has an unbelievable ability to stick to his style. There are numerous investment styles on Wall Street that work: value, momentum, trend following, buy and hold. The challenge is sticking to your style and not selling at the worst time.

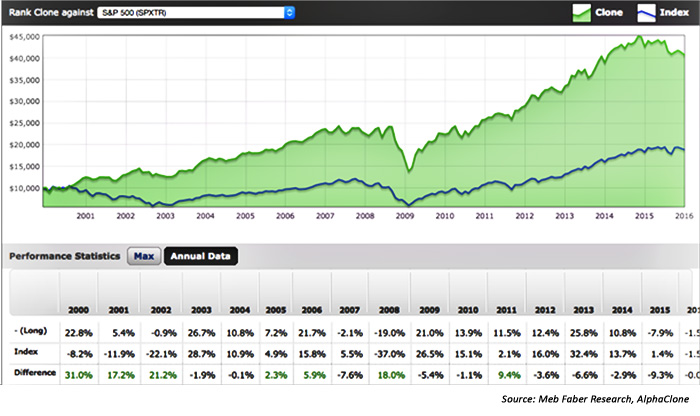

Below is a simulation from AlphaClone that looks at the 13F tracking performance of Buffett’s top 10 investment holdings for Berkshire Hathaway. This performance crushes the market, represented by the S&P 500 Index. But notice something else. It would have underperformed U.S. stock averages in seven out of the last nine years! When would you have fired this manager? 2009? 2010? Certainly by 2013.

So, as you think about your strategy, are you willing to give it 10 years? 15? 20? It is understandable why academic studies show people are so bad at timing the markets and their investments…they’re human.

SIMULATED TRACKING OF BERKSHIRE HATHAWAY’S TOP 10 STOCK HOLDINGS, 2000–15

Meb Faber is a co-founder and the chief investment officer of Cambria Investment Management. Mr. Faber is the manager of Cambria’s ETFs, separate accounts and private investment funds. Mr. Faber has authored numerous white papers and three books: "Shareholder Yield," "The Ivy Portfolio," and "Global Value." He is a frequent speaker and writer on investment strategies and has been featured in Barron’s, The New York Times, and The New Yorker. Mr. Faber graduated from the University of Virginia with a double major in engineering science and biology. cambriafunds.com, mebfaber.com

Meb Faber is a co-founder and the chief investment officer of Cambria Investment Management. Mr. Faber is the manager of Cambria’s ETFs, separate accounts and private investment funds. Mr. Faber has authored numerous white papers and three books: "Shareholder Yield," "The Ivy Portfolio," and "Global Value." He is a frequent speaker and writer on investment strategies and has been featured in Barron’s, The New York Times, and The New Yorker. Mr. Faber graduated from the University of Virginia with a double major in engineering science and biology. cambriafunds.com, mebfaber.com