John P. Reese is co-founder of Validea Capital Management. He is the manager of Validea Capital’s active equity ETF and separate accounts, and the subadvisor to the Consensus Funds in Canada. John is the author of “The Guru Investor: How to Beat the Market Using History’s Best Investment Strategies.” He is a graduate of MIT and Harvard Business School and holds two patents in the area of automated stock investing. www.theguruinvestor.com

John P. Reese is co-founder of Validea Capital Management. He is the manager of Validea Capital’s active equity ETF and separate accounts, and the subadvisor to the Consensus Funds in Canada. John is the author of “The Guru Investor: How to Beat the Market Using History’s Best Investment Strategies.” He is a graduate of MIT and Harvard Business School and holds two patents in the area of automated stock investing. www.theguruinvestor.com

Are value stocks making their long-awaited comeback? It certainly seems that way. And it’s about time. U.S. value stocks have been lagging their growth counterparts since 2006—a historically long stretch of underperformance. In 2015 alone, growth stocks on average outperformed value stocks by more than 9 percentage points, according to Morningstar.

There are likely a number of reasons for value’s struggles. One is that, in the aftermath of the financial crisis and Great Recession, investors have been incredibly risk-averse and thus very hesitant to buy value stocks, which usually have some sort of cloud hanging over them. Another reason involves the rise of index funds. Because most of these funds are market-capitalization weighted, they are overweight overvalued stocks. As index funds have become more and more popular in recent years, it has created a cycle in which pricey stocks get pricier and pricier.

Since 1998, the S&P value index’s earnings yield has on average been 1.4 percentage points higher than the S&P growth index’s earnings yield, according to Bloomberg. (Earnings yield, a measure of how cheap or expensive the index is—the higher, the cheaper—was calculated by dividing five-year average earnings of each index’s constituent companies by the price of the index.) For the early stages of 2016, the gap stands at 2.1%, meaning value stocks are offering more value than usual.

That’s good news, because over the past couple decades, the earnings yield gap has been a pretty good indicator of how growth and value stocks perform in subsequent years. Back in 1999, amid the growth-focused tech-stock boom, the S&P value index’s earnings yield grew to a full 3 percentage points greater than that of the S&P growth index.

Value then went on a huge run, returning 8.5 percentage points per year more than growth stocks over the next seven years, according to Bloomberg’s Nir Kaissar. By 2006, value stocks’ earnings yield advantage had shrunk to about 0.4 percentage points, well below the two-decade average. Growth stocks have led the way ever since. Now, value stocks have again opened up a bigger valuation advantage, making them poised to outperform.

So far in 2016, while the broader market is about break-even, U.S. value stocks are up about 3.6% on average, according to Morningstar. U.S. growth stocks, on the other hand, are down 0.8% (through the beginning of April). The growth-value pendulum has finally been swinging back in the value direction. Amid this shift, several of the value-oriented/guru-inspired portfolios I use on my research site, Validea.com, are off to excellent starts this year. One of them picks stocks using a strategy based on the writings of the late Benjamin Graham in the “Intelligent Investor.” Another is based on the quantitative model outlined in the book “Buffettology,” which codified Warren Buffett’s value and quality strategy.

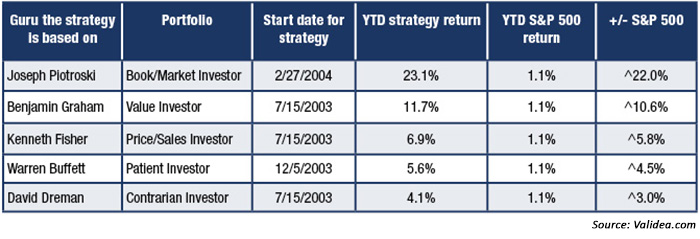

I’ve summarized these strategies below. The accompanying table shows the YTD returns on five top value models through April 4, 2016.

Joseph Piotroski Strategy: This value-quant strategy screens for high book-to-market stocks and then separates out financially sound firms by looking for a host of improving financial criteria.

Benjamin Graham Strategy: This deep value methodology screens for stocks that have low price/book and price/earnings ratios, along with low debt and solid long-term earnings growth.

Kenneth Fisher Strategy: This value strategy rewards stocks with low price/sales ratios, high long-term profit growth, strong free cash flow, and high profit margins.

Warren Buffett Strategy: This strategy seeks out firms with long-term, predictable profitability and low debt that trade at reasonable valuations.

David Dreman Strategy: This contrarian strategy finds the most unpopular mid- and large-cap stocks in the market and targets those with improving fundamentals.

While it’s too early to call a final turn in the growth/value trade, the recent performance of value stocks is encouraging for those value investors who have hung in and stayed disciplined. Based on our analysis of historical value-stock returns, once the turn does take place, we expect a prolonged and significant reversion to the mean in which value stocks outperform growth names.

GURU STRATEGIES: 2016 YEAR-TO-DATE RETURNS (THROUGH 4/4/16)