Understanding gold’s performance under different market scenarios

Understanding gold’s performance under different market scenarios

The role of gold in investment portfolios: Part I

Should an investment in gold be a key element of effectively diversified and risk-managed portfolios?

Editor’s note: A revised and updated version of this article can be found here.

Editor’s note: Flexible Plan Investments, an active money manager and provider of investment risk-management services, first authored an extensive analysis of the role of gold in investment portfolios in 2013. This white paper has been recently updated for 2020 and will be presented as a guest commentary in two parts in Proactive Advisor Magazine. We are pleased to present Part I here.

We examine some of the history and ongoing debate over owning gold from the context of an investor. Quantitative analysis of gold in different economic and market regimes demonstrates that gold has been valuable for investors as both an alternative source of return and as a hedge against other asset-class risk. Contrary to conventional wisdom, the study finds that over the period from 1973 to 2019, the efficient allocation addition of gold to a typical balanced (60% equity/40% bond) investor portfolio ranged from 5% to 35%, depending on the desired risk preference. Furthermore, the optimal allocation (maximum point on the efficient frontier) was at the 20% mark, as it produced the highest risk-adjusted return.

Even the most ardent supporters of portfolio- and investment-management theory have had belief systems shaken to the core over the past 15 years. With all of the “boom and bust” volatility and unprecedented global systemic risk, both traditional advisors and individual investors have been forced to re-evaluate approaches to risk management and consider new alternatives in portfolio construction. Asset classes have, to say the least, challenged historical norms.

One thing is certain. Within the challenging environment we have all seen, it has become imperative to develop a portfolio approach that minimizes drawdowns and volatility while delivering respectable returns, and all within an individualized investor risk profile.

Perhaps nowhere has the debate raged more fiercely than in consideration of alternative asset classes, especially the role of commodities and precious metals, and most notably gold. Many traditional wealth and portfolio managers will begrudgingly acknowledge that gold should play a role in investors’ portfolios, but the rationale can seem quite thin and more instinctual than empirical.

This paper will present a brief discussion of the “gold debate,” a broad overview of the tangible benefits of portfolio diversification with gold, and some eye-opening data suggesting a much more important role for gold in portfolios that seek optimal risk-adjusted returns.

Throughout history, gold has been universally revered as the physical embodiment of enduring wealth and status. King Midas (famed in Greek mythology for his “Midas touch”) and El Dorado (the mythical “Lost City of Gold”) are just two examples of the evocative and exotic images raised by the allure of gold. The quest for gold has created and toppled dynasties and nation-states over the millennia.

Gold has been used as a form of currency for thousands of years. Unlike paper or some electronic currency, gold has a fixed supply and as a physical commodity can be relatively difficult to obtain. As a result, gold has historically offered a natural hedge against inflation and provided an alternative to investors when the value of other forms of currency is depreciating.

But what does this mean for today’s investors and those entrusted to manage their portfolios?

One can find compelling arguments from respected investment professionals, economists, hedge fund managers, and major Wall Street strategists on all sides of the gold issue as it pertains to portfolio management.

Ray Dalio, founder, chair, and CIO of Bridgewater Associates, LP (generally regarded as the world’s largest and most successful hedge fund … ), shared this in a 2019 post on LinkedIn:

“I believe that monetizations of debt and currency depreciations will eventually pick up, which will reduce the value of money and real returns for creditors and test how far creditors will let central banks go in providing negative real returns before moving into other assets. … Those that will most likely do best will be those that do well when the value of money is being depreciated and domestic and international conflicts are significant, such as gold.”

The role of gold in

investment portfolios

This two-part guest commentary

by Flexible Plan Investments explores

why investors should reconsider

their portfolio’s allocation to gold.

Part II: How gold can help in creating

a more optimal portfolio allocation

Before we delve into the quantitative analysis, let’s take a big-picture look at some of the most enduring arguments for the role of gold in a portfolio.

The literature from academia, the financial press, respected Wall Street firms, and the investing community all generally come back to some basic assertions about the potential benefits of allocations to gold in a portfolio:

- As a hedge against inflation.

- As a hedge against deflation.

- As protection against a declining U.S. dollar (and other major global currencies).

- As a safe haven in times of geopolitical and financial-market instability.

- As a basic commodity, with its own supply-and-demand fundamentals.

- As a long-proven store of historical value.

- As an “insurance policy” against black swans and “left-tail” risk events.

- As an asset with negative (though not perfect) correlations with other asset classes.

- As an investment with an underlying global central bank and sovereign wealth demand.

- As an underowned investment class, suggesting future demand increases.

- As an important portfolio diversifier.

Each of these arguments can find its supporters and naysayers, all armed with their own particular analyses and biases. But even well-credentialed critics of gold grudgingly admit there is a place for it in most investor portfolios.

A paper titled “The Truth about Gold: Why It Should (or Should Not) Be Part of Your Asset Allocation Strategy,” by professor Campbell R. Harvey of Duke University’s Fuqua School of Business, summarized in part,

“The attractiveness of gold as an investment can generate heated arguments, many of which are based on wishful thinking rather than fact. … Most arguments for holding gold in a portfolio are not supported by an analysis of the data. Nonetheless, an argument can be made for including gold as a commodity in a well-diversified portfolio, particularly if investors and central banks increase their demand—even moderately—for gold.”

“We find that because of its lack of correlation with other financial assets, gold has a useful role to play in stabilizing the value of a portfolio even if the conservative assumption of a modest negative real annual return is made.”

Of course, there are no guarantees of even “a modest negative real return” on one’s investment in gold. Gold can go through periods of extreme volatility, like all asset classes. One only has to look at the period from 2008 to 2013, when gold suffered a 34% decline, then delivered a 281% price increase, followed by a sharp 38% retracement. Gold’s volatility can be intimidating for short-term traders and should be considered principally as a long-term portfolio component for most investors. Of course, for professional traders, its volatility can make it an excellent tactical trading tool, as well.

Opinions on the subject of gold as a portfolio component are highly polarized, and it is often difficult to separate hyperbole from facts. We believe it is necessary to fully understand the economic and market drivers that can make gold a valuable constituent of a typical investor’s portfolio.

We will focus this quantitative assessment on a look at how gold has performed relative to other major asset classes since 1973 (the first full year in which the price of gold was finally unfrozen from its $35-per-ounce Great Depression status) under a variety of market and economic conditions. The global and U.S. economies since that time have thrown a multitude of challenging situations at investors, including several energy crises, the interest-rate spikes of the 1970s, and many macro geopolitical situations—including the two great booms and busts of the stock market over the past two decades.

We have selected 1973 as the starting point for our analysis, as this represents what we believe to be the first “clean” calendar year for gold price performance following the momentous decisions of the Nixon administration in August 1971. Actions taken then effectively ended “ties” to the historic gold standard for the U.S. dollar and suspended convertibility of the dollar to gold.

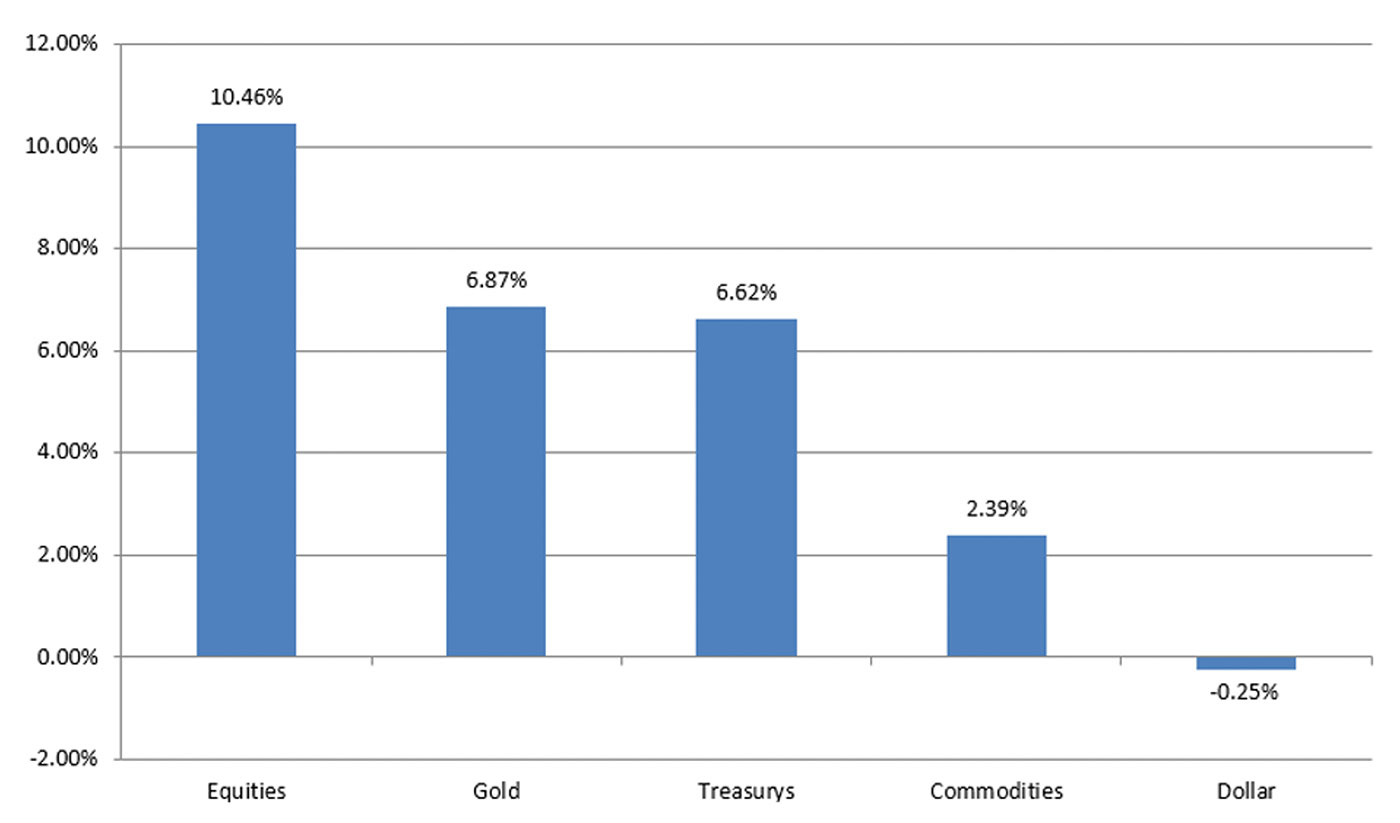

Let’s first look at the annualized rate of return of various asset classes from 1973 to December 31, 2019 (Figure 1).

FIGURE 1: BASELINE—PERFORMANCE OF VARIOUS ASSET CLASSES (1973–12/31/2019)

Definition: Annualized returns of various asset classes over time. See the note at the end of this article for more information on source data.

Source: Flexible Plan Investments

As shown, equities have been the best-performing asset class throughout this period, followed by gold and Treasury bonds. But equity performance has been far from a “smooth ride” for the past several decades. Although gold has experienced an even bumpier journey, it has also demonstrated the ability to outperform equities in times of equity market stress and bonds under a variety of different economic conditions than equities.

It is also noteworthy that the dollar fell on average during the period. In addition, commodities rose, suggesting that the period was typically inflationary. These conditions provided a tailwind for both equities and gold.

We will review several economic scenarios, again based on historical data from January 1973 to December 31, 2019. We will examine the performance of gold relative to other asset classes under seven different market environments that typically concern investors:

- Real returns on the 10-year Treasury bond are negative (real interest rates less than zero).

- Equities are in a bear market.

- Commodity prices are in a bull market.

- The U.S. dollar is in a bear market.

- U.S. Treasury bonds are in a bear market (rising interest-rate environment).

- Inflation is rising.

- Market volatility is high.

The method used in these comparisons was to first determine the dates during which each of these conditions existed. Then we calculated the daily rate of total return achieved by each asset class during the periods when these conditions were extant. An annualized return was then calculated by geometrically linking each period of daily returns for the various periods of the condition for each of the asset classes. Finally, a comparison of each asset class with the other was made for the entire time period studied.

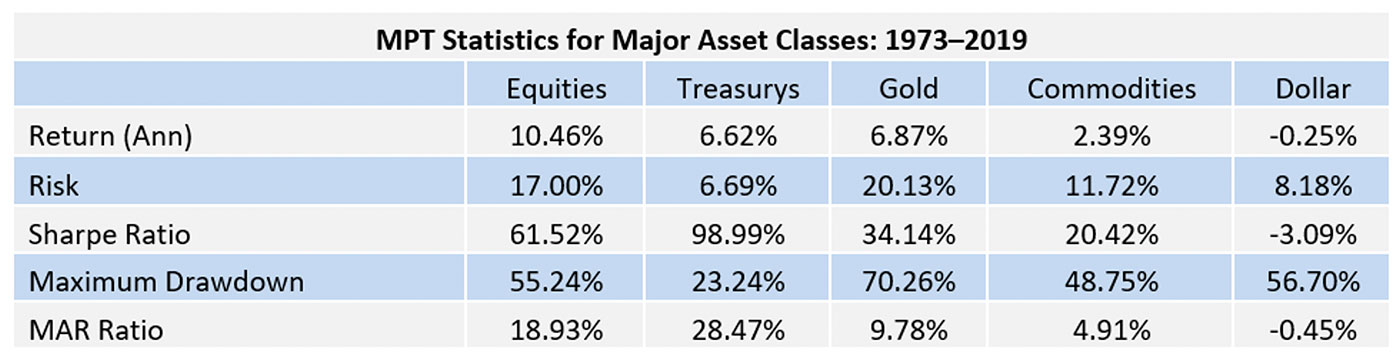

One of the most important benchmarks for investor returns is the “real” 10-year yield, or the current total return of a 10-year Treasury bond minus the expected rate of inflation. Since the Treasury return is considered virtually “risk-free,” this represents what an investor can reasonably expect to earn on a long-term investment adjusted for changes in currency purchasing power.

Typically, when real yields are positive, equities and bonds tend to perform well as long-term investments. However, the nightmare scenario that keeps pension-fund and other asset managers up at night is when real yields are negative.

Under certain conditions, investors are willing to accept a negative real return in exchange for “safety” and the likelihood that they will recover most of the principal that they invest. This is most common for conservative investors that are near to or currently in retirement.

Negative real rates have been common throughout much of the era that has followed the financial crisis of 2007–2009. This is the result of the Federal Reserve systematically lowering interest rates to near-zero levels in order to boost the economy. Treasury yields had fallen so far that they were below the rate of inflation for much of 2011 and 2012—indicating that real yields were actually negative.

In such an environment, the question becomes, “How is an investor going to earn a real return on his or her investments?” This scenario deserves serious consideration. As it turns out, the great savior in this scenario has historically been gold.

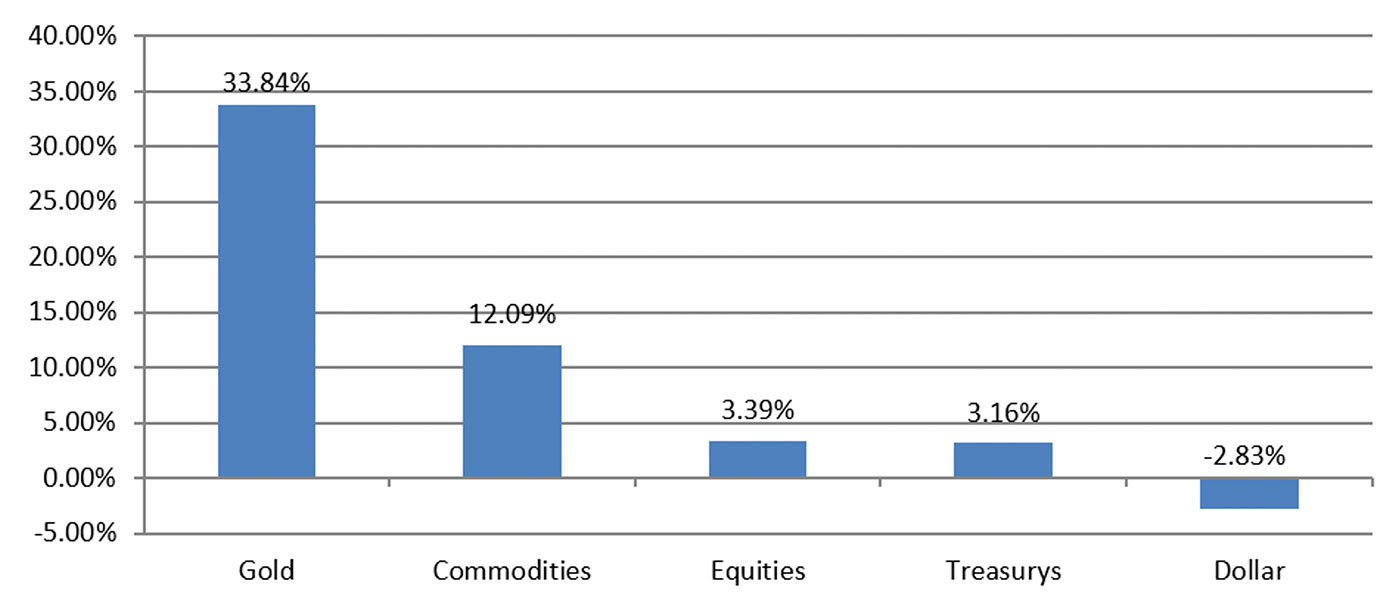

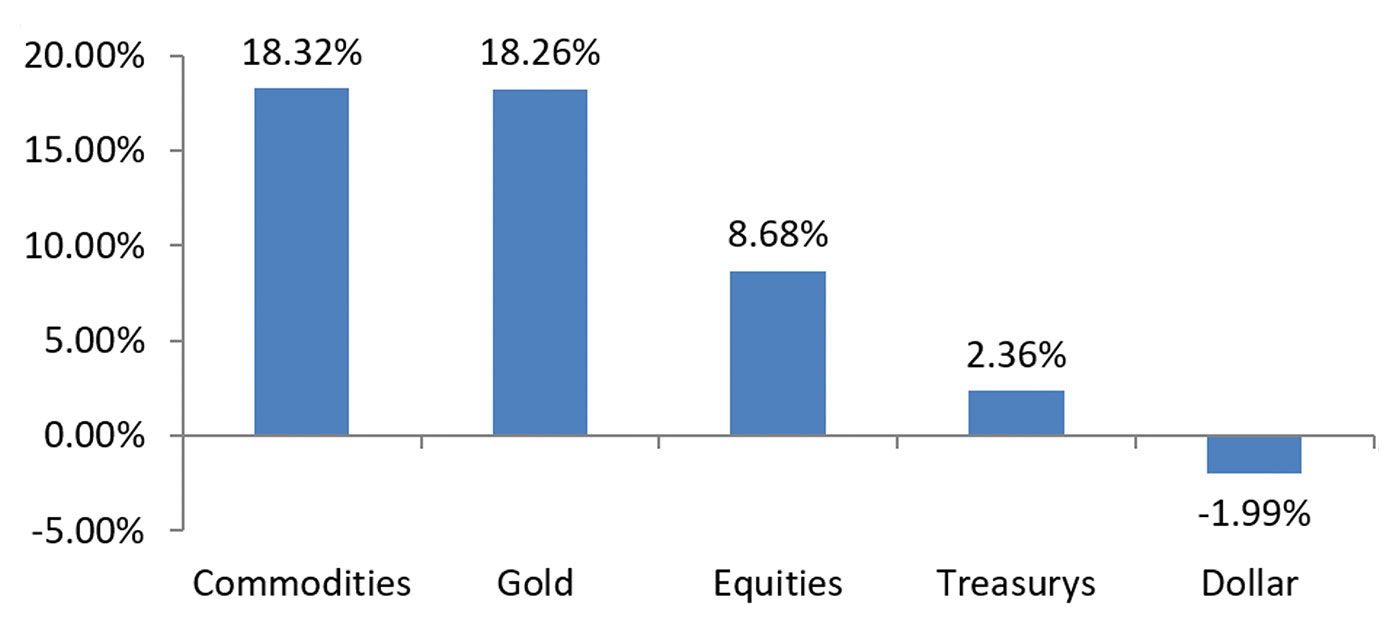

Figure 2 shows the compounded annual return for various asset classes when real 10-year yields are negative.

Definition: When the current total return of a 10-year Treasury bond minus the expected rate of inflation is less than zero.

Source: Flexible Plan Investments

As shown, gold is the best performing of all major asset classes, delivering nearly 34% annualized returns when real Treasury rates are negative. The other asset classes, except for commodities, barely break even.

Only gold and commodities perform well in these instances. Real rates are negative particularly in times of market stress, leading to a flight to safe-haven assets. Additionally, a negative real-interest-rate environment can be caused by high inflation values. Both of these scenarios are positive for gold, giving it the highest return of any asset class in this scenario.

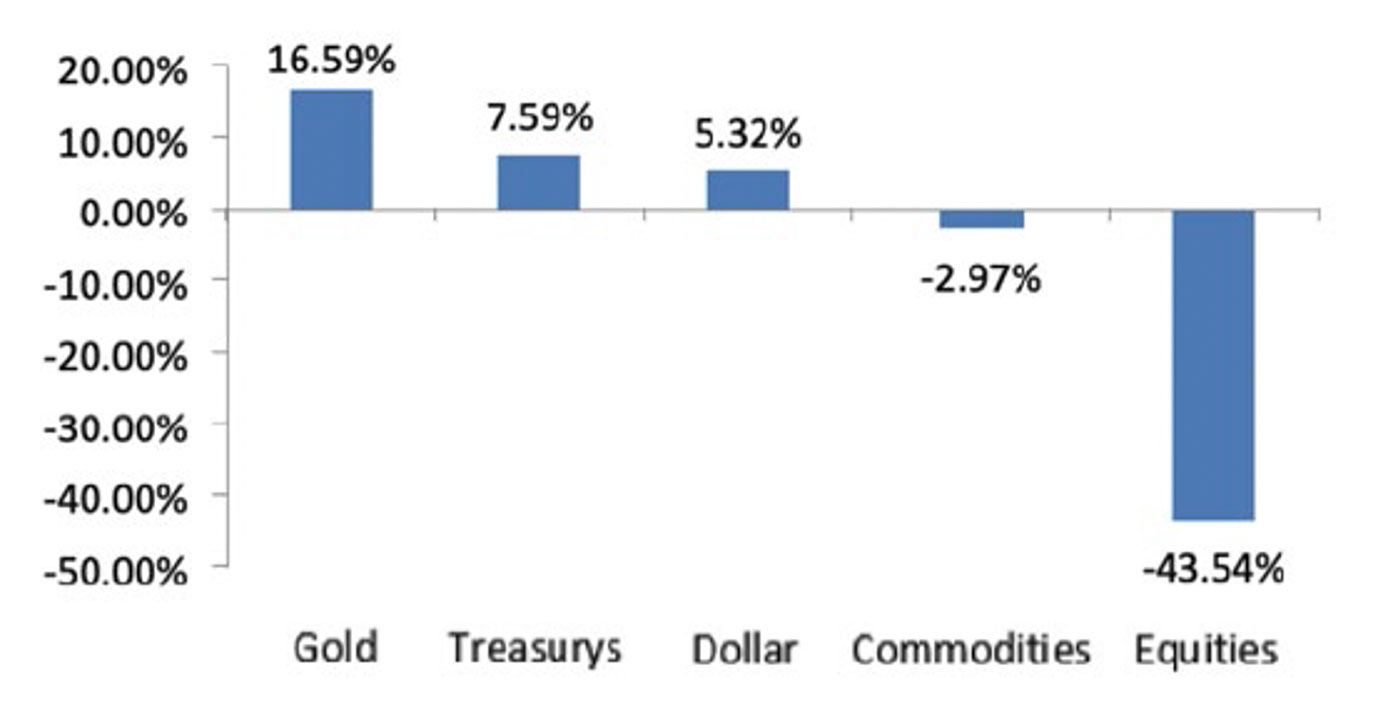

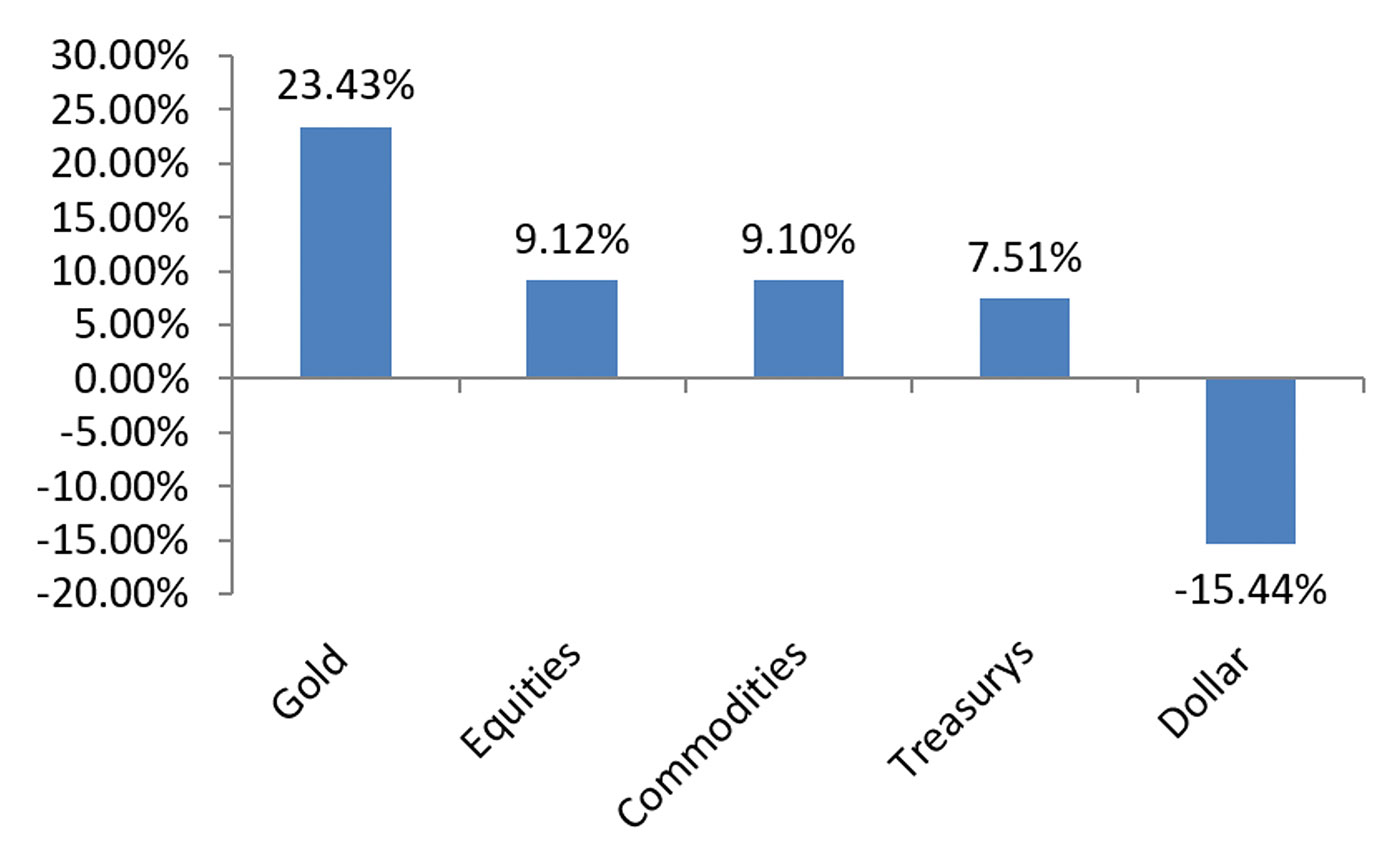

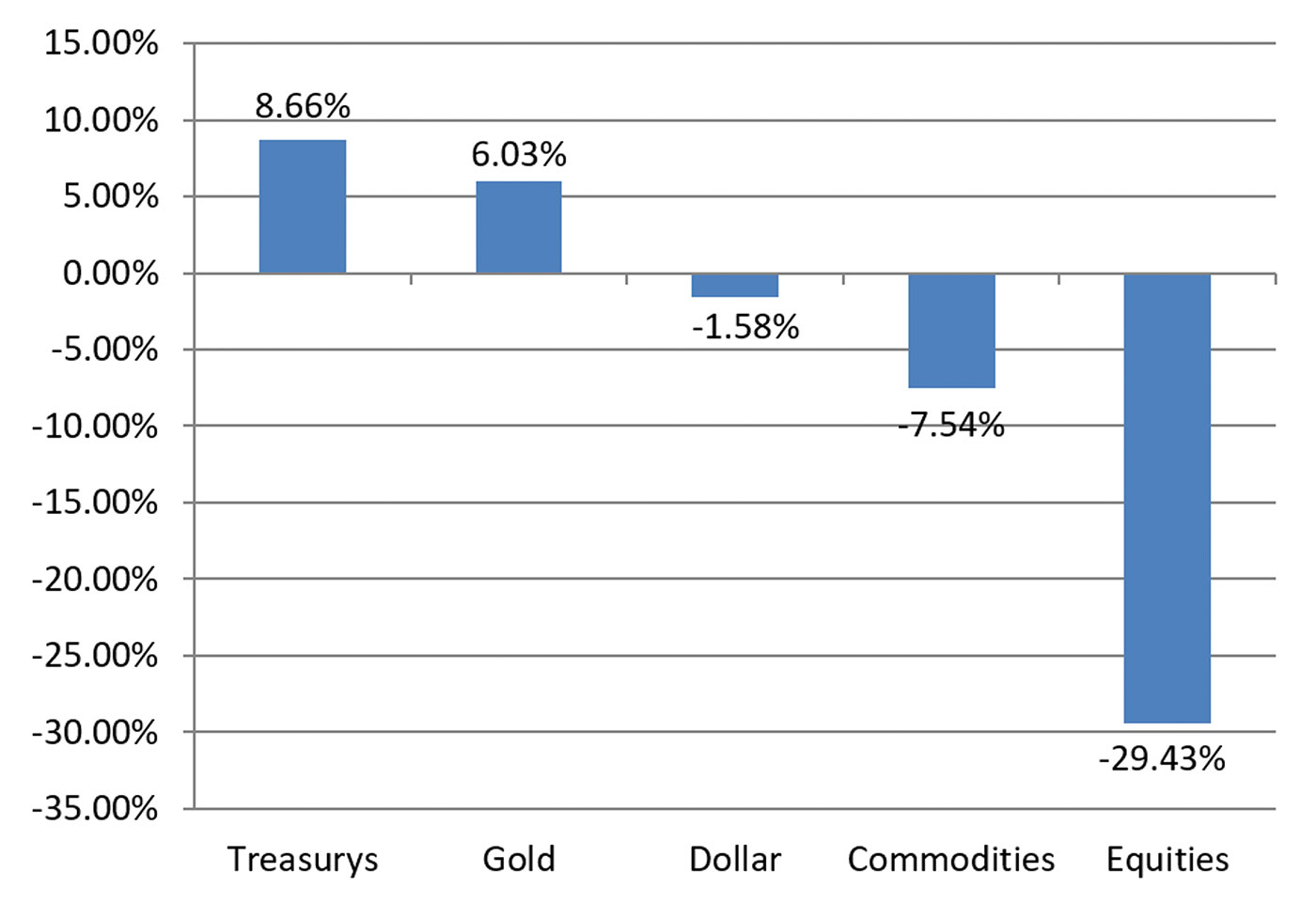

Another benefit attributed to investing in gold is that it provides valuable protection in equity bear markets. It would be reasonable to assume that Treasurys would perform best in equity bear markets, but that has not been the case. Looking across more than 40 years of market history, we identified bull, bear, and sideways markets in the S&P 500 Index, then assessed the returns of alternative asset classes during the bear periods (Figure 3).

FIGURE 3: PERFORMANCE OF VARIOUS ASSET CLASSES IN EQUITY BEAR MARKETS

(1973–12/31/2019)

Definition: Equity bear markets are said to occur when equity prices decrease 20% or more.

Source: Flexible Plan Investments

Gold has outperformed all other asset classes during periods of equity market stress. Its historical compound return during major stock declines has been higher than the return of Treasurys. This disparity arises because gold offers inflationary protection as well as crisis protection. In addition, because gold has relatively minor demand as an industrial metal, and demand is only partially consumer-driven, it tends to have very little economic sensitivity.

The period from 10/10/2007 through 3/9/2009 marked the recent credit crisis, and it was considered a major bear market, lasting 355 days. During this period, the equity market fell by 55.2%. In contrast, gold rose 24.6%, more than both Treasurys and the U.S. dollar, which both gained 13.5%. Surprisingly, commodities as an asset class fell in value and did not prove to be a fully defensive allocation.

Definition: Commodity bull markets are said to occur when commodity prices rise 20%.

Source: Flexible Plan Investments

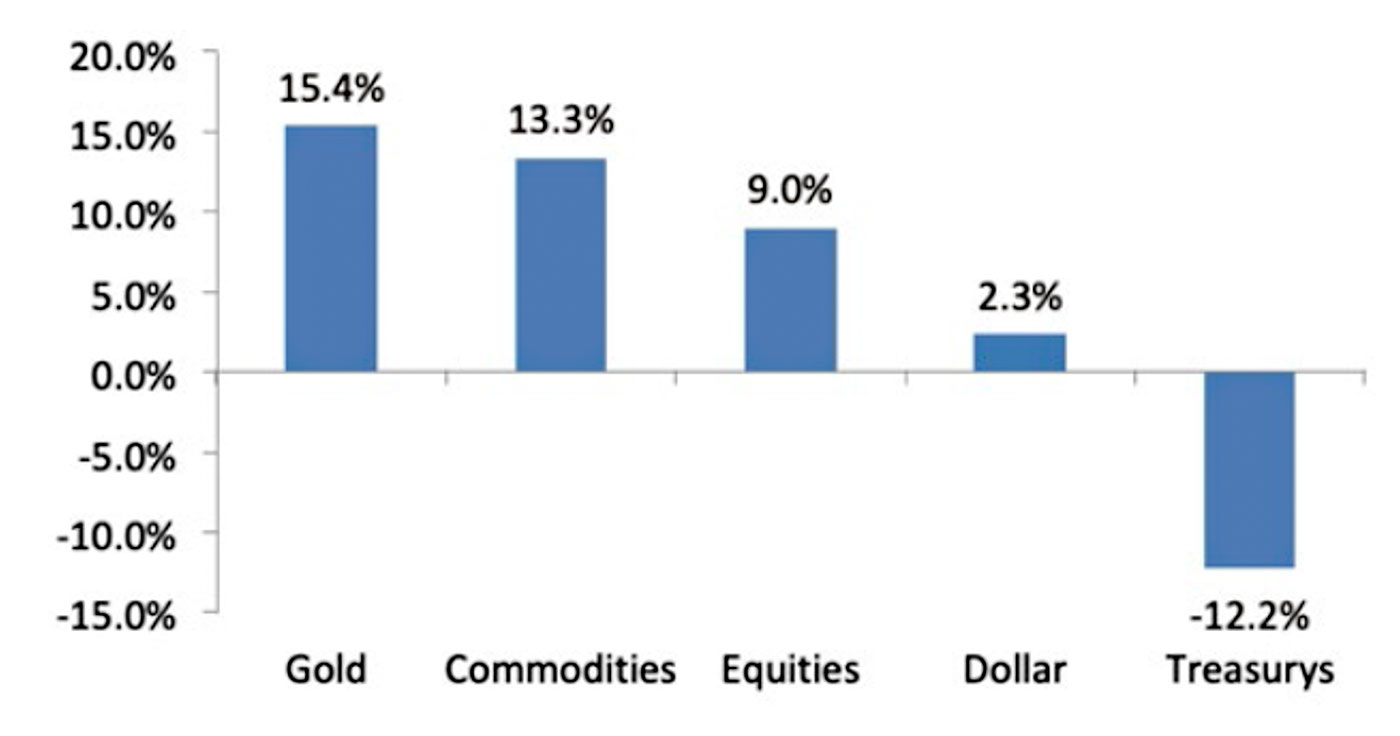

Definition: Bear markets for the U.S. dollar are said to occur when prices decrease 10%.

Source: Flexible Plan Investments

A U.S. dollar bear market can occur for a number of reasons, ranging from trade and budget deficits to monetary policy decisions. The data in Figure 5 shows that gold performed extremely well, significantly outperforming all other asset classes, when the U.S. dollar was falling. Perhaps this is because it is considered to be the currency of last resort by many investors.

For example, the Bretton Woods agreement was a fixed-exchange-rate system where the U.S. dollar could be exchanged for gold at a fixed price of $35 per ounce, and other major world currencies had a fixed exchange rate to the dollar. In response to a growing deficit in U.S. gold reserves versus U.S. dollars outstanding, President Nixon decided to break the agreement in 1971. In March 1973, the fixed-exchange-rate system officially became a floating-exchange-rate system. The U.S. dollar was in a bear market from 1/22/1973 to 7/6/1973 and declined roughly 18% during that time. Gold gained 331% over that same period, reflecting the increased money supply that was not factored into the price.

Definition: Bear markets for U.S. Treasurys are said to occur when Treasury prices decrease 10%.

Source: Flexible Plan Investments

Figure 7 shows the historically positive performance of gold when there was a sustained increase in the general level of prices for goods and services. We have defined rising inflation as periods when the one-year rate of change of the Consumer Price Index (CPI) is positive, with causality arising from increased demand chasing too few goods or a rising cost environment for producers and manufacturers.

Within this type of environment, the U.S. dollar clearly weakened, in both “price” and purchasing power. Gold performed well. In fact, the yellow metal outperformed a basket of commodities, the usual safe harbor preferred by investors during inflationary times. At the same time, however, both equities and, surprisingly and ever so slightly, Treasurys have historically outperformed gold during these periods.

Definition: Rolling 12-month rate of change in the CPI is positive.

Source: Flexible Plan Investments

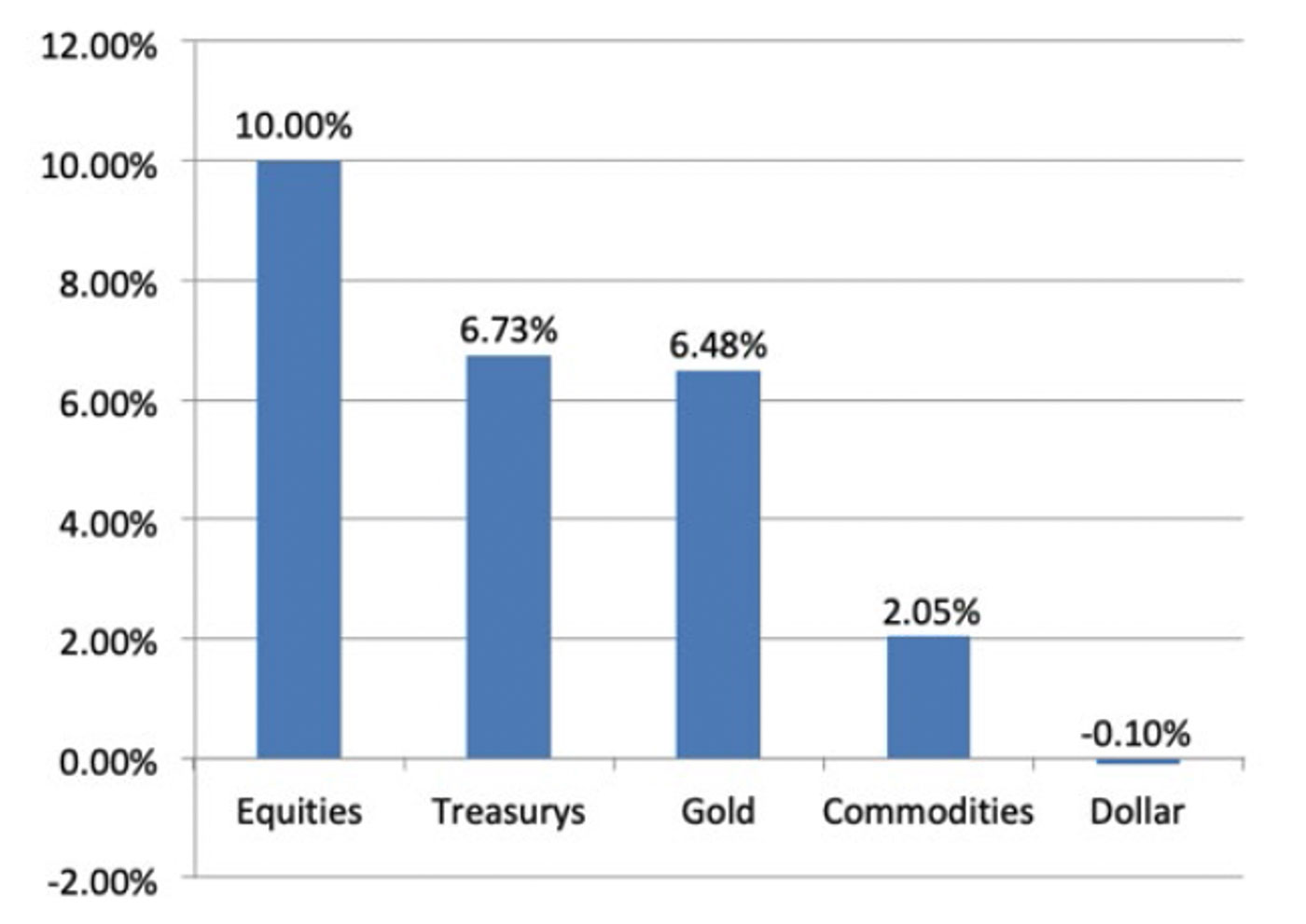

FIGURE 8: PERFORMANCE OF VARIOUS ASSET CLASSES WHEN VOLATILITY IS HIGH

(1990–12/31/2019)

Definition: The VIX Index is in the top quintile of historical data.

Source: Flexible Plan Investments

Editor’s note: It is clear from the examples given here that gold can provide favorable returns and act as an important counterbalancing portfolio component under a variety of very specific market and economic conditions.

But, how does gold perform under different classic economic regimes?

Part II of “The Role of Gold in Investment Portfolios” will examine this question in some detail, as well as provide overall conclusions surrounding optimal allocations to gold in a modern portfolio. Look for Part II in an upcoming issue of Proactive Advisor Magazine.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

This article presents an excerpt of the white paper “The Role of Gold in Investment Portfolios.” The complete paper—including a list of source data—can be found here.

Past performance does not guarantee future results. Inherent in any investment is the potential for loss as well as profit. A list of all recommendations made within the immediately preceding 12 months is available upon written request.

This white paper is provided for information purposes only and should not be used or construed as an indicator of future performance, an offer to sell, a solicitation of an offer to buy, or a recommendation for any security. Flexible Plan Investments, Ltd., cannot guarantee the suitability or potential value of any particular investment. Information and data set forth herein have been obtained from sources believed to be reliable, but that cannot be guaranteed. Before investing, please read and understand Flexible Plan Investments’ ADV Part 2A and Part 2A Appendix 1.

The original white paper, published by Flexible Plan Investments in November 2013, was written by David Varadi, David Wismer, and Jerry C. Wagner. The updated white paper, published in April 2020, was revised by Jerry C. Wagner, Jason Teed, Tim Hanna, and Ansh Chaudhary. flexibleplan.com

Since 1981, Flexible Plan Investments (FPI) has been dedicated to preserving and growing wealth through dynamic risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine FPI’s many risk-managed strategies within a single account. FPI’s fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. FPI also offers advisors the OnTarget Investing tool to help set realistic, custom benchmarks for clients and regularly measure progress. flexibleplan.com