The Federal Reserve today [Nov. 3] announced the (much-overdue) start of tapering, which means it will continue to increase the size of its balance sheet, but not quite as fast.

Starting later in November, the Fed will reduce its monthly pace of asset purchases to $105 billion per month from the current rate of $120 billion per month. In particular, the Fed will reduce Treasury purchases to $70 billion per month from $80 billion, while reducing mortgage-backed securities purchases to $35 billion per month from $40 billion. And the Fed expects to keep tapering Treasury securities by a further $15 billion per month (in the same proportions) starting in December. At this pace, tapering would conclude in June 2022, just in time for the market-implied first rate hike in July of next year.

Beyond the wording changes to the Fed statement to announce the tapering timeline, there were also changes reflecting updated views on the economic front. For example, the Fed noted an additional tailwind for future activity as “an easing of supply constraints [is] expected to support continued gains in economic activity and employment as well as a reduction in inflation.”

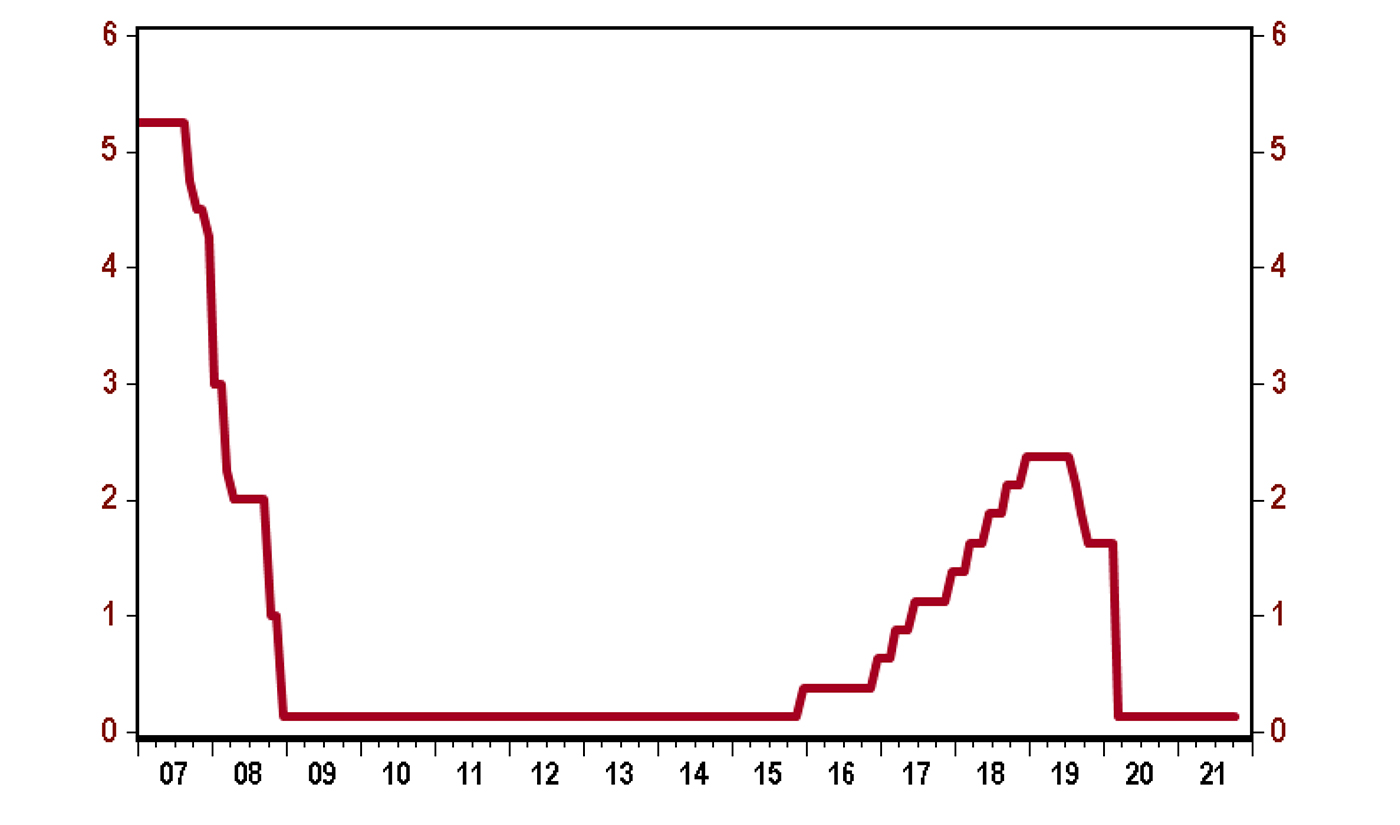

Sources: Federal Reserve Board, Haver Analytics

It’s also worth noting that the Fed tempered its “transitory” inflation talk. In September, it had little doubt that the drivers of inflation would be temporary, stating the higher prices were “largely reflecting transitory factors.” Today’s statement hedged that comment, stating these factors are now “expected to be transitory.” In other words, the Fed’s confidence that inflation pressures will ease any time soon is waning.

While pushed in his press conference to comment on rate hike timing, Chair Powell was very intentional not to make any commitments, but he implied that if progress meets expectations, a rate hike could likely be appropriate in the second half of next year. As per the usual line, future decisions are “data dependent,” and faster or slower growth would shift that timeline. When pressed on if the Fed is starting to fall behind the curve (given that it has been consistently low on inflation expectations up to this point) and how it would react if progress exceeds expectations, Powell simply reiterated that the Fed is prepared to accelerate (or slow) purchases if the data justify it.

At the end of the day, the Fed wanted to get the process toward normalization started, but the path this will follow in the year ahead remains uncertain. There is no reason why QE should still be in effect today; tapering should have started, and ended, a long time ago. In addition, the Fed’s forecast on inflation is clearly too low. And with the Fed not raising interest rates anytime soon, inflation is likely to turn out much more persistent than the Fed hopes.

Editor’s note: Related to the commentary above, First Trust offered the following thoughts on the latest inflation reading on Nov. 10.

Topline summary

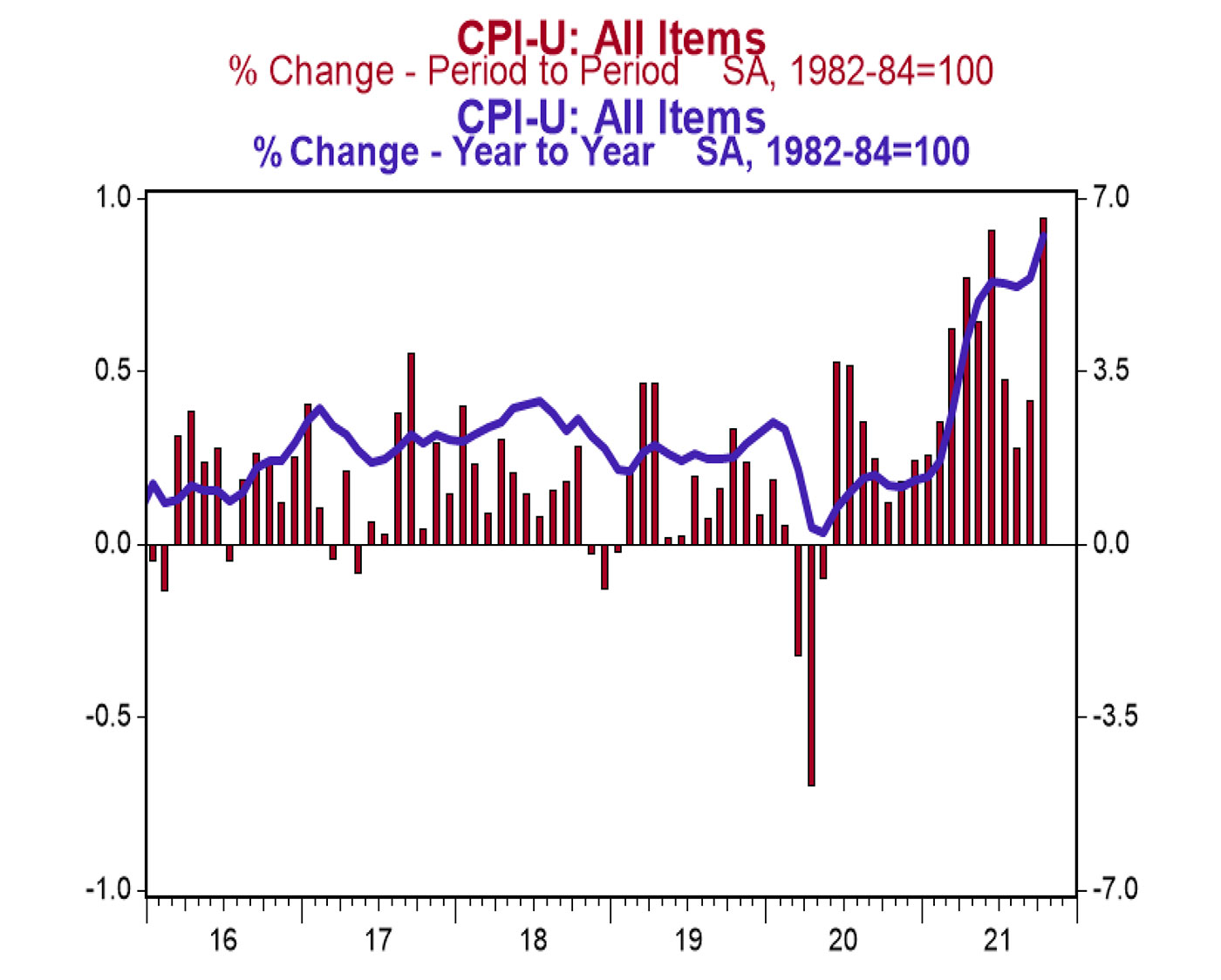

- The consumer price index (CPI) soared 0.9% in October, well above the consensus-expected +0.6%. The CPI is up 6.2% from a year ago.

- Energy prices increased 4.8% in October, while food prices increased 0.9%. The “core” CPI, which excludes food and energy, rose 0.6% in October, above the consensus-expected +0.4%. Core prices are up 4.6% versus a year ago.

- Real average hourly earnings—the cash earnings of all workers, adjusted for inflation—declined 0.5% in October and are down 1.2% in the past year. Real average weekly earnings are down 1.6% in the past year.

Implications

Consumer prices continued to accelerate in October, rising at the fastest pace for any month in more than a decade and pushing the 12-month increase to 6.2%, the largest since 1990.

Sources: Bureau of Labor Statistics, Haver Analytics

Inflation is clearly a problem and the Federal Reserve’s claim that it’s “transitory” looks more and more ridiculous each month. This is what happens when the M2 measure of the money supply moves so high. It is up 38% since COVID started, well above the pre-COVID trend.

Inflation in October was broad-based but led by energy, housing rents, vehicles, and food. Energy prices rose 4.8%, including a 6.1% increase in gas prices.

Meanwhile, housing rents rose 0.4% (rents for both actual tenants and the rental value of owner-occupied homes). Rents are important to watch because we expect large gains in this category now that a national eviction moratorium has ended and it makes up more than 30% of the overall CPI.

In addition, vehicle prices rose steeply for both new and used vehicles (1.4% and 2.5%, respectively), with ongoing supply-chain issues being the obvious culprit. Last, food prices rose 0.9%, with food at home up 1.0%.

Stripping out the volatile food and energy components, “core” prices still rose 0.6% in October and are up 4.6% in the past year, which is also a multi-decade high.

It’s important to recognize the inflation experienced today is not merely a rebound from the steep price declines in 2020 when COVID first hit the U.S.; consumer prices are up at a 4.1% annual rate since February 2020 (which was pre-COVID) and core prices are up 3.3%.

The current economic environment warrants not only tapering but also rate hikes. And while inflation was a key factor pushing the Fed last week to announce the start of tapering asset purchases, what matters most for the economy—and markets—is when the Fed will lift the federal funds rate.

Unfortunately, that is likely to be a long way off.

First Trust Portfolios LP and its affiliate First Trust Advisors LP (collectively “First Trust”) were established in 1991 with a mission to offer trusted investment products and advisory services. The firms provide a variety of financial solutions, including UITs, ETFs, CEFs, SMAs, and portfolios for variable annuities and mutual funds. www.ftportfolios.com