Successful risk management requires two correct decisions

Successful risk management requires two correct decisions

For active managers, avoiding downside risk is just half of the equation in value-added portfolio management.

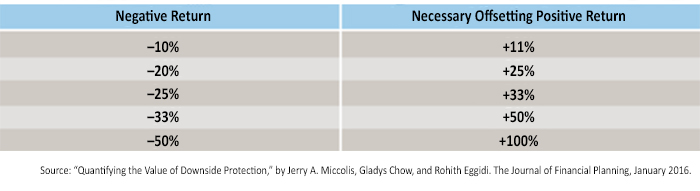

Using the classic table of the mathematics of losses and gains, the authors offer the best observation of the piece:

To quantify the economic benefit of capturing the gain, the authors test the benefit of reducing volatility in a market decline of 10% and more by assuming the portfolio would participate in the first 10% of the market drawdown and 50% of the decline after the initial 10%. This is set as a level of risk reduction that should be possible given a number of active-management techniques. Mathematical tests of the risk-management hypothesis that compare the drawdown against the subsequent market rebounds illustrate the value of reducing market drawdowns.

But the subsequent calculations of the level of fees that could be charged and the benefits investors would gain by the reduced volatility have a major flaw. Calculations are based on re-entering the market at the precise bottom.

“The 7%-8% sell rule is based on our ongoing study covering over 130 years of stock market history. Even the best stocks will sometimes break out and then drop to slightly below their ideal buy point. When they do, they typically do not fall more than 8% below it. If your stock does decline more than 8% it usually means something is wrong with your chosen entry point, the company, its industry, the general market or all of the above.”

Getting back in the market or an investment is typically based on noticeable improvement—that is, the market or investment is gaining value and volume or funds flow is improving. By the time that happens, the investor has already missed the market bottom. Active-management strategies that use trend lines and moving averages will always lag the market’s top and bottom.

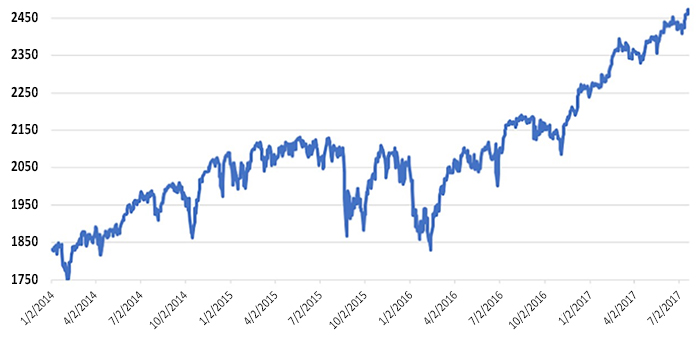

This is not necessarily a disqualifying factor for successful risk-managed strategies. It is simply a fact of investing life. It is also a fact that markets will sometimes enter periods of “whipsaw,” where rebounds from the market’s short-term bottom can be extremely quick and occasionally deceptive. This was demonstrated in both August 2015 and the first quarter of 2016.

During a relatively low-volatility market, the S&P 500 fell 11% in six trading days in mid-August 2015, rebounded 6% in four trading days, bounced around for two weeks, and then fell 5% over the next nine trading days only to start a relatively steady upward trend. A similar pattern emerged in early 2016. In both cases, strategies might have been forced to exit the market and then re-enter, but in the bigger picture, potentially deep losses were avoided and strategies were able to get back into an upward trend.

In the previously cited Journal of Financial Planning article, the authors briefly discuss the nonquantitative benefits of reduced drawdowns, including greater peace of mind for investors and more willingness to allocate a larger portion of their portfolios to equities. Mitigation of sequence-of-returns risk is also recognized as a benefit of managing portfolio risk by reducing drawdowns. There is also an interesting discussion of how “de-risking” the portfolio can elevate the efficient frontier. But it rather rattles one’s confidence in the authors’ conclusions when they are based on 100% participation in the recovery phase of a market cycle.

How much of the market’s fall and subsequent recovery could an active manager participate in/miss and still equal the performance of a buy-and-hold investment? A 1997 study in The Journal of Investing that used daily prices for the Dow Jones Industrial Average from 1885 to 1994 found an active manager could participate in up to 20.63% of the decline in a bear market of 20% or more and miss up to 20.63% of the following advance and still equal the performance of a buy-and-hold investor—before the consideration of fees. When the scale of the market decline was lowered to 15% or more and 10% or more, the degree to which a manager could participate in declines and miss advances fell to 15.37% and 10.79%, respectively. It would be interesting to see if the last 23 years have made a significant difference in this specific type of analysis.

Linda Ferentchak is the president of Financial Communications Associates. Ms. Ferentchak has worked in financial industry communications since 1979 and has an extensive background in investment and money-management philosophies and strategies. She is a member of the Business Marketing Association and holds the APR accreditation from the Public Relations Society of America. Her work has received numerous awards, including the American Marketing Association’s Gold Peak award. activemanagersresource.com

Linda Ferentchak is the president of Financial Communications Associates. Ms. Ferentchak has worked in financial industry communications since 1979 and has an extensive background in investment and money-management philosophies and strategies. She is a member of the Business Marketing Association and holds the APR accreditation from the Public Relations Society of America. Her work has received numerous awards, including the American Marketing Association’s Gold Peak award. activemanagersresource.com